|

Today’s letter is brought to you by Trust & Will!

Trust & Will is the most trusted name in online estate planning and settlement.

The company has helped hundreds of thousands of families create their estate plans, and they’re just getting started. Trust & Will enables every American to create a plan that’s customized to fit their needs, their life, and their legacy.

Their mission is to make estate planning simple, affordable, and inclusive.

All of Trust & Will’s documents have been designed and approved by estate planning attorneys to meet the highest legal standards. Their process is simple, secure, complete, and customized for your specific needs and state requirements.

To investors,

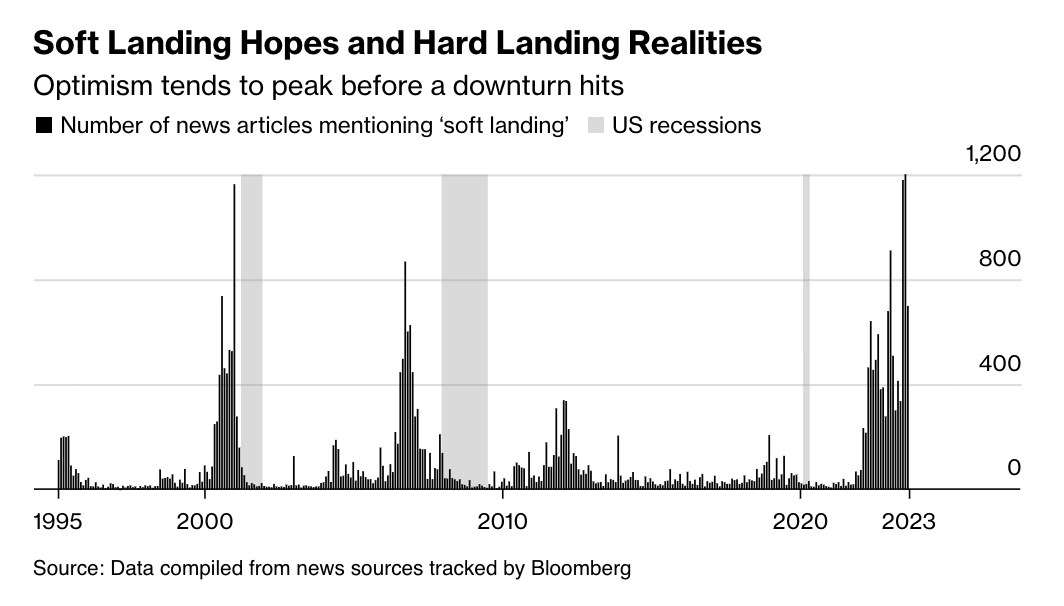

Almost one month ago to the day (October 19th), I warned you to be fearful if we ever saw a barrage of articles claiming that a soft landing was going to happen. In that letter, I wrote the following and included this chart:

“Bloomberg recently did a study that showed a rapid increase in articles talking about a soft landing was usually followed by a recession. You can see the large spike in recent articles mentioning a soft landing would suggest that a recession is incoming. Humans are optimistic and like to think that bad things are not on the horizon, but this study shows that we should be fearful when others are not.”

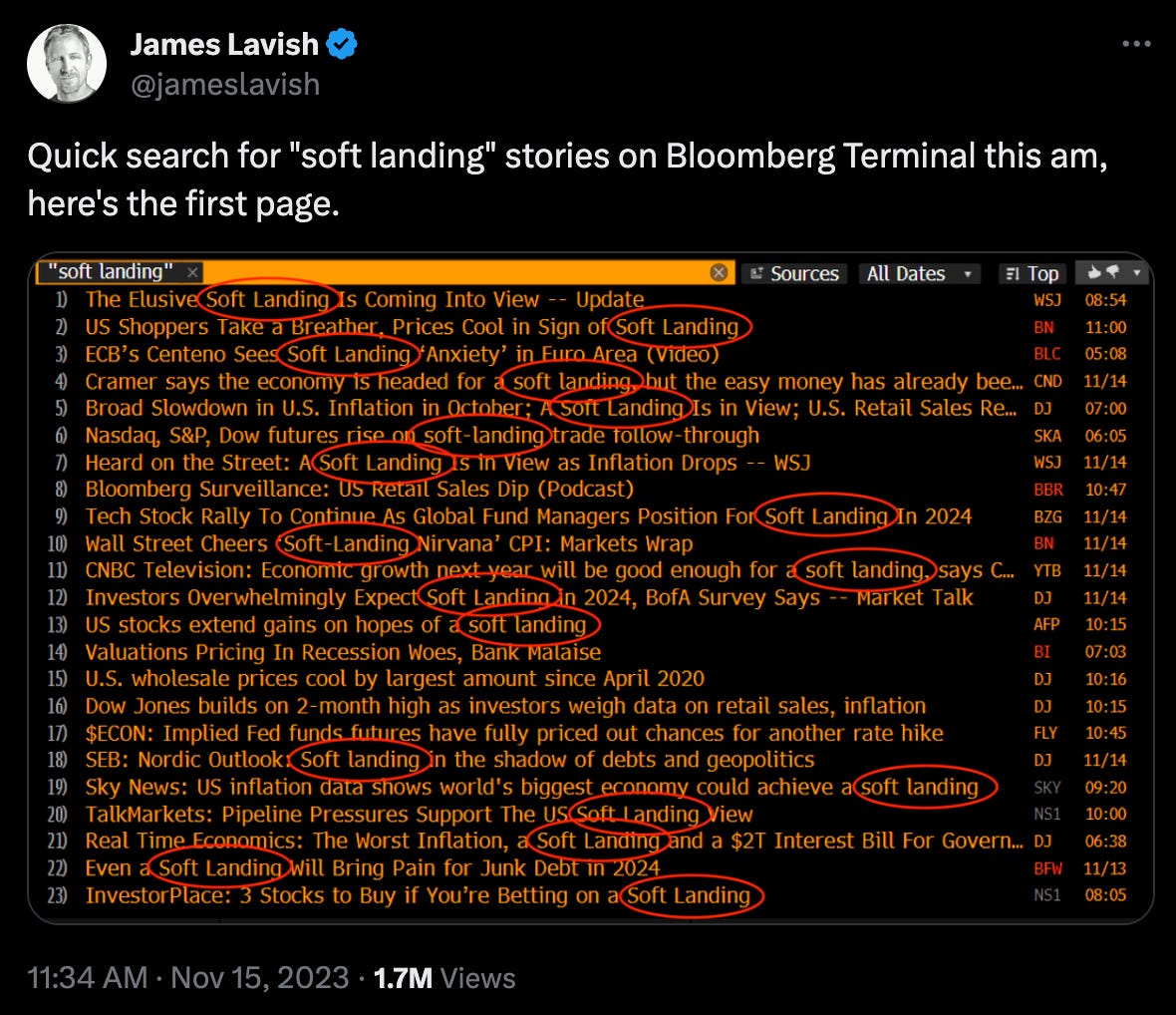

I wish that I had better news, but it appears that the barrage of “soft landing” articles is upon us. James Lavish pointed out the rapid increase in frequency earlier this week.

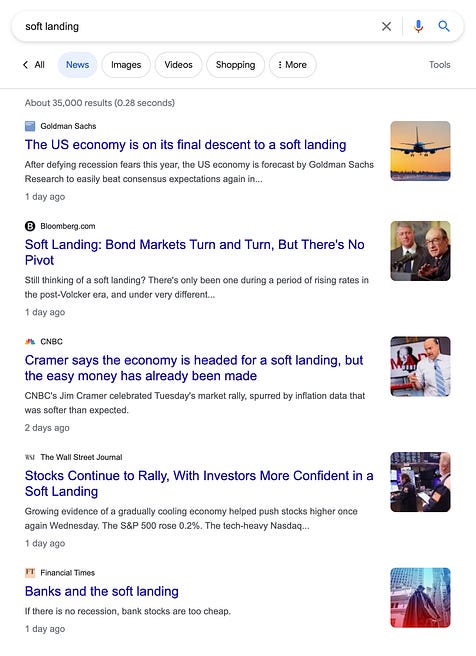

This phenomenon is not exclusive to the Bloomberg Terminal. A quick Google search turns up plenty of articles predicting a soft landing across every major media platform, including CNBC, Wall Street Journal, Financial Times, and many more.

We don’t have to merely rely on the mainstream media’s sudden obsession with a soft landing to find reasons to be concerned.

The real-time Sahm Rule Recession Indicator, which “signals the start of a recession when the three-month moving average of the national unemployment rate rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months,” is the highest it has been since the Global Financial Crisis if you ignore the COVID anomaly.

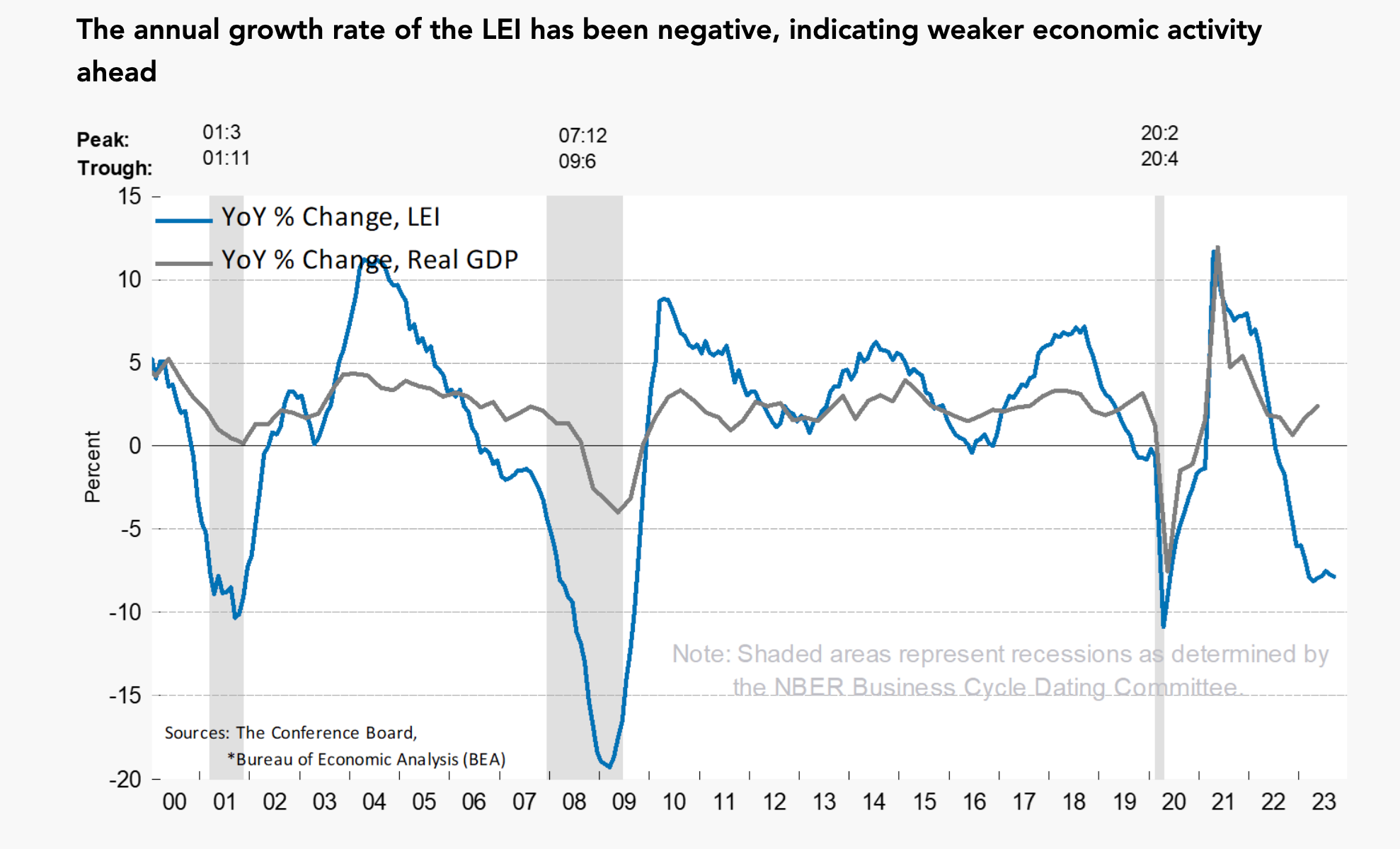

We can also look at the Conference Board’s Leading Economic Index (LEI). According to Justyna Zabinska-La Monica, Senior Manager of Business Cycle Indicators at The Conference Board:

“The LEI for the US fell again in September, marking a year and a half of consecutive monthly declines since April 2022. In September, negative or flat contributions from nine of the index’s ten components more than offset fewer initial claims for unemployment insurance. Although the six-month growth rate in the LEI is somewhat less negative, and the recession signal did not sound, it still signals risk of economic weakness ahead. So far, the US economy has shown considerable resilience despite pressures from rising interest rates and high inflation. Nonetheless, The Conference Board forecasts that this trend will not be sustained for much longer, and a shallow recession is likely in the first half of 2024.”

I have no idea whether a recession will actually come. Even if we have two consecutive quarters of negative GDP growth, which historically marked a recession, the government and economic organizations may not acknowledge it as they did in 2022.

Predicting the future is hard. But it increasingly feels like the public narrative is offsides. We are not out of the woods yet, so people celebrating the Fed’s avoidance of a recession should be more cautious.

Hope you all have a great weekend. I’ll talk to everyone on Monday.

-Anthony Pompliano

If you enjoyed this letter, you should consider subscribing to the Pomp Letter. I write 3-5x per week and explain in simple language what is happening in the economy, financial markets, and bitcoin.

Aaron Ginn is the CEO & co-founder of Hydra Host, revolutionizing the way data centers operate by bringing GPUs everywhere to you easily and quickly. He also is the founder of the Lincoln Network, which connects the tech industry with policy makers.

In this conversation, we talk about the state of venture capital, advanced computing, geopolitical conflict, politics, contrarian ideas, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

This Founder Raised $10 Million To Protect Artificial Intelligence From Governments

Podcast Sponsors

Cal.com - Changing the calendar management game. Use code “POMP” for $500 off when you sign up.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Base: Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub: Your data-driven gateway to the US housing market.*

Bay Area Times: A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.