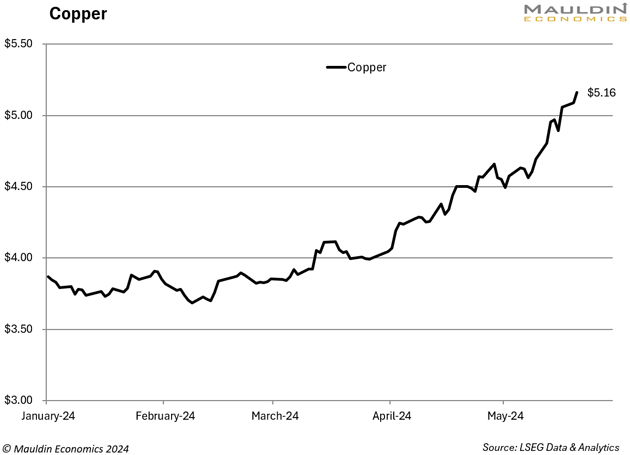

Copper prices have exploded higher, up 33% year to date.

The demand is coming from so many sectors of the global economy, it is hard to find a reason not to invest.

The energy transition is driving much of the demand. Copper is a critical input for renewable power generation like wind turbines, solar panels, and batteries. It’s also essential for electrical wiring for the grid. Global power grid capacity will need to double by 2050 to meet increased electricity demand, requiring an additional 427 million metric tons of copper.

Copper is a key component in electric vehicle (EV) batteries and motors. EVs use up to 4X more copper than gas-powered cars. Before you scoff at the analysis, remember, the US car market is very different from the rest of the world. US demand for EVs may have slowed, but that’s not the case abroad.

China produces twice as many electric vehicles (not just cars, but vehicles, including e-bikes) as gas-powered cars. This makes sense. China is building new sources of electricity, with more nuclear power plants under construction than any other country. And it has ample rare earth metals and battery manufacturing capacity. What it does not have is an overabundance of oil. Going electric makes China more resilient and energy independent.

India is another copper story. While China’s economic growth is slowing, India’s is ramping up. Demand for EVs there is surging. The country is building a network of high-speed rail, along with multiple nuclear and solar power plants. The most populated nation in the world will need to expand its energy grid for years to come.

Finally, and closer to home, artificial intelligence data centers require copper and grid expansion.

All of this is happening in the face of limited supply. Miners have increased copper production annually for the past 20 years, but many analysts are concerned supply cannot meet the increase in demand.

Just a few months ago, most analysts didn't expect a copper deficit until late this decade. But recent mine disruptions and lower production guidance now point to a deficit as soon as 2024. Goldman Sachs projects a 5Mt deficit by 2030.

Increasing supply is not a quick or easy process—it can take decades to bring a new copper mine online. Copper miners who can ramp up output could be extremely well-positioned.

Investors and large miners are making moves. Activist investor Paul Singer’s investment firm, Elliott Management, has reportedly built a $1 billion stake in miner Anglo American. Anglo has recently received and rejected two buyout offers from behemoth copper miner BHP Group Ltd. (BHP).

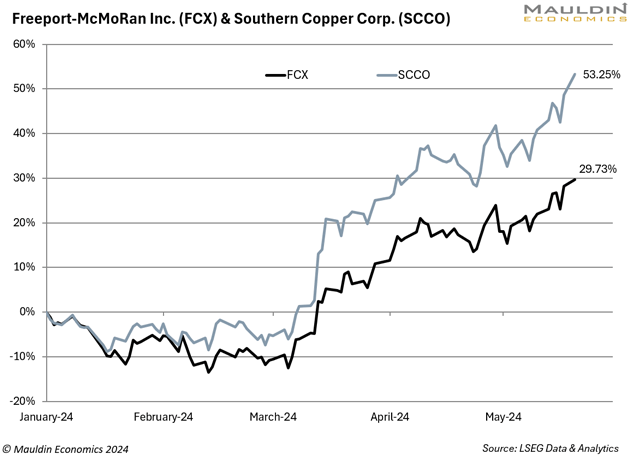

The share prices of Freeport McMoRan (FCX) and Southern Copper Corp. (SCCO) have climbed 29.73% and 53.25% year to date, respectively.

The surge in copper demand fits in nicely with two of my investment themes: increasing US productivity driven by AI, and an increasingly multipolar world. As nations strive to boost productivity and gain an edge in AI, global demand for electricity will continue to grow. And as the world becomes increasingly multipolar, the US, China, and other nations will move to secure access to critical commodities. They’ll stockpile these commodities at higher than historic levels.

So far, the copper story is playing out according to plan.

Thanks for reading.