| This Group of Stocks Could Crush the U.S., Even During the 'Melt Up' | | By Dr. Steve Sjuggerud | | Monday, October 23, 2017 |

| The last time we saw today's setup, one group of stocks more than doubled in four years and left U.S. stocks in the dust...

It has nothing to do with China. And it might surprise you...

European stocks are now dirt-cheap compared with their U.S. counterparts.

Based on history, that means we could see an incredible scenario... European stocks could significantly outperform the overall U.S. market during the next four years.

Don't get me wrong... I am still bullish on U.S. stocks over the next 12 to 18 months. I think they will absolutely soar, thanks to the last explosive phase in this bull market, which I've called the "Melt Up." But Europe could do even better.

Let me share the details...

----------Recommended Links---------

---------------------------------

U.S. stocks crushed European stocks in 2016... The S&P 500 Index soared 12%, while the STOXX Europe 600 Index actually fell 1%.

The U.S. market has been outperforming Europe like this for years. But this outperformance might finally be coming to an end... even as the Melt Up gets going.

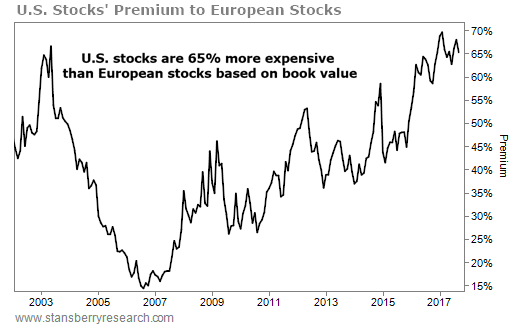

You see, U.S. stocks are expensive compared with European stocks today. The chart below shows the premium of the U.S. market versus Europe, based on the price-to-book value ratio.

It's coming off the highest level we've seen in years. Take a look...

The U.S. market is roughly 65% more expensive than Europe right now. That's a massive premium. As you can see above, the last time U.S. stocks were this expensive relative to the U.S. was in 2003.

Surprisingly, that wasn't a bad time to own U.S. stocks... Just because they were more expensive than Europe didn't mean they were set to crash.

In fact, that year turned out to be a great time to own both the U.S. and Europe. U.S. stocks did well from 2003 to 2007... But European stocks absolutely crushed the returns we saw in the U.S. Take a look...

| Total Returns |

|---|

| Year | European Stocks | U.S. Stocks | | 2004 | 21.8% | 10.9% | | 2005 | 11.3% | 4.9% | | 2006 | 35.7% | 15.8% | | 2007 | 13.8% | 5.6% |

U.S. stocks jumped a total of 42% over this four-year stretch... But European stocks more than doubled.

We could be at the beginning of a similar trend... a multiyear move higher in the U.S. and Europe... with European stocks dramatically outperforming. It's already starting this year...

European stocks are up 24.4% this year, while U.S. stocks are up only 16.3%.

Again, don't get me wrong here. I expect the gains in the U.S. to continue...

The Melt Up should help push the overall U.S. market higher. And certain sectors will absolutely soar – potentially hundreds of percent.

But on the whole, European stocks could outperform during the next few years or so. They're dirt-cheap compared with the U.S. And they doubled in four years the last time we saw an opportunity like today... a massive 100% gain.

If you're interested in owning Europe, the simplest way to do it is through the SPDR EURO STOXX 50 Fund (FEZ).

FEZ holds a basket of Europe's largest blue-chip companies. And while the U.S. will likely soar in the years to come, European stocks – and shares of FEZ – could do even better...

Good investing,

Steve

P.S. Today looks like a perfect time to own both U.S. and European stocks – just like it was in 2003. So when you make this trade, don't forget about the Melt Up... It could be your last chance to see truly explosive gains in the U.S. market. And if you make the right moves now, you could earn an absolute fortune before it's all over. Click here to learn more. |

Further Reading:

Steve says European stocks could outperform over the next few years... But he still predicts massive upside ahead as the U.S. market "melts up." Catch up on this big theme right here: |

|

NEW HIGHS OF NOTE LAST WEEK Facebook (FB)... "FANG" stock Intel (INTC)... chipmaker Interactive Brokers (IBKR)... online brokerage JPMorgan Chase (JPM)... financial-services giant MetLife (MET)... health insurance UnitedHealth (UNH)... health insurance AbbVie (ABBV)... prescription drugs Biogen (BIIB)... biotech Johnson & Johnson (JNJ)... Band-Aids, Tylenol, Listerine Dollar General (DG)... discount retailer Dollar Tree (DLTR)... discount retailer Toll Brothers (TOL)... homebuilder United Rentals (URI)... equipment rental Chevron (CVX)... Big Oil CF Industries (CF)... agricultural fertilizer

NEW LOWS OF NOTE LAST WEEK Party City (PRTY)... party supplies Bed Bath & Beyond (BBBY)... home goods Sears Holdings (SHLD)... clothes, tools, appliances Dick's Sporting Goods (DKS)... athletic goods Foot Locker (FL)... athletic apparel Harley-Davidson (HOG)... motorcycles |

|

| A 700%-plus gain is possible in these future economic giants, starting now... A major bull market is starting... one that could turn a small $10,000 investment into $70,000 or more... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

The Dow is hitting new highs every month. Yet according to one PhD, at least 99% of investors have left thousands of dollars of profits in the market, unclaimed forever. How is this possible? Click here to learn more. |

| How to Rescue Your Retirement in Four Easy Steps | | By Dr. David Eifrig | | Friday, October 20, 2017 |

| | Forget fear... Stress is the real hurdle for retirement savings. |

| | The Ultimate Buy Setup Right Now in This Asset | | By Dr. Steve Sjuggerud | | Thursday, October 19, 2017 |

| Everyone's talking bitcoin. It's extremely "loved" by investors right now... The thing is, when I look at investment opportunities, I pay more attention to what's "hated." |

| | So You Want to Buy Bitcoin... Now What? | | By Tama Churchouse | | Wednesday, October 18, 2017 |

| | If you are interested in speculating in bitcoin, I urge you to pay attention to my friend Tama Churchouse. |

| | The Big Advantage You Have Over Institutional Investors | | By Tama Churchouse | | Tuesday, October 17, 2017 |

| | How can an individual compete against the big, institutional asset managers who dominate the financial markets? |

| | Bitcoin Won't Replace Gold... Here's Why You Should Still Own It | | By Tama Churchouse | | Monday, October 16, 2017 |

| | Bitcoin is frequently compared to gold. But it's not an either/or proposition... And I'll tell you why... |

|

|

|

|