|

|

To investors,

The United States of America is open for business. We voted a real estate developer and famed businessman into office. He has appointed everyone from Elon Musk to Howard Lutnick to Scott Bessent as members of his team to help change the economic status of the country.

The plan is to increase government revenue, decrease government spending, weaken the US dollar, and bring the 10-year bond yield down as a way to spur economic growth. This may sound like a dream, but I think we should take the plan more seriously than the market is currently taking it.

This new economic strategy is being called the “Mar-a-Lago Accord” and contains three important components:

Tariffs to increase government revenue and incentivize American manufacturing.

The sovereign wealth fund and External Revenue Service to increase government revenue.

DOGE to cut government waste, abuse, and fraud.

The last few weeks have been dominated by news pertaining to tariffs and the Department of Government Efficiency, but yesterday we got more information on how the government is planning to increase revenue through various business deals or activities.

First, Ukraine is reported to have agreed to a mineral rights deal with the United States. The Wall Street Journal described the deal with the following:

“Ukraine has agreed to a mineral-rights deal with the U.S. that could be finalized as soon as Friday at a White House meeting between President Trump and Ukrainian President Volodymyr Zelensky.

People close to the negotiations said the text had now been agreed, and the U.S. had dropped its previous demand for the right to $500 billion in potential revenue from the development of Ukraine’s mineral resources.

“It’s a very big deal. It could be a trillion-dollar deal,” Trump told reporters Tuesday. “We’re spending hundreds of billions of dollars on Ukraine and Russia fighting a war that should have never ever happened.”

The signing ceremony would be a personal victory for Zelensky, who has been pushing for a face-to-face meeting with Trump but has instead had to watch as the U.S. opened discussions with Moscow about how to end the war—excluding Ukraine. The Ukrainian president had refused to sign the mineral-rights deal presented by a lower-level official, Treasury Secretary Scott Bessent.”

The details of the agreement are not known yet, but the Wall Street Journal went on to write:

“Under the terms of the agreement, Ukraine would pay some proceeds from future mineral resource development into a fund that would invest in projects in Ukraine. Resources that already make money for the Ukrainian government—such as existing oil and gas production—will be exempt from the deal.

The size of the U.S.’s stake in the fund and joint ownership deals will be hashed out in future agreements.”

This is a prime example of where the current administration is leaning on their business experience to strike a deal that creates revenue for the country and ensures that any foreign nation that wants services from the US will be paying for the service.

According to Perplexity, my favorite AI search engine, here is the American history with these payment for security agreements:

The next development of the day came in the form of an announcement from Donald Trump and Howard Lutnick in the Oval Office. The pair created something called a “Gold Card” which will be sold to foreigners for $5 million and give these individuals benefits equivalent to a green card.

Here is Trump and Lutnick announcing the idea:

If the United States government can sell about 200,000 gold cards, we have a shot at eliminating the annual deficit. If the government can sell about 7 million gold cards, we have a shot at eliminating the entire national debt.

Critics are already screaming that no one will buy these new gold cards, but the truth is no one knows what demand will look like yet. There has been demand for immigration investment programs in the past and I anticipate there will be some portion of the global population willing to part with $5 million in exchange for an American green card. Your guess is as good as mine on the exact number of people.

But this was not the only announcement made by Trump and Lutnick in the Oval Office yesterday. They also announced a brand new probe into copper and copper-products. Bloomberg explained it with the following description:

“President Donald Trump has signed an executive action directing the Commerce Department to examine possible copper tariffs, the latest in a string of measures aimed at imposing sector-specific levies that could reshape global supply chains.

Trump said the order would have a “big impact” as he signed it in the Oval Office, joined by Commerce Secretary Howard Lutnick.

Senior administration officials earlier on Tuesday cast the step as necessary to address what they said was a national security issue. They argued that dumping and overcapacity in world markets had impacted domestic US copper production, leaving weapons systems and other critical products dependent on imports.”

This brings me to my big takeaway from the last 24 hours — the United States is open for business. We are striking mineral rights deals in Ukraine, we are announcing new gold cards that will get someone US residency for $5 million, and we are looking into ways to use tariffs on copper to raise additional revenue.

Howard Lutnick told me last year the United States should monetize our balance sheet and use our position in the world to create $1 trillion in annual revenue. It looks like he is doing the best he can to follow through on that promise, including the creation of a sovereign wealth fund and the External Revenue Service.

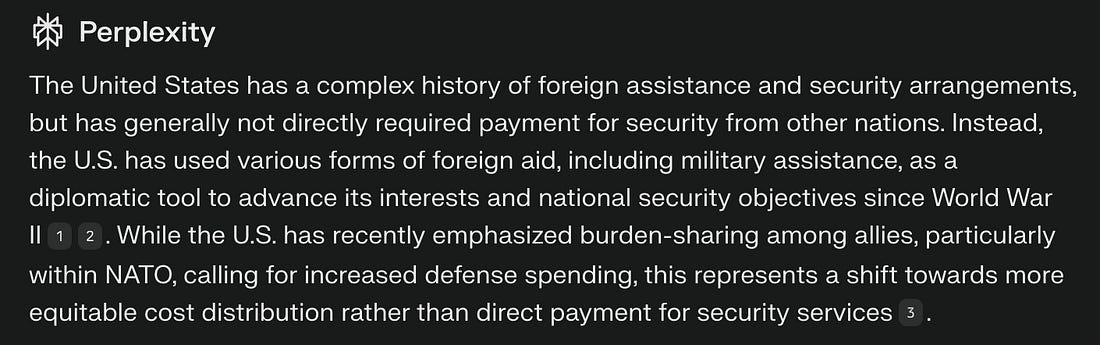

The big question is whether most people believe the current administration will be able to balance the budget. The odds on prediction market Kalshi are only at 18% right now.

Anecdotally, I was at a large lunch event yesterday with ~ 25 attendees. I asked how many people thought the US would balance the budget in the next 4 years. Not a single person raised their hand. No one.

Zero.

This blew my mind. I have the odds at around 50% right now, so either the market is mispricing the situation or I will be very wrong. Time will tell which is true.

Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Why Is Bitcoin Crashing?

Polina Pompliano, Author of ‘Hidden Genius’ and Founder of The Profile, and Anthony Pompliano, Author of ‘How To Live An Extraordinary Life’ and CEO of Professional Capital Management, discuss the bitcoin crash, what’s going on, Coinbase, Ken Griffin jumping into the crypto trading game, regulation, and what is going on with the Bybit hack.

Enjoy!

Podcast Sponsors

Reed Smith - Smart legal solutions for complex disputes, transactions, and regulations. Learn more atwww.reedsmith.com

Ledger - Ledger secures 20% of the world’s digital assets. Their latest devices, Ledger Stax and Ledger Flex, feature secure touchscreens for safer, easier crypto management.

Franzy - Ready to leave the 9-to-5, start a side hustle, or expand your portfolio? Franzy is your gateway to franchise ownership—research, compare, and fund the right opportunity with confidence and transparency.

Bitwise - America’s largest crypto index fund manager and the only Bitcoin ETF issuer that publishes its wallet address plus donates 10% of profits to open source developers. Learn more at BitwisePomp.com

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Bitdeer - A global technology company focused on Bitcoin mining, ASIC development and HPC for AI, backed by advanced R&D and a massive 2.5 GW global power portfolio.

Meanwhile - The world’s first licensed and regulated life insurance company built for the Bitcoin economy. Learn how to tax-optimize your BTC holdings for your life and beyond.

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadotis a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.