| This Precious Metal Could Be a Better Buy Than Gold... | | By Dr. Steve Sjuggerud | | Thursday, May 25, 2017 |

| I made a lot of enemies at the end of July last year…

In a room full of hundreds of "gold bugs," I told the crowd that I had personally sold all my gold and gold stocks the day before.

I was the first speaker at the 2016 Sprott Natural Resource Symposium in Vancouver. The attendees thought I was crazy… But in hindsight, it was exactly the right thing to do at the time.

I showed the crowd slide after slide proving that gold had gone from one of its most hated levels in history – in late 2015 – to its most loved level in history in mid-2016. It was the opposite of what I want to see in an investment… I look to buy when assets are hated – when no one else is interested.

Five months after I gave that speech, gold stocks had fallen about 40%.

I thought I wouldn't be invited back to Vancouver to speak. But to my surprise, Rick Rule – a legend in natural resource investing, and the man behind the conference – just asked me to speak again this year.

"What am I going to say this time?" I thought…

I started looking more closely at commodities that the attendees might be interested in… And I may have found a better precious metal than gold today…

----------Recommended Links---------

---------------------------------

I'm talking about platinum…

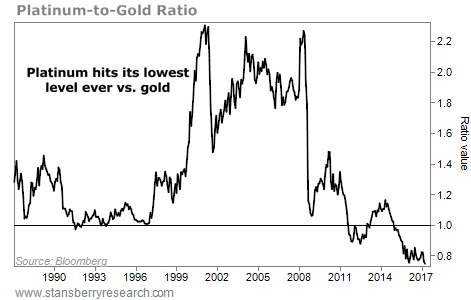

Platinum just hit its cheapest level EVER relative to gold.

Both metals started 2017 up double digits… Platinum was up nearly 14% at one point. But while gold is still up 9% year to date, platinum is now up less than 5%.

This fall pushed platinum to its cheapest discount ever compared with gold earlier this month… And that likely makes it a better value play than gold right now.

Specifically, platinum trades for a massive 25% discount. This is rare, as you can see in this chart…

I don't have any particular insight or expertise in platinum.

I just know three things:

| 1. The downtrend in prices is still in place. So… | | |

| 2. I am not a buyer yet. However… | | |

| 3. History says big platinum discounts usually don't last long. |

For instance, the platinum-to-gold ratio bottomed in December 1996. After that, platinum went from trading at a razor-thin discount to a premium of 35% in less than two years.

More recently, the ratio bottomed in July 2012 with platinum at a 12% discount to gold. Again, the metal went on to surge higher, hitting a 16% premium to gold by May 2014.

So history says that this discount will unwind. But it can actually happen in two different ways…

| 1. The gold price could fall, or… | | |

| 2. Platinum could soar to catch up with the gold price today. |

Either way, platinum is now at its cheapest discount ever compared with gold.

This is potentially a major opportunity… And history says it likely won't last long.

I'm not a buyer yet, because we don't have the uptrend. But I am now watching platinum closely…

Good investing,

Steve

P.S. If you want to learn more about gold and other resources, please join me at the Sprott Natural Resource Symposium in Vancouver this July. Vancouver is one of the most beautiful places on earth. And we always have a great time with our host, Rick Rule, and his top-notch list of speakers. We'll hear from mining CEOs, expert analysts, and former U.S. Secretary of Energy Spencer Abraham. I'll be speaking, too. If you're interested, please don't wait to register. This event always draws a crowd. You can learn more about the event and register right here. |

Further Reading:

"Optimism was at an extreme. And a mini-crash followed," Steve writes. After a peak in bullish bets on silver, prices dropped double digits. Now, optimism among silver traders has worn off... Read more about this potential opportunity right here: All-Time Record Bets on Silver... Here's What's Next. "Gold marches to the beat of its own drum... especially during times of stress," Kim Iskyan writes. That's why gold is more than just a hedge – it's also a "safe haven." Learn how to protect your portfolio with gold and precious metals right here: Here's Why the Conventional Wisdom on Gold Is Right. |

|

USE THIS STRATEGY TO FIND CONSISTENT WINNERS

Today's chart shows one of our favorite strategies at work... investing in companies with great brands. When you think of ketchup or soda, there are probably one or two brands that immediately pop into your mind... And you've probably been buying the same one for years. That's the enduring power of an elite brand. These businesses thrive over time because of the loyalty of their customers. They can even raise prices when they need to. Today, we're highlighting this in the food industry... Pinnacle Foods (PF) sells a variety of packaged goods... The company's major brands include Birds Eye and Hungry-Man frozen foods, Duncan Hines cake mixes, Log Cabin and Aunt Jemima syrups, and Vlasic pickles, among others. These kinds of products stay popular for decades. They generate billions of dollars in revenue, and they don't require additional spending from the company. As you can see from the chart below, Pinnacle Foods has been in a solid uptrend. Shares recently broke out to an all-time high... and have risen nearly 45% in the past year alone. If you're looking for consistent winners in the stock market, enduring consumer brands are a great place to start... |

|

| How to profit from the kind of discovery miners dream of...

While platinum is a good opportunity right now, Porter Stansberry has another precious metal on his radar. Today, he shares exactly how to profit...

|

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

Last night, Porter dropped a bombshell on attendees. He announced Stansberry Research readers have "zero chance" at real investing success in the weeks and months ahead – without making this one simple adjustment. What's he talking about? Get the details here. |

| How One Bad Trade Got Trump Elected | | By Richard Smith | | Wednesday, May 24, 2017 |

| | I never dreamed that a classic investing disaster could have been instrumental in getting a president elected. It's an astonishing tale. And we can learn from it today... |

| | This Simple Investing Tool Can Help You Beat the Market | | By Richard Smith | | Tuesday, May 23, 2017 |

| | Today, individual investors can access more information than ever, more quickly than ever. Yet they continue to dramatically underperform the markets... |

| | What Happens to Stocks After Panics Like Wednesday's | | By Dr. Steve Sjuggerud | | Monday, May 22, 2017 |

| | I asked our True Wealth Systems computers a simple question... "What has happened to stocks in the past after one-day falls as big as Wednesday's (or bigger)?" |

| | You Shouldn't Be 'Super Excited' About This Record | | By Justin Brill | | Saturday, May 20, 2017 |

| | It took nearly 10 years, but it finally happened... |

| | All-Time Record Bets on Silver... Here's What's Next | | By Dr. Steve Sjuggerud | | Friday, May 19, 2017 |

| | Traders are making "extreme bullish bets on higher silver prices. And history says lower silver prices are likely, starting now." |

|

|

|

|