| This Critical Signal Says the Next Big Uptrend Has Started | | By Porter Stansberry | | Thursday, June 30, 2016 |

| A crucial indicator is telling us our favorite precious metals are ready to explode higher.

And it underscores why silver must make up a small – but critical – part of your portfolio.

This indicator has held true throughout history. And right now, it's showing that it's time to buy silver again… and that silver stocks could see even bigger gains.

Let me explain…

----------Recommended Link---------

| New gold bull market officially here... do THIS first

We're officially in a new bull market for gold, up nearly 20% this year. That's the metal's best start in over 30 years. But before you buy a single ounce, national security insider Jim Rickards says you absolutely must do one thing FIRST. What does he know that the average American doesn't? Click here to see. |

|---|

---------------------------------

First, you should understand that silver acts like gold's volatile shadow. Whatever direction gold moves in, silver tends to follow… but its price action is much more extreme. When investors hate gold, they loathe silver. And when they're desperate for gold, they buy up silver even faster.

For example… in a little more than three years, from August 1976 to January 1980, gold soared 700% to $850 an ounce. But silver soared an incredible 1,100% over the same period. And the pattern has repeated for more than four decades… Silver has outperformed its more expensive cousin in each of the six bull markets of the past 40 years.

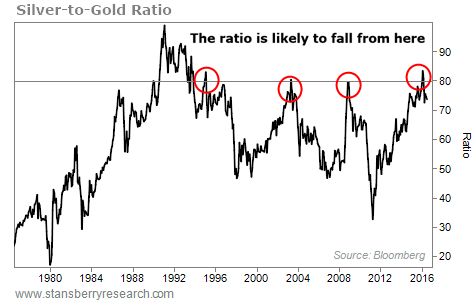

You can see this clearly in the silver-to-gold ratio. This indicator is simply a measure of how many ounces of silver you can buy with one ounce of gold. It's a rough guide that shows how cheap or expensive one metal is relative to the other. When the ratio is low, gold is relatively cheap. When the ratio is high, silver is relatively cheap.

Over the past 40 or so years, the ratio has averaged around 60:1… meaning you needed 60 ounces of silver to match the value of an ounce of gold.

Today, the ratio is 74:1. That means you need about 14 more ounces of silver to buy an ounce of gold than you would have needed, on average, over the past 40 years.

Like with most indicators, extremes in the silver-to-gold ratio present the best opportunities for us to profit.

For example, when both gold and silver sold off in 2008, the ratio jumped to more than 80:1. In other words, when people were selling gold, they were dumping their silver even faster. (The ratio hit as high as 83:1 again this past February.)

Then, as both metals rallied, the ratio narrowed to just more than 30:1 in April 2011. People were bidding up silver even faster than gold. Gold climbed more than 160% during that period. But silver soared by more than double that – 359%.

In both cases, silver crushed gold.

Silver outperforms gold in a bull market as investors pour in. But likewise, it underperforms gold dramatically in a bear market as investors dump silver faster than gold.

In the chart below, we've plotted the silver-to-gold ratio for the past 30 years. You can see that the ratio typically peaks around 80:1 when a bear market in precious metals is at its worst. The ratio has now dipped to about 74:1, which is why we believe we are in the early stages of the next bull market…

That's why we think silver is ready to explode again…

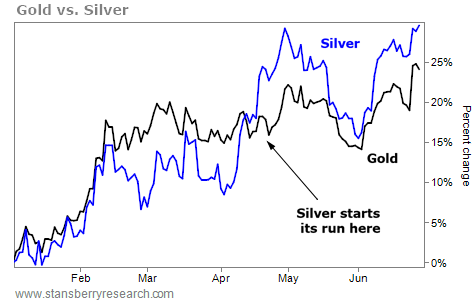

Silver's moves tend to lag gold. So when gold makes a move, it sometimes takes a little time before silver follows. But when it does… it can skyrocket.

During the first quarter of this year, gold climbed 16%. Silver was up, too, but only by 9%. So even though silver stocks soared along with gold stocks in the first quarter, the underlying metal still trailed gold.

Now, fast-forward to today.

Silver just picked up the pace. Through Friday's close, silver is now up almost 30% versus gold's 25% return. Both are great returns. But if history is any indication of where silver might be heading, it's time to buy silver stocks again.

Since both metals last peaked in 2011, silver has lagged gold. In that span, gold is down about 30%, while silver has fallen 58%.

Recent data suggest that the ratio is starting to narrow… It's another sign that the five-year bear market in gold and silver is over.

When silver takes off, it can soar. And silver stocks can soar even more. This powerful historical trend is coming around… and now is the perfect time to take advantage.

Regards,

Porter Stansberry

Editor's note: We launched Stansberry Gold Investor less than three months ago to take advantage of rising gold and silver prices, which could be entering their biggest bull markets ever. The results so far have been incredible. Subscribers are up 10%-plus on every single recommendation, including returns of 86%... 98%... and even 107%. If you aren't reading Stansberry Gold Investor, you're making the biggest mistake of your life. Learn more here (without sitting through a long video). |

Further Reading:

When gold is up, gold stocks can soar even higher – and you can profit from this trend using one simple system. "When this idea is in buy mode, gold stocks return 19.2% annualized gains," Steve writes... And it only takes one decision, once a month. Learn more here. Most people have never heard of owning gold this way. But if you buy at the right time, gold can boost your returns AND lower your overall risk. Learn how it works and capture this shocking benefit right here. |

|

THE 'PICKS AND SHOVELS' OF TELECOM IS SOARING

Today's chart looks at a big " picks and shovels" winner in the worldwide mobile-data boom. Regular readers know we're proponents of investing in picks-and-shovels companies to profit from sector and commodity booms. These companies don't bet it all on one project. Instead, they sell goods and services to an entire industry. American Tower (AMT) is a great example. The company owns and leases real estate all over the world that telecom giants AT&T and Verizon use for wireless infrastructure (like cellphone towers). While AT&T and Verizon fight over market share, American Tower profits from both – along with many other carriers around the globe. As you can see in the chart below, business is steadily growing for American Tower. Over the past three years, shares are up 60%... and yesterday set a new all-time high. As long as folks continue to buy mobile devices and use more and more data, wireless "picks and shovels" businesses like American Tower should do well. |

|

Why you should consider platinum instead of gold today... If you're thinking about buying precious metals right now, you need to consider platinum... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

Claim your "early bird" ticket today (before they sell out), and you'll have the chance to meet and hear from one of the investors from The Big Short... a former Navy SEAL with an incredibly unique skill (he'll do a live demonstration you should not miss). And more. Click here for details. |

| The 10 Ways to Find Your Next Great Investment Opportunity | | By Mike Barrett | | Wednesday, June 29, 2016 |

| | Improve your odds of finding great investments by reviewing 10 classic setups that consistently produce winning ideas. |

| | Why China Is NOT an Emerging Market | | By Dr. Steve Sjuggerud | | Tuesday, June 28, 2016 |

| | Take your opinions or mental images of Beijing, and throw them out the window. |

| | A Place Where Dividend Yields Are Higher Than P/E Ratios | | By Dr. Steve Sjuggerud | | Monday, June 27, 2016 |

| | There's hardly a man who's more knowledgeable about Asian investing than Peter Churchouse... |

| | My First Million-Dollar Investment Mistake | | By Kim Iskyan | | Friday, June 24, 2016 |

| | My first big investment did not go well... |

| | The Worst Commodities Bust in Generations Is Over... Time to Buy! | | By Dr. Steve Sjuggerud | | Thursday, June 23, 2016 |

| | This is an ideal setup... the uptrend has finally appeared. It's time to get in! |

|

|

|

|