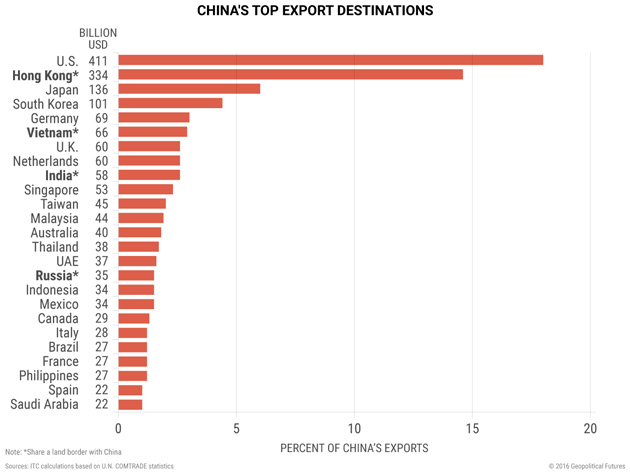

| -- | April 3, 2017 Trump and Xi Take Center Stage By George Friedman and Jacob L. Shapiro US President Donald Trump and Chinese President Xi Jinping will meet April 6–7 at Trump’s Mar-a-Lago estate in Florida. Most meetings between world leaders are relatively unimportant. This meeting is an exception, not because of whatever agreements or statements will emerge, but because of what it reveals about the current needs of the political administration of the world’s two largest economies. The issue of unfair Chinese trade practices was a recurrent theme in Trump’s campaign, and Trump needs to show his base that he can deliver on some of his promises. Xi wants to avoid straining US-China relations because he needs stability at home ahead of the Communist Party’s National Congress at the end of the year. While the US and China do not see eye to eye on many issues, they share a need for stability in the broad relationship right now. The four graphics below represent some of the fundamentals of this relationship. What China Needs  The story for China is simple. China achieved 30 years of rapid economic growth primarily by relying on exports. The US is the largest market for China’s exports. As the chart above shows, almost 20% of all Chinese exports went to the United States in 2015 (the last year for which this data is available). China has reached the limits of this export-led growth and is attempting to focus more on internal consumption without drastically reducing growth, which could put jobs and, by extension, social stability at risk. To pull this off, Xi has asserted increasingly direct control over China’s political administration, economic policies, and the People’s Liberation Army. This year’s National Congress will be one of the key moments in Xi’s consolidation of control. Most of Xi’s political challengers have been neutralized, but Xi still must strike a delicate balance. He cannot afford to appear weak at either the domestic or international level. He also, however, cannot afford a full-scale trade conflict with the United States. If the US significantly restricts Chinese access to the US market, the effects on China’s economy would be drastic. This is the “trump card” lurking behind these talks: China is in no position to play hardball with the US right now. It should be noted that disagreements over trade between these two countries are not new. The administration of former President Barack Obama was less abrasive with China than Trump’s administration, but Obama still adopted measures to protect the US market. For example, Obama erected tariffs on Chinese tires entering the US, which severely harmed China’s tire industry. A US-China Trade War?

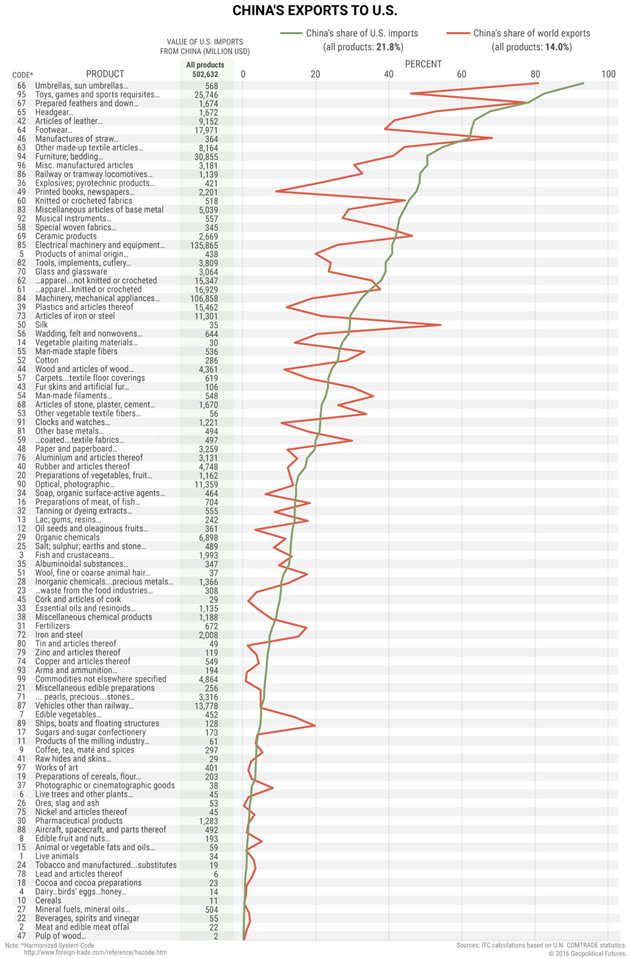

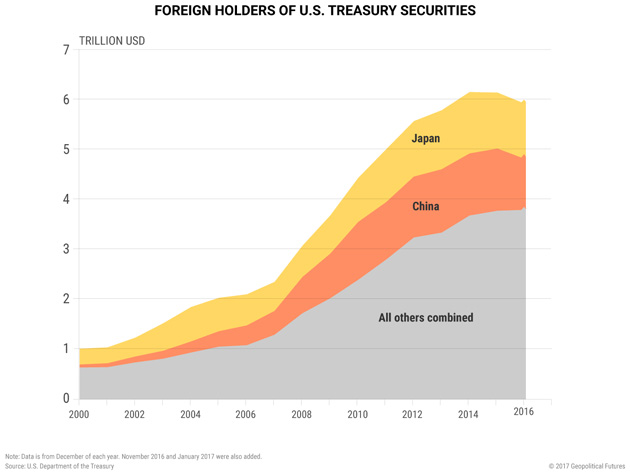

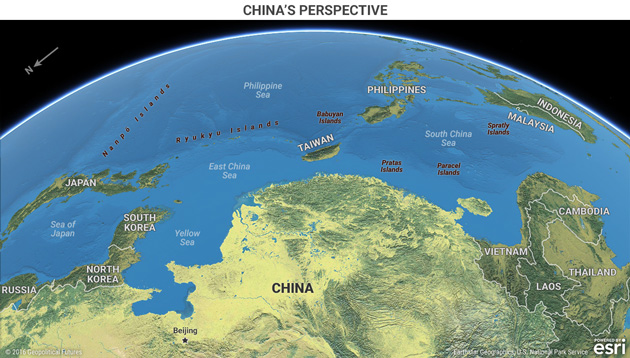

Click to enlarge Frequent readers of Geopolitical Futures know that we have written in-depth about why the US-China trade relationship favors the US. That, however, does not mean the US can simply do whatever it wants. More than one-fifth of all US imports came from China in 2015. The chart above breaks down those imports by product type and compares China’s share in US imports with China’s share in global exports. China relies on exports to the US, but a similar case could be made that the US is addicted to cheap imports from China. This is why all the talk of a trade war has been overblown from the start. Many have noted that Trump has not labeled China a currency manipulator, as he promised to do during the campaign. The US could weather a US-China trade war better than China could, but that does not mean that the US would come out unscathed. If such an economic conflict did take place, the effects would be disproportionately felt by the very class of voters that put Trump in office. The argument can be made that US production capacity could eventually replace some of the goods the US currently imports, but this assertion has three key problems. First, it would take time for US production to increase. Second, encouraging US production would require introducing tariffs on imports from China, which would make goods more expensive for American consumers and disproportionately affect the middle and lower classes. Third, many countries are already stepping into China’s shoes as mass exporters of cheap goods. (GPF has a list of 16 countries it continuously tracks. We will be updating this list in a few weeks.) Trump needs political victories more than anything else. Upon winning the election, Trump accepted a phone call from Taiwan’s president and openly questioned the “One China” policy. Some feared that Trump would start either a trade war or a real war with China. He has moved away from both these scenarios because they aren’t in the interests of the US or the administration. He needs to show that he can deliver wins in the US-China relationship when it comes to trade, North Korea, and the South China Sea. Trump is already tweeting a big game about how difficult these meetings will be, and on a certain level he is right. But both sides have an interest in coming to a mutual understanding that both Trump and Xi can use to strengthen their positions at home. US-China relations in 2017 have much more to do with domestic constraints in both countries than with open conflict between the two. Dispelling a Myth  GPF readers often ask what China’s large holdings of US debt securities mean in terms of Chinese leverage over the United States. The short answer to this question is not much. China is a significant holder of US securities, but it is no longer the largest—Japan claimed that title in October 2016, and the fact that this went relatively unnoticed underlines just how ineffectual these holdings can be. In fact, China’s holdings of US debt securities are more indicative of China’s economic problems than anything else. China runs a massive trade surplus with the US and other countries, but China cannot have that money flowing back into the Chinese economy. If it did, the yuan’s value would rise, making Chinese exports less competitive. China invests in US debt securities not to increase its leverage over the US but because US debt securities are some of the most reliable and attractive investments in the world and China needs a place to park its money. The deeper question here is the effect of the $19 trillion US government debt on the reliability of US government securities and the dollar in the long run. That is a subject for a different time and one that will have relatively little to do with US-China relations in the next decade. For now, it suffices to remember that the US makes up almost a quarter of the world’s GDP, that the dollar remains the world’s reserve currency (without a challenger on even the mid-term horizon), and that demand for US debt securities remains high. Many of the reasons people assume China has a lot of leverage over the US, like its holding of US debt securities, are really Chinese weaknesses disguised as strengths. Never Forget Geography  We often return to the above map because it is highly relevant to any discussion of US-China relations. China is surrounded by US allies and small island chains that the US Navy could use to put China in a de facto cage if a military conflict ever arises. This map also emphasizes North Korea’s importance in negotiations between China and the US. China uses North Korea to gain leverage over the US because it can claim, with some validity, to be the country with the most influence in North Korea. The US is concerned about North Korea because of the recent actions by Kim Jong Un’s administration. This plays into China’s hands—it can offer to cooperate on the North Korea issue in exchange for US concessions on some of the points laid out above. The map above also shows China’s geographic challenges in trying to assert itself in its own backyard against the United States. China’s best move right now is to try to destabilize US allies in the region, preferably by increasing China’s influence at the same time. China is trying this to varying degrees with countries like the Philippines and Myanmar. But so far, it has had limited success partly because China lacks sufficient military power to challenge the US and its allies in the region. Regional countries are also wary of getting too close to China because of China’s proximity and ambiguous long-term ambitions. Conclusion Xi and Trump’s meeting at Mar-a-Lago will be a useful barometer in determining how US-China relations will develop over the year. If the above analysis is correct, those relations, at least in 2017, should be significantly more cooperative than most expect. The US and China have differences but also share some broader interests. As we move further into the Trump administration’s time in office, that may change—especially if Xi is successful at consolidating his rule while bringing a semblance of stability to China’s economy. But that is a big if. For now, keeping these basic strategic realities in mind helps make sense of what’s at stake this week in geopolitics.

George Friedman

Editor, This Week in Geopolitics

| Prepare Yourself for Tomorrow with George Friedman’s This Week in Geopolitics

This riveting weekly newsletter by global-intelligence guru George Friedman gives you an in-depth view of the hidden forces that drive world events and markets. You’ll learn that economic trends, social upheaval, stock market cycles, and more... are all connected to powerful geopolitical currents that most of us aren’t even aware of. Get This Week in Geopolitics free in your inbox every Monday. |

Share Your Thoughts on This Article

Not a subscriber?

Click here to receive free weekly emails from This Week in Geopolitics.

Use of this content, the Mauldin Economics website, and related sites and applications is provided under the Mauldin Economics Terms & Conditions of Use. Unauthorized Disclosure Prohibited The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Mauldin Economics reserves all rights to the content of this publication and related materials. Forwarding, copying, disseminating, or distributing this report in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.

Participation in such activity is grounds for immediate termination of all subscriptions of registered subscribers deemed to be involved at Mauldin Economics’ sole discretion, may violate the copyright laws of the United States, and may subject the violator to legal prosecution. Mauldin Economics reserves the right to monitor the use of this publication without disclosure by any electronic means it deems necessary and may change those means without notice at any time. If you have received this publication and are not the intended subscriber, please contact service@mauldineconomics.com. Disclaimers The Mauldin Economics website, Yield Shark, Thoughts from the Frontline, Patrick Cox’s Tech Digest, Outside the Box, Over My Shoulder, World Money Analyst, Street Freak, Just One Trade, Transformational Technology Alert, Rational Bear, The 10th Man, Connecting the Dots, This Week in Geopolitics, Stray Reflections, and Conversations are published by Mauldin Economics, LLC. Information contained in such publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated and there is no obligation to update any such information. You are advised to discuss with your financi al advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

John Mauldin, Mauldin Economics, LLC and other entities in which he has an interest, employees, officers, family, and associates may from time to time have positions in the securities or commodities covered in these publications or web site. Corporate policies are in effect that attempt to avoid potential conflicts of interest and resolve conflicts of interest that do arise in a timely fashion.

Mauldin Economics, LLC reserves the right to cancel any subscription at any time, and if it does so it will promptly refund to the subscriber the amount of the subscription payment previously received relating to the remaining subscription period. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of any Mauldin Economics publication or website, any infringement or misappropriation of Mauldin Economics, LLC’s proprietary rights, or any other reason determined in the sole discretion of Mauldin Economics, LLC. Affiliate Notice Mauldin Economics has affiliate agreements in place that may include fee sharing. If you have a website or newsletter and would like to be considered for inclusion in the Mauldin Economics affiliate program, please go to http://affiliates.pubrm.net/signup/me. Likewise, from time to time Mauldin Economics may engage in affiliate programs offered by other companies, though corporate policy firmly dictates that such agreements will have no influence on any product or service recommendations, nor alter the pricing that would otherwise be available in absence of such an agreement. As always, it is important that you do your own due diligence before transacting any business with any firm, for any product or service. © Copyright 2017 Mauldin Economics | -- |