|

|

There Were Two "Safe Havens." Now There's Only One!

Why U.S.treasuries won't work this time. Gold will If Property rights survive.

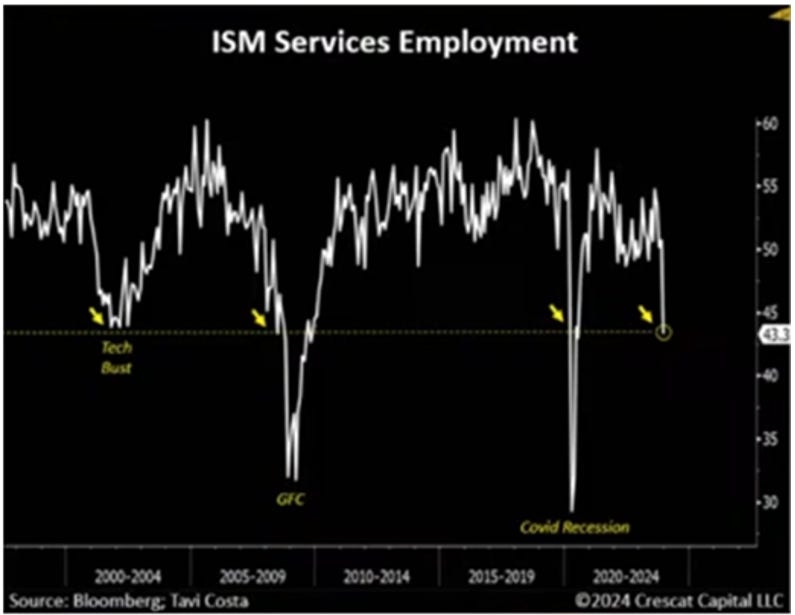

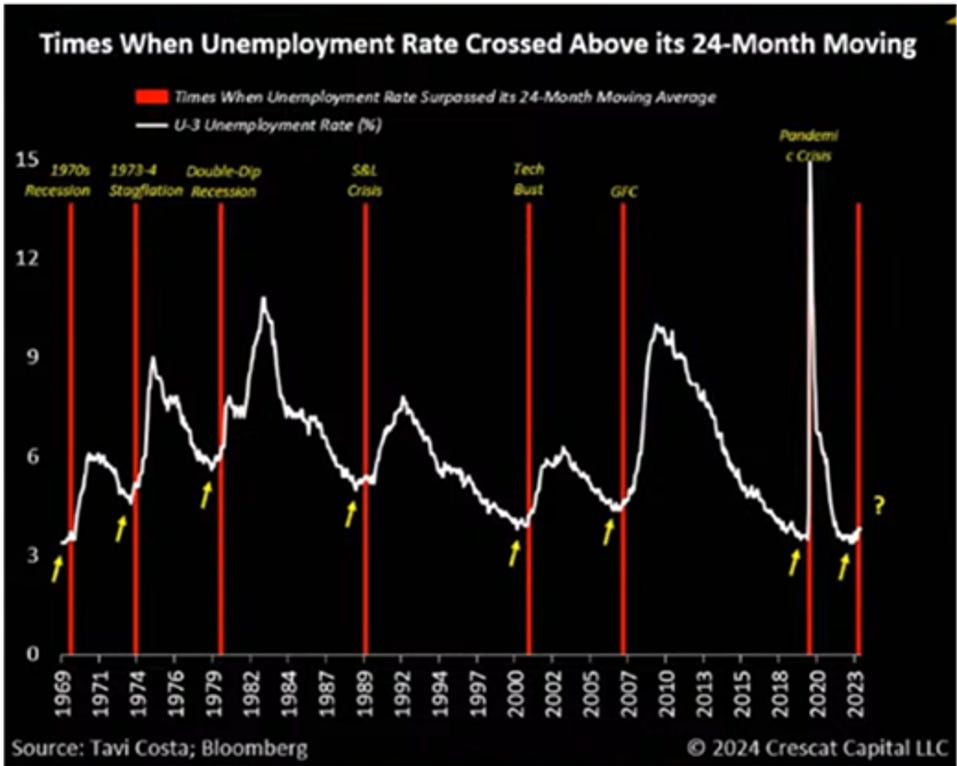

Janet Yellen has just declared a “soft landing” victory. Something tells me it’s not smart to buy the words of a woman who is playing more the role of a politician than an economist. On January 5, 2024, Tavi Costa of Crescat Capital provided investors with two charts investors must see before going all in on the S&P 500 at the start of this year. Both of Tavi’s charts strongly suggest that we are on the precipice of a significant recession that is likely to negatively impact corporate earnings and their shares. Those two charts, both of which apply data from Bloomberg, are: the ISM Service Employment Chart and an Unemployment Chart.

The ISM Service Employment Chart NOW has a 43.3 reading. Anything below 50.0 means the sector is contracting. The service sector is a dominant sector of the U.S. economy so this is a seriously negative indicator. The dot-com bear market in 2000, the financial market crash in 2008, and the COVID-related market decline all took place shortly after this level of contraction took place.

The Unemployment Chart Tavi displayed on January 5, 2024, shows that the unemployment rate has NOW crossed above its 24-month moving average. This chart dates back to 1868. It also shows that every time the unemployment rate crossed above the 24-month moving average, a recession followed.

So, just buy U.S. Treasuries, right?

There are many fundamental reasons beyond the two charts provided by Tavi to believe that we are on the precipice of a recession and equity bear market that I don’t have time to discuss now. But for the sake of argument, let’s assume we are indeed entering a recession and bear market as this new year gets underway.

Normally most investors who see a bear market coming would sell some or all of their equities and buy U.S. Treasuries. As the recession takes hold, demand for goods and services will be reduced. That, combined with massive money printing by the Fed, would be expected to lower interest rates, in which event the bonds you buy would appreciate while the stocks you sell will decline in value. When the bear market in stocks is over, you sell your bonds and buy equities, ready for the next bull market. That strategy has worked really well during recent recessions. But can we assume it will work again this time?

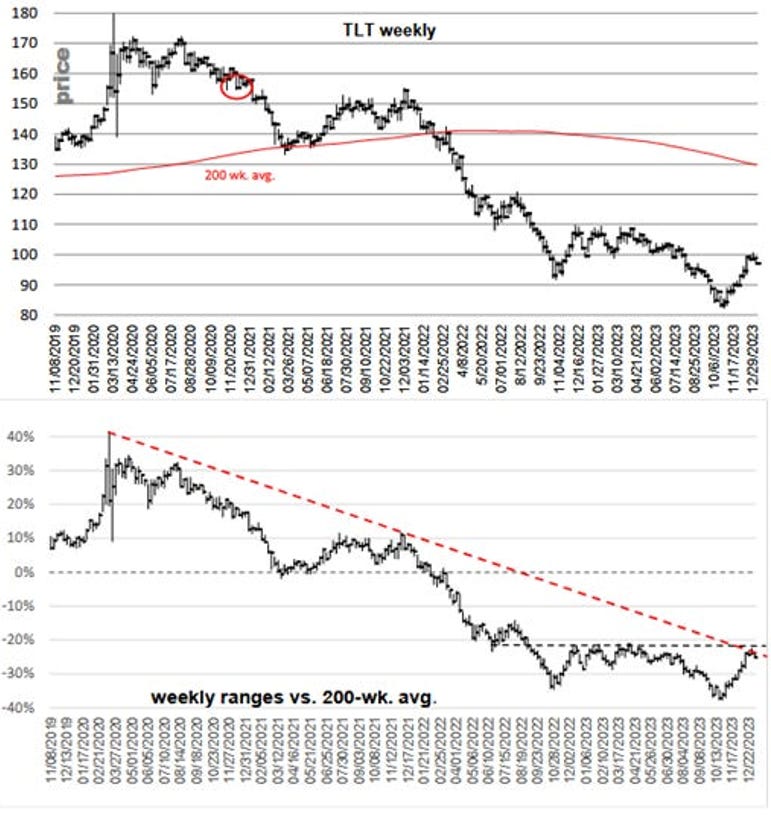

Michael Oliver(OliverMSA.com), one of the most objective and effective technical analysts alive, posted the following charts for TLT, the 20 plus years Treasury bonds ETF on January 4 for his subscribers. The trend line on the lower momentum chart suggests longer duration Treasuries may still be heading lower with or without an impending recession. Michael’s suggestion to his paid subscribers? “Be gone from this market!”

With the macroeconomic environment looking more like that of the 1970s on steroids, there is reason to believe that one of the two known safe havens—U.S. Treasuries—may not be a profitable trade this time. In fact, the one asset that stood out head and shoulders above others in the 1970s was gold, because as inflation was threatening to go hyper, bonds were an extremely unprofitable asset class as interest rates ran into the high double digits in some instances. For example, my first mortgage was a 17.5% mortgage with no ability to prepay it for 5 years!

With the macroeconomic environment looking more like that of the 1970s on steroids, there is reason to believe that one of the two known safe havens—U.S. Treasuries—may not be a profitable trade this time. In fact, the one asset that stood out head and shoulders above others in the 1970s was gold, because as inflation was threatening to

go hyper, bonds were an extremely unprofitable asset class as interest rates ran into the high double digits in some instances. For example, my first mortgage was a 17.5% mortgage with no ability to prepay it for 5 years!

With the macroeconomic environment looking more like that of the 1970s on steroids, there is reason to believe that one of the two known safe havens—U.S. Treasuries—may not be a profitable trade this time. In fact, the one asset that stood out head and shoulders above others in the 1970s was gold, because as inflation was threatening to go hyper, bonds were an extremely unprofitable asset class as interest rates ran into the high double digits in some instances. For example, my first mortgage was a 17.5% mortgage with no ability to prepay it for 5 years!

Realizing the U.S. is in much deeper trouble now than in the 1970s given a federal debt load of 125% of GDP, compared to just 35% in the 1970s, Michael’s not only shared technical jargon in in his January 5 letter but he’s also ended this very important missive with the following ominous comments:

“MSA is also very much aware of a massive variable out there that could flip all sorts of assumptions and tables over. But we must admit that factor is currently unquantifiable in its specific wave effects. But political upset of a scale not seen in a century plus is quickly approaching, we argue. (See our Tabula Rasa report sent December 18th.)

“What impact will such an anticipation and then reality have on U.S. debt market stability and liquidity? Will U.S. Government long-dated debt still be perceived (erroneously) as a “safe” place to park one’s capital? And if such variables begin to affect T-Bonds—and other markets—what will or must the Fed do policy-wise in such a market combat-zone environment? We can’t answer that, except to argue that it’s coming and with likely major impact on many markets and situations. And it’s still not being discussed on CNBC, FOX Business, etc., which remains very interesting.”

That Other “Safe Haven.” Like a “Thief in the Night”?

On December 4, Michael Oliver wrote an article titled “The final fight: a price Chart Fight.” That was the day after gold shot up to $2,150 in response to the most recent “Powell pivot.” Technically this told Michael that we could expect a pullback and some “arm wrestling” before a final and dramatic victory for gold bulls.

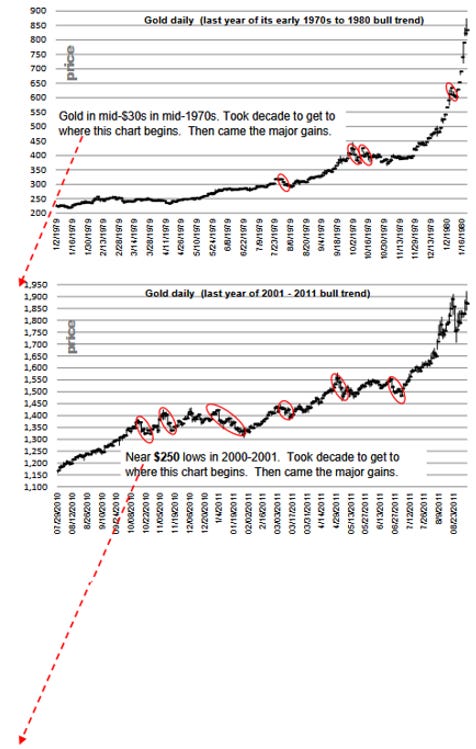

With respect to a final victory for the bulls, Michael was looking back at what happened in the 1970s ($38 to $875) and a rise from ~ $250 in 2002 to ~ $1,920 in 2011. Yes, these were dramatic “wins” for the bulls, but a major point Michael made in his December 4 missive was that the lion’s share of those gains was made in the last few months of multiyear bull markets.

“As we have noted before, late in gold and silver bull trends—such as the final several quarters or final year—the vast percentage of its overall multi-year price advance occurs. Compressed! Years of laborious up/down...then the dynamic phase commences.

“But even in the dynamic final year or final several quarters of the multi-year bull trends there were savage daily declines of 10% and even much more. Yet shrugged off quickly with upside resumption. Some of those that were 5% to 10% collapses or even more are circled.”

Charts shown above are daily, so keep that in mind when noting those savage percentage selloffs. Did not take months to recover.

Michael also noted in that December 4 issue that when you get a dramatic rise in the price of gold, as happened in the early hours of trading on December 4 when gold spiked to $2,150, you get a long period of “arm wrestling” between bulls and bears before the final dramatic rise. Then based on his momentum and structure approach he commented as follows:

“This case looks totally different to us. Momentum pre-ordained the price breakout well before the apparent-to-all pivotal price levels were achieved. So, for those of you who are buying (finally) into gold’s breakout—above all the highs of the prior three years—realize that you are late and you just might have to weather the turbulence. If it were always so easy to buy every price chart breakout, whether upside or downside, and make money from that moment forward, then everyone, idiots included, would be rich. The game would be so easy.

“Well, it doesn’t work that way.

“We suggest that the litmus test for this breakout—in terms of price action—will be what happens in the coming days or week or so. After the relapse from last night’s highs does its thing, will we see price arm-wrestle itself back up to the $2100 to $2150 zone (above all highs since mid-2020)? It likely won’t be a rapid and breathtaking event, but more arm wrestling. And once it occurs, price is saying the vacuum upside whoosh last night was in fact in the true direction, albeit packed with too much emotion and occurring at an illiquid trading time.”

In an interview Michael recently gave, he touted a “conservative” final upside price for gold of $5,000 but suggested, given all the changes that are taking place, it could be much, much higher. With dollar hegemony in its last days and with the Fed having no way out but to print enormous amounts of money just to enable Uncle Sam to pay the interest on its $34 trillion of debt (in addition to far more off-balance sheet obligations), the only way out will be to destroy the dollar. What the U.S. now faces is reminiscent in many ways with the Mississippi Bubble in which, to “save” the currency, France destroyed its purchasing power. You may have had shares of the Mississippi Company that were priced very high in the currency yet bought nothing.

The Holy Bible says that Jesus will return at the end of time like a “thief in the night,” when few are looking. From what I can observe, it seems a very small percentage of investors and citizens, at least in the Western world, are looking for the kind of rise in price that Michael is suggesting.

In my January 5 letter, I passed along comments from three very exciting, emerging world-class gold exploration companies. It’s exactly in troubled times when safety in the form of real money—gold—is most necessary to have in your investment portfolio. I hope you will consider subscribing to J Taylor’s Gold, Energy & Tech Stocks,where more than 40 gold and silver miners and exploration companies are covered in addition to a few energy and tech stocks.

Those who have not prepared by transferring worthless fiat money into real money—gold—will feel like they have been robbed by a “thief in the night.” Those who are prepared will be the recipients of a massive transfer of wealth, assuming of course that whatever government evolves then will allow you to keep your gold.

The answer to that question is only known by the Almighty. Absent the omniscience of our Creator, we do the best we can from our limited perspective. History and the work of Michael Oliver, whose eyes are wide open, see an inevitable dramatic rise in the price of gold measured by worthless fiat currency. I will be working as hard as I can to identify companies that discover and produce real money and, with that, richly reward their shareholders. There are some new great emerging gold deposits discovered by the likes of Snowline Gold, Goliath Resources, New Found Gold & Nevada King Gold Corp to name just 4 of several more. If I’m right about 2024 being the year for gold, owning those names and others should be fun and very rewarding.

Whether you join me as a paid subscriber or not, best wishes for a happy, prosperous, healthy, and joyful 2024.

Jay Taylor

You're currently a free subscriber to J Taylor's Gold Energy & Tech Stocks. For the full experience, upgrade your subscription.