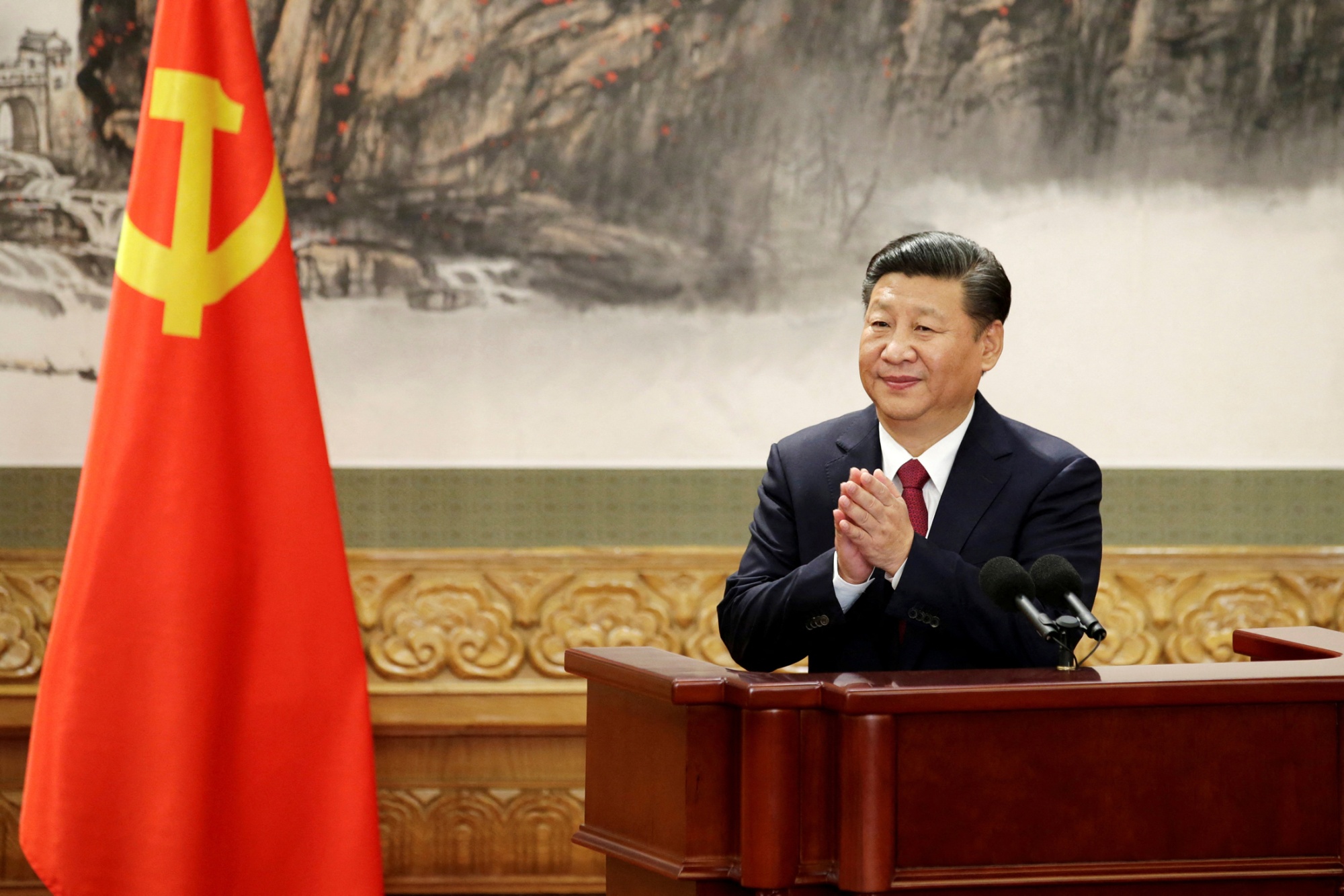

| It’s AI’s turn. Since March, the US Securities and Exchange Commission has accused three companies of misrepresenting how they use machine learning and other tools—so-called AI washing. The moves follow multiple warnings from SEC Chair Gary Gensler and the regulator’s top enforcement attorney over misstatements around artificial intelligence. While Gensler has referred to AI as “most transformative technology of this generation,” he has also said it could spark a financial meltdown. Even before the recent SEC cases, the agency had proposed new restrictions for brokerages and advisers using AI. Lawyers contend the enforcement actions brought so far around AI washing are similar to those involving statements some companies made about Covid treatments and ESG. —David E. Rovella When it comes to the direction of the stock market (or the timing of Federal Reserve rate cuts), everyone has an opinion. A new one arrived on Thursday, with Stifel, Nicolaus & Co. saying the S&P 500 Index may rally close to an additional 10% this year, if past market manias are any guide. But when will the bubble—as they all must do—pop? Stifel’s Barry Bannister says by mid-2026, with the gauge likely to sink back to where it began this year—around the 4,800. Here’s your markets wrap. Friday’s US options expiration may provide volatility-starved traders with some short-term market swings. The so-called triple-witching will see some $5.5 trillion worth of options tied to indexes, stocks and exchange-traded funds fall off the board. As the contracts disappear, investors will adjust their positions, adding a burst of volume capable of swinging individual holdings. It started with a cryptic quote from Xi Jinping buried in a 172-page book on the financial sector. Three months later, plans for potentially the biggest shift in years in how China conducts monetary policy are starting to surface. Pan Gongsheng, governor of the People’s Bank of China, just gave the clearest acknowledgment that the monetary authority is looking into trading government bonds in the secondary market as a way to regulate liquidity.  Xi Jinping Photographer: Jason Lee/Reuters Hackers are selling data about consumers of the LendingTree subsidiary QuoteWizard after the company detected unauthorized access on a cloud database hosted by Snowflake. There are said to have been several listings of the data on cybercriminal forums, with information being sold to the highest bidder. LendingTree is still investigating the size and scope of the theft. Auto retailers across the US suffered a second major disruption in as many days due to another cyberattack at CDK Global, the software provider thousands of dealers rely on to run their stores. CDK informed customers on Thursday of the incident that occurred late the prior evening. The company shut down most of its systems again, saying in a recorded update that it doesn’t have an estimate for how long it will take to restore services. Gilead Sciences’s experimental twice-yearly shot prevented 100% of HIV cases in women and adolescent girls in Africa, the first successful big trial of what it hopes will become a powerful new drug for fending off the virus. The regimen could provide an easier-to-use option compared to other HIV prevention drugs that are either daily pills or must be injected every two months. Gilead shares rose as much as 8.3% in New York, their biggest intraday gain since October 2022. Before Thursday, the stock was down 22% this year. Melinda French Gates has come out in support of US President Joe Biden’s reelection, saying it’s the first time she’s ever publicly endorsed a candidate for that office. “This year’s election stands to be so enormously consequential for women and families that, this time, I can’t stay quiet,” the billionaire philanthropist said Thursday.  Melinda French Gates Photographer: Michael Short/Bloomberg - Trump-appointee Cannon reportedly declined to hand off secrets case.

- Putin’s hybrid war opens a second front on NATO’s eastern border.

- Bloomberg Opinion: Nvidia’s explosive growth masks AI disillusionment.

- United jet turns back to Connecticut airport after engine piece falls off.

- FBI raids home of progressive Oakland mayor amid recall effort.

- Bruce Springsteen’s town fears a “disaster” courtesy of the Kushners.

- LVMH is buying one of the most famous restaurants in Paris.

A new Bugatti will succeed the Chiron as the company pushes to extend its hypercar dominance and secure a stronger position within parent company Volkswagen. The Tourbillon is the second Bugatti to come out of the Porsche and Rimac joint venture formed in 2021 that incorporated Bugatti in a plan to nudge it toward electrics. The reorganization at the time was seen as evidence that the French brand’s large internal combustion engine cars lacked a critical role at VW, since VW’s strategy focuses on producing EVs.  The Tourbillon Source: Bugatti Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Sustainable Business Summit: As ESG reporting shifts toward being mandatory, companies across the Asia-Pacific region are grappling with increasing scrutiny, compliance fatigue and intense global competition. Join us in Singapore on July 31 for a day of expert-led discussions and unique in-person experiences as we convene business leaders and investors to dive deeper. Get your presale ticket now at 60% off. |