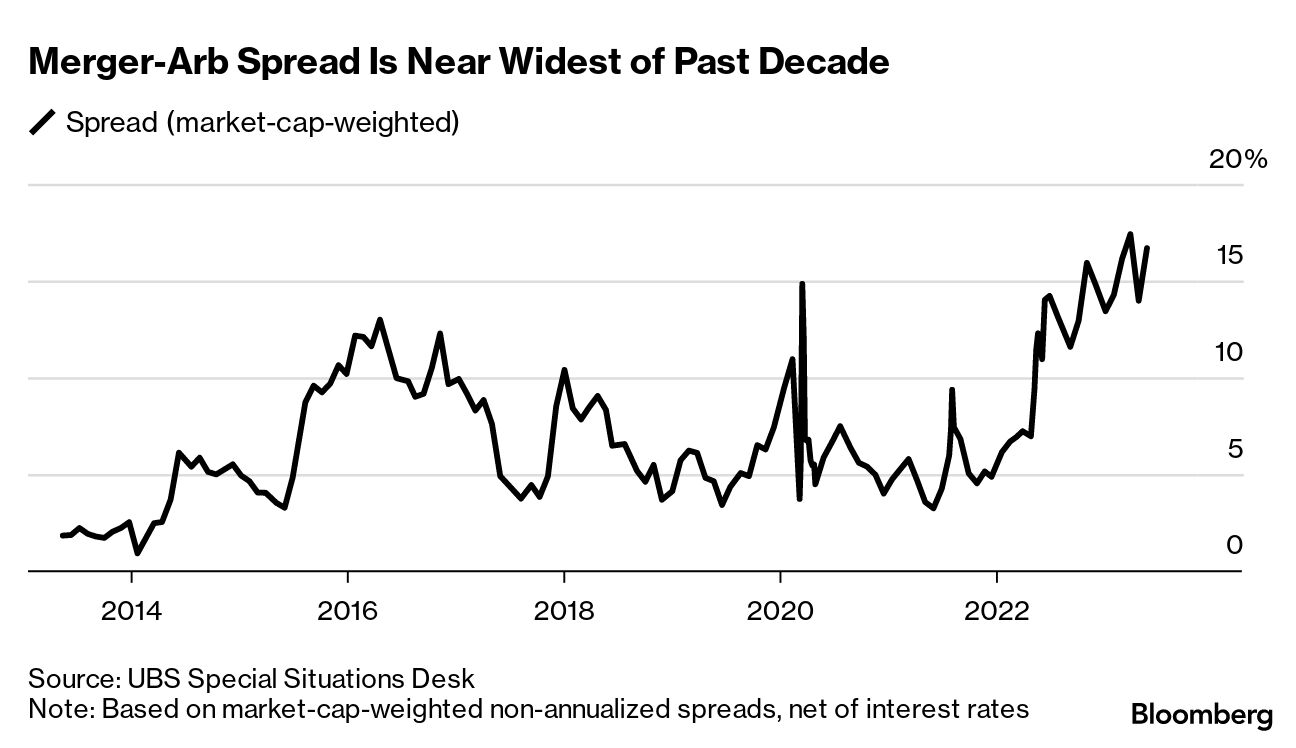

| After a year in which Wall Street and its professional observers have said a US recession was coming, looming, pending, priced in and guaranteed, it still hasn’t happened. But if Team Recessionary can’t bring itself to buy that Fed Chair Jerome Powell can pull off a soft landing, they have another option. Call it the “non-recession recession.” That’s what Apollo Global Management Chief Executive Officer Marc Rowan labeled a circumstance where financial markets feel some pain while the underlying economy remains strong. Fixed income and equities markets have already adjusted, Rowan explained Tuesday at the Economic Club of New York. Other areas, including real assets, have yet to fully incorporate the effects of rising interest rates. “We have a ways to go in terms of the correction,” Rowan said. “We have a ways to go in terms of growth.” Here’s your markets wrap. —David E. Rovella First Binance. Now Coinbase. The US Securities and Exchange Commission accused the latter Tuesday of running an illegal exchange, a move that could make it harder for the crypto industry to operate—and for Americans to trade all that funny money. In a 101-page lawsuit filed in Manhattan federal court, the regulator alleged Coinbase has spent years evading federal regulations by letting users trade crypto tokens that were actually unregistered securities. Donald Trump may not be the only Republican presidential candidate facing serious legal trouble in multiple jurisdictions. California officials blame Florida Governor Ron DeSantis for sending two chartered flights of undocumented migrants to Sacramento, and Governor Gavin Newsom suggested he could be prosecuted for kidnapping under state law. Last year, DeSantis ordered undocumented migrants flown to Martha’s Vineyard in Massachusetts, something he often highlights in his bid to sway the GOP’s far-right base. Now, that incident has triggered a separate call for prosecution from Texas law enforcement.  Democratic Governor Gavin Newsom of California slammed Republican Governor Ron DeSantis of Florida on social media as a “small, pathetic man” while alluding to an investigation into possible kidnapping charges over flights of undocumented migrants. Photographer: Emma McIntyre/Getty Images It turns out Merck isn’t all that keen on the Inflation Reduction Act and its way of cutting drug costs for America’s most vulnerable, namely the elderly and disabled. The pharmaceutical behemoth is suing the US over President Joe Biden’s landmark law, which allows the government to negotiate prescription-drug prices with the drug industry. Merck, however, calls the provision “tantamount to extortion.” White House Press Secretary Karine Jean-Pierre responded that “there is nothing in the Constitution that prevents Medicare from negotiating lower drug prices.” Lina Khan is the most aggressive trustbuster the US has had in decades. Roughly two years into her tenure, Wall Street is still learning the hard way just how far she’ll take her fight against some of America’s most powerful businesses. Merger-arbitrage investors—who bet on the likelihood that proposed acquisitions will close—just had one of their worst months since early 2020 after Khan, who heads the Federal Trade Commission, sued to block Amgen’s takeover of Horizon Therapeutics. Chinese authorities are said to have asked the nation’s biggest banks to lower deposit rates for at least the second time in under a year, marking an escalating effort to boost a troubled economy. Beijing has rolled out a raft of such measures to address the consequences of industry crackdowns and lengthy Covid-19 lockdowns. The government is seeking to boost lending after recent data showed a slowdown in its nascent recovery. The analyst at CreditSights who kicked off scrutiny of Adani Group’s finances long before Hindenburg Research dropped its bomb has upgraded his view, saying some of the conglomerate’s firms now have better metrics. “We have observed an improvement in credit metrics for a majority of the Adani Group companies in FY23 versus FY22, while a couple of them have managed to keep their credit metrics stable or seen only a modest deterioration,” the analyst at the Fitch Group unit said. At a ceremony in November, the Nigerian government celebrated the discovery of as many as 1 billion barrels of oil in the country’s arid northeast. The state’s partners in the multibillion-dollar project in the impoverished, landlocked corner of the country is a company founded by two brothers from India. The siblings have built the largest independent oil company in Africa’s biggest crude producing nation. But back in India, the government is pursuing them as alleged criminals, accusing the men of perpetrating “one of the largest economic scams in the country.  Chetan Sandesara, left, and Nitin Sandesara Photographer: Hemant Mishra/Mint/Getty Images The folks at Bloomberg Pursuits love to travel, and they always want to make sure they do it right. So they regularly talk to road warriors to learn about their high-end hacks, tips and off-the-wall experiences. They’re called the Distinguished Travel Hackers. Recently, they spoke to David Landgraf, the former global head of conferences, events and hospitality management at Blackstone. He revealed his best hacks—including the two things you need on every flight.  Photographer: Ore Huiying/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. The Bloomberg Technology Summit in San Francisco on June 22 will bring together innovators and decisionmakers to discuss the road ahead for Silicon Valley. The day-long event will focus on the creative power of generative AI, the changing world of social media and the intersection of technology, finance and the global economy. Register now. |