The U.S. Dollar Strength: Itâs All Relative

Link to full report and disclosures

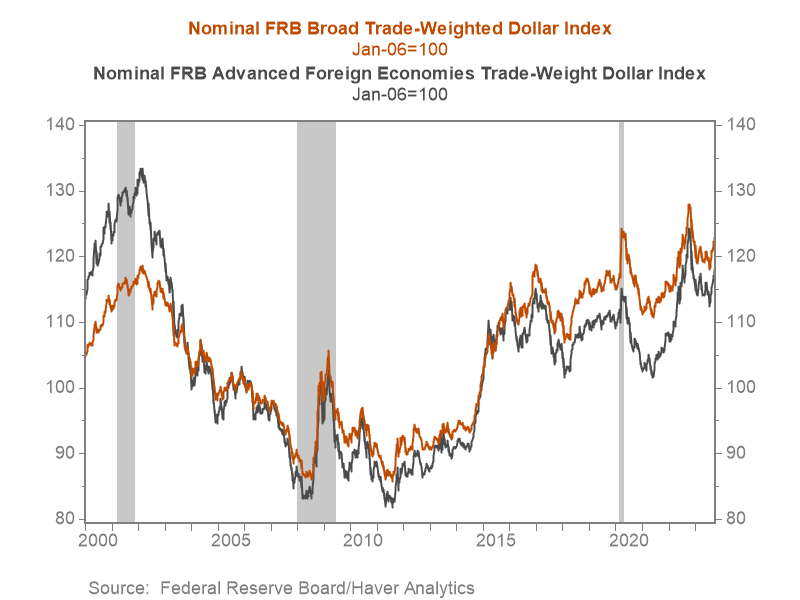

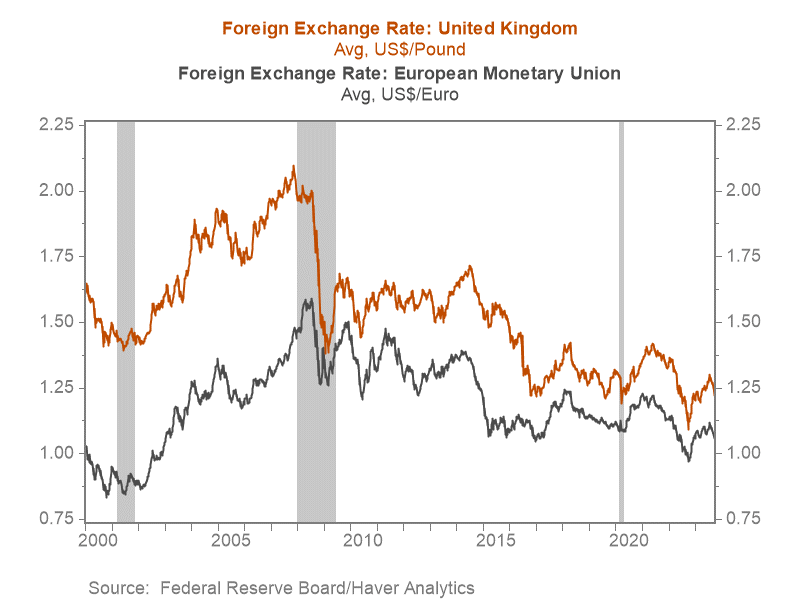

The strength of the U.S. dollar versus the euro, UK pound, and Japanâs yen has received a lot of attention and generated a great deal of angst in financial markets (Charts 1 and 2). A few observations are appropriate. Currencies are relative prices, so they reflect relative differentials and expectations. The U.S. dollar strength reflects a combination of favorable real economic factors relative to other nations and differentials in inflation and inflationary expectations, central bank monetary policies, and interest rates. International capital tends to flow toward the highest risk-adjusted expected rates of return on investment. These factors explain the recent strength in the U.S. dollar. Also, the U.S. dollar is considered a safe haven that attracts international capital during periods of severe stress (even when the U.S. is the source of the stress...witness the spike in the USD during the Great Financial Crisis).

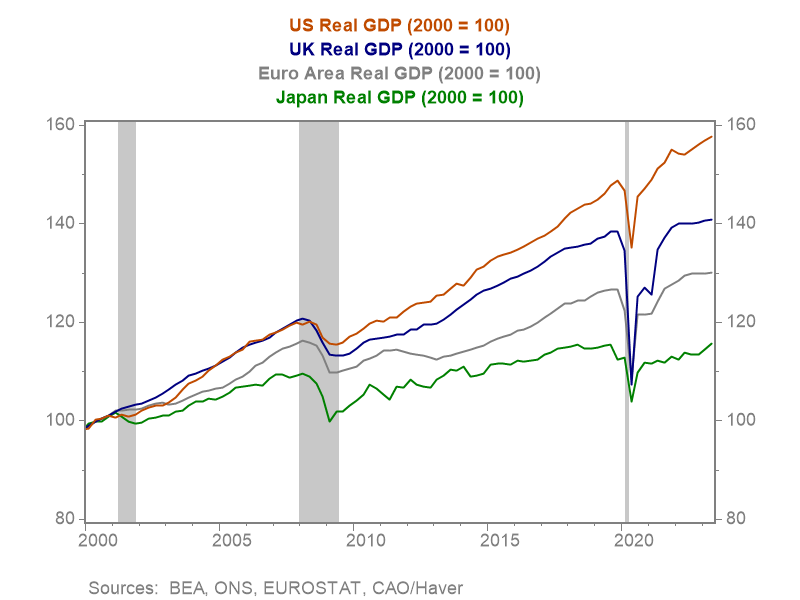

Real economic performance: advantage U.S. The U.S. economy has been resilient while the EU economy faces recessionary-type conditions and the UK has been weak. Importantly, it is widely perceived that the U.S. has far higher potential growth than the EU, and the UK to a lesser extent. U.S. GDP growth has far exceeded growth of these other advanced economies over time (Chart 3) and that pattern is widely expected to continue. Japanâs economy has picked up decidedly in 2023, but there are concerns about its very large export exposure to China, and Japanâs longer-run potential growth is very low, reflecting its declining population.

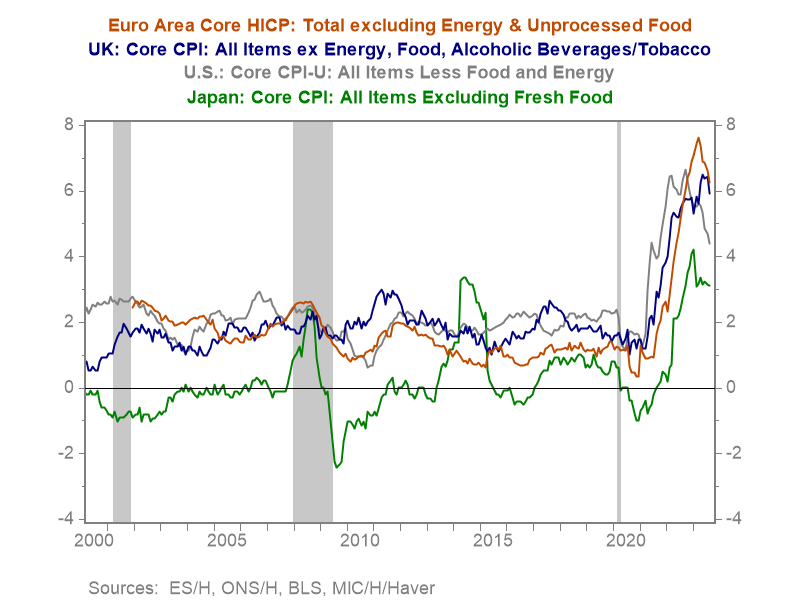

Core inflation and inflationary expectations. U.S. core inflation measured yr/yr rose by less than in the UK or Europe and has receded quicker (Chart 4). Japanâs recent, relatively modest inflation has followed a bout of deflation. Inflationary expectations are more moderate in the U.S. than in the UK or Europe, but above those in Japan (Chart 5).

Central bank policies. The U.S. Fed has been more aggressive in raising rates than the Bank of England or European Central Bank while the Bank of Japan has not, still maintaining a policy rate of minus 10 basis points. The Fed funds rate is a full percentage point above U.S. core inflation while the policy rates of the BoE, ECB and BoJ have remained decidedly below zero (Chart 6). The ECB and BoE expect their real policy rates will become positive as inflation falls, while the BoJ continues to project inflation will recede to 2% and it maintains a negative real policy rate.

Real Bond Yields: Advantage U.S. Adjusted for market-based measures of inflationary expectations, real bond yields are significantly higher in the U.S. than in the UK, Germany, or other EU nations, and far above Japanâs negative real yields (Chart 7).

Observations. It is not surprising that the relative outperformance of the U.S. economy and the more aggressive Fed response to the higher inflation that has involved relatively higher interest rates has been associated with a strong U.S. dollar.

Of note, recently the U.S. dollar has appreciated modestly versus the Canadian dollar and the Mexican peso, the U.S.âs two largest trading partners, but over the last year the dollar has depreciated significantly versus the Mexican peso and chopped sideways versus the Canadian dollar. Of note, while Canadaâs economic growth has slowed relative to the U.S.âs, its core inflation has fallen faster (to 3.6% yr/yr) while the Bank of Canada has maintained a 5% policy rate, with higher real rates than in the U.S. Mexicoâs economy has been strengthening significantly; its core inflation has receded to 3% and the Bank of Mexico has raised its policy rate to 11.25%. Mexico has surpassed China as the U.S.âs main manufacturing partner, and is positioned to benefit further from the shift toward nearshoring that will lift intermediate and final-stage production of goods in Mexico aimed at supplying the U.S. market (Chart 8).

Chinaâs currency has depreciated significantly against the U.S. dollar, reflecting the sharp deceleration in economic growth in China and widely acknowledged concerns about its excesses in debt and real estate. While Chinaâs policymakers have stepped in to prevent a disorderly yuan depreciation, they partially welcome a weaker yuan as an opportunity to bolster the competitiveness of Chinese exports and to prop up economic activity amid weak domestic demand.

The stronger U.S. dollar poses challenges some global economies. For example, some merging economies with large shares of dollar-denominated debt face higher real debt service costs at the same time the dollar appreciation coincides with softening global trade and industrial production volumes, and are likely to weigh on international credit flows.

Chart 1. The Trade-Weighted U.S. Dollar

Chart 2. The U.S. Dollar vs the Euro and the Pound

Chart 3. International Comparisons of Real GDP

Chart 4. International Comparisons of Core Inflation

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2023 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (âBerenberg Bankâ). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCMâs prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.