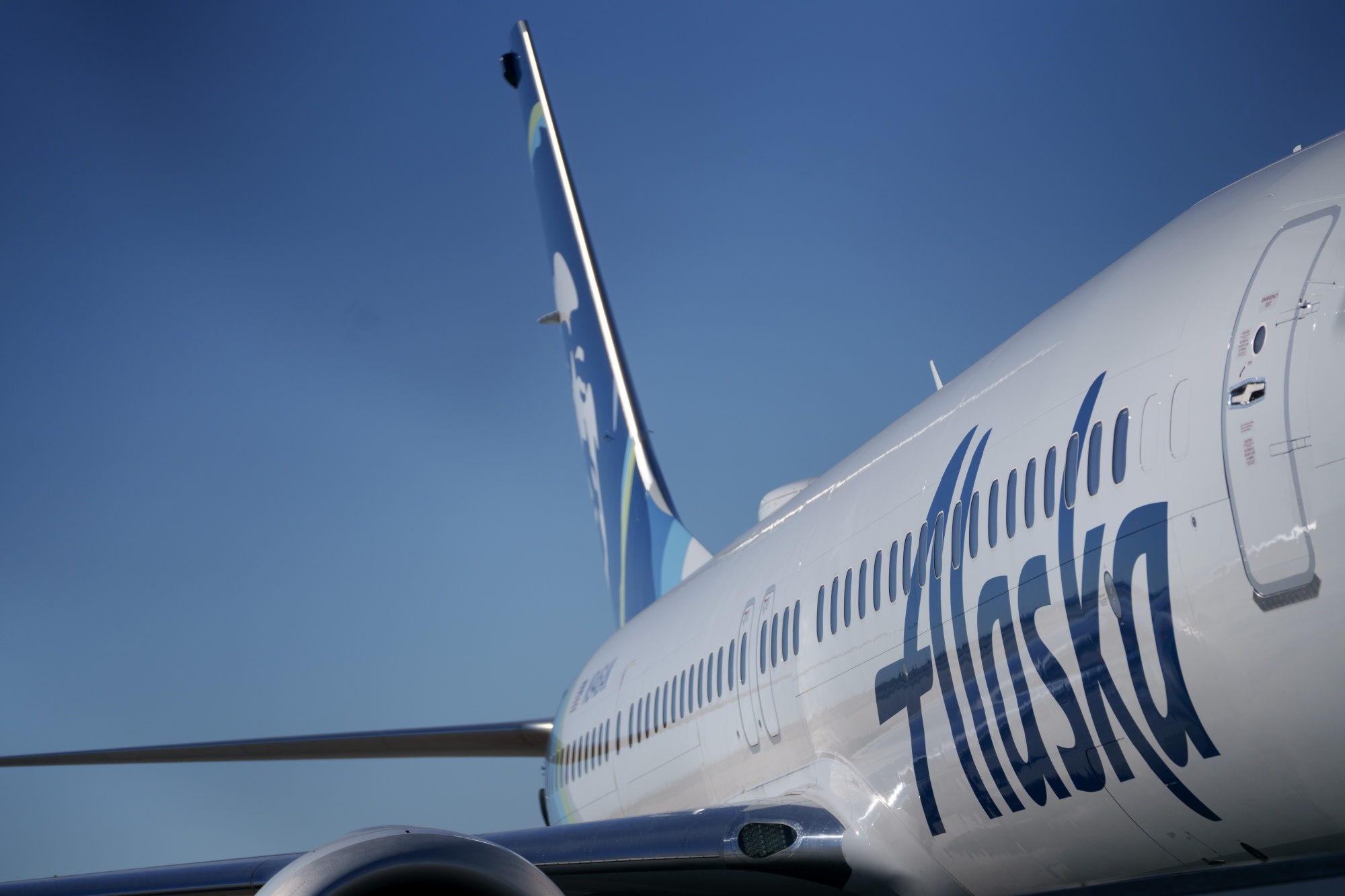

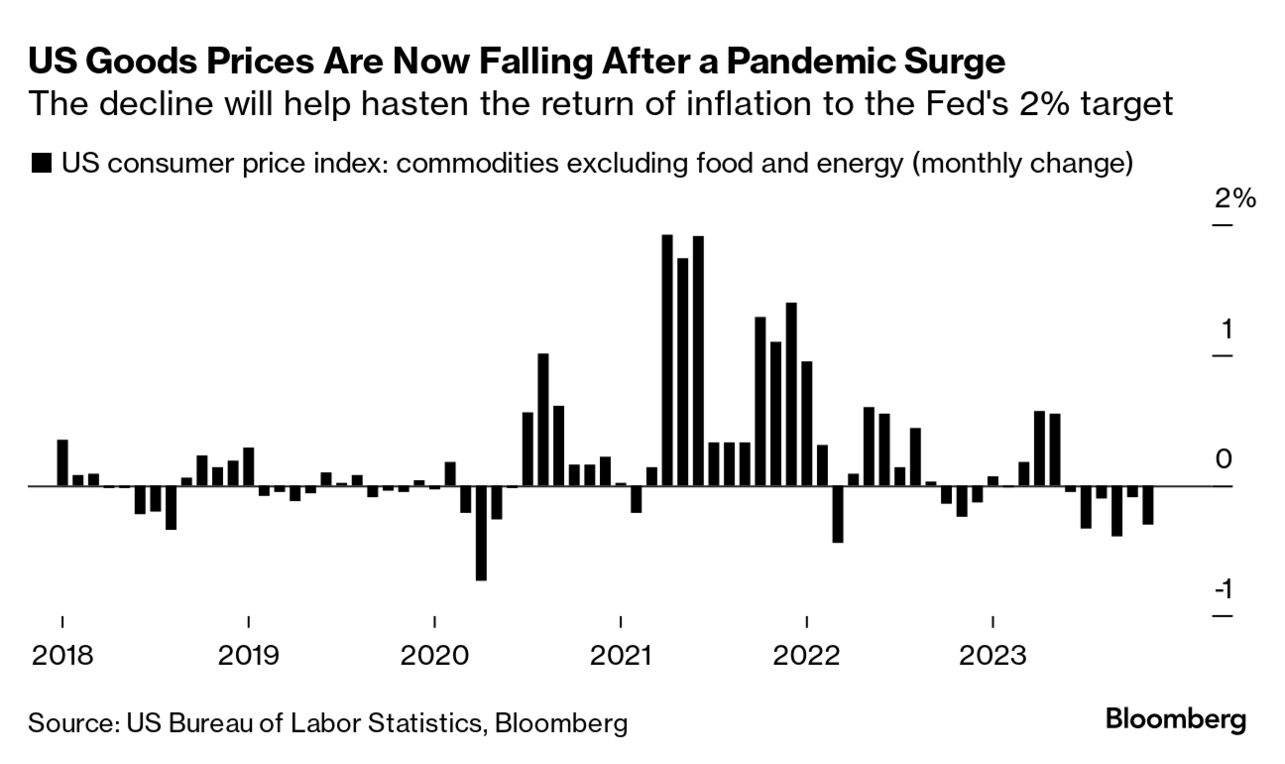

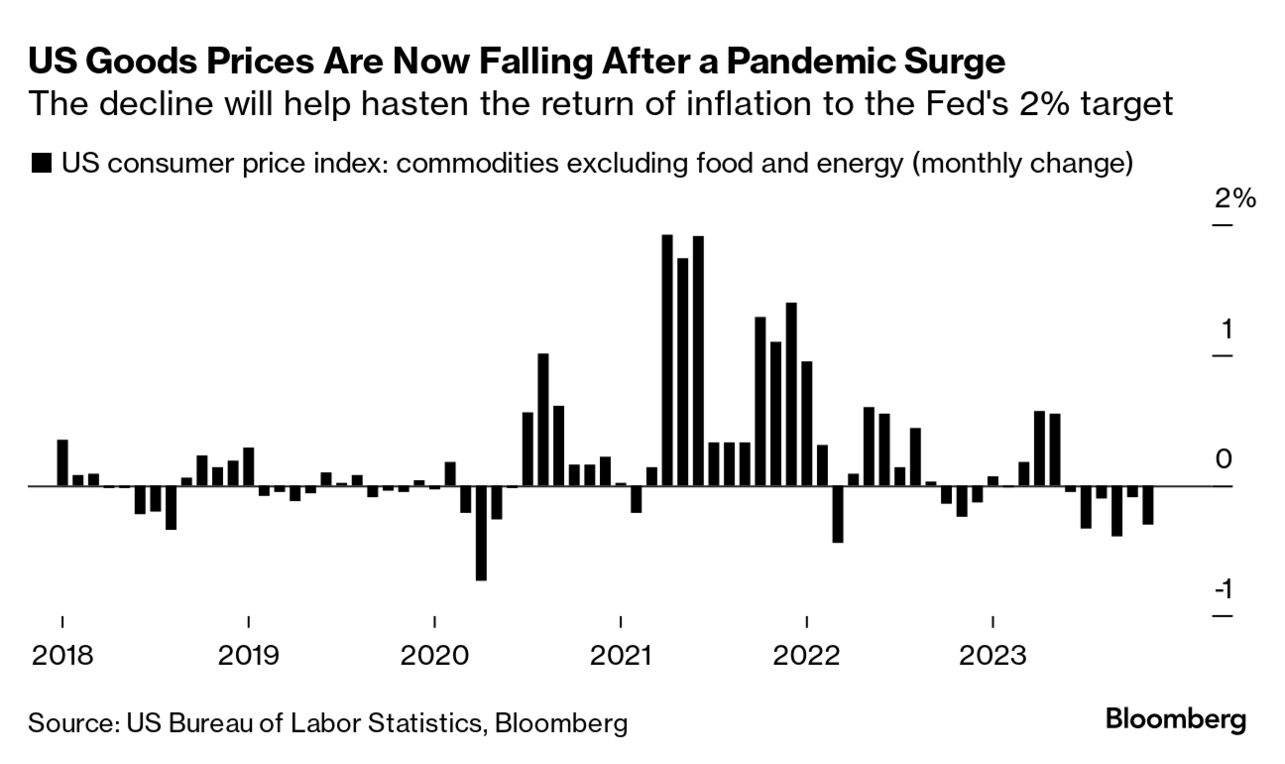

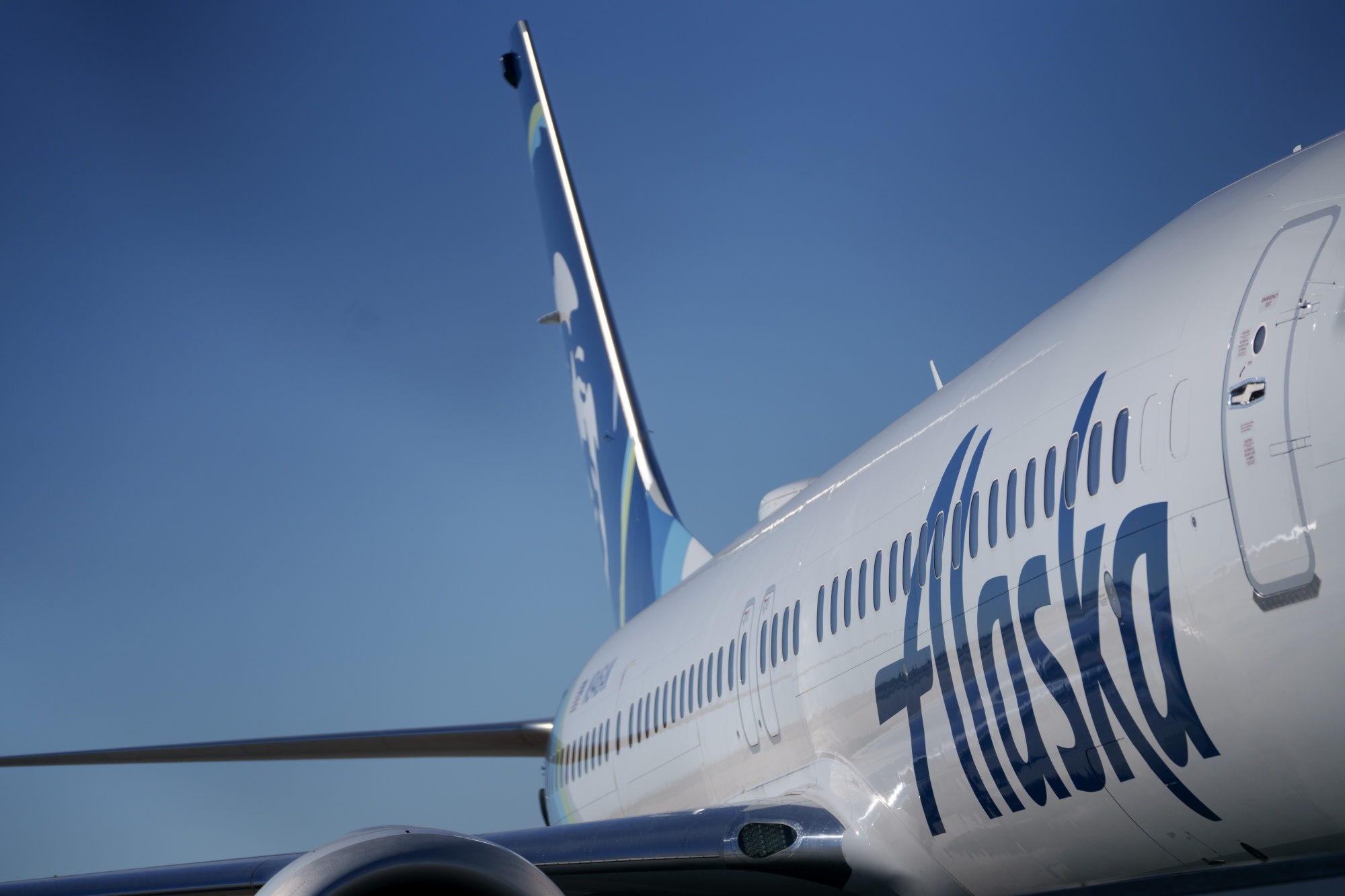

| US inflation looks like it will keep slowing through the rest of this year, perhaps ending 2024 near the Federal Reserve’s 2% target. Prices for some goods have even started dropping. The downdraft should keep the US central bank on course to start lowering interest rates, with the more optimistic hoping for cuts as soon as March. Coupled with a still-booming American employment landscape, the taming of inflation is good news for the Fed’s goal of a soft landing. It’s also a boon for President Joe Biden as he launches his re-election campaign in earnest. But whether or not the central bank overshot with its record rate-hike campaign is still an open question. Lower inflation could augur a broader economic slowdown, which would be less-than-pleasant news for the Democrat.  Thursday’s report on consumer prices will probably give a taste of the disinflation to come for the American consumer. Goods prices overall have stopped rising and some, like those for cars, are falling. Surveys of consumers have shown improvements in sentiment about the outlook for inflation with declines in gas prices leading the way. Grocery costs are still up from a year ago—though they’re not rising as fast as they were. Still, some forecasters on Wall Street anticipate the effect of elevated interest rates has yet to be fully felt on growth and hiring. “If some of that deceleration is coming at the expense of weakening demand—and that being tied to the job market—that could be an offsetting factor,” said Sarah House, a senior economist at Wells Fargo. —David E. Rovella US regulators formally approved exchange-traded funds that invest directly in Bitcoin, a move heralded as a landmark event for the roughly $1.7 trillion digital-asset sector. The Securities and Exchange Commission authorized 11 funds to begin trading Thursday. But even before the announcement, and amid the falloutof Tuesday’s hack of the SEC’s social media account, the jostling for position had already begun. Competition among prospective Bitcoin ETF issuers intensified as companies further slashed prices in a bid to make products more attractive to investors. BlackRock lowered the fee on its iShares ETF by five basis points to 0.25%. It also lowered its introductory offer on the fund. “BlackRock is really going for the jugular here,” said Bloomberg Intelligence analyst Eric Balchunas. Here’s your markets wrap. The regulatory approval of an ETF isn’t supposed to be a mass-media event worthy of Wrestlemania, Lionel Laurent writes in Bloomberg Opinion. Yet here we are. The hype around US spot Bitcoin ETFs has reached meme levels akin to pandemic-era laser eyes: Crypto prices are soaring, hackers are mobilizing and Redditors are pumping. But Laurent says the promise of game-changing, gold-like adoption looks like a meme too far. Alaska Air is grounding all flights by Boeing 737 Max 9 aircraft over the next three days as it awaits instructions from the planemaker and US safety regulators on inspections. Meanwhile, Boeing Chief Executive Officer Dave Calhoun said his embattled company must own up to its shortcomings, underscoring the stakes of a safety incident that’s renewing questions over the quality of its manufacturing and the long-troubled 737 Max program.  An Alaska Airlines Boeing 737 Max-9 aircraft grounded at Los Angeles International Airport on Jan. 8. Photographer: Eric Thayer/Bloomberg With aid to Ukraine still blocked by Congressional Republicans, the Biden administration is now backing legislation that would let it seize some of $300 billion in frozen Russian assets to help pay for reconstruction of Ukraine. The administration welcomes “in principle” a bill that would allow it to confiscate the funds, according to a November memo from the National Security Council to the Senate Foreign Relations Committee. The shift however has engendered fears in some quarters that it could taint the reputation of the US financial system and spark a flight from the dollar. When Xi Jinping attended talks with Joe Biden in November, seated to his right was a man who is quietly emerging as one of China’s most influential figures. Not only does Cai Qi sit on the seven-man Politburo Standing Committee, China’s most powerful body, but he serves as Xi’s chief of staff—the first person to hold both positions since the era of Mao Zedong. Those dual titles have given Cai another privilege: He’s the only member of China’s top decision-making body to have publicly traveled overseas with Xi. Cai may officially be China’s No. 5, but he has unusual clout for the position. This is how he got there.  Cai Qi Source: Bloomberg Over the past two years, Amazon fired more than 27,000 of its employees, part of a flood of terminations by technology companies tied to pandemic fallout and a recession that never came. Now it’s 2024, and Amazon is dismissing its workers again. The company announced it’s terminating hundreds of people in its Prime Video and studios business. Former Credit Suisse star trader Hamza Lemssouguer guided his hedge fund to double-digit gains last year, making it one of the best-performing credit money pools out there. His $2.7 billion Arini Credit Master Fund is said to have returned 32% while the $544 million Arini Structured Credit Equity Fund gained 26.7%. By comparison, credit hedge funds tracked by Bloomberg returned only 8% on average last year. So what’s Lemssouguer’s secret? His gains were largely driven by these bets.  Hamza Lemssouguer Photographer: Chris J. Ratcliffe/Bloomberg False information poses the biggest danger to the world in the next two years amid a confluence of elections, according to a survey by the World Economic Forum. Hours after a fake post on the SEC’s X account fueled a brief surge in Bitcoin, the Geneva-based organization that will next week host the global elite in Davos highlighted how worries about the potential manipulation of voters are mounting.  Davos, Switzerland Photographer: Michele Limina/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays |