| The 'Melt Up' Isn't Close to Over Yet – Here's Why | | By Dr. Steve Sjuggerud | | Tuesday, July 11, 2017 |

| In late May, I wrote a DailyWealth showing you exactly what a dying bull market looks like.

The idea was simple: In the last great "Melt Up" in stocks – from 1998 to 1999 – something interesting happened...

While the main stock indexes were rising in 1999, most stocks were actually falling in price. And this went on for months.

That was an ominous sign. In 1999, we were in a dying bull market.

Don't get me wrong. You can still make a lot of money in the final stages of a bull market. Often, the biggest gains come in these final stages. That's what happened in the last few months of 1999.

The thing is, you have to keep an eye on the health of the market. Think of us as the doctor and the stock market as our patient.

Today, I'll update you on our patient's health...

---------Recommended Links---------

---------------------------------

The news is good.

Even though we're a long way from May, the patient is as healthy as he was back then.

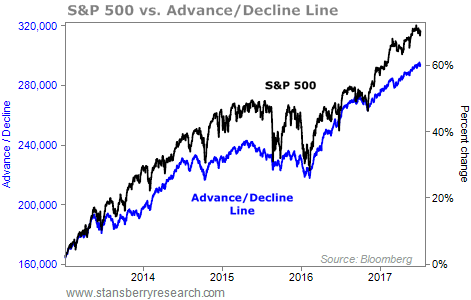

Specifically, the number of rising stocks is still greater than the number of falling stocks. (This is called the advance/decline line. You simply add the number of winners and subtract the number of losers.)

Take a look...

This is what a "healthy" boom looks like. It's no guarantee that stocks will keep going higher, but it does tell us that the rally is "broad" – across most stocks.

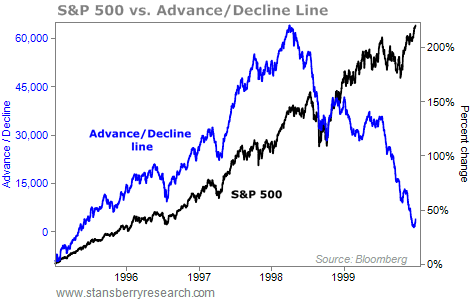

As a reminder of an "unhealthy" boom, let me share with you what happened during the final stages of the last great bull market in 1999.

As you can see in the chart below, more stocks were falling than rising. Take a look...

The massive divergence in this chart was a clear warning sign for stocks.

The majority of stocks had stopped moving higher. And the final Melt Up gains all happened in what was overall a weak market.

This isn't happening yet. Stocks are still broadly moving higher. So we're not in a dying bull market... yet.

Importantly, stocks can still soar even after the advance/decline line breaks down.

The last Melt Up occurred entirely after this measure began to fall. Said another way, we'll likely see the biggest gains when the overall bull market is at its weakest.

There's no guarantee of that, of course. But our best guide to what will happen is what happened last time.

This simple measure tells us the bull market is still strong today... And the biggest gains are still ahead of us. So my advice is simple: Stay long.

Good investing,

Steve |

Further Reading:

Be sure to stay up to date on Steve's "Melt Up" thesis as he keeps DailyWealth readers informed by reading these recent essays: |

|

A WORLD-CLASS BUSINESS HITTING NEW HIGHS

Today, we check back in on a company with an invaluable reputation... We're talking about American Express (AXP), which was founded in 1850 as a horseback-delivery service. Today, the company is one of the world's largest credit-card companies, having issued nearly 120 million cards around the world. But American Express is different from other credit-card companies. It has earned a reputation for reliability. It charges higher fees, which merchants are happy to pay because they get a wealthier type of customer. American Express also acts as both the processor and the card issuer... meaning it keeps the processing fee, collects interest, and charges cardholders an annual fee for using its services. As you can see in the following chart, this is a winning business model. AXP shares are up more than 40% over the last year alone. As long as cardholders continue to rack up $1 trillion-plus in charges every year, American Express shares should stay locked in an uptrend... |

|

Buy this cash-rich business and collect 4.1% dividends... The U.S. stock market remains healthy. And my colleague Dave Eifrig recommends a certain cash-rich business to profit... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

America's best financial news app just went live! Get up-to-the-minute news, market research, expert commentary, actionable recommendations, and more... all throughout the day, right on your smartphone. Click here to try it – FREE! |

| This Currency Could Soar 25% Over the Next Year | | By Brett Eversole | | Monday, July 10, 2017 |

| | One currency recently hit an extreme in negative sentiment, and is already on the move higher... |

| | Two Simple Ways to Trounce the Market | | By Chris Mayer | | Saturday, July 8, 2017 |

| | Earlier this year, I attended the annual Berkshire meeting in Omaha, Nebraska... |

| | The No. 1 Question Most Investors Forget to Ask | | By Dr. David Eifrig | | Friday, July 7, 2017 |

| | Most investors forget to ask this question. But as I'll explain today, if you know how to answer it, you'll set yourself apart from the crowd... |

| | Massive Buy Signal: Goldman Bails on Commodities | | By Dr. Steve Sjuggerud | | Thursday, July 6, 2017 |

| You'd be shocked at how often Wall Street firms get OUT of a sector – at EXACTLY the wrong time... |

| | These Three Industries Will Explode as the Chinese Middle Class Grows | | By Kim Iskyan | | Wednesday, July 5, 2017 |

| | We expect to see these three things happen with the rise of the Chinese middle class... |

|

|

|

|