Editor's note: Many companies are facing big piles of debt that are about to come due. But according to Joel Litman – founder of our corporate affiliate Altimetry – that's a good thing for strategic acquirers. In this piece, adapted from a recent issue of the free Altimetry Daily Authority e-letter, Joel details one pharmaceutical giant's sacrifice to stay afloat... and explains how investors stand to gain from moves like these.

This Pharma Company's 'Crown Jewel' Is Up for Grabs By Joel Litman, chief investment strategist, Altimetry

Bausch Health (BHC) is looking for a lifeline... The pharmaceutical giant has a staggering amount of debt coming due. Its problems began when it tried to force growth from 2013 to 2015... buying up competitors and raising the prices of their drugs. Bausch was still known as Valeant Pharmaceuticals back then. And Valeant's shopping spree impressed investors... at first. The stock jumped from $47 per share to start 2012... to more than $250 per share before folks noticed how much debt the company had tacked on. It's still carrying that debt to this day. Total long-term debt stood at more than $30 billion in 2015. While Bausch has paid back some of its debt in the intervening years, it still sits at $21.9 billion. With even more debt coming due soon, Bausch has been racing to fix the problem... and as I'll explain, investors should be paying close attention.

| Recommended Links: |  See by MIDNIGHT: 'We Smell Blood in the Water' Forensic accountant Joel Litman and Dr. David Eifrig just teamed up for the first time ever to discuss the most overlooked stock market opportunity for 2024. Wall Street sharks like Goldman Sachs and JPMorgan Chase are already circling the same thing in anticipation. It's not artificial intelligence, tech, or anything you've likely ever considered. Instead, it stems from a well-hidden crisis affecting 1 in 3 U.S. stocks – a situation most investors are completely missing. Until midnight tonight, get the full story here. |  |

|---|

Why Banks Are Collapsing Again 2024 has barely begun and we're ALREADY seeing echoes of the 2023 banking crisis everywhere. New York Community Bancorp's stock dropped almost 40%, and the SPDR S&P Regional Banking Fund saw its largest single-day drop since the banking crisis of 2023. If you have any money stashed away in a U.S. savings account, individual retirement account, or 401(k) right now, do NOT make another move in the markets until you see this. |  |

|---|

|

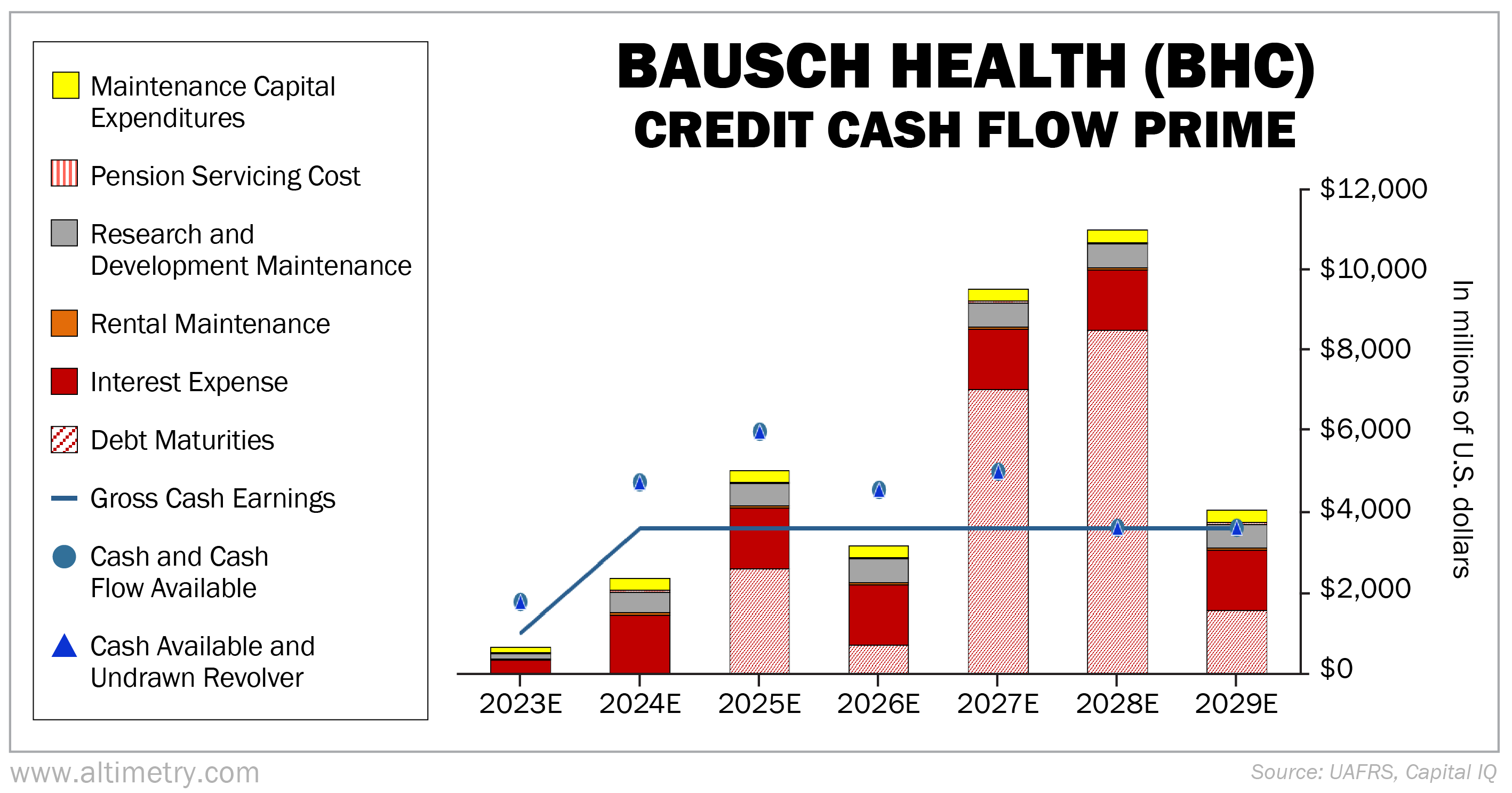

Bausch is running out of time to get its house in order... We can see this through our Credit Cash Flow Prime ("CCFP") analysis. The CCFP gives us a more accurate sense of a company's overall health. It compares financial obligations against cash positions and expected cash earnings. In the following chart, the stacked bars represent Bausch's obligations through 2029. This is what it needs to pay in order to keep the lights on... to prevent the company from collapsing. We compare these obligations with cash flow (the blue line) and cash on hand at the beginning of each period (the blue dots). As you can see, starting next year, Bausch won't have enough cash flow to cover all its obligations...

Bausch is facing a "Wall of Debt" in the coming years. And according to credit-ratings agency Moody's, over 90% of rated health care providers are in the same boat. More than half don't have enough cash on hand to deal with it. These companies are now scrambling to raise enough cash to stave off bankruptcy. Bausch started with a failed spinoff of its medical-aesthetics business, Solta Medical. The company announced the spinoff in 2021... but it never materialized. Starting in 2022, recessionary concerns caused a lot of initial public offerings to raise less than expected. Bausch worried that a Solta spinoff would end the same way. So it withdrew those plans – and instead, it turned to its Bausch + Lomb (BLCO) eye-care business. Bausch + Lomb was the company's crown jewel... It's one of the biggest names in eye care... and eye care itself is a stable, predictable business. Bausch + Lomb was a huge cash cow for Bausch Health, bringing in nearly $4 billion in revenue each of the past six years. Bausch was reluctant to part with it... But it had no choice. So the eye-care business struck out on its own back in May 2022. And now that Bausch + Lomb is an independent company, any competitor can scoop it up for cheap. We'll see a lot more setups like Bausch in the coming months and years... and not only in the health care industry. Faced with a mountain of debt and nowhere near enough cash, companies will be forced to sell their top assets. But smart strategic acquirers will snap up these deals as fast as they can. In the meantime, keep an eye on Bausch + Lomb. One pharma giant's painful loss might turn into a big gain for investors. Regards, Joel Litman

Editor's note: Joel is "sounding the alarm" today. A hidden crisis is putting 1 in 3 U.S. stocks in danger... But prepared investors can leverage events like these to make fantastic gains in one corner of the market – even if other stocks suffer. That's why Joel recently teamed up with Dr. David Eifrig to deliver an urgent message. Together, they shared how you can protect your portfolio from this looming event... and why it could lead to opportunities you've likely never considered before. Click here to learn the details. Further Reading Many U.S. companies have debt coming due soon. It's likely some companies will sell assets to get extra cash on hand. As the wave of obligations comes due, 2024 could be the "year of divestitures." And this could create a unique opportunity for investors... Read more here. Businesses that apply "Kaizen" are great targets for smart investors. This Japanese philosophy is all about "continuous improvement." Right now, two companies in particular are great examples of why it pays to embrace forward-thinking strategies... Learn more here. |

|