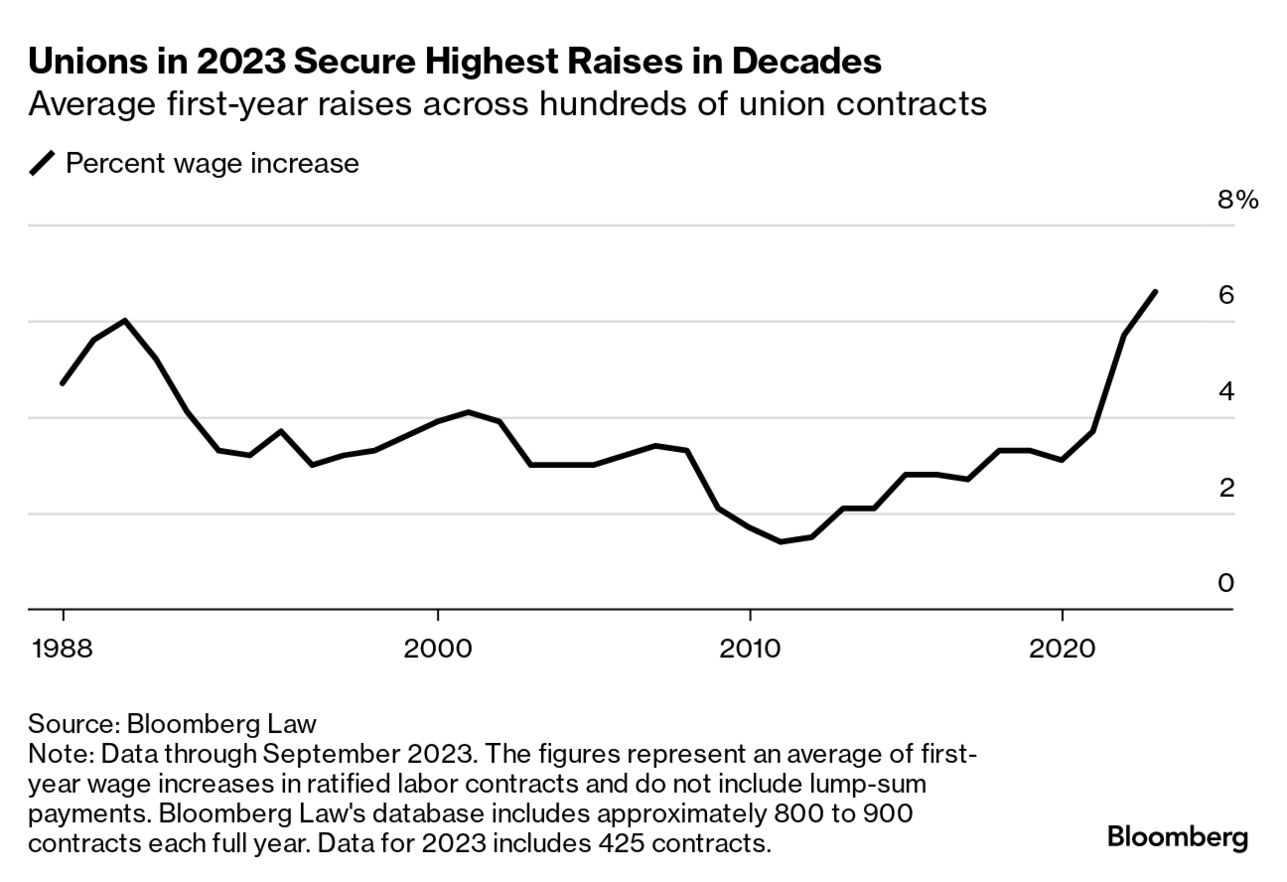

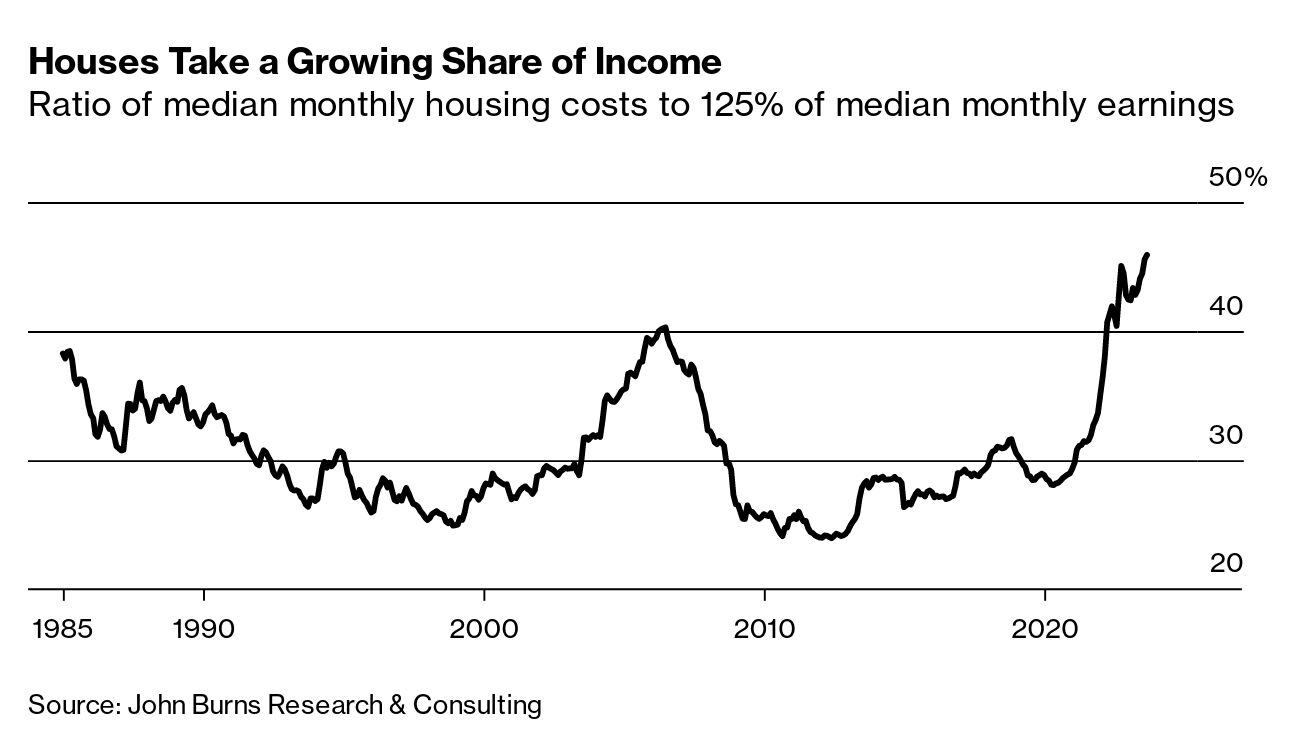

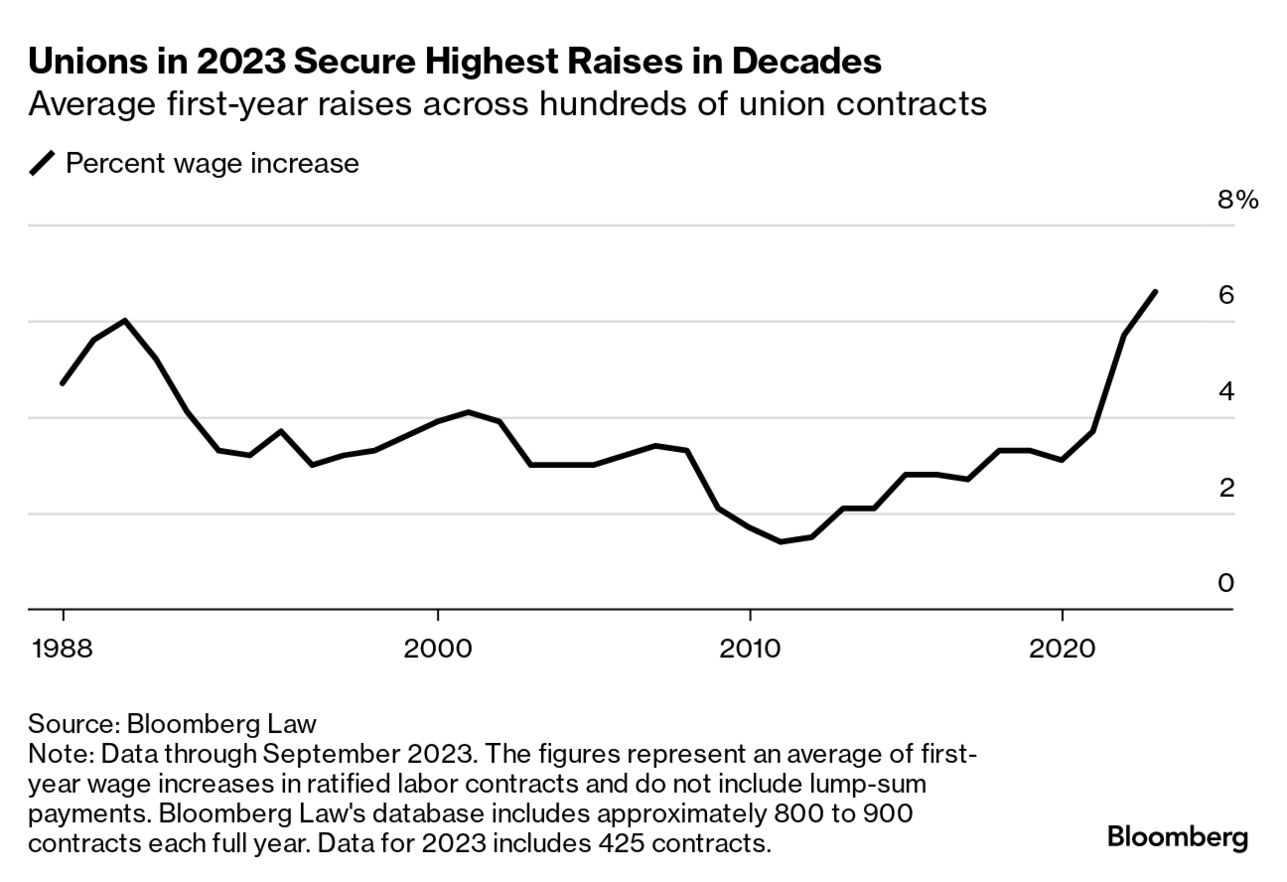

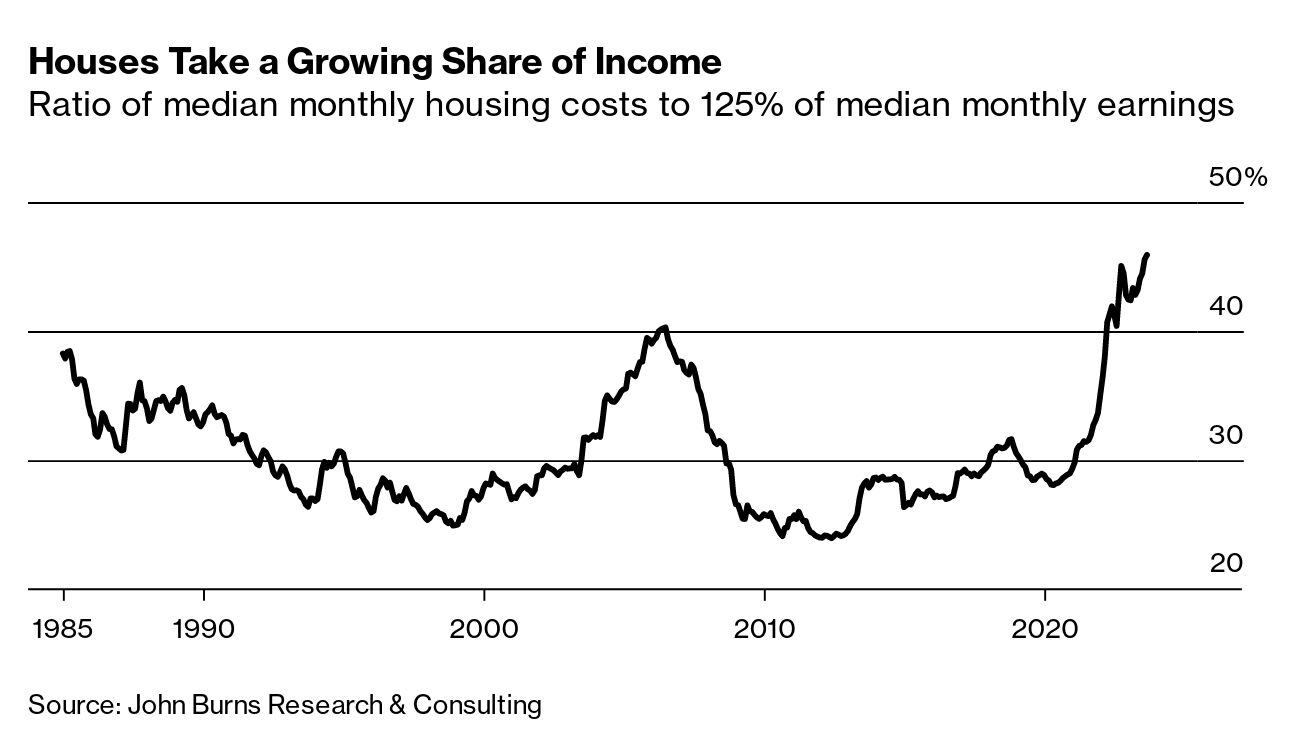

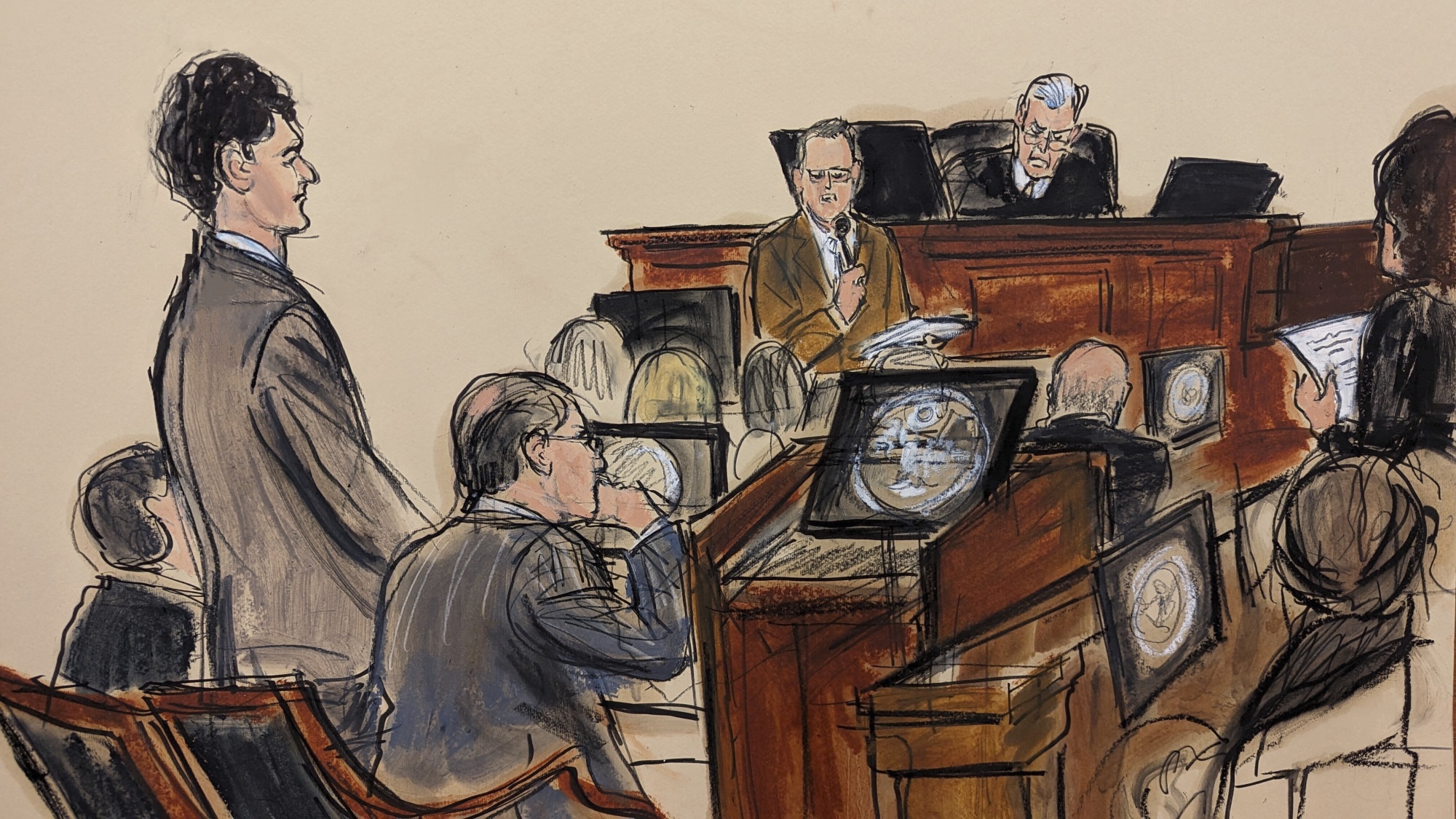

| It’s been quite a journey for the US economy over the past several years, from pandemic supply chain upheaval to the Federal Reserve’s hyper-focused battle against inflation. Consumers have kept spending, and the job market has proven perpetually robust, with predictions of recession regularly falling flat. Now, the central bank’s aggressive interest rate-hike campaign is bearing fruit as the red-hot labor landscape begins to cool, with employers slowing hiring in October and the unemployment rate rising slightly to a still-low 3.9%. Employees do remain in a position of power, securing record-breaking wage hikes and contract wins, not the least of which was the victory notched by striking United Auto Workers against the Big Three automakers.  A new labor report also showed monthly wage growth slowing and the participation rate ticking down—good news for Fed Chair Jerome Powell’s soft landing. Fed watchers say all of this bolsters expectations that the pause in rate increases is permanent, and that even rate cuts might be in store for next year. Powell and other policymakers have also alluded to the jump in longer-term debt yields as likely helping bring the economy to heel. But with inflation still above the Fed’s 2% target and growth steaming ahead, all of those predictions could change on a dime. The stubbornly strong US economy threatens to keep the housing market a mess and mortgages expensive for years. Interest rates on a 30-year mortgage are close to 8%, the highest point in almost a quarter century, adding some $1,100 to monthly payments for a $400,000 loan. A collapse in home building in Europe threatens to intensify shortages for years to come. Politicians in the UK, Germany and elsewhere are gingerly weighing in on the growing problem—but much bolder moves may be needed. If you’re a frustrated house hunter in this market, here are some tips. And as for migration patterns, Conor Sen writes in Bloomberg Opinion that “a return to offices and the broken housing market have put population outflows on hold, but don’t bet on it lasting.”  Israel says its forces have encircled Gaza City and are engaged in “close combat” with militants from Hamas, which Israeli authorities said killed 1,400 people in the Oct. 7 assault that triggered the current war. Heavy Israeli strikes on the northern Gaza refugee camp of Jabaliya drew calls from allies including the US for Israel to limit Palestinian deaths, which Gaza health officials say exceed 9,000 people. Violence hasspread to the West Bank, where the United Nations said more than 100 Palestinians have been killed by Israeli forces and settlers since the war began. US Secretary of State Antony Blinken visited Tel Aviv, repeating a plea for humanitarian pauses to help the flow of aid and allow foreign citizens to leave Gaza. Israel’s Prime Minister Benjamin Netanyahu, facing an ever-louder chorus to resign, rejected American calls for a pause, saying hostages held by Hamas must first be released. It took fewer than five hours for the jury weighing charges against Sam Bankman-Fried to convict him of all seven counts, including fraud and conspiracy. That was much quicker than other high-profile white-collar crime convictions, including Theranos’s Elizabeth Holmes. While he now faces the possibility of decades in prison, Bankman-Fried, his collapsed FTX empire and his inner circle are not alone in their legal woes. And what does it all mean for crypto? For some, it’s helping create a badly-needed regulatory framework and an end to risky practices. Others view the crypto industry as inherently riven with weaknesses that attract criminals, hackers and rogue states.  Sam Bankman-Fried stands as the jury foreperson reads his guilty verdict in Manhattan federal court. Illustration: Elizabeth Williams via AP It’s been four straight quarters of declining revenue for Apple, its worst stretch in 22 years. Now the company’s tepid holiday-quarter outlook is also highlighting its problems in China, where the iPhone maker is struggling with the unexpected rise of Huawei’s new phone and an increasingly hostile business environment. Though iPhone revenue is expected to increase in the December quarter, overall sales will be similar to the year-earlier period, Chief Financial Officer Luca Maestri said. SpaceX’s Starlink has hit cash-flow breakeven, according to Elon Musk, as it seeks to make internet available around the world. Shares in Musk’s Tesla, meantime, have plummeted over the past two weeks amid growing concerns that demand for electric cars is starting to weaken. Fashion is often more than just a trend, and we track the history of modern dress from skinny jeans to Doc Martens to Zoot suits for all they say about the broader culture. Not sure about your off-road driving skills? For $795, Ford provides day-long training once reserved for new Bronco owners to anyone. And here is the final Beatles recording, rescued from a batch of John Lennon demo tapes from the 1970s.  Photographer: Gabriel Bouys/AFP The US is going full steam ahead in its effort to catch up with China in a part of the world that’s become central to the green transition: Africa’s “Copperbelt.” In the Bloomberg Originals mini-documentary, How the US Can Rival China in Africa, we show how the demand for key minerals is fueling a new struggle between Washington and Beijing. Get Bloomberg’s Evening Briefing: If you were forwarded this newsletter, sign up here to get it every Saturday, along with Bloomberg’s Evening Briefing, our flagship daily report on the biggest global news. Bloomberg Green at COP28: World leaders will gather in Dubai on Dec. 4-5 in an effort to accelerate global climate action. Against the backdrop of the United Nations Climate Change Conference, Bloomberg will convene corporate leaders, government officials and industry specialists from NGOs, IGOs, business and academia for events and conversations focused on creating solutions to support the goals set forth at COP28. Register here. |