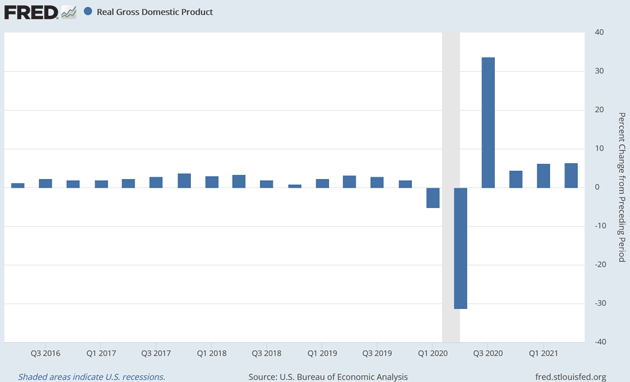

COVID Consumer Headache By John Mauldin | Aug 07, 2021     If you look just at 2021, it seems the US economy is tearing higher. Real GDP grew an annualized +6.5% in the second quarter, the Commerce Department estimated last week. This follows a similar +6.3% first quarter, and a pandemic-interrupted 2020 that turned out not so bad in the end. The July unemployment report showed more impressive jobs growth. The Fed will increasingly have problems maintaining its credibility with interest rates at the zero bound and massive QE and inflation still rising. For one thing, we’re only halfway through 2021. Much of this impressive growth derives from consumer spending, and much of the consumer spending was funded by government benefit programs and monetary stimulus money. This is a problem because the US economy wasn’t exactly in a great place when COVID-19 came along. It wasn’t terrible, either. Real GDP growth had been above 2% since the prior recession. The economy could certainly have been worse, but it rarely posted the kind of growth that was previously normal in recovery phases. This has persisted long enough that even a 6% GDP growth rate this year won’t restore what used to be “average.” Today we’ll look at this most recent GDP data and what it tells us about consumers. Then I’ll have some thoughts about COVID’s long-term effects on both people and the economy. Let’s start with a 2021 big-picture review. As the year opened, the US was in the middle of its largest COVID wave yet, and had just started the vaccine rollout. Cases peaked in January and receded over the next couple of months. Congress had passed another relief bill in late December, extending unemployment benefits and sending $600 stimulus checks to most Americans. The Fed was keeping rates low and buying truckloads of Treasury and mortgage bonds. Following an unusually turbulent (to say the least) presidential transition, Congress passed another relief bill in March. It extended the supplemental unemployment benefits to September and gave another $1,400 to most Americans. Those payments actually hit in late March and April, with a noticeable effect on consumer spending. The CDC imposed a moratorium on evictions affecting a minimum of 12 million people (actual survey responses) and more likely closer to 25 million, extrapolating from those who did not respond to the survey. Concurrently, reduced COVID fears and more vaccinations were encouraging more Americans to resume travel, shopping, and other habits many had set aside in 2020. Businesses responded, though supply chain problems and an inability to hire more workers constrained many. Inflation benchmarks started creeping higher, but that didn’t stop many from going on vacation and otherwise making up for lost time. June 2021 may have marked a kind of “peak optimism.” By then, those who wanted the vaccine had been able to get it, the pandemic seemed to be behind us, the economy looked to be mending, and we could look ahead with more confidence. That was the backdrop for this last GDP report. Here’s a chart of the last five years (percent change from previous period, seasonally adjusted annualized rate).

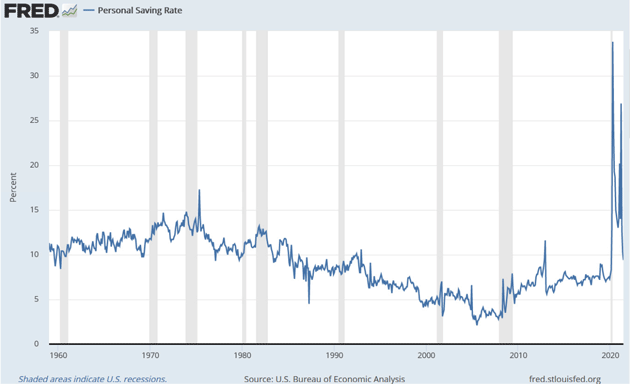

Source: FRED The negative quarters in 2020 were due largely to a major drop in consumer spending—specifically consumer service spending: restaurants, travel, etc. That’s why unemployment was concentrated in those industries. Then there was a major bounceback in late 2020, and now here we are… trying to find “normal” again. On the surface, it seems like we found it. Consumer spending, largely services rather than goods, accounted for about two-thirds of the Q2 GDP gain. Personal Consumption Expenditures (PCE) rose 11.8% for the quarter. So consumers are back in a spending mood—good news in a consumer-driven economy. What we don’t know is how much of this spending depended on unrepeatable income sources. A family of four that received $5,600 in stimulus money could have gone on a nice vacation, spending liberally on hotels, entertainment, and restaurant meals for a week. Good for them and good for the businesses they visited… but the next week it was over. Nor is it just the fiscal stimulus. The Fed’s asset purchases are driving a home refinancing wave, which in many cases involves taking out cash for improvement projects. That’s good for builders and contractors but again, may not continue. And it often leaves the homeowners even more leveraged than they were before. So, we know much of the first half’s consumer spending revival wasn’t organic; it was more of a sugar high, with the sugar coming from Washington, DC. And yet, it wasn’t all spent. It turns out that a great deal of that money was saved. The personal savings rate went at times to levels that we have not seen for multiple generations, if ever.

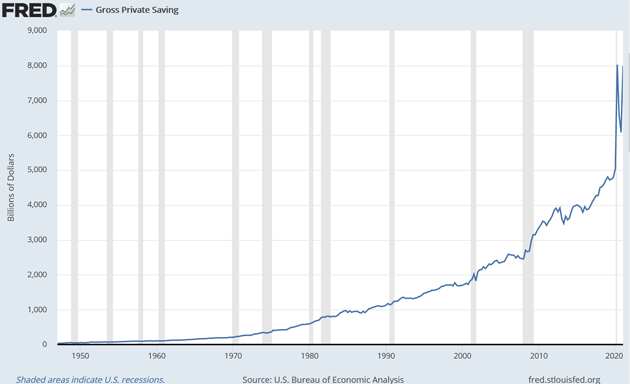

Source: FRED And a great deal of that money is still in savings and remains to be spent.

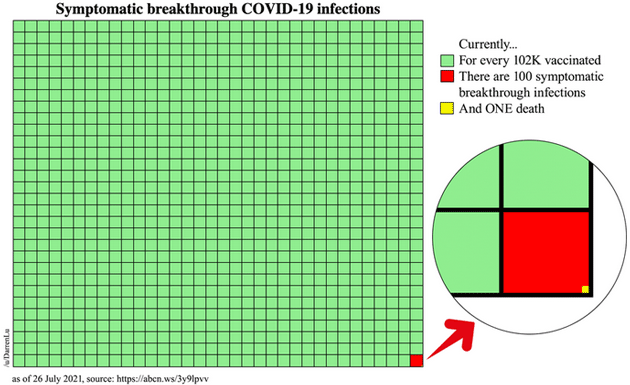

Source: FRED On the monetary side, I’m dubious the Fed will slow its asset purchases or do anything else to tighten financial conditions this year, but the markets may do it for them. The Fed can pump money into the banking system; it can’t make the banks lend. Worse, it also can’t control foreign exchange rates, and an adjustment in the dollar could have the same effect as a rate hike. Congress has still not decided what future stimulus will look like, so it is truly hard to speculate. Maybe a lot, maybe nothing. Many states have already canceled the supplemental unemployment benefits, and they will end everywhere in September if not extended. We can speculate, but we will actually know in a few months if things are really changing or if they go back to “normal,” whatever that will come to mean. The smart thing has always been to rely on the American consumer’s willingness to spend. My job is to ask the uncomfortable questions. What if the entire COVID crisis has changed the willingness of the American consumer to spend just like the Great Depression did to our grandparents? I am not saying it has, but those high savings rates pictured above were certainly different from the past. GDP has been averaging roughly 2% for the last 20 years. I am quite concerned that the next 10 years will see an average of 1.5%. Debt and deficits are going to be a drag. Technology will be awesome, but even the Bank Credit Analyst is suggesting that social media is a net negative for GDP. And they do have a case. And then there’s the elephant in the room: COVID-19. As of a few months ago, it seemed like vaccines would let the US reach herd immunity this year. But between more-transmissible variants and lower-than-expected vaccination rates, that now looks unlikely. That’s partly why we now see a new wave building. It is still very much smaller than past waves but growing quickly. The good news is the most vulnerable people—the elderly and those with serious health challenges—are mostly vaccinated. The people now being hospitalized are mostly unvaccinated but also younger and healthier. There’s reason to think mortality will be much lower this time around. But death isn’t the only problem. As I have done in the past when stepping outside my area of competency on things medical, I will rely on Dr. Mike Roizen, head of wellness at the Cleveland Clinic and who has sold 35 million books. We are simply going to offer some statistics, similar to investment risk/reward. What you do with this data is up to you. I simply want to keep my readers healthy. By Dr. Mike Roizen and John Mauldin First, let’s say that we both hate the “crisis/panic porn” associated with some media and the pandemic. This Newsweek cover is barely disguised click bait:  The Delta variant is a very real and serious problem, but it’s not Doomsday. This variant seems to be more transmissible and less deadly. That shouldn’t surprise us. Serious scientist Matt Ridley shows how viruses evolve that way. Those that kill their host don’t spread as well. The vast majority of people infected with COVID-19 don’t die. Most are never even hospitalized. Many have no symptoms, or minor symptoms, and don’t even know they had it. But that isn’t the end of the story. Some people who survive the virus are experiencing long-term problems that can be serious. A growing pile of data says the number afflicted with “long COVID” is significant. We urge you to read this short Scientific American note by Claire Pomeroy, an infectious disease physician and president of the Lasker Foundation. Here are some excerpts, with some relevant points highlighted in bold. Consider the numbers we know. At least 34 million Americans (and probably many more) have already contracted COVID. An increasing number of studies find that greater than one fourth of patients have developed some form of long COVID. (In one study from China, three quarters of patients had at least one ongoing symptom six months after hospital discharge, and in another report more than half of infected health care workers had symptoms seven to eight months later.) Initial indications suggest that the likelihood of developing persistent symptoms may not be related to the severity of the initial illness; it is even conceivable that infections that were initially asymptomatic could later cause persistent problems. For some, symptoms have now continued for many months with no apparent end in sight, with many survivors fearing that they will simply have to adjust to a “new normal.” More and more sufferers have not been able to return to work, even months after their initial illness. While the number of patients with persistent illness remains undetermined this early in the pandemic, estimates suggest that millions of Americans may enter the ranks of the permanently disabled. The related health care and disability costs are also still unknowable. How many “long haulers” will never be able to return to work? How many will need short-term disability payments? How many will be permanently disabled and become dependent on disability programs? As increasing numbers of younger people become infected, will we see an entire generation of chronically ill? We must actively work to better understand the size and scope of the problem and begin planning now. What kind of symptoms are we talking about? People who experience long COVID have reported a range of problems—sometimes multiple symptoms at a time—from shortness of breath to joint and muscle pain. Other articles highlight “brain fog,” including problems with memory and concentration., difficulty sleeping, heart palpitations, dizziness, and joint pain. The US Department of Health and Human Services (HHS) and the Department of Justice jointly released new guidance classifying long COVID as a physical or mental impairment, which means that those affected can qualify for disability benefit programs and discrimination protections under the Americans with Disabilities Act (ADA). As with everything else about this virus, we are still learning. We think we can safely say it will be a major problem. Millions more disabled workers in an already-stretched healthcare system, and an economy already suffering from a labor shortage? That’s not good, any way you look at it. The idea that COVID’s medical impact falls mainly on elderly or unhealthy people may prove optimistic. Fortunately, we have an easy way to help prevent this from getting worse. The mRNA vaccines from Moderna and Pfizer-BioNTech are proving highly effective in reducing COVID-19 hospitalization and death. We lack data on whether they prevent long COVID symptoms in people with “breakthrough” infections, but it seems likely they would help. Yet, for various reasons, large numbers of Americans aren’t getting vaccinated. The most common barrier among those we talk to is risk. They think the risk of getting COVID-19 is low, and think it won’t be serious if they do. They’re balancing that against a vaccine they consider new and untested and therefore risky. In fact, these vaccines are not new; they are the application of a technology that was already in development before this particular virus, and has been studied for almost 20 years now. And untested? After hundreds of millions of doses, major side effects are vanishingly rare. The people in hospitals right now aren’t there with vaccine side effects. They are mostly unvaccinated. Let’s be clear: The vaccines aren’t perfect. Vaccinated people can be infected and get sick, but it’s extremely rare. Here’s a chart John shared on Twitter that makes the point better than words, using data from an ABC news story, with links to even more data. Simply stated, for every 102,000 people vaccinated, there have been 100 symptomatic “breakthrough” infections. But out of those 100 people, only one died.

Source: Reddit Restated statistically: If you have a vaccination your risk of dying is 1 in 100,000. The odds of being struck by lightning during a normal lifetime is one in 15,300. Yes, you are more likely to be struck by lightning in your lifetime than to die from COVID-19 if you have been vaccinated. Of course, the vaccines have risks. Mike cites studies that show the risks of a serious impact from the vaccine is one in 250,000 with the Johnson & Johnson vaccine, and one in 750,000 with Pfizer and Moderna vaccines. Again, we are talking serious complications, not headaches or a slight fever or something that is annoying. The vaccines that we took as kids had (mostly rare) side effects. WebMD says 48 million people suffer food poisoning every year, 128,000 are hospitalized and 3,000 die. The odds of getting sick from eating restaurant food are astronomically higher than getting sick from a vaccine. As with investing, you have to balance risk with reward. A growing number of experts think we missed our shot at herd immunity and this virus will become “endemic.” That means almost everyone who hasn’t already been infected or vaccinated will eventually get it, and we will slowly develop immunity over years until it becomes a minor annoyance. But meanwhile it can still make you very sick. Balancing that against a vaccine many millions have received with no or very minor side effects seems like a slam-dunk to us. The key point is this: If you get the virus, there is something like a 10% to 20% chance that you will have “long Covid” symptoms. That is not doom porn, it is just the facts. The odds are many tens of thousands to one when you weigh the risks from getting COVID-19 and potentially long Covid versus the vaccine risks. There is not enough data yet to calculate the precise set of statistical odds, but when we do have that data, it is going to be overwhelming. If you are in the US, or another country where the vaccine is available, we strongly urge you to get it pronto. You won’t have full protection until two weeks after the second dose, so the sooner the better. It is the best way to protect yourself, others, and the economy. It is increasingly clear that we will need boosters for some years, just like many take annual flu shots. We live with the flu each year. Life goes on, and we will have to make the same accommodations with COVID. For inexplicable reasons, this virus has become politicized. That’s not just wrong, it’s dangerous. A virus has no political sentiments. The fact of the matter is, we should be celebrating the fact that we as humanity developed these vaccines in an incredibly short time, have manufactured billions of doses, with multiple billions more coming over the next 12 months. Over 100 companies worked on vaccines, most of which haven’t proved viable, but dear gods, it was literally a Cambrian explosion of scientific data. The new drugs and therapies that are going to come from this extraordinary focused effort will be felt for decades. This pandemic has been a disaster, but humanity’s (at least the scientific community’s) response has been a triumph. Through Operation Warp Speed and the experience of various nations, we are better prepared for the next time something like this hits. Yes, it’s been a disaster, and each death diminishes us all, but it was nothing like the Spanish flu or the black plague. I realize many readers will see this differently. I (John) get slammed with feedback, much of it highly emotional, whenever I mention vaccines. I think the data is quite clear on this and I’m sorry if you disagree. The virus really doesn’t care. It is out there and, given a chance, will do all it can to multiply. You have ways to fight back. Please take advantage of them. Schedule note: Thoughts from the Frontline will not be published for the August 14–15 weekend, as I will be at Camp Kotok in a remote part of Maine. We’ll be back the following weekend with a special edition for you. And as everyone knows by now, I will be in Washington, DC, Maine, and Steamboat Springs. Tiffani, Tracy, and my granddaughter Lively have all departed, and my daughter Amanda and her husband Allen show up today (Friday). Tuesday I fly out for 10 days, meeting Trey in DC and then flying to Bangor where we rent the world’s most expensive Nissan. I think Hertz is trying to make up for their crisis shortfall on my one rental. Supply and demand and all that. This is the 21st anniversary of writing Thoughts from the Frontline. Some of you have been with me from the beginning. I appreciate each and every reader and the fact that you give me one of the most valuable things you have, your attention. I try to be worth it. I’m going to do one thing differently. For whatever reason, since moving to Puerto Rico, I pretty much work every day, with almost no downtime. I think it is affecting my productivity and creating unwanted pressure. I plan to start purposely taking “time off,” more than just going to the gym. And with that, I will hit the send button. I should note that for the first 10–12 years of writing this letter, when I hit the send button the letter literally went out. Today, it goes through editing, then back to me, then back to another edit and proofing and then formatting before being teed up to arrive Saturday morning for most people, depending on your time zone. It’s great to have a team that makes all these things happen. You have a great week and let’s all take some downtime. And follow me on Twitter. Your concerned about the economy analyst,   | John Mauldin

Co-Founder, Mauldin Economics |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.    | | Share Your Thoughts on This Article | | |

|