| The Three Principles of Consistent Wealth-Building | | By Dr. David Eifrig, editor, Retirement Trader | | Monday, March 28, 2016 |

| Building wealth is all about being patient and staying committed...

If your strategy works, sticking to it will pay off. No single trade will make you or break you.

This idea is crucial to your long-term success as an investor.

As I'll show you today, if you want to grow your wealth meaningfully over time, there are three principles you must understand...

----------Recommended Links---------

---------------------------------

Principle 1: You Will Have Losers in the Stock Market

My Retirement Trader newsletter has one of the highest win percentages in the business. We've made money on 93% of the positions we've closed since we started the service in 2010.

That's an incredible number. But it's not 100%. Losers are inevitable. No system in the world can guarantee 100% winners. In fact, using most trading methods, a win rate of 60% would be great. (It's the way we use options that gives us such a high win percentage.)

But one or two losing trades along the way won't wreck your portfolio (as long as you're using correct position sizing). You make your progress over time.

Principle 2: Stock Market Moves Are Unpredictable, so Be Prepared

In Retirement Trader, we do the research to pick the best stocks in the market.

We don't pick struggling businesses trying to turn things around. We don't pick high-growth businesses that need to outperform expectations every quarter to justify their high valuations.

We stick to high-quality stocks with reasonable valuations and strong businesses.

Even so, these businesses operate in the real world. Sometimes unpredictable things happen in the markets that can shock your stocks.

Investors in burrito chain Chipotle Mexican Grill (CMG) couldn't do anything to predict the food-poisoning outbreak that tanked shares. Investors in banking giant JPMorgan (JPM) couldn't have known a "rogue trader" would cost the investment bank $2 billion in trading losses in 2012. And health insurance firm Anthem's (ANTM) announcement came as a similar surprise.

That's why we use a 25% stop loss on our trading positions. That makes sure no big surprise erases too much of our gains. We also don't put too much of our capital into a single trade. We want to be sure that the rare loser doesn't wipe us out and keep us from making the next trade.

Our strategy has another benefit, though, that keeps us prepared...

Principle 3: We Have a Leg Up on Others With Our Option Trading

When you buy a stock, you accept the possibility that its price will drop. You just have to deal with it.

But not if you're an options trader. We know a stock can drop. But we have the flexibility to turn that position into a winner.

For example, we recommended energy icon ExxonMobil (XOM) last year, shortly before oil prices fell.

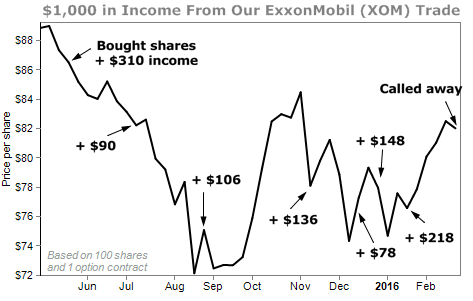

The stock took a nosedive, and by fall the position looked like it might end up a loser... but we kept selling options on the stock, earning more and more income. Retirement Trader subscribers who opened an XOM position on our original recommendation have generated more than $1,000 in income per options contract and another $219 in dividends for every 100 shares they own.

That's not too bad... In the chart below, you can see how they racked up steady income even as the stock struggled to rebound from its summer swoon.

And on option-expiration day, XOM shares closed well above the $76.50 strike price. So our shares were called away, and we earned about 3.3% on the position... even though the stock is still trading for less than when we first opened the position.

Do you know how the overall stock market did over the same period? It was down 9.2%.

Stocks move up and down. And you can't control or predict what they'll do from day to day.

But by remembering these three trading principles and sticking to a smart strategy, you can turn even down moves into profits.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

Editor's note: With a 93% win rate, Doc's success in Retirement Trader is unmatched. His trading strategies allow readers to generate instant income... with little risk. If you're looking to safely earn hundreds or even thousands of extra dollars every month, consider a risk-free trial subscription to Retirement Trader. Learn more here. |

Further Reading:

"More than half of all Americans are ruining their financial future," Doc wrote earlier this year. He says that not investing is one of the biggest mistakes you can make if you want a wealthy retirement... and that fear prevents most people from starting. Read his full argument here. "Most people who call themselves 'investors' really aren't," Doc says. "People buy high and sell low... Ultimately, it's a lot of stress and research for an uncertain payoff." But there's an easier way... Learn more in this classic essay: This Is Your Cure for Stock Market Volatility. |

|

NEW HIGHS OF NOTE LAST WEEK Progressive (PGR)... auto insurance Northrop Grumman (NOC)... defense contractor Colgate-Palmolive (CL)... consumer basics Valspar (VAL)... paint Exelon (EXC)... utilities Pan American Silver (PAAS)... silver miner Estee Lauder (EL)... cosmetics

NEW LOWS OF NOTE LAST WEEK AstraZeneca (AZN)... pharmaceutical firm Teekay Tankers (TNK)... oil shipping Frontline (FRO)... oil shipping |

|

| Hedge your portfolio with this unusual options strategy... My colleague Ben Morris knows most investors only anticipate stocks going up. This keeps them vulnerable to market corrections. |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

You may need to act by Friday, April 29 to avoid missing out on $10,000s in extra benefits from Social Security. Luckily, there's an easy solution. Check out the summary of our findings, here. |

| Triple-Digit-Upside Potential in a Sector You Haven't Considered... | | By Dr. Steve Sjuggerud | | Thursday, March 24, 2016 |

| | A certain commodity jumped 7% from February 26 to March 4, its largest weekly return since 2011. And based on history, the jump will likely lead to even higher prices... |

| | Grow Your Wealth for Decades Without a Single Losing Year | | By Mark Ford | | Wednesday, March 23, 2016 |

| I have learned several lessons about growing wealth and avoiding the biggest mistakes average investors make... |

| | 53% Upside in Hong Kong Stocks | | By Dr. Steve Sjuggerud | | Tuesday, March 22, 2016 |

| | Hong Kong residential sales just hit a 25-year low... Based on history, gains of 53% in two years are possible, starting now... |

| | YOU Can Be Smarter Than Harvard Magna Cum Laude Bill Ackman | | By Dr. Steve Sjuggerud | | Monday, March 21, 2016 |

| Bill Ackman is supposed to be the best of the best, the brightest of the bright. But last week, he lost $1 billion – in one day – in one stock – for his investors... |

| | How to Stay 100% Away From the Market's Most Dangerous Stocks | | By Porter Stansberry | | Friday, March 18, 2016 |

| | Losing time and opportunity are just as serious as losing money... Today, I'm going to show you a surefire way to avoid losing all three... |

|

|

|

|