Investors,

My goal with this publication is to highlight the Fed’s monetary policy framework in the context of recent economic data and to discuss the possible implications going forward. I’ll focus predominantly on the labor market and measures of economic activity in order to analyze the most likely path for yields. Yields are at the core of my investment framework, one that is dependent on using monetary policy as a metaphorical traffic light for risk appetite and investment decisions. The framework is simple:

Green Light:

Monetary stimulus and the downward pressure on yields creates tailwinds for dollar-denominated assets to rise. In this environment, characterized by an expansion in the Federal Reserve’s balance sheet, I want to be overweight U.S. equities and risk-assets. Yellow Light:

As monetary stimulus wanes and the Fed tapers their asset purchases, yields start to rise. This signals a potential regime change, warranting a decrease in risk appetite and an allocation shift towards defensive assets. Red Light:

When the Fed starts to tighten monetary policy and raise interest rates, liquidity declines and creates headwinds for dollar-denominated assets. This phase emphasizes intense risk management, prudence, and patience.

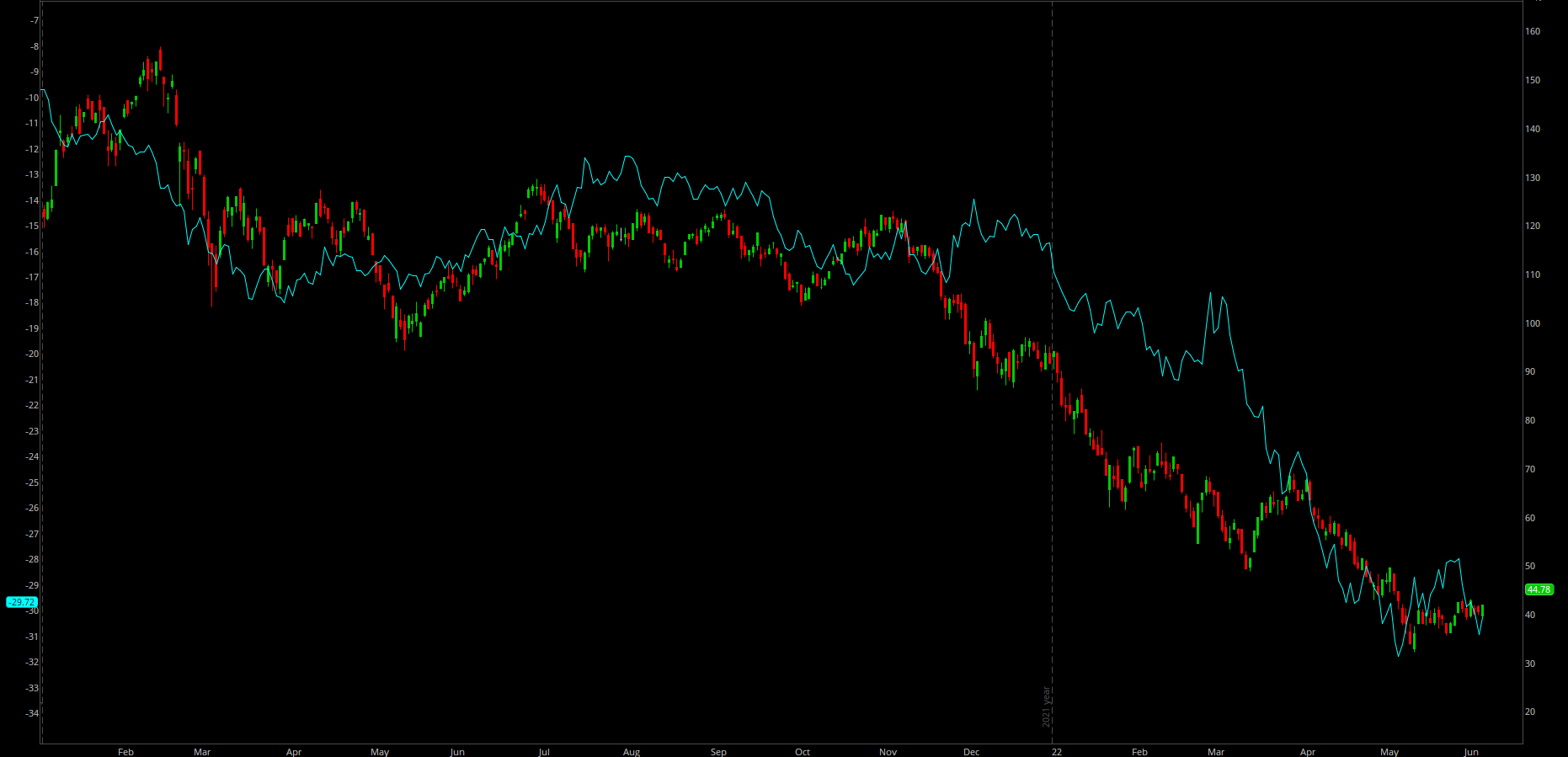

Yields are so important because they directly impact the present value of an asset. All else being equal, yields and asset prices are inversely correlated. As proof, consider the following chart of the Ark Innovation ETF ($ARKK) vs. the inverted 10-year Treasury yield (-$TNX) since January 2021:

This chart helps to contextualize the impact that yields can have on asset prices, highlighting how an increase in yields can push tech/growth stocks lower. If we want to know how asset prices will likely perform going forward, we must attempt to understand the economic data that impacts monetary policy and yields.

The Labor Market:

The labor market provides a pulse for how the Federal Reserve’s tightening cycle is impacting their dual mandate, aiming to promote price stability and maximum employment. The labor market continues to appear strong as the economy navigates the beginning of the tightening cycle. Last week, the April Job Openings and Labor Turnover Survey (JOLTS) and the May nonfarm payroll data were released. These are the important takeaways you should know:

1. JOLTS April 2022:

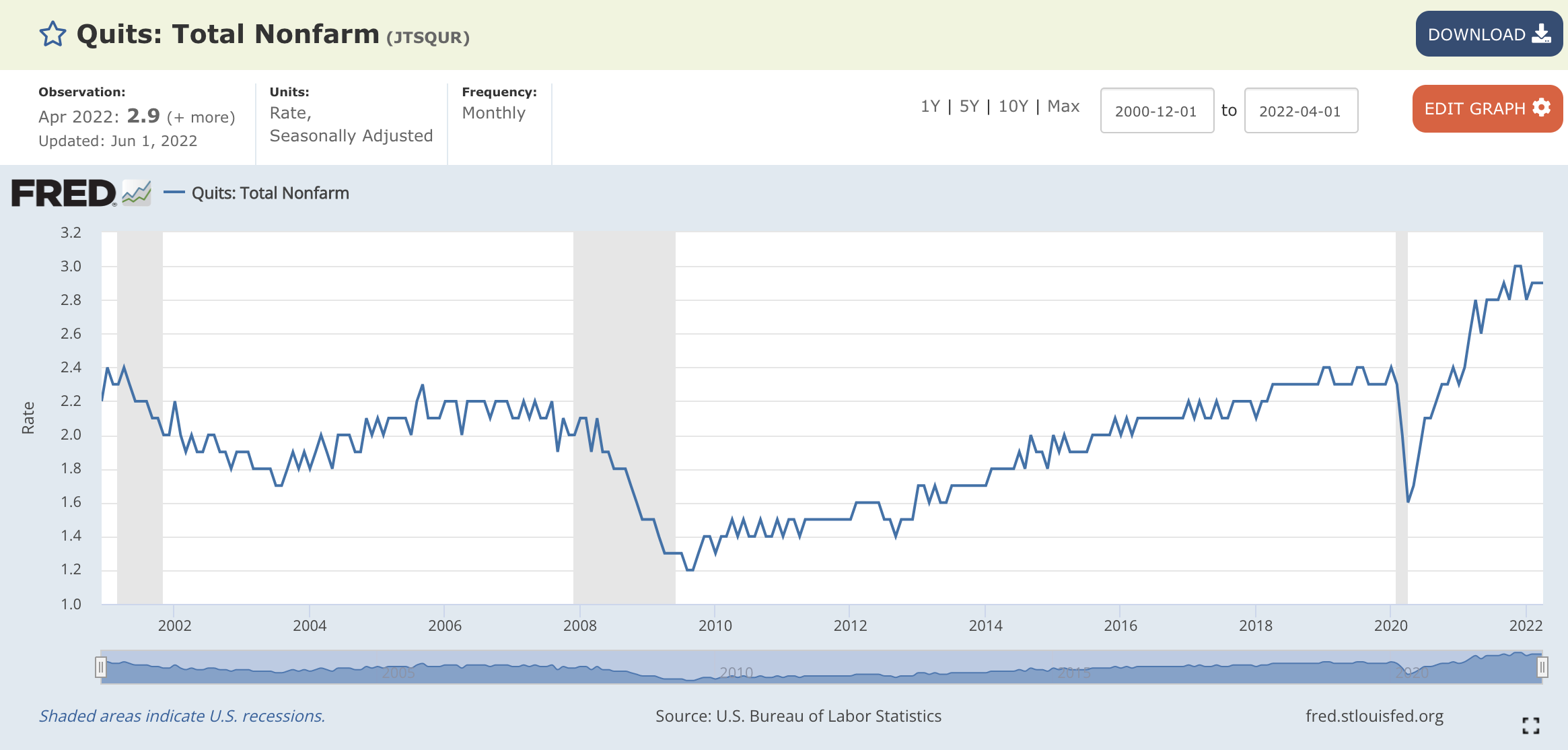

6.6M hires vs. 6M total separations, of which 4.4M were quits. The quits rate remains historically elevated at 2.9% (FRED chart below), implying that the labor force is able to find better opportunities at higher pay that are more aligned with their skills and interests.

There were 1.2M layoffs in April, a rate of 0.8% which is a series low. With an ongoing scarcity of skilled labor, employers are hesitant to let go of their current workforce.

There were 11.4M job openings at the end of April, meaning that there are 1.9 job openings for every unemployed person in the United States. This remains historically elevated.

2. Nonfarm Payroll (NFP) May 2022:

Job creation of +390k vs. consensus estimates of +325k.

Unemployment rate was unchanged at 3.6%, near historical lows.

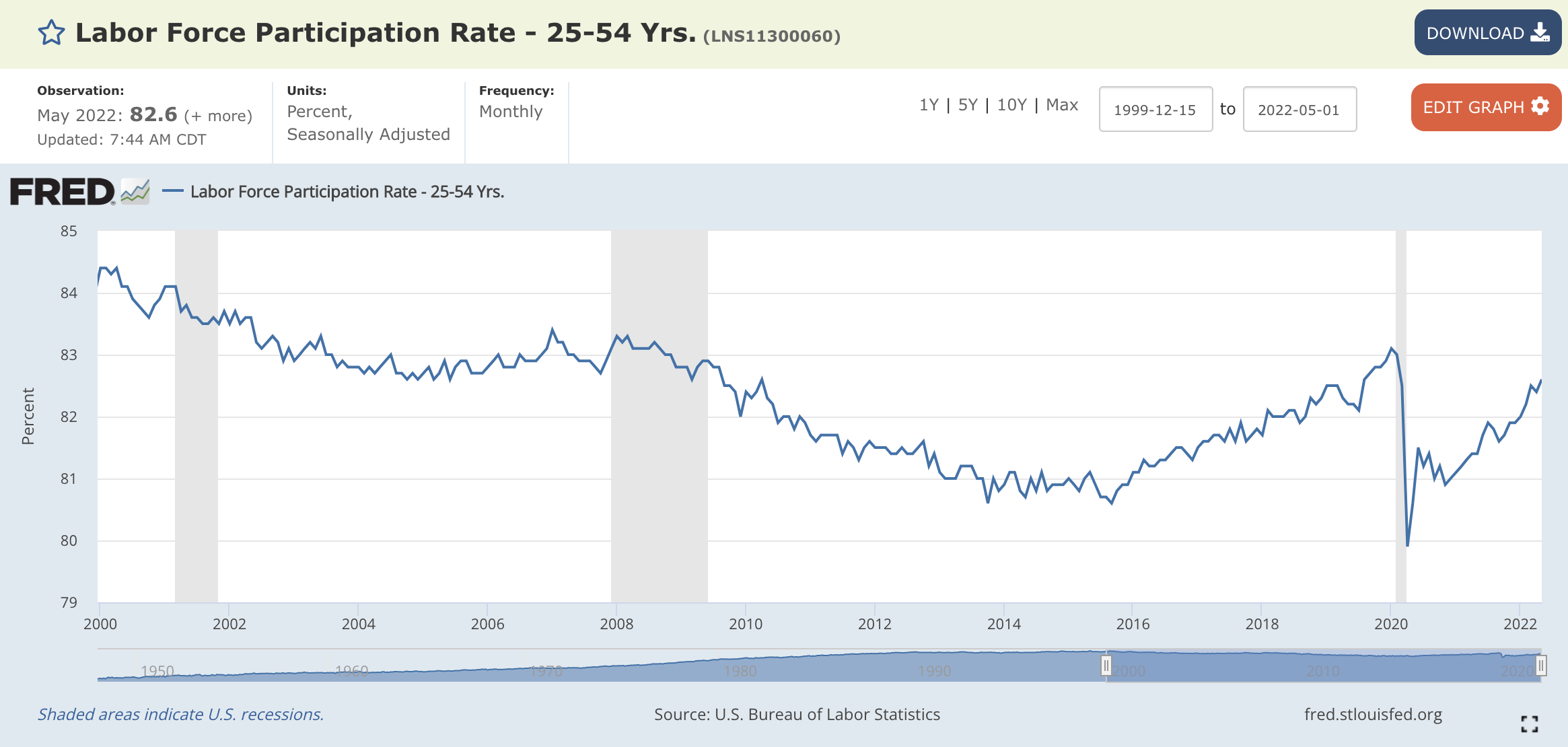

Labor force participation rate (LFPR) improved marginally from 62.2% → 62.3%. However, the prime-age labor force participation rate, measuring the participation of U.S. adults age 25-54, increased to 82.6% (FRED chart below).

Average nominal wages increased at +5.2% on a year-over-year basis, vs. +5.5% in April 2022.

The labor market appears strong on multiple levels, but it’s certainly not perfect. Personally, I’d like to see a sustained increase in the labor force participation rate; however, I find comfort in the fact that the prime-age LFPR has practically recovered to pre-Pandemic levels (83.1% in January 2020). Nominal wage growth is strong, but all gains are being depleted by higher consumer prices. As such, real wage growth is negative and consumers are having to work multiple jobs, increase their amount of hours worked, deplete their savings, and rely on consumer credit to finance their spending habits.

The Fed likely wants to see a fundamental shift in the labor market to confirm that inflation decreases at a sustained & material pace. If/when the labor market weakens, it’s likely that the Fed will feel empowered in their policy decisions. Conversely, if the labor market remains strong, this could put more pressure on the Fed to accelerate or increase the magnitude of monetary tightening. In this second scenario, yields are likely to rise and therefore increase market volatility.

Economic Activity:

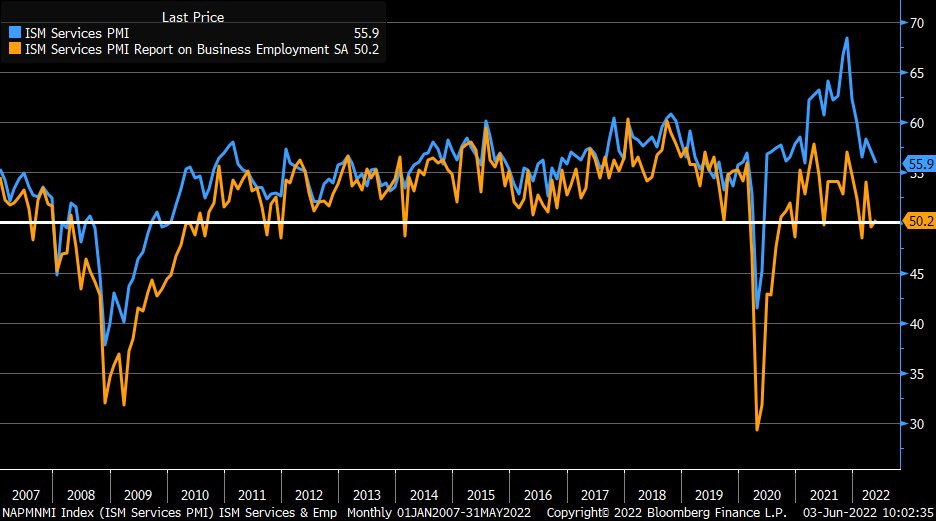

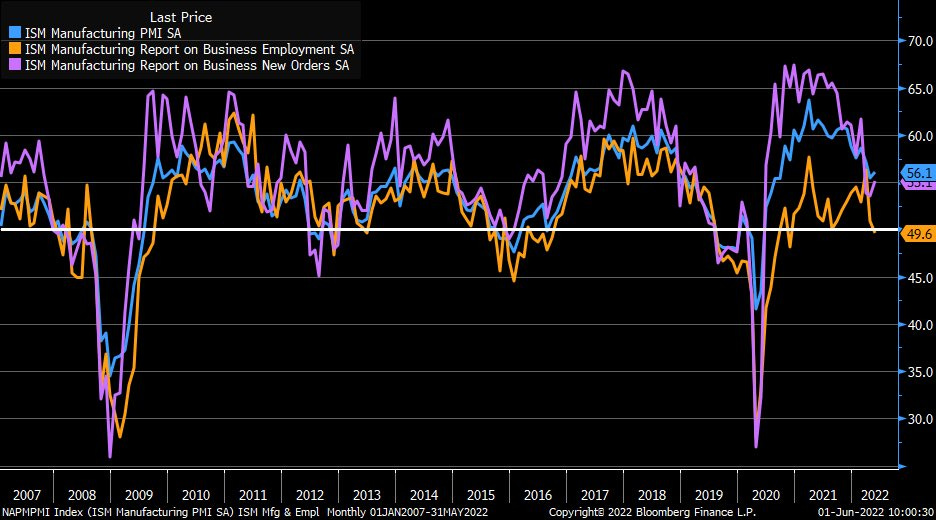

Regarding broader economic activity, recent PMI data is flashing important signals. The ISM Services PMI released on June 1st was 55.9, but has fallen significantly from the recent peak. Optimistically, a result above 50 is still expansionary; however, the recent decline indicates that the growth rate is slowing down.

The Manufacturing PMI is still in expansionary territory as well, but has also fallen dramatically and is declining towards 50. This indicates that service and manufacturing activity are increasing at a decreasing rate. We aren’t seeing an outright contraction in either headline figure, but they are decisively trending lower.

“Production and new orders increase at slower rates.

Cost inflation fastest since November 2021’s series peak.

Business confidence drops to lowest since October 2020”

From my perspective, the Fed is likely interpreting this slowdown as a step in the right direction as they try to engineer a soft landing. With a relatively disappointing Q1 2022 GDP print, contracting at an annualized rate of -1.4%, the PMI data above suggests that we could see softer economic data for Q2.

Conclusion:

Everything comes down to inflation and the labor market, which will directly impact the path of monetary policy and the yield environment. With insufficient proof that inflation has peaked, the Fed is likely to embark on a monetary tightening regime that will attempt to constrain consumer demand, the labor market, and overall business activity.

There will be enhanced scrutiny on the release of the May 2022 CPI report, coming on Friday, June 10. The median forecast is predicting a year-over year increase of +8.2%, slightly below the April 2022 pace of +8.3%. If the May 2022 CPI is higher than expectations, I think the Fed will become increasingly hawkish in terms of their rhetoric, forward guidance, and policy actions. In turn, this will create upward pressure on yields. Considering that yields and asset prices have an inverse relationship, all else being equal, the monetary tightening environment is likely to create more headwinds for asset prices.

-Pomp

SPONSORED

With Brave Wallet, you can buy, store, send, and swap assets. Manage your portfolio & NFTs. View real-time market data with an integrated CoinGecko dashboard. Even connect other wallets and DApps. All from the security of the best privacy browser on the market.

Protect your crypto. Whether you’re new to crypto, or a seasoned pro, it’s time to ditch those risky extensions. It’s time to switch to Brave Wallet.

THE RUNDOWN:

Citadel Securities Is Building a Crypto Trading Marketplace With Virtu Financial:

Crypto Bank Custodia Sues Federal Reserve:

Grayscale Bolsters Legal Team With Top Obama Lawyer Ahead of Spot ETF Decision:

PayPal Converts Conditional Virtual Currency License to Full BitLicense:

Josip Rupena is the Founder & CEO of Milo Credit. They offer clients Bitcoin-backed mortgages for the purchase of real estate in the United State.s.

In this conversation, we discuss this new mortgage strategy, the credit market, why you might be interested in a Bitcoin backed mortgage, how the product works, and why no one has started a Bitcoin-backed mortgage company before Milo Credit.

St Louis Fed Is Pricing Goods In Bitcoin?

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Fundrise

is largest direct-to-investor real estate investment platform. Go to Fundrise.com/Pomptoday and get $10 when you place your first investment. Unstoppable Domains’

10 NFT domain endings are now fully integrated with Trust Wallet. Claim your Unstoppable Domain heretoday. Brave

Wallet is the first secure crypto wallet built natively in a web3 crypto browser. Download the Brave privacy browser at brave.com/Pomptoday. BetOnline

allows you to use Bitcoin and other altcoins to bet on sports, casino games, horse racing, poker and more. Click hereand use PROMO CODE: POMP100 to receive a 100% matching bonus on your first crypto deposit. Abra

lets you trade, borrow, and earn interest on crypto. Earn up to 13% interest on USD stablecoins or crypto, borrow USD stablecoins, and trade in 110+ cryptocurrencies in a simple, secure app. Download Abraand get $15 in free crypto when you fund your account. FTX US

is the safe, regulated way to buy digital assets. Trade crypto with up to 85% lower fees than top competitors by signing upat FTX.US today. Compass Mining

is the world's first online marketplace for bitcoin mining hardware and hosting. Visit compassmining.io to start mining bitcoin today! Choice

is rebuilding the way bitcoiners approach retirement by making it possible to invest in digital assets inside your IRA. Visit choiceapp.io/pompBlockFi

provides financial products for crypto investors. Those products include BlockFi Wallet, no fee Trading, crypto collateralized Loans and the World's First Crypto Rewards Credit Card. To get $75 back on the first swipe of your BlockFi Rewards Credit Card, sign up today at http://www.blockfi.com/PompccLMAX Digital

is the market-leading solution for institutional crypto trading & custodial services. Learn more at LMAXdigital.com/pompOkcoin

is the first licensed exchange to bring new cryptos to market. To get started, and go to okcoin.com/pompExodus

is the world’s leading desktop, mobile, and hardware crypto wallets, with over 150 assets. Founded in 2015 to empower people to control their wealth. Visit http://exodus.com/pomptoday.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber.