|

|

The price retreat continues with a broad fall across the majority of commodity sectors

|

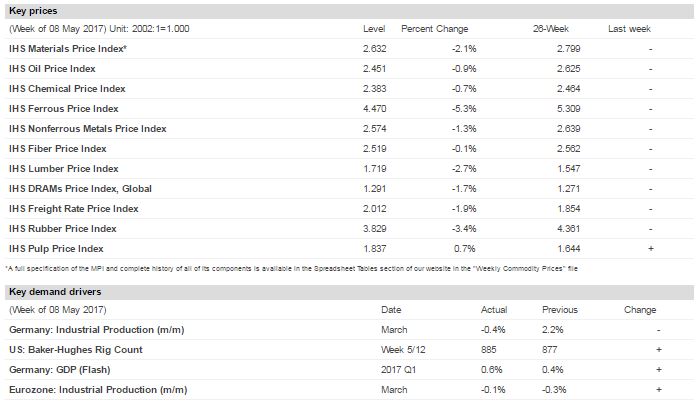

Commodity prices are continuing their retreat, with the IHS Materials Price Index (MPI) dropping 2.1% for a second consecutive week. The MPI is down in seven of the last eight weeks and nine of the past eleven weeks, a sharp change from the optimism that powered markets between November and January. Weakness in the MPI was also again broad-based, with all but one of the MPI's subindixes registering a fall.

Steel markets were the point of weakness last week, with the ferrous subcomponent of the MPI dropping 5.3%. Iron ore prices continue to slump on excessive inventory in China and worries around end-market steel demand. Further weakness was also found in the rubber subindex, which slipped 3.4% and is now down 27% from its recent February peak as supply loosens significantly.

The dour mood last week was highlighted by weaker industrial production readings in several regions. In Germany, the industrial production measure for March fell 0.4% on the month, with weakness in capital goods particularly sharp. Indeed, March industrial production for the whole of the Eurozone fell 0.1%. In China, industrial production expanded at a robust 6.5% rate year on year (y/y) in April, but this was a full percentage point lower than in March. Moreover, tightening credit markets signal a further slowdown ahead and are raising concerns about commodity demand in the second half of the year.

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Costs Rise for Sixth Consecutive Month in April

| | According to IHS Markit and the Procurement Executives Group (PEG), construction costs rose in April on price strength in materials and equipment. |

The headline IHS Markit PEG Engineering and Construction Cost Index registered 57.0 in April, the sixth consecutive month of rising prices, and up from the 53.9 reading in March.

Carbon steel pipe had the largest increase in the materials/equipment index this month when compared to March as higher steel input costs and better demand prospects pushed steel pipe prices higher. “Higher steel input costs and better demand prospects are pushing steel pipe prices higher and will cause prices to escalate further over the next several months. Pipe imports have increased in response to rising demand and they will continue to trend upward and maintain a sizeable share of the market,” said Amanda Eglinton, senior economist at IHS Markit.

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|