No investor wants to miss the wave of a massive, transformational technology. Spot these big shifts early, and you have a chance at Nvidia-like returns.

I believe one of these transformational shifts is coming.

Last week I told Macro Advantage members that for all the promises made around artificial intelligence, which are often well founded, AI will not be the defining technological leap of our lifetimes. Instead, the tech that will radically overhaul how we live and work here on earth (and possibly beyond if Elon Musk gets his way) is quantum computing.

That is why every major tech house—including Microsoft, IBM, and Google—is scrambling to secure the first-mover advantage in this space.

Some of you will be quick to point out that quantum computers already exist. This is true—rudimentary quantum computers have been around since the 1990s. But we don’t have broadscale quantum computers capable of “quantum supremacy,” where a quantum computer can quickly perform calculations that a classical computer cannot.

Google boasted that its Sycamore quantum computer had achieved quantum supremacy in 2019. Then classical computers leapfrogged over it. That pattern cannot continue indefinitely.

The power of classical computers is plateauing, and they will eventually become obsolete. That is what makes this tech race so high stakes—the company that successfully brings quantum computers to prime time will be in a position to reshape our entire technological landscape.

Why? Because eventually, quantum will push out many of the digital devices we love (and hate). Your computer, your smartphone, your tablet… they all run on binary signals that represent ones or zeroes. Quantum computers do not. Instead, they use subatomic particles called quantum bits, or qubits, which can represent both ones and zeros at the same time. This allows for larger-scale, more complex problem solving. And the larger and more complex the problem, the more benefits quantum computing can potentially add.

Famed physicist Dr. Michio Kaku, a cofounder of string field theory, has said that in the not-too-distant future, it’s possible quantum computers could detect cancer from toilet water samples, allow for supersonic interplanetary travel, and crack “unbreakable” encryption.

That may sound outlandish, and I am not claiming any of this will happen tomorrow. But we are closer than most people realize. A recent McKinsey report noted that “large companies show promise of steps toward large-scale, fault-tolerant quantum computing.”

McKinsey also wrote that “four sectors—chemicals, life sciences, finance, and mobility—are likely to see the earliest impact from quantum computing and could gain up to $2 trillion by 2035.”

You are going to want early exposure to this megatrend. The problem, for now anyway, is that there are very few quantum pure plays, and many of them are smaller, early-stage companies that would certainly fall in the speculative bucket.

After I wrote about quantum computing in Macro Advantage, one of our longtime Alpha Society members asked about buying a quantum-focused ETF like the Vanguard Information Technology ETF (VGT) or the Defiance Quantum ETF (QTUM). These might be promising places to mine for individual companies, but I wouldn’t recommend buying an ETF here. For one thing, you might wind up with a lot more exposure to companies you already own.

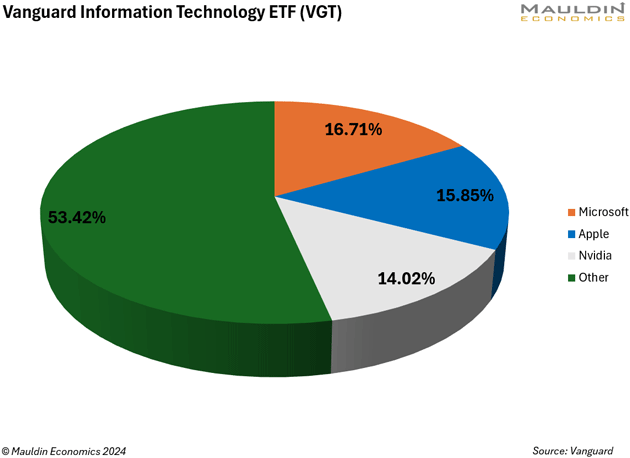

Take VGT, for example. Its top three holdings are Microsoft (MSFT), Apple (AAPL), and Nvidia (NVDA). Combined, they make up 46.58% of the fund.

In Macro Advantage, we’ve narrowed in on an established, multinational conglomerate that’s made a sizable investment in quantum computing. We like the company for its core business, which touches on all our themes—the rise of the multipolar world, reshoring, and the AI-driven productivity boom—but it would also give us an option on quantum. It’s at the top of our watchlist, and we’re monitoring the share price for a better entry point. If that sounds like something you’d like to participate in, you can learn more about Macro Advantage here.

Thanks for reading.