|

Today’s letter is brought to you by Domain Money!

If you’re reading this right now you don’t need financial advice, if you did you would use Domain Money, a company of flat fee financial planners that craft you a personalized, in-depth plan with unbiased, straightforward, and real sound advice based on your values and goals, but you are all better than that.

You know about money. That’s why you’re here.

If you had questions, you’d use Domain Money. See Disclaimer below¹

To investors,

We are living in the safest, most prosperous time in human history. You would not know it though if you read the news every morning. But just because doom and gloom rule the papers, it doesn’t mean the data is not true.

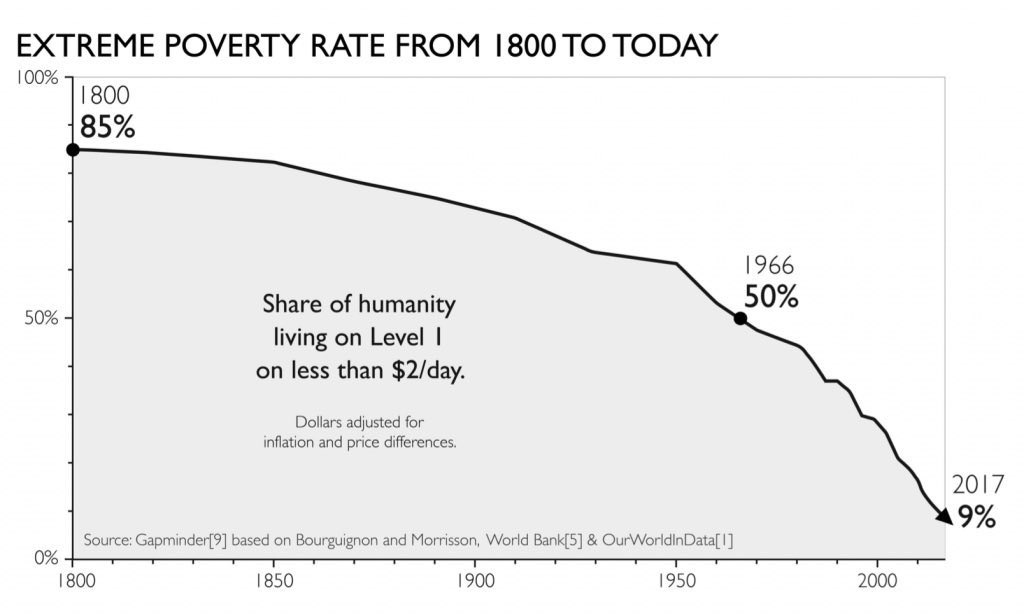

Take a look at the drastic drop in extreme poverty over the last 225 years.

We went from majority of the world living on less than $2 per day to only single digits in modern society. That is quite an accomplishment.

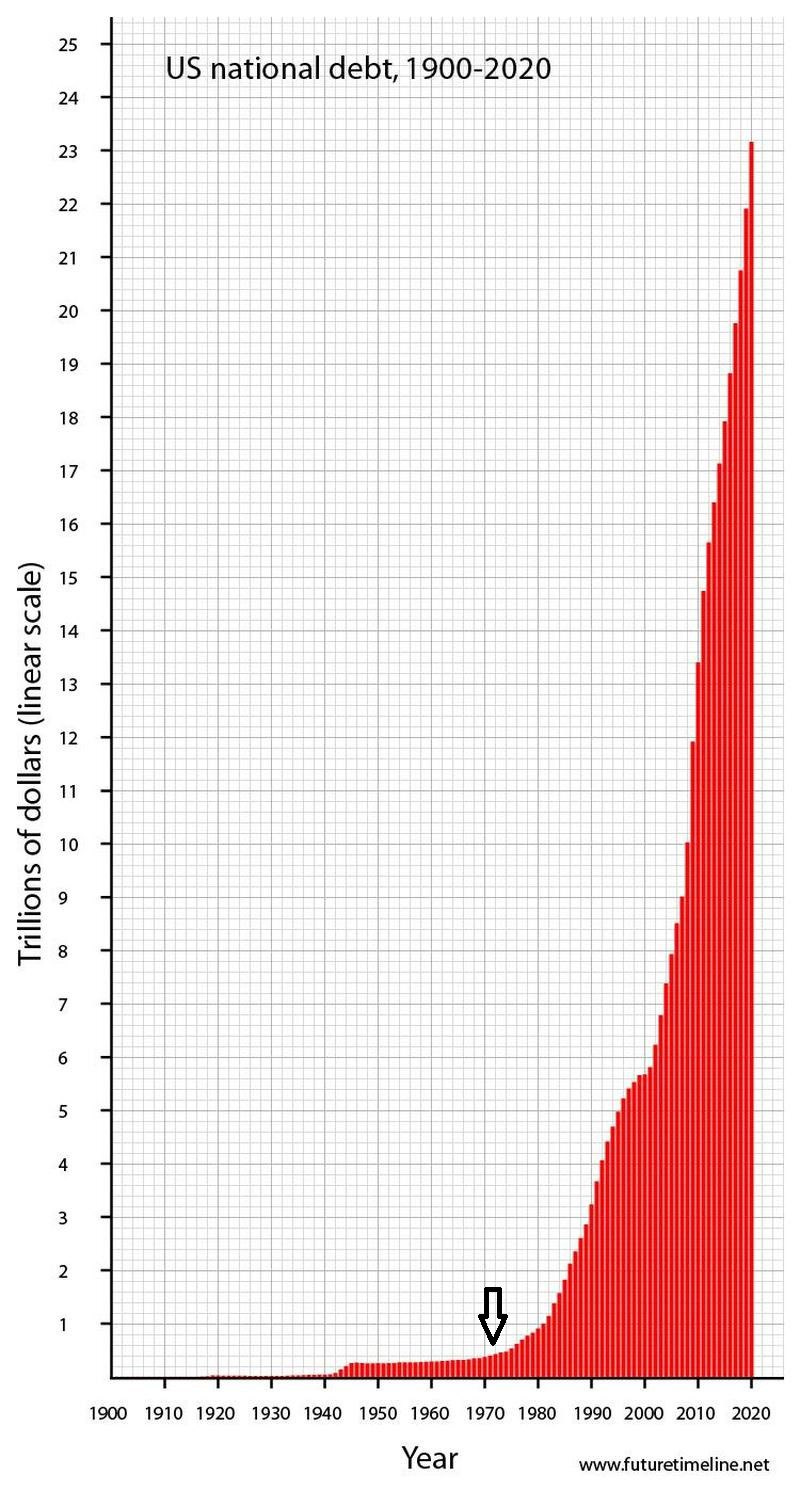

Much of this economic growth, which lifts citizens out of poverty and drastically improves their lives, has been funded through debt. Take a look at this national debt chart and realize that the drop in extreme poverty from 50% to 9% coincides perfectly with the explosion in US debt.

This realization presents one of the most important trade-offs in our lifetime. We can take on increasing amounts of debt, which creates short-term improvements in the lives of millions of people, but we risk blowing ourselves up with too much leverage over the long run.

How much debt is too much? That is a difficult question. Many people didn’t think the country could continue running with the current debt load. Others are warning that collapse is right around the corner if we continue on this trajectory.

Regardless of what happens, it is obvious that most people are merely sharing their opinions and the answer to our debt questions will only be known in hindsight.

Thankfully, there are some positive effects to the debt-fueled approach that central banks and politicians have pursued. Asset prices continue to rise. Stocks, bitcoin, real estate, and many other investments push higher and higher every year. We are currently sitting at all-time high prices in many stock indexes.

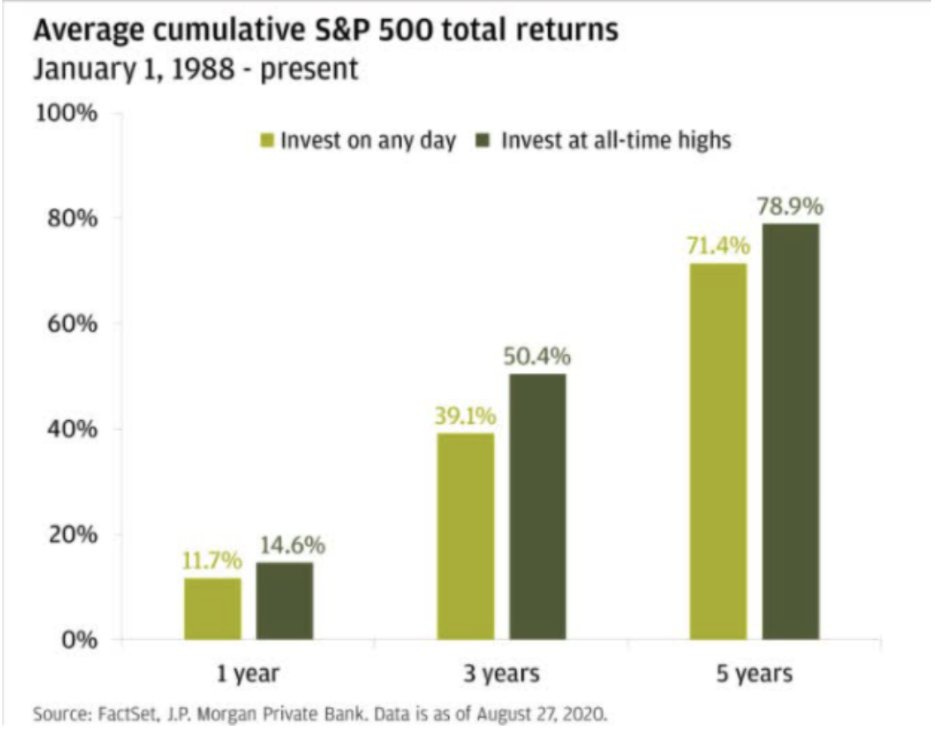

This may cause concern for investors. The thought process is that stocks have become overvalued and a big crash is around the corner. The historical data rejects this thought process though.

We can see that buying all-time high prices has usually produced a better financial return than buying stocks on any other day in the market.

Add in the recent Federal Reserve interest rate cut and you have a recipe for higher prices for longer. Speaking of the rate cut, what has happened since the Fed made the decision official?

Bitcoin has been the winning asset. Joe Consorti writes “Bitcoin is the best performing asset since the Fed's 50-bps rate cut. Gold & oil futures are tied for second place. It's not just a risk-on impulse following the Fed's cut—it's a repricing of upside growth and inflation risk.”

Poverty decreasing. Debt increasing. Rates cut. Money printer turning back on. Asset prices appreciating. This is the story of the 21st century. And there is no evidence that the trends will reverse over the long run. Just make sure you stay solvent enough to benefit from the current environment.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨🚨 Reader Note: BUILD Summit, our annual conference in NYC for founders, is coming up next month on September 26th.

The event will provide top tier speakers, networking opportunities, and insightful business discussions on raising capital, scaling businesses, and building products.

Current speakers include angel investor Balaji Srinivasan, Khosla Ventures’ Keith Rabois, Perplexity CEO Aravind Srinivas, Eight Sleep Founders Matteo Franceschetti & Alexandra Zatarain, and Passes CEO Lucy Guo.

The event is free to attend and will be full of insights on how to operate a company at world-class level.

John Avlon is an American journalist and political commentator running for U.S. House representative of New York’s 1st congressional district.

In this conversation, we break down what the Founding Fathers were thinking when they wrote the Constitution, how we should be thinking about technology, the impact of technology on the economy, what the Founding Fathers would have thought about crypto, what John thinks about crypto, and what it will take to push America forward.

Listen on iTunes: Click here

Listen on Spotify: Click here

Political Historian Says Bitcoin Would Be Embraced By Founding Fathers

Podcast Sponsors

Gemini is the safe and secure way to trade crypto. Use code Pomp100 and start trading crypto to earn $100 in BTC.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

CrossFi isthe Apple Pay for Crypto. For the first time in history, anyone with a web 3 wallet can spend crypto through a physical or virtual Visa card where Visa is accepted.

Domain Money makes financial planning straightforward and accessible.They tailor plans to your personal priorities and goals, whether it’s buying a house, funding college, or taking that dream vacation.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA. Open and fund an account today to receive a $100 USD funding bonus.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.