The shorts are going after billionaire investor Carl Icahn, the man who created modern activist investing...

Specifically, Icahn’s master limited partnership (MLP), Icahn Enterprises LP (IEP).

I’ve followed IEP for many years. It’s an enigma among public companies, and Carl Icahn is a master magician when it comes to capital markets and arbitrage.

I’m a big fan of Icahn and his investing style—it’s part of the reason why I’ve invested in one of his small-cap names (more on this below)—but I’ve never owned IEP because I always found it to be overvalued.

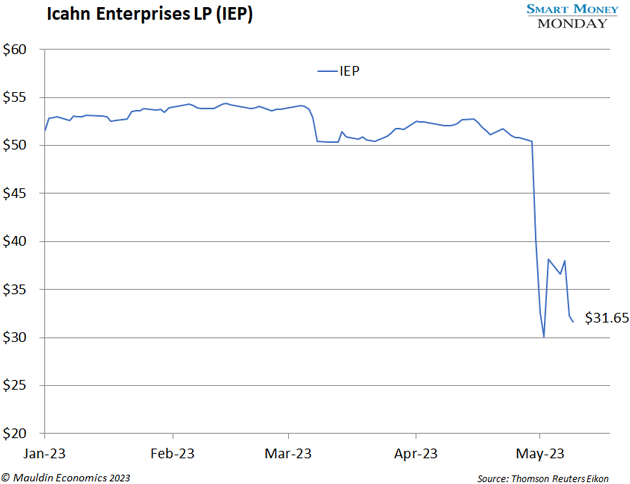

IEP has taken a hit, though, since becoming the target of short sellers.

It’s down 35%+ in the past month, which has me curious about its latest valuation and whether it warrants another look as a potential buy.

An Insane Dividend Yield

In 2007, IEP purchased Icahn’s asset management business for around $800 million. Today, the company has a market cap of $11 billon. So, it’s done well, and that’s before you factor in all the dividends it’s paid out to minority shareholders.

IEP currently has a dividend yield of 25%—an insane figure. With an $11 billion market cap, that would imply a total cash outlay of $2.7 billion.

Here’s the catch, though: Icahn elects to take his dividend in additional “units” (as an MLP, Icahn Enterprises trades via units instead of shares) and not in cash. And since he owns 85% of the company, the cash outlay (for those who elect cash) is only $400 million. That’s a much more manageable figure.

Icahn has boosted the stock price by appealing to retail investors who seek one thing and one thing only: dividends. They buy the highest-yielding dividend companies out there and happily clip their coupons.

The problem is that you can’t simply value a company off its dividend yield. It’s one method, but with IEP, there’s no real operating company inside of it. There isn’t a Coca-Cola or a Nestle that has steady profits year after year. Instead, there are a bunch of stocks and a few relatively minor investments.

Which brings us to the short sellers…

The Shorts Call Out IEP’s Valuation

I typically have a lot of respect for short sellers, who profit when a stock goes down. Often, to get a stock down, they must make the market aware of the reasons why it should be down.

One of these vocal short sellers is Hindenburg Research, run by Nate Anderson. Hindenburg has a solid track record. Its attack of Indian conglomerate Adani is one of its recent successes, and its latest report on Icahn Enterprises highlights the company’s primary issue.

At the end of the day, the problem with IEP is that it’s extremely overvalued. Prior to the short report, it traded somewhere north of 60% of net asset value.

So, the market valued IEP at $160, while the readily available fair market value of those assets was $100.

The reason it was valued so high was due to the obscure dividend arrangement I mentioned above. The headline dividend yield is absurdly high, but that yield doesn’t reflect the actual cash outlay that IEP must make.

The shorts have a point here on IEP. Ultimately, the report was a valuation call: Icahn Enterprises was overvalued; therefore, it should be down.

I don’t typically like short reports such as this one. Stocks can stay irrational longer than you can remain solvent.

In this case, though, it looks like Hindenburg may have won.

So, Is It a Buy?

Icahn Enterprises LP (IEP) isn’t a buy for me here. I don’t like the governance structure or the history of massive stock (or units) issuance. Units outstanding have grown from 241 million in 2020 to 353 million in 2022. That’s crazy.

The way I’d rather play Icahn is to get involved with some of his individual names.

In High Conviction Investor, we own one small-cap name that Carl Icahn is deeply involved in. He’s already implemented many changes at the board and management level. And the company is set to spin off one of its assets later this year.

I think the stock has good upside from here. It’s one of the three stocks I recommended my paid-up subscribers add to earlier this year in my issue “3 Places to Put New Capital to Work in Today’s Tough Environment.”

If you’re interested in my research and full guidance on this stock, as well as my entire High Conviction Investor portfolio, go here to discover more.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

P.S. Many of you have asked for an update on the latest developments at Activision Blizzard Inc. (ATVI), which I recommended as a good merger arbitrage play in February. That was related to its pending acquisition by Microsoft Corp. (MSFT).

Well, it seems like the UK competition authorities may have successfully blocked the deal.

Here’s the thing, though…

Activision is going to walk away with a pile of cash in a break-up fee—$3 billion to be exact. Adjusting for this cash per share, at $77, Activision is trading somewhere around 15X my estimate of earnings per share for 2023. That’s cheap, especially considering the quality of the business.

And the deal is still not 100% dead. Not yet, anyway. I say continue to hold your Activision position.