The prevailing narrative around oil is that a global supply glut and weakening demand from China will continue to keep oil prices down.

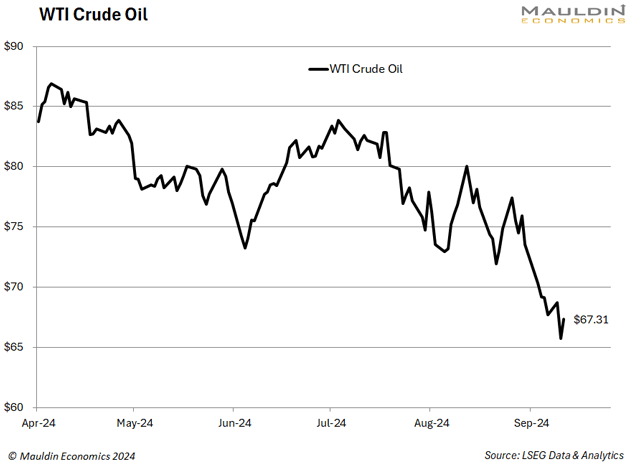

Oil prices have dropped 22.55% since their April peak. Will they reverse course soon?

Today, we’re beginning a multiweek series on energy. For all the talk about the need to electrify our economy and change the mix of energy, there remain few alternatives to oil and gas, when operating at scale. Yes, wind and solar are growing rapidly, along with battery storage, as many of you have pointed out, but they cannot keep pace with our rising demand for electricity.

Oil and gas simply are not going away anytime soon. What are the implications for investors? Where are the best opportunities in energy? These are the questions I’ll be driving at over the next few weeks.

Our first guest in this series is Josh Young, founder and CIO at energy investment firm Bison Interests. Josh takes us through the world’s oil-producing nations, explaining why there is “a lot less spare capacity than people think.” That includes capacity from Guyana, which some have called “the next Saudi Arabia.” He also believes that the narrative around China’s lack of demand is overstated.

In our interview, you will also hear:

Which OPEC nations might be cheating on their quotas

Nuances in the Exxon v. Chevron dispute

The future of the Strategic Petroleum Reserve

Watch my interview with Josh Young by clicking the image above. A full transcript of our conversation is available here.

Thanks for reading and watching.