| The dents in global economic growth are growing more visible and fallout from financial-market tension is lingering—potentially indicating that most central banks are close to a peak in hiking interest rates. While the US is making some progress in its inflation fight, the Federal Reserve is still expected to hike rates again next month, potentially followed by a pause. The possible price of progress? Fed staff economists now forecast a “mild recession” later this year. The European Central Bank and its regional counterparts might keep going with rate hikes a bit longer, but from Brazil to Indonesia, central banks could pivot toward rate cuts. A new wrinkle is the Saudi-Russia oil alliance: The OPEC+ decision to cut output for the second time since President Joe Biden sought an increase will widen supply shortfall later this year. For consumers, gas and oil prices could rise, possibly pushing inflation back up while funneling more money to Vladimir Putin and his war. What to do with those half empty, aging US skyscrapers? Tear ‘em down—that’s the advice of Kyle Bass, founder of Hayman Capital Management. He predicts more pain for the commercial real estate sector, thanks to employees working from home and the impracticality of converting most office towers to housing. Meanwhile, almost $1.5 trillion of US commercial real estate debt comes due for repayment before the end of 2025, begging the question: who will help refinance it? Shadow lenders are circling as traditional banks and the bond market back away. This could get expensive. A 21-year-old US Air National Guardsman, Jack Teixeira, was charged in connection with the leak of highly classified documents including maps, intelligence updates and the assessment of Russia’s war. It was one of the largest leaks of classified military documents, many detailing recent assessments of the bloody conflict in Ukraine as well as US surveillance of allies like South Korea. Biden, facing awkward conversations in his trip abroad, downplayed the impact of the disclosures.  Alleged leaker Jack Teixeira is taken into custody by FBI agents in Dighton, Massachusetts on April 13. Source: WCVB-TV US-China tensions weren’t helped by China’s military drills around Taiwan following President Tsai Ing-wen’s visit to the US, nor by a US Navy destroyer’s passage through waters claimed by Beijing in the South China Sea. France’s President Emmanuel Macron, fresh off a trip to China, defended his position that Europe should avoid being dragged into a conflict between Beijing and Washington. But while the European delegation’s visit “didn’t move China closer to the European position on Ukraine, their unified front on longer-term geopolitics will serve the West well,” writes James Stavridis in Bloomberg Opinion. The Biden administration asked the US Supreme Court to keep the abortion pill mifepristone fully available and to set aside extraordinary restrictions ordered up by three lower court judges, all appointees of Donald Trump. If the high court (which granted a five-day reprieve) ultimately rules on the pill’s approval by the Food and Drug Administration more than two decades ago, Associate Justice Brett Kavanaugh may end up as the deciding vote. The Biden administration should prepare for the most extreme outcome, Bloomberg Opinion editors write: that mifepristone is taken off the market entirely. The same Supreme Court, controlled by a 6-3 Republican-appointed supermajority, last year struck down the 49-year old federal right to abortion. In Florida, GOP Governor and presidential aspirant Ron DeSantis signed a law banning most abortions in his state after six weeks. But while the Republican base may be mollified by such restrictions, the party may risk boxing itself in nationwide: Polls consistently show most Americans support abortion rights and medication abortion. How high can Manhattan rents go? Still higher, it seems, as they hit a record $4,175 a month in March, and the busiest and most expensive time of the year for rentals—July and August—is just ahead. That annual rent is about one third of the salary of NYC’s new “rat czar.” To escape the city and its trash-dwelling critters, consider these 14 restaurants upstate for more bang for your buck.  Manhattan apartment rents are climbing sky high Photographer: Gabby Jones/Bloomberg - Earnings season kicks off in Europe, with Heineken, SAP reporting.

- UK inflation, jobless claims, housing prices amid money supply concern.

- Apple’s first retail locations in India as it moves beyond China.

- China’s GDP amid contradictory economic data.

- Ramadan ends, Muslims celebrate the Eid-al-Fitr holiday.

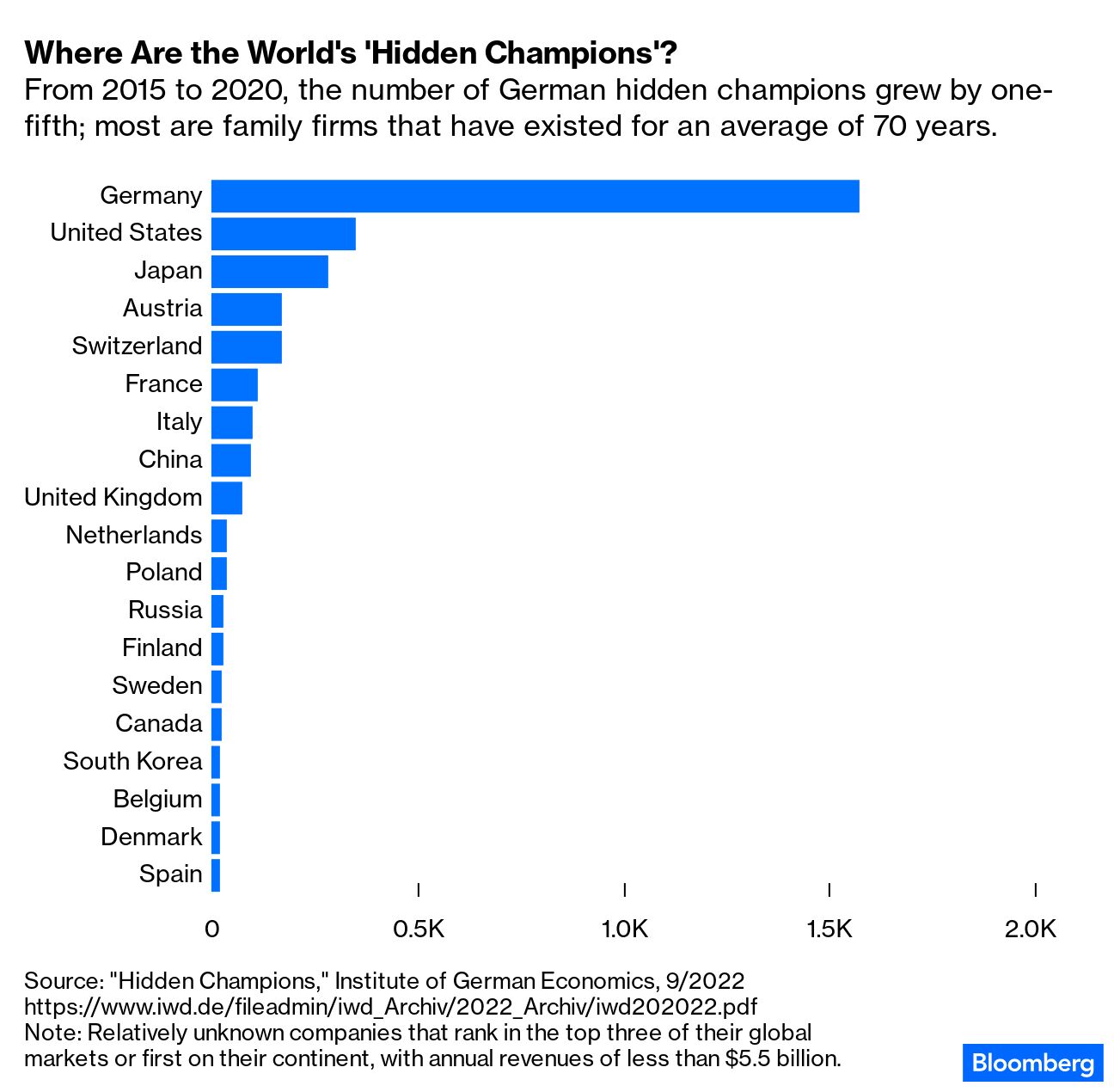

Germany was the West’s biggest winner from the past 30 years of globalization. But the real engine of the German economy isn’t big corporations like Siemens or Porsche, but middle-sized companies you’ve probably never heard of. Germany has more than a thousand companies that dominate tiny global niches, firms that management gurus have dubbed “mighty minnows” or “hidden champions.” The companies that might be the secret weapon to Germany getting, and staying, ahead in the new economic era. Get Bloomberg’s Evening Briefing: If you were forwarded this newsletter, sign up here to get it every Saturday, along with Bloomberg’s Evening Briefing, our flagship daily report on the biggest global news. The Bloomberg Wealth Asia Summit returns on May 9. Join us in Hong Kong or online as we sit down with the region’s leading investors, economists and money managers to discuss the mindset of next-generation investors, Web3 and investing in art. Speakers include top executives from Amundi, Hong Kong Monetary Authority and Sotheby’s. Register here. |