| This Great Anomaly Will Go Away Soon – Take Advantage Now | | By Dr. Steve Sjuggerud | | Tuesday, May 2, 2017 |

| I've called this "the greatest anomaly in finance."

It's a massive discrepancy – one that makes no sense.

Importantly, you can make a lot of money as the discrepancy goes away… And it will go away.

So what is this anomaly? Let me explain…

----------Recommended Links---------

---------------------------------

Many stocks trade in different places – whether on different stock exchanges or in different countries.

For example, Microsoft (MSFT) trades in Germany, just like it trades in the U.S.

This is not normally a big deal…

The price of Microsoft shares trading in Germany is typically the same as the shares trading in the U.S. If a penny-or-two difference appears, computerized traders jump in to capitalize on that spread.

It's a basic version of "arbitrage" – buying the cheaper stock and selling the more expensive one.

You and I would never do this, because there's only a penny or two of profit when the opportunity appears. And thanks to computerized trading, the opportunity is typically gone as soon as it appears.

However, the story much different with one country's stocks: China.

Right now, there's a massive difference in the prices of the same companies trading in China and in Hong Kong. Today, as I write, the identical shares are (on average) 19% more expensive in China than they are in Hong Kong.

Said another way, the shares in Hong Kong need to rise by 19% to equal the price of their China-traded identical twins.

This is a crazy anomaly – the biggest anomaly in finance.

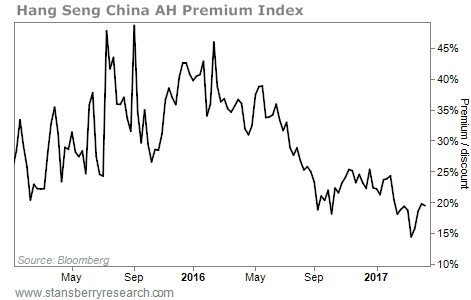

Here's what the average price difference of A-shares over H-shares (called the "AH Premium") looks like over time…

As you can see, the premium is shrinking…

I started writing about this anomaly in 2015. Nobody talked about it that year… or even in 2016.

This year, finally, the Chinese have been piling in to take advantage of it… However, a considerable gap still exists. The current premium sits at 19%.

Ultimately, the Chinese premium should end up at zero. The gap should completely go away.

Just like Microsoft trading in the U.S. and in Germany, smart traders will arbitrage away this premium by forcing up the prices of the cheap listings – and forcing down the prices of the expensive listings.

The simplest way for you to take advantage of this is to buy the iShares China Large-Cap Fund (FXI).

It's the biggest China exchange-traded fund… and the easiest way to enter this trade.

Three of FXI's top five holdings are dual-listed in Hong Kong and China. These are massive businesses, including the largest bank in the world. And while the premiums have narrowed considerably, they still exist.

I am incredibly bullish on Chinese shares right now. And taking advantage of the AH Premium is just one of the many smart ways to get exposure to China today.

I highly recommend you own China – now. FXI is the simplest way for you to do it…

Good investing,

Steve

Editor's note: A huge change is coming to China's stock market in a matter of days... which means this rare setup may not last much longer. That's why Steve is hosting an Emergency Briefing tomorrow at 8 p.m. Eastern time. He'll even share a recommendation live on air, so you can take advantage immediately. Reserve your seat for free by clicking here. |

Further Reading:

"The end result of Japan's globalization was a 527% gain over a decade," Steve writes. "And I believe we have a similar opportunity in China today." China's stock market continues to open up to the world – and the potential upside is enormous. Read more here: Japan's 527% Boom... And Why China Could Be Next. "Chinese property stocks and bank stocks have had a strong start to the year," Steve explains. "Now Goldman is catching on..." Big, institutional investors have started paying attention to China. Learn what that means for you right here: Morgan – and Now Goldman – Are Finally in My China Trade. |

|

AN AMERICAN CLASSIC HITS NEW HIGHS

Today's chart once again highlights one of our favorite strategies... buying companies that sell simple products. You don't need to sell flashy, innovative products to have a successful business. "Boring" products like cigarettes, soda, coffee, and cleaning supplies are always in demand. These staples are the cornerstones of steady, profitable companies that generate good cash flows for investors. For example, let's look at the sweets business... Hostess Brands (TWNK) is one of the largest packaged-foods companies in the U.S., specializing in fresh baked goods. The company is best known for its Hostess CupCakes and Twinkies. But customers also love its Ding Dongs, Ho Hos, and Donettes. These kinds of products can stay popular for decades... They generate millions of dollars, and they don't require additional spending from the company. After going public in November, Hostess' shares have soared. As you can see, they're up nearly 80% in the last year, and they just hit a new all-time high. People say that Twinkies can survive anything – even nuclear war – so don't expect this business to go away anytime soon... |

|

| Our favorite way to profit from the biggest anomaly in finance The Chinese are finally taking advantage of the biggest anomaly in finance. We have to take advantage, too – in a big way – before the opportunity is gone... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

Steve Sjuggerud called the bottom for gold in '03... the bottom for stocks in '09... and a huge rally in biotech in '13. And his next big prediction (the most controversial one yet) is starting to come true. See it live. |

| Japan's 527% Boom... And Why China Could Be Next | | By Dr. Steve Sjuggerud | | Monday, May 1, 2017 |

| | Japan in the 1980s was one of the greatest booms in stock market history... |

| | This Alarming Trend Is Just Beginning | | By Justin Brill | | Saturday, April 29, 2017 |

| | Stocks are expensive. But we remain cautiously bullish for now. |

| | How to Escape the Trap of Knowing Too Much | | By Dr. David Eifrig | | Friday, April 28, 2017 |

| | It sounds crazy, but you can know too much about a stock... |

| | Traders Just Made an Extreme Bet on Silver | | By Brett Eversole | | Thursday, April 27, 2017 |

| | Gold is up double digits, and silver is up almost 15%. But the rally in silver is getting ahead of itself. |

| | This Common Strategy Could Be Quietly Ruining Your Portfolio | | By Dan Ferris | | Wednesday, April 26, 2017 |

| | For decades, financial advisers have recommended putting 60% of your money in stocks and 40% in bonds... |

|

|

|

|