|

|

Today’s letter is brought to you by Espresso Displays!

I normally work on my desktop computer and am hyper productive. The second that I leave my desk, I lose my productivity on a laptop.

So I started to use a second screen and it seems to have fixed the issue.

It took awhile to evaluate many different screens — Espresso Displays was by far the best one.

I use it every day. I can’t imagine working from my laptop without it now. They are lightweight, thin, and look like Steve Jobs designed them himself.

Any reader of The Pomp Letter who orders one today will get $100 off before midnight. Highly recommend!

To investors,

The US government is already paying more than $1 trillion in annual interest payments on the national debt. That is a mind-boggling number that is set to get much worse in the coming year if something doesn’t change quickly.

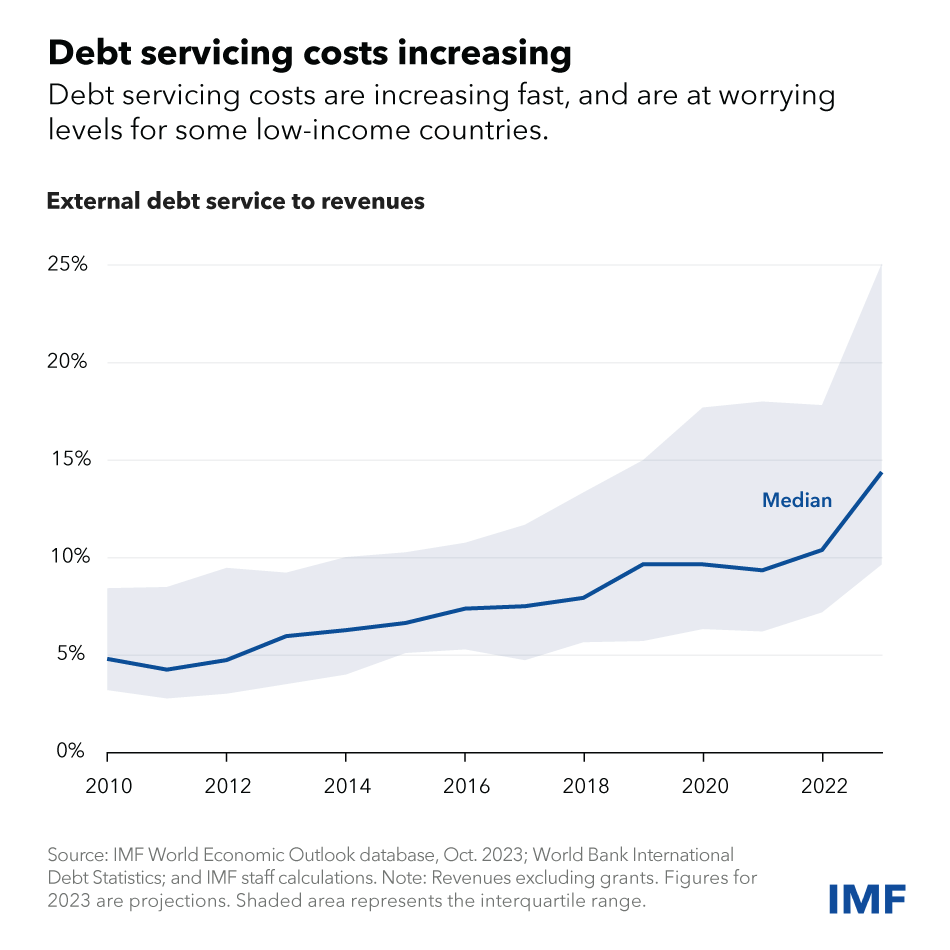

The debt servicing cost of national debt around the world has been steadily rising in recent years. Smaller, low-income countries are suffering more than large countries, but no country has been immune to the problem.

Countries had to take on significantly more debt to deal with the pandemic and various secondary issues. That debt came at a time of low-interest rates, but now that interest rates are rising, and many countries have not stopped borrowing, the servicing costs will continue to grow rapidly.

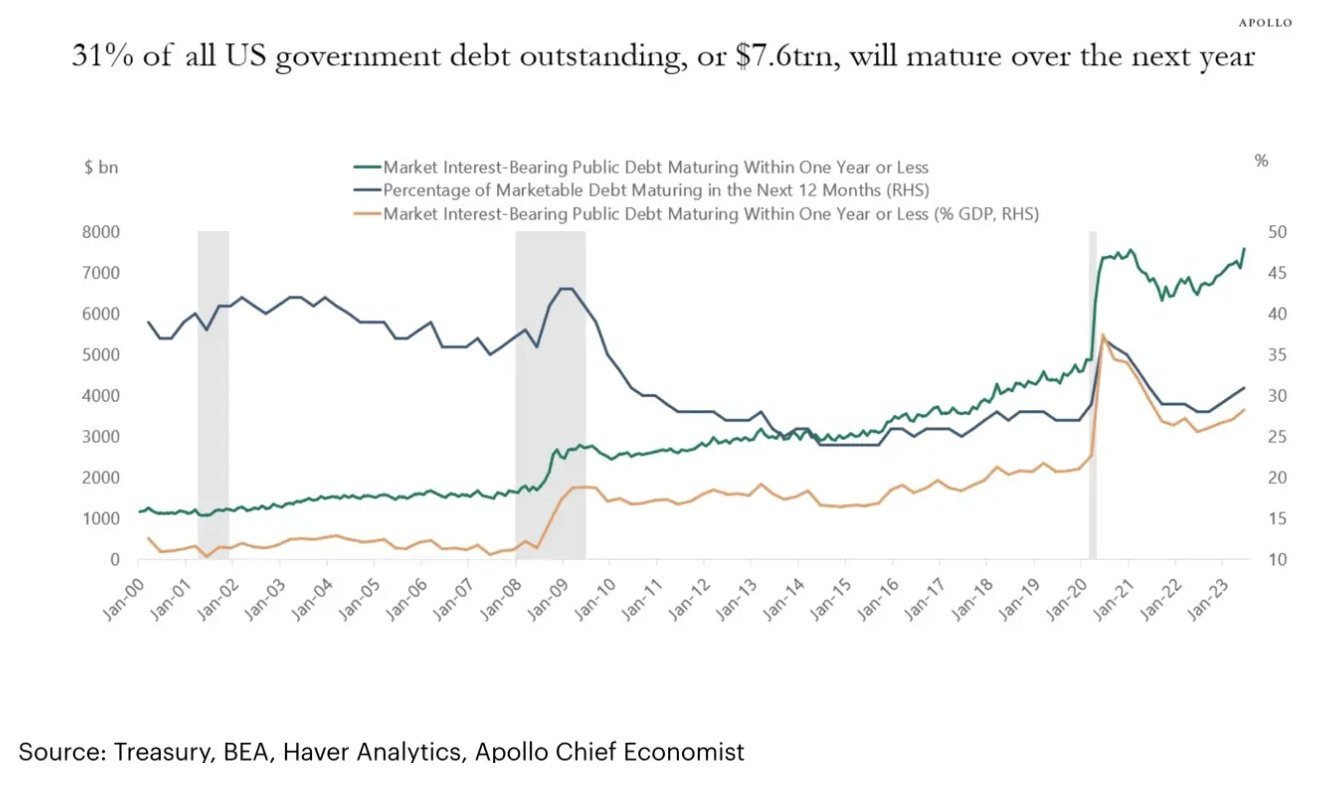

The United States is a good example of the trouble ahead. More than 30% of all US federal debt is set to roll over in 2024, which is over $7.5 trillion.

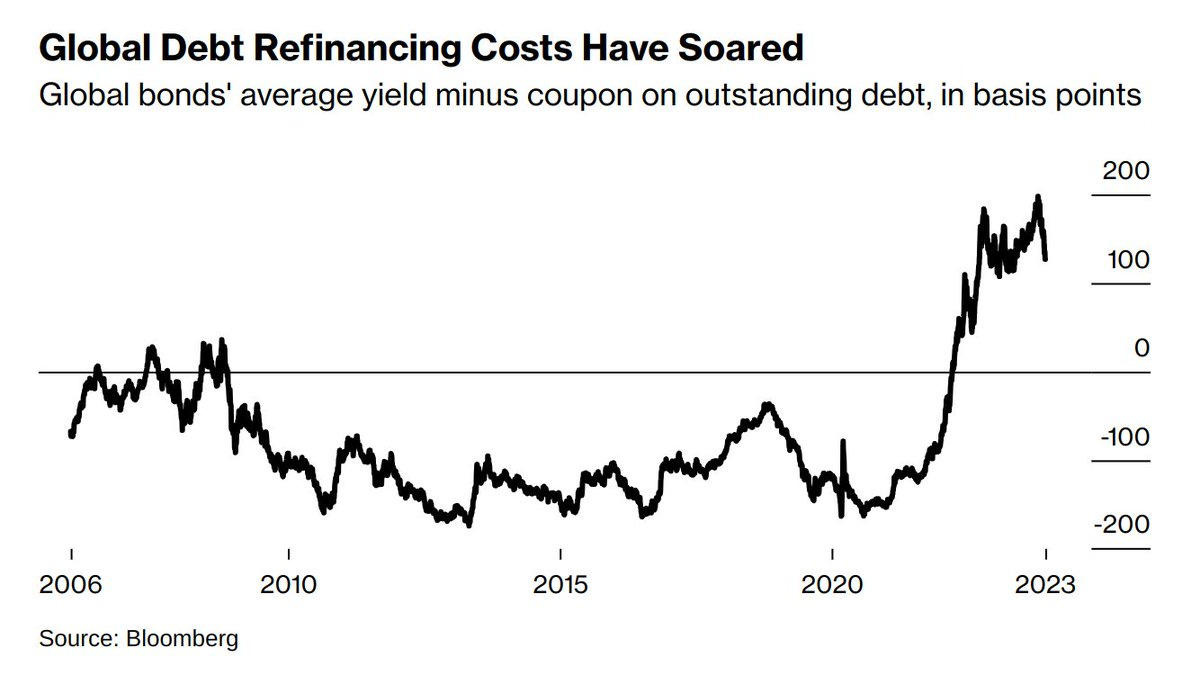

This is problematic because the refinancing cost of this debt is the worst it has been in more than two decades. The average interest rate on each global bond that rolls over will increase by more than 100 basis points.

Thankfully, there was relief on the way at the start of this year. The market believed the Federal Reserve would cut interest rates and the refinancing costs of some of the debt would drop simultaneously.

The market believes that story less today than it did just 7 weeks ago.

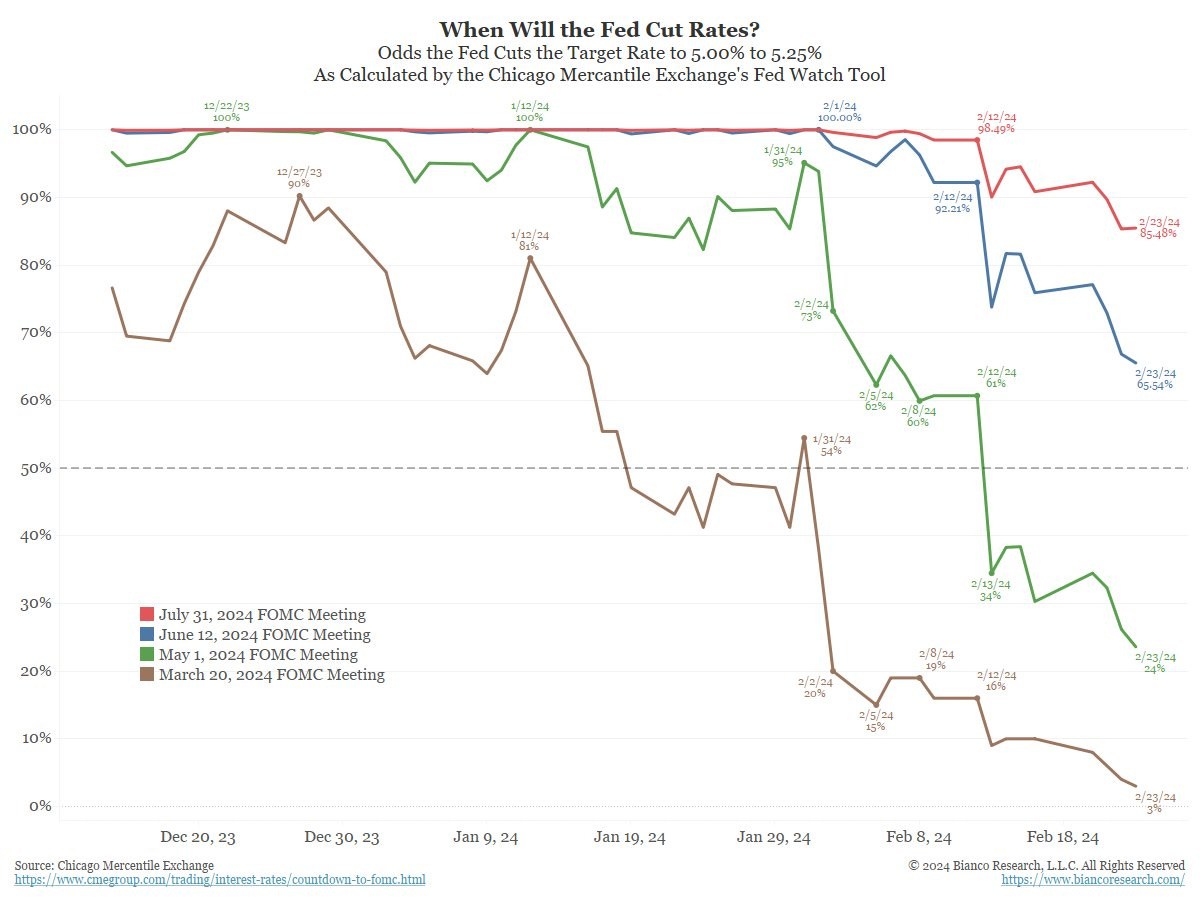

Jim Bianco explains with this chart and overview:

“Here are the probabilities of the first Fed cut over the next four FOMC meetings.

The next FOMC meeting is on March 20 (brown). The market is pricing just a 3% probability of a cut. This was nearly 90% at the beginning of the year.

The May 1 FOMC (green) is down to 24%. Being well below 50%, it is unlikely this meeting will see a cut. Right before the January Payroll report (massive beat of 353k), the pricing had a 95% probability of a cut in May.

The June 12 FOMC (blue) has a 65.54% probability that the Fed will cut at this meeting, so a cut is still priced in (above 50%). However, this was 100% the day before the beat in the January payroll report and 92% the day before the beat (more than expected) in January CPI.

The July 31 FOMC meeting (red) has an 85% probability of a cut. But note this was 98% the day before the January CPI report (February 12).

In other words, all the probabilities are in a downtrend. So, while March and May are priced out, check back after February payrolls and CPI to see where all these probabilities are. If payrolls and CPI are again strong (above consensus), I would look for June and July cuts to get priced out.” - Jim Bianco

This is an important point from Bianco because the relief that was on the way seems to be quietly walking out the back door of the party. The US will continue to have higher interest payments on the debt until the Fed can cut rates. The Fed can’t cut rates until they are sure that inflation won’t come roaring back.

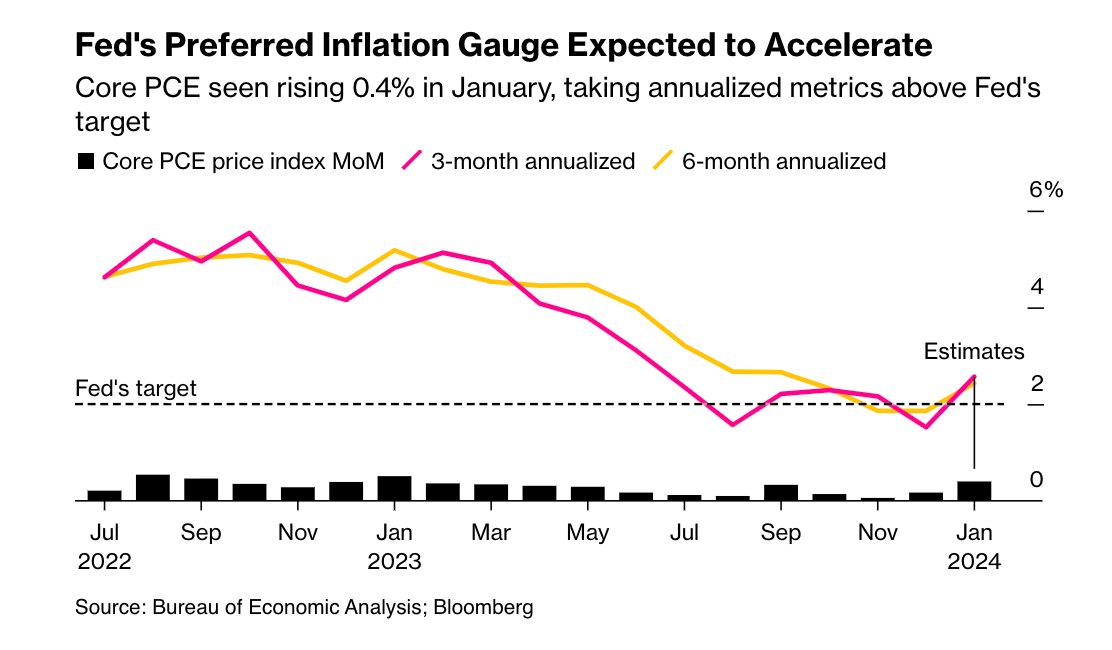

According to Molly Smith and Craig Stirling at Bloomberg:

“Underlying US inflation probably rose in January by the most in a year, as tracked by the Federal Reserve’s preferred metric, highlighting the long and bumpy path to taming price pressures.

The core personal consumption expenditures price index, which excludes food and energy costs, is seen rising 0.4% from a month earlier. That would mark the second straight monthly acceleration in a gauge that’s largely been receding over the past two years.”

The Fed is officially in a lose-lose situation. Keep interest rates high and you will probably push the US economy into a recession. Cut interest rates and risk inflation coming back to ruin your legacy.

There are no winners in an inflation fight.

And while this is going on, the American people will continue to see more than 40% of all personal income tax dollars spent on servicing the debt. Rather than having those dollars devoted to better education, defense, infrastructure, and various other services, the money evaporates into thin air as interest payments.

Not exactly the news we want as the US heads into tax season.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here.

Santiago Pilego is the Director who leads the venture side of a company called New Founding.

In this conversation, we talk about the vibe shift that is happening in America, culture wars, backing companies defined by American ideals and positive national vision, DEI and ESG, bitcoin, and creating solutions.

Listen on iTunes: Click here

Listen on Spotify: Click here

The Vibe Shift in America is Underway - Conversation with Santiago Pilego

Podcast Sponsors

Frec.com - Use tax-loss harvesting to save on your tax bill, while keeping the same investment exposure you already have.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.