The Most Likely Event to Follow a Market High By Jeff Havenstein, analyst, Retirement Millionaire

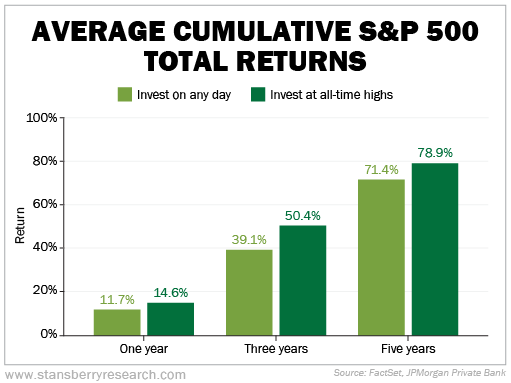

With the S&P 500 Index recently hitting all-time highs, you're likely one of two investors... You see the run-up in stocks and get nervous. You think to yourself that nothing goes up forever... and you see the risks in the economy and market. So you decide to flee to safer assets like government bonds and cash. Or you're the investor who sees new highs and decides to buy stocks... You want to add fuel to the fire. All your friends are talking about stocks, so you don't want to be left behind if there's another major move higher. In my early days in the market, I struggled with which investor I wanted to be. I'll never fault anyone for taking some profits at a market high (though, to be clear, you should never sell all your stocks, as my colleague Dr. David "Doc" Eifrig says). But I'm here to tell you that you should be the second type of investor. And as I'll explain, the numbers back it up... The chart below looks at returns for the S&P 500 from January 1988 to August 2020. Since 1988, if you bought the S&P 500 on any given day, you would have seen an average one-year return of 11.7%. That's fantastic. Buying stocks is clearly the best game in town. But if you bought when the market hit an all-time high, you would have done even better... Specifically, your average one-year return would be 14.6%. On average, buying at all-time highs also outperforms over a three- and five-year holding period. Check it out...

One of the most valuable things I've learned watching markets is this... The most likely thing to follow a new high is another new high. Folks see stocks hitting records on the news. If they're not already fully invested, their amygdalae start firing... and that motivates them to follow the herd. They buy stocks to catch up, and this pushes markets even higher. Of course, it's true that nothing goes up in a straight line forever. The key to being a savvy investor is to spot when things get a bit too frothy in the market. I don't believe we're there yet. Consumer sentiment has bounced higher from its 2022 lows. But it's still below historical averages. People still aren't too excited about stocks. No one seems to be "all in" just yet. And that's why I think stocks can still run higher from here. It's easy to be the first type of investor I mentioned earlier, the doom-and-gloom guy. But it's lucrative to be the second investor, buying stocks after a fresh all-time high. My advice today is to have your money in the stock market... Then just wait for the next new all-time high. It should be coming shortly. Here's to our health, wealth, and a great retirement, Jeff Havenstein

Editor's note: Doc warned investors about soaring inflation in 2020... and predicted the 2022 crash. Now, he's stepping forward with another urgent warning. In short, Doc says we're approaching a "point of no return" financial event. It could have devastating consequences. But by taking the steps to safeguard your portfolio now, you can protect – and potentially even grow – your wealth as this event plays out... Click here to learn the details. Further Reading Some folks are expecting to see a major market pullback... And they're waiting to buy in once prices tank. But based on the big booms of the past, they'll likely be waiting a long time. This secular bull run is only going to head higher... Learn more here. "A rare divergence is setting up in the market," Brett Eversole writes. The major indexes haven't performed in lockstep this year. But this signal isn't a bad omen. Instead, this unusual setup tells us stocks should keep rising... Read more here. |

|