|

|

READER NOTE: This Thursday I am hosting a free webinar for anyone who is trying to transition into a new job in the bitcoin and crypto industry. Previously, my team and I have helped more than 3,000 people find a new role, so I will break down the lessons learned and provide actionable advice on how to make the jump efficiently.

The event is completely free and I will also be joined by people from BTC Inc, Compass Mining, Rhino Bitcoin, and Serotonin who will share their experience in finding a new job.

To investors,

One of the big differences in the US economy post-pandemic is how much extra capital is sloshing around the financial system. You can see the impact everywhere.

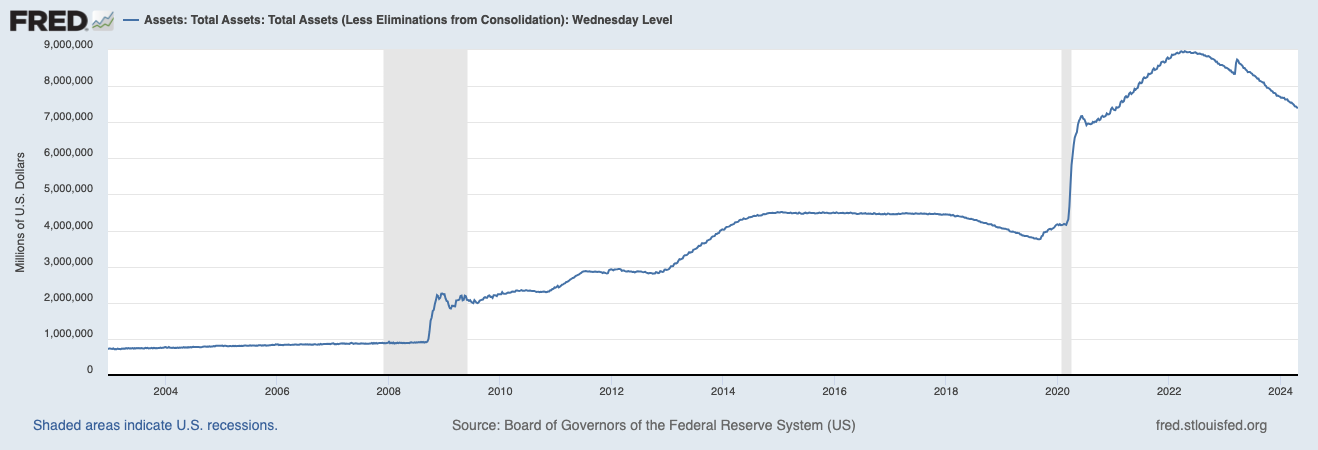

First, the Fed’s balance sheet has nearly doubled since 2020 even though the central bank has been trying to aggressively drain liquidity from the system and sell assets.

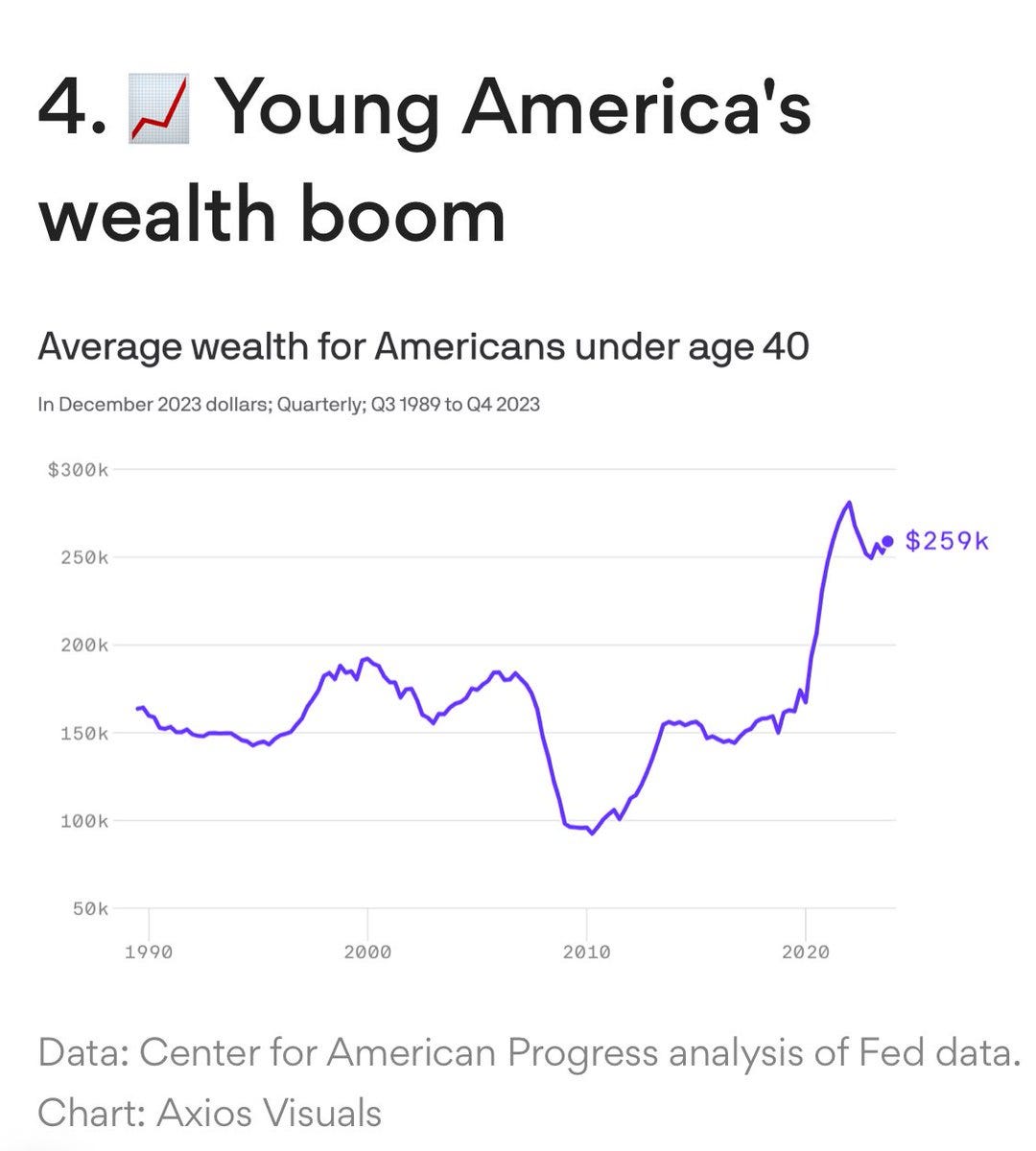

Second, according to Axios, “the average household wealth for those under 40 in the U.S. is up 49% from its pre-pandemic level.”

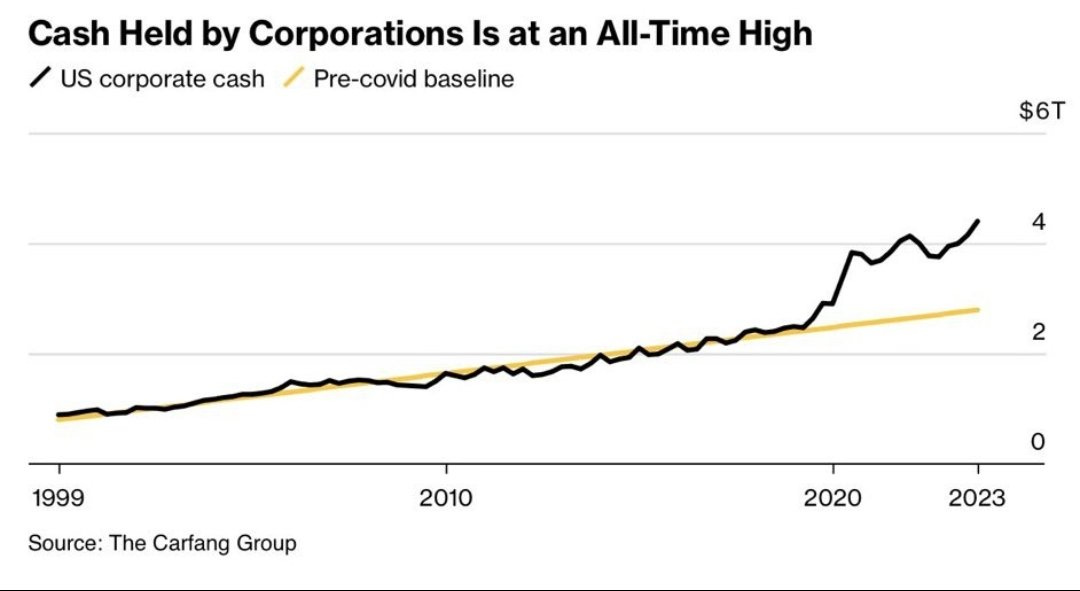

Third, US corporations are sitting on all-time high amount of cash, which comes in today at $4.4 trillion.

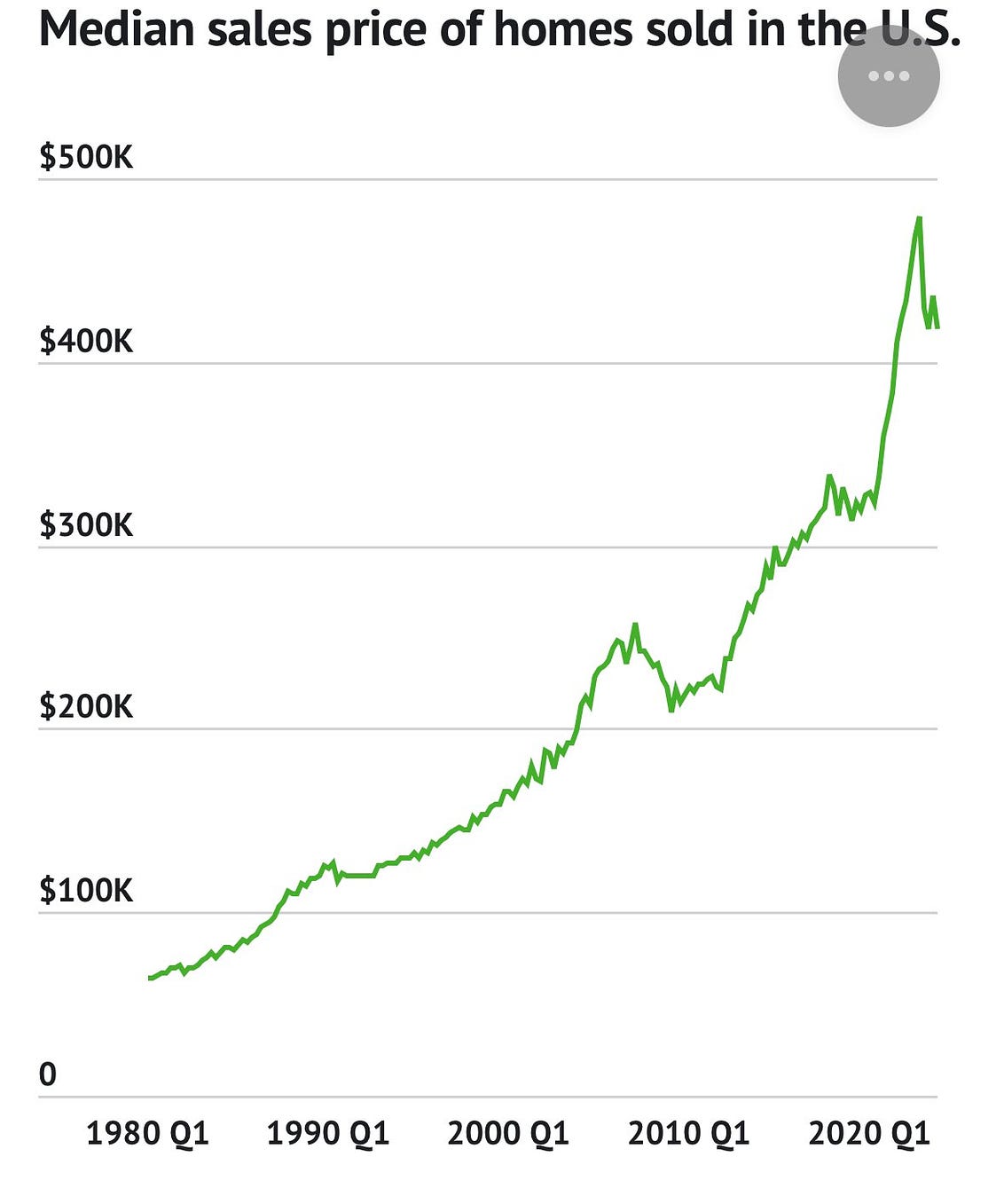

Fourth, US home prices are up about 30% bringing the median sales price of homes sold in the US to over $400,000.

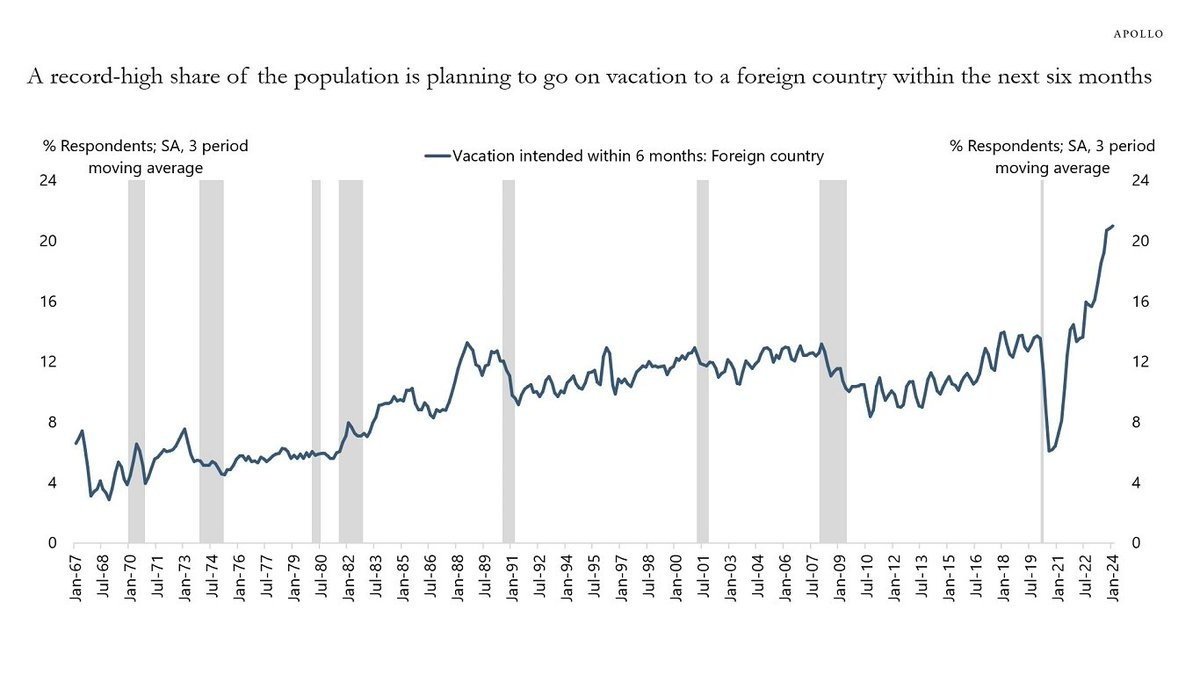

Fifth, all this extra money flowing through the system has a record amount of people planning to go on vacation to a foreign country in the next 6 months.

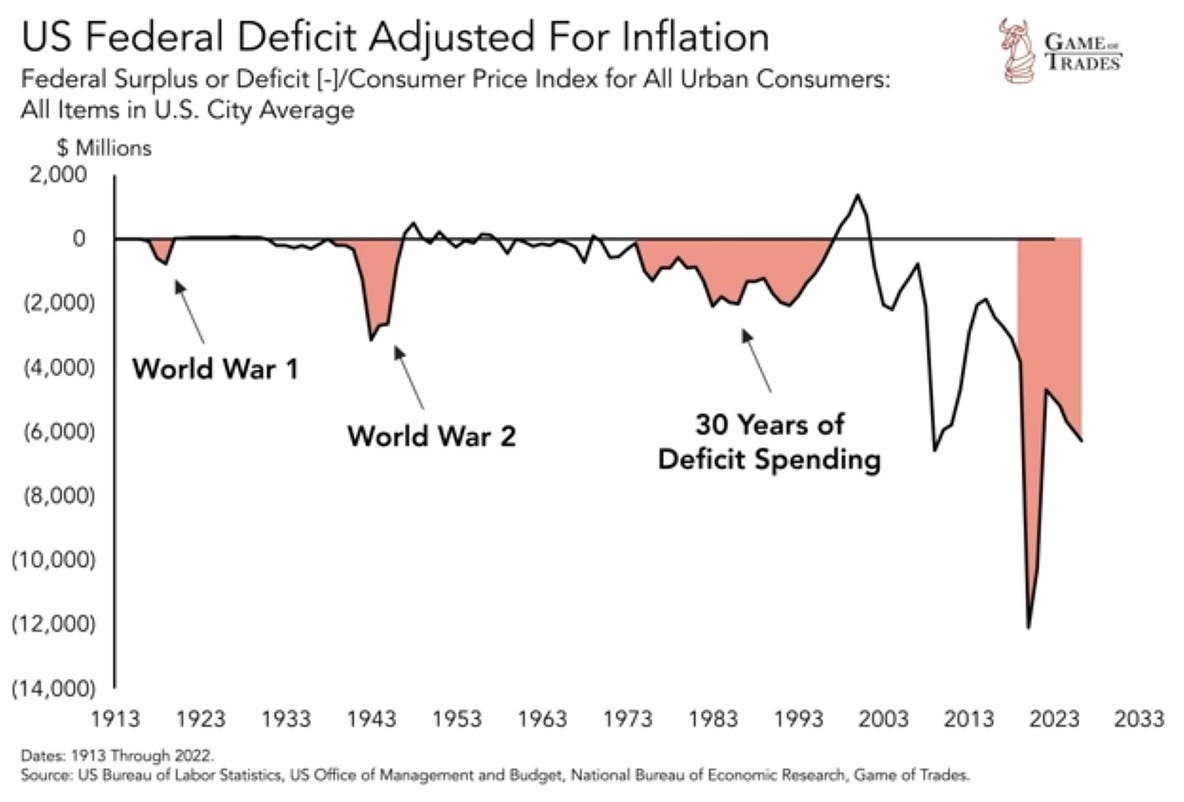

Most of this extra money is coming as a byproduct of government spending. According to Game of Trades, “US government spending (inflation-adjusted) since 2020 now exceeds the combined spending of: World War I, World War II, and the 1970 to 1990 time period.”

So it shouldn’t be surprising that inflation refuses to come down. The government is spending like drunk sailors. The US consumer has extra cash that they want to spend like it is a hot potato. And US corporations have never had more cash on-hand than they do right now.

This is a cocktail for higher inflation, regardless of what the Fed does with interest rates.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Renato Moicano is a UFC Fighter who went viral after his most recent fight, talking about defending liberty, importance of private property rights, and suggest everyone read the 6 lessons of Ludwig Von Mises.

In this conversation, we talk about the lessons he has learned from Brazilian constitution vs American constitution, private property rights, why he suggested Ludwig Van Mises, principles of America, why he views bitcoin as a lifeboat, capitalism, national debt, taxation, upcoming elections, inflation, the responses he has received, and crypto in Brazil.

Listen on iTunes: Click here

Listen on Spotify: Click here

Interview with UFC Fighter Renato Moicano on Economics, Freedom, and Bitcoin

Podcast Sponsors

Core Scientific is one of the largest public Bitcoin miners and hosting solutions providers for Bitcoin mining in North America.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA.

Supra- Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

Propy - Now, anyone can start their on-chain journey by minting home addresses via PropyKeys and staking them for profit until they are ready to sell their home.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.