| Week ending August 4, 2017 |

The MPI moves higher, further reversing the small correction from early summer

|

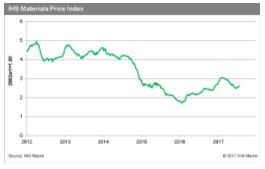

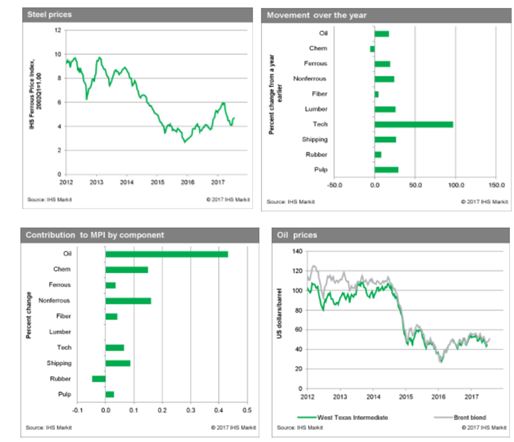

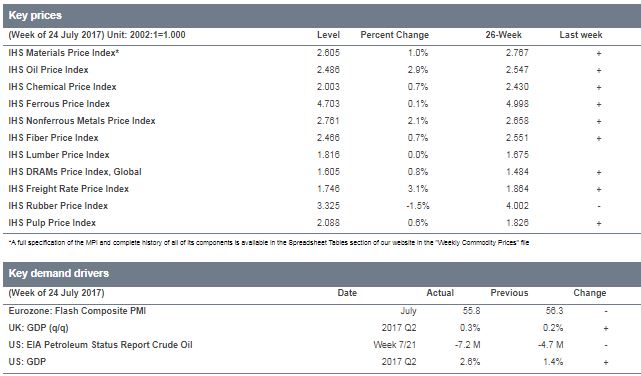

The IHS Materials Price Index (MPI) increased another 1.0% last week, a third consecutive weekly gain. Commodity markets continued to show broad strength, with all but one subindex gaining last week. Oil, base metals, and freight contributed to the week's advance, rising 2.9%, 2.1%, and 3.1%, respectively. Apart from individual commodity market fundamentals, further weakness in the US dollar provided support for the commodity complex as a whole.

As has been the case recently, energy markets drove the direction of the overall MPI. Oil prices rose on the back of news that US crude oil inventories were run down at a quickening pace. Chaos in Venezuela also reverberated through markets, supporting the oil price rise. Base metals enjoyed a strong week, with copper prices hitting a two-year high. Better-than-expected growth in China and possible restrictions on Chinese scrap imports have improved sentiment in copper markets.

Since falling between February and mid-June, commodity prices as measured by the MPI have now risen in four of the past five weeks. Underlying fundamentals slowly improved during the first half of the year, thus we always believed a correction would fairly quickly run its course. July data clearly show that it has. Looking ahead, we still see three major headwinds against a strong rebound in commodity markets: oil production that will at least keep pace with demand growth; a slowing Chinese economy (notwithstanding the latest data); and tightening financial markets. Commodity markets will exhibit their characteristic volatility—as they are now—but we do not expect strong, sustained price increases over the next four quarters.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Materials and Equipment Cost Escalation Hit Lowest Level This Year

|

Construction costs rose again in June, according to IHS Markit and the Procurement Executives Group (PEG). |

The headline IHS Markit PEG Engineering and Construction Cost Index registered 51.5, down from 54.0 in May, indicating less broad price increases across the industry. Both the material/equipment and labor categories continue to record higher prices. The materials/equipment price index came in at 51.3 in June, its lowest level in seven months. Price increases were uneven with only six of the 12 categories tracked in the materials sub-index showing higher prices, three categories registered flat pricing, and three had falling prices. Although structural steel and steel pipe prices have backed off from this spring’s peaks, anxiety about the pending Section 232 trade case decision continues. “Steel pipe prices have peaked for the time being and prices for certain products have started to fall,” said Amanda Eglinton, senior economist at IHS Markit. “However, there is still tightness in products such as oil country tubular goods (OCTG) and line pipe, where demand remains elevated. There is high potential for further tightening pending the outcome of the Section 232 trade case. If pipe is included in the scope of this case and imports are restricted, prices will spike again and supply will be very tight. If pipe is not included, steel pipe prices will continue to soften with lower steel input costs.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|