Economists care about jobs for a different reason. Labor is a factor of production—part of the formula for economic growth. Ample labor income promotes consumer spending and raises living standards. All good for everyone. Rising wages and growing productivity? Nirvana!

Inflation complicates this. A strong job market leads to higher wages, which can eventually feed into consumer prices. That brings the dreaded “wage-price spiral.” We aren’t there yet; wage growth has actually lagged inflation for many workers. This could change, though.

That presents a dilemma for central bankers like Jerome Powell whose mandate is to maintain both stable prices and maximum employment. What happens when the Federal Reserve has to choose one or the other?

In the early 1980s inflation episode, the Volcker Fed chose to stamp out inflation at the cost of raising the unemployment rate to double digits. We who remember those times know it wasn’t fun, even if you kept your job. Jimmy Carter lost his job and Paul Volcker wasn’t exactly Mr. Popularity. But more inflation wouldn’t have been great, either.

So now many ask if Jerome Powell can emulate Volcker. We will certainly find out. But much has changed in 42 years. Does Powell even need to emulate Volcker? Here, some prominent economists disagree. Today we’ll talk about the issues.

But first, we need to get the data straight. And that’s a whole different issue.

Measuring employment is hard. We don’t have any national database showing every individual’s job status. What we know comes from surveys, with all the associated limitations.

For example, total nonfarm employment increased 315,000 in August. Sounds very precise, but it’s not. Dig into the footnotes and it really means BLS was 90% confident nonfarm employment grew somewhere between 198,900 and 431,100, with a 10% chance it was above or below that range. Yet we seem to live and breathe off that headline number like it’s etched in stone.

A further complication is that the data we see every month comes from two different surveys: a household survey (i.e., workers) and an establishment survey (employers). Both are important for different purposes, but they can give conflicting results.

This gets messy because the same worker can have multiple jobs. The number of jobs will thus never match the number of workers . The establishment survey saying employers created 315,000 (+/-) new jobs doesn’t mean 315,000 previously unemployed workers found jobs. Some could have already had one job and taken another one.

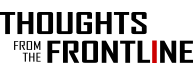

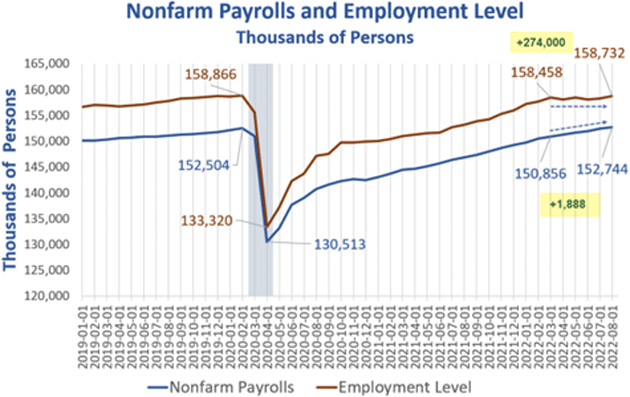

My friend Mish Shedlock thinks that is exactly what’s happened this year, which would mean at least some of the job market “strength” is illusory. Here’s part of his analysis from last week. Note he looks at the last six months, not just August.

“[From March to August] the economy added 1,888,000 jobs while full-time employment declined by 383,000 and total employment (as measured by sum of full and part time) was down by 48,000.

“The total discrepancy between the trends is 1,888,000 + 48,000 = 1,936,000.

“You get a slightly different number if you compare the employment level to nonfarm payrolls (instead of the sum of full and part-time employment) as I did above.

“The latter method shows a surplus of 1.614 million jobs vs. employment gains whereas the sum of parts method has a 1.936 million discrepancy.

“A likely explanation for the divergences is Boomer retirements coupled with approximately 2 million people taking extra part-time jobs to make ends meet due to high inflation.

“No matter what the explanation, if the Household and BLS Jobs reports are both reasonably accurate, the highly touted jobs boom is dramatically overstated in any practical sense, especially real consumer spending.

“Don't anticipate strong spending based on strong jobs because the data suggests this is a mirage of part-time job strength (as little as one extra 8-hour shift, or less).”

If Mish is right, we can look at it either positively or negatively. The positive spin is that the economy is growing strongly enough to generate part-time opportunities for employed workers who want/need additional income. That’s not what you see in a normal recession. The negative spin is that so many people are willing to accept even more work in (supposedly) the strongest job market in generations. That suggests underlying weakness.

| [Attention] The Fed is acting aggressively to “fight inflation,” but if history is any guide, the response will likely be too little, too late. Discover what you can do now to protect your retirement wealth. Click here to get the full story. |

We don’t have the data to fully explain this, but it matters to Fed policy. Powell wants to stamp out inflation with higher interest rates and quantitative tightening, i.e., balance sheet reductions. This will inevitably hurt employment. The question is how much pain is necessary to achieve the desired inflation rate.

Back in the 1950s, A.W. Phillips developed what we now call the “Phillips Curve,” basically an inverse relationship between inflation and unemployment. The idea says the same growth that creates jobs also sparks inflation. Low inflation means high unemployment and vice versa.

You can easily find times when this relationship didn’t hold. The 1970s “stagflation” period saw concurrently high inflation and unemployment. As recently as 2019 we had both low inflation and low unemployment. Nonetheless, policymakers still look at the Phillips curve for guidance.

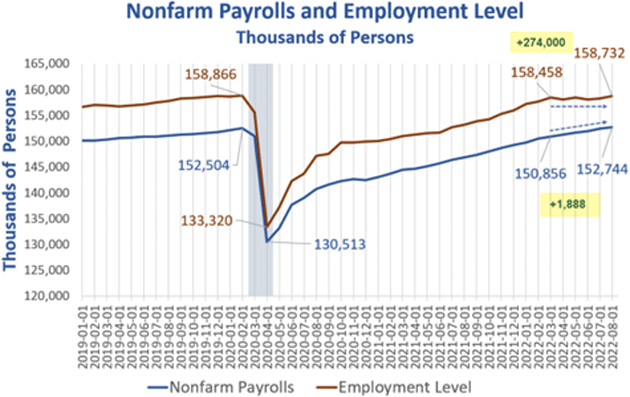

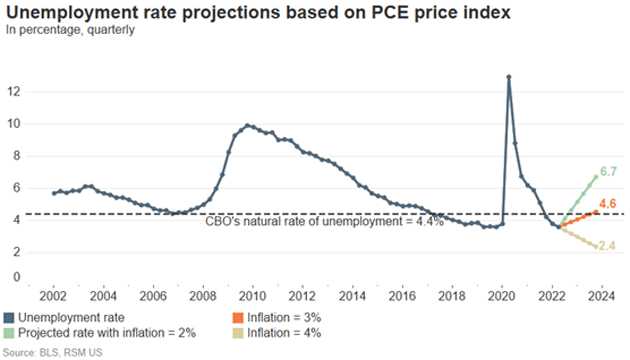

A recent RSM analysis augmented the Phillips curve with other variables, including a proxy for supply chain deficiencies, to estimate the inflation-unemployment tradeoff. Of course, the answer depends on how low the Fed wants inflation to be before it stops tightening. (The official long-term target is 2% “average” PCE inflation over some unstated time period. Currently PCE is running at a 6.3% annual rate. CPI is above 8%!)

Here’s what RSM calculated.

“To reach the 3% base case in terms of PCE, the economy would have to shed 1.7 million jobs to get to a 4.6% unemployment rate.

“This unemployment rate would be close to the natural rate of unemployment forecasted by the Congressional Budget Office at 4.4%, another reason why we think this base case is much more manageable for the Fed without pushing the economy into a severe recession.

“To reach the Fed’s long-term target, the cost would be much higher: 5.3 million jobs and a 6.7% unemployment rate.”

Source: RSM

As with all modeling, we should take these results with many grains of salt. But if correct, they indicate the Fed could achieve 3% inflation while raising the unemployment rate to only 4.6% (from the present 3.7%).

That’s not so bad. It would be a relatively “soft landing” from inflation of this magnitude. But would 3% inflation be low enough to make the Fed stop tightening? Maybe, because getting down to their 2% target would mean way more pain, sending unemployment up to 6.7%, if the team at RSM is right. They may be off in their numbers, but they clearly have the right direction. Driving inflation to 2% is going to require higher interest rates and higher unemployment than many observers think.

I can imagine Powell saying that 3% is enough progress to justify a pause, at least. He would no doubt hope to see that last percentage point happen gradually on its own, while vowing to remain vigilant etc., etc. I think most FOMC members would see that as preferable to launching the kind of recession needed to reach the target more quickly.

While it would be unstated, the Fed’s thinking might be something like, “We’ve wanted a soft landing and it seems to be happening. Let’s book it.” In that scenario I think they would have a lot of support, too, both politically and from Wall Street. Investors would know full well what a deeper recession would do to corporate earnings and share prices.

Unfortunately, it’s not at all clear the much-desired soft landing would kill inflation.

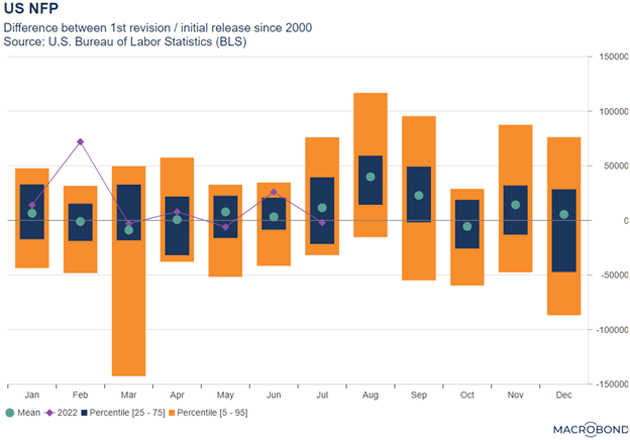

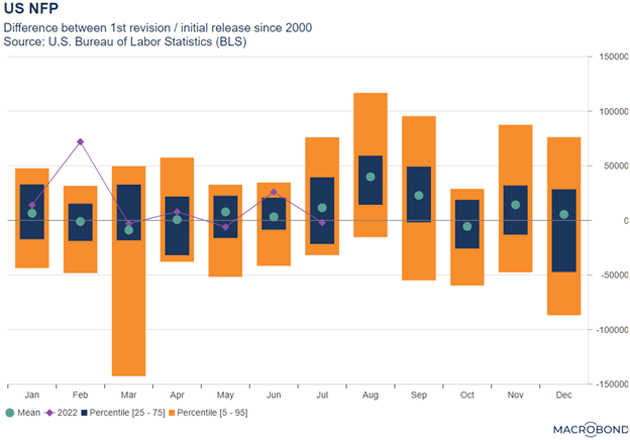

When I write anything, I start with a first draft and revise, often a lot. Unemployment data is revised on a regular schedule, often a lot. For instance. August jobs are usually undercounted at first because of seasonal adjustments used to smooth out the monthly real numbers. August, and to a lesser extent September, have a history of undercounted job growth, according to our chart of monthly data from January 2000. Revisions to NFP for August are usually positive, with a mean upward increase of 40,000 (via MacroBond).

Source: Macrobond

Then there is the controversial but absolutely necessary birth-death model in the establishment survey. As the survey by definition calls known establishments, how can they call and count a new start-up? What happens when a business closes? No one to call. It turns out this is a large number, so they have to make a guess. Unsurprisingly, they assume a moving average of births and deaths of new businesses over years (by very narrow sectors and detail).

It turns out this works pretty well ~80% of the time. But when the economy is entering or leaving a recession, those moving averages are often very wrong. The birth-death model will understate jobs during the beginning of a recovery and overstate jobs early in a recession. I am not being critical here. That is just about the best they can do with the tools they have. Market observers should be aware of this and adjust their own forecasts, but often don’t, because it requires guesswork and anecdotal data.

Revisions are potentially much larger in times of economic change, like now. And birth-death revisions can be pronounced a year from now for August, by which time no one will care except the statisticians.

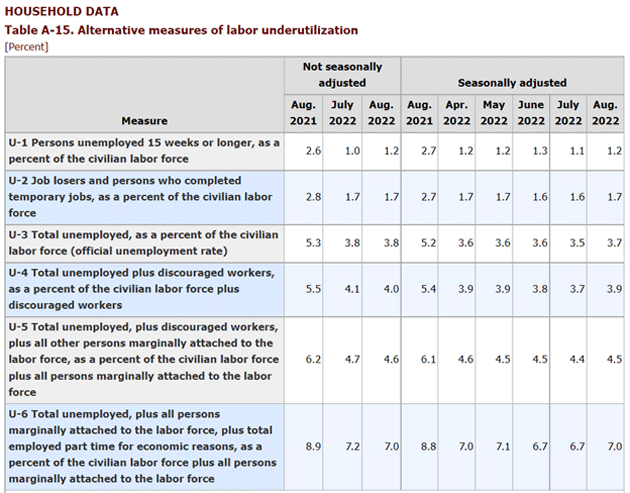

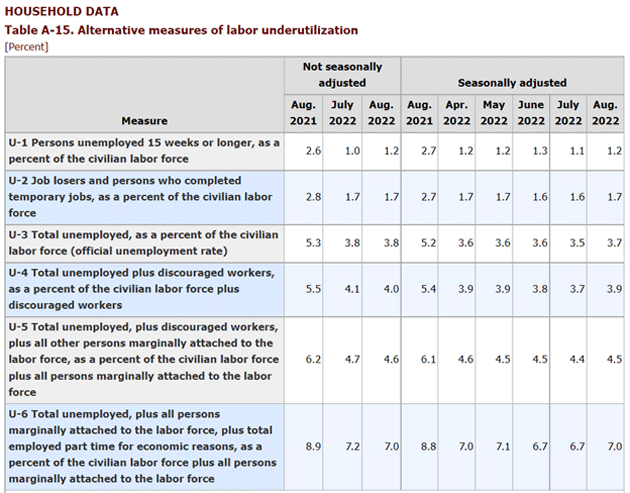

Finally, the BLS has six different ways to look at unemployment numbers. Here is the table from their website. The far right is August of 2022. Typically, the BLS and the media use U-3 as their headline number, as it is lower than other methods. If you haven’t looked for a job in the last 30 days (sometimes called discouraged workers) they don’t count you as unemployed, even though you would take a job if there were one. I personally like U-5, but U-6 takes into account all unemployed, even if they didn’t look for a job within the last month.

Source: BLS

Fed officials and economists know all this. They understand the employment number is a little squishy. But they have to deal with the headline in their communications with the public.

All this is to say that Powell is not locked into a specific target number where he will “pause.” He will be as much environment sensitive as data dependent. And right now, he is telling us that inflation is his lodestone.

All this is sparking a bunch of lively debates among economists. Much of it relies on the employment data which, as noted above, is not nearly as precise or reliable as we wish.

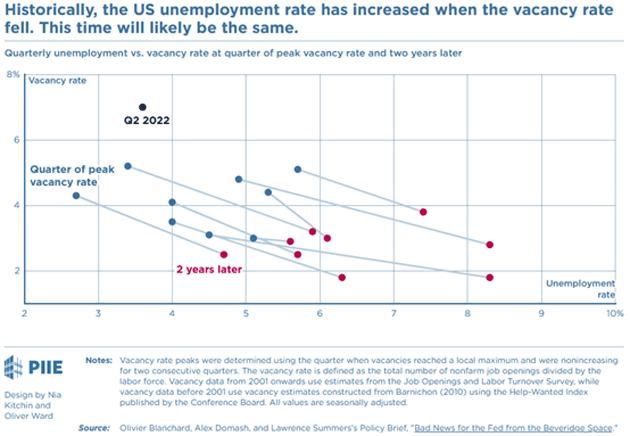

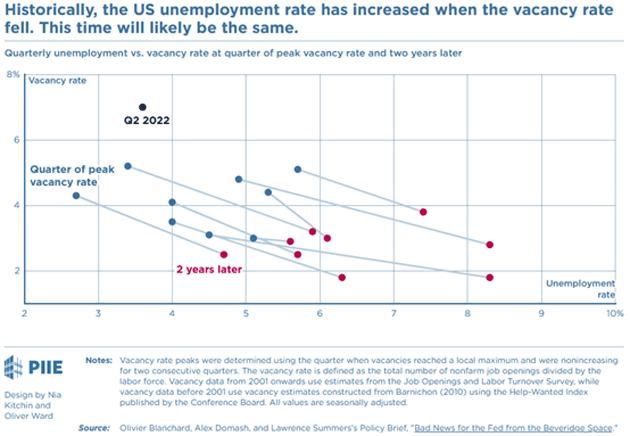

Fed Governor Chris Waller issued a paper in July arguing the high job vacancy rate gives the Fed room to tighten policy without raising the unemployment rate as much as in previous cycles. He floats the possibility of a “soft landing” with headline unemployment below 5%.

Waller’s paper was in part a response to Larry Summers, who has been saying for some time the Fed can’t reach its inflation target without pushing unemployment up to the 6% area. (Which, by the way, isn’t far from the 6.7% the RSM model found.) Summers, along with Olivier Blanchard and Alex Domash, fired back in a PIIE blog post. They show how job vacancies were high in past cycles, too (though not this high) but unemployment still rose as vacancies fell—sometimes sharply.

Source: PIIE

But here again, we have data deficiencies. BLS keeps finding large numbers of job vacancies but are they real? So much has changed in the last few years, it’s hard to trust the numbers.

Those very changes are why Paul Krugman says a soft landing is quite possible. I am a well-known Krugman critic so rather than be accused of misstating his point, I will simply quote a Twitter thread he posted over Labor Day weekend (sorry for the math but it’s important).

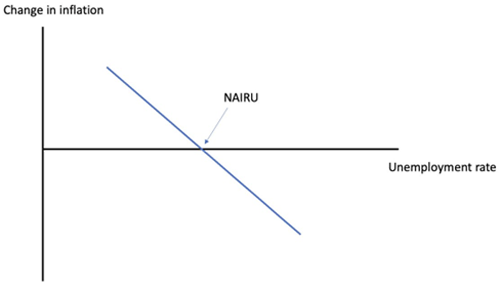

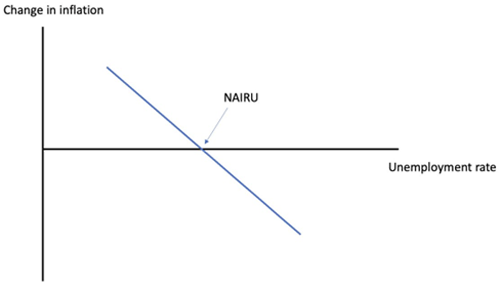

“Ever since Friedman and Phelps wrote their seminal papers on inflation and unemployment in the ‘60s, most practicing macroeconomists have worked with a model that looks something like this:

“Core inflation = f(u) + Expected inflation

“where u is the unemployment rate.

“There is some level of u—call it u*—for which f(u)=0. One way or another, u* (which can change over time!) is highly significant. But exactly how it's significant depends on what determines expectations

“In the ‘60s and ‘70s it seemed reasonable to assume that expected inflation was equal to recent past inflation—in fact, the previous year's inflation looked like a pretty good proxy. So the Phillips curve could be rearranged to

“Change in inflation = f(u)

“In that case u* became the NAIRU—the rate of unemployment at which inflation neither rose nor fell. The picture looked like this.

Source: Paul Krugman

“Given that picture, bringing inflation down would require a period of unemployment higher than u*. How much higher for how much longer? The "sacrifice ratio" was an estimate of how much excess unemployment would be needed to bring inflation down by one point.

“And if you apply estimates of the sacrifice ratio to the gap between core inflation and the Fed’s 2 percent target, it’s ugly: it says that we need a lot of excess unemployment in the years ahead.

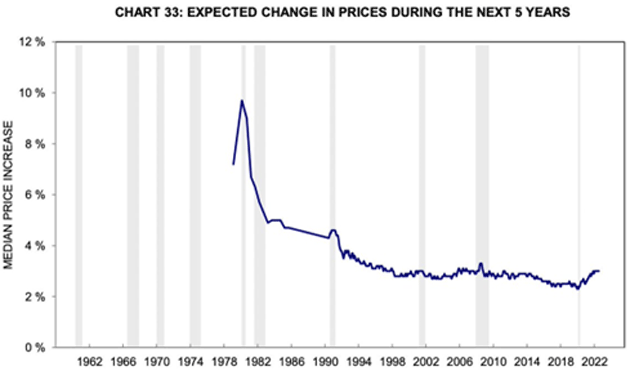

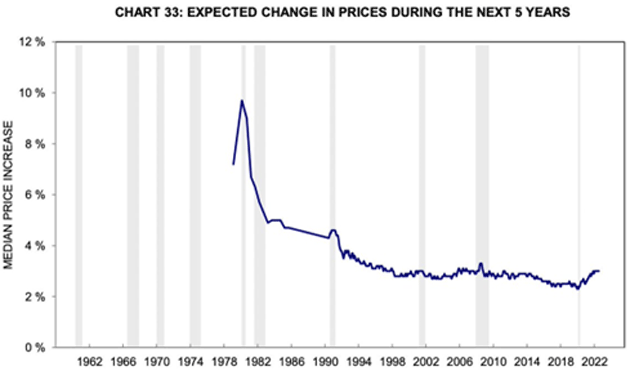

“But is this calculation relevant? Both market prices and surveys suggest that medium-term inflation expectations have remained "anchored" despite recent inflation.

Source: Paul Krugman

“If those measures are right, getting inflation under control requires getting u up to u*, so f(u) is zero—so some pain—but that's the end of the story. No need for a period of above-normal unemployment.

“This could, of course, be wrong, and God knows we've learned to be wary of optimistic forecasts. But what seems odd to me is that the pessimists don't even seem to engage with this issue. They're just telling ‘80s-style stories and ignoring the direct evidence on expectations.”

Krugman thinks a soft landing is possible—though, to be fair, he agrees the Fed should keep tightening until it sees lower inflation. His disagreement with Summers and others is a matter of degree. In a later tweet he said “current data suggest the need to cool off the labor market, not put it through a Volcker-style wringer.”

The problem is this relies upon the Phillips curve, which is notoriously unreliable. It should simply not be used as it is so often wrong. I once asked a Fed economist at Camp Kotok why they keep using it? His answer floored me: “We use it because we don’t have anything else to model and we need to use something.”

(It’s not unlike when future Nobel Laureate Kenneth Arrow was a captain in the army and was asked to predict the weather 30 days out for Normandy on D-Day. He finally went to the general and told them any forecast he made was likely to be wrong. The general said, “We know that. But we have to have a forecast for our planning.” The Fed does the same with a lot of poorly performing models and data.)

The data right now is varied enough to lead different very knowledgeable people to different conclusions. Volcker had the benefit of oil prices trending steadily down in the early 1980s and then crashing in 1986. That doesn’t seem likely this time, which could force the Fed to lean harder on its other tools.

I’ve said it before, but I’ll repeat: The real danger is that the Fed stops tightening too soon and lets inflation move even higher and stay there longer. They need to drive a stake into this vampire’s heart so it stays dead. Yes, they should try to minimize the pain, but that can’t be the primary goal.

The pessimist in me says Larry Summers is right but it won’t matter, because the Fed will proclaim victory long before the unemployment rate reaches 6%. Powell has turned his eyes on the target of inflation with what appears to be flinty resolve. The market does not believe he will see it through. Here’s hoping his skin is as thick as Volcker’s was.

But then, maybe they’ll find another way. If so, I’m really curious about what it will be. I now think Powell stays the course until something breaks.

Long-time great friend and mentor Tom Romero passed away Wednesday night from what was described as a massive heart attack in his home in Connecticut. We met at my SIC over 15 years ago. Tom is part of a regular market-focused video call I attend every week. He was there this past Tuesday with his trademark smile (I am not sure if I ever saw him without a smile) and willingness to share his trading and economic ideas. He was someone I could always call for explanations or introductions through his extensive Rolodex. His breadth of market knowledge and experience was staggering. He was always sending pictures of his daughters Tessa and Kate. He was to me relatively young. He will be missed by his family as well as many in the finance business. Rest in peace, Tom.

I came back from British Columbia (23 miles from Alaska) where Steve Blumenthal, Jim Tosti, and his son Nic plus another 49 people stayed at the phenomenal West Cost Fishing Club. It’s a first-class enterprise in everything from organizing plane/helicopter trips to the gourmet food.

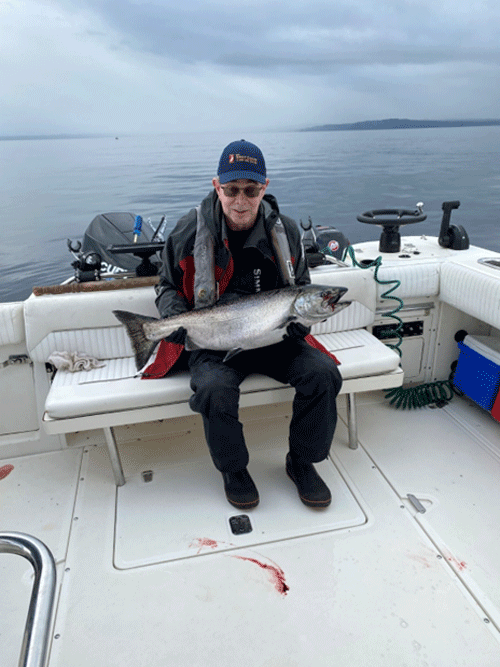

The fishing was good for the first two days then went cold, at least for me. But I took home a salmon, halibut, and cod, pictured below. I didn’t include the Ling cod’s picture as it is a candidate for ugliest fish. But it makes excellent fish and chips.

I literally lost a monster salmon just as the guide was netting him. A 1,500-pound sea lion, all 15 feet of him, came out of the water and leaped at the fish. He got my next one as well before we moved.

I came back and since I don’t sleep on planes very well, had been up 30+ hours when I got to bed Friday. The next day I woke up to a very bad head cold which tested positive for COVID, thankfully minor. I have gotten steadily better and should be back in the gym tomorrow. Shane had it for a few days and likewise recovered fast (she is at the beach as I write). Whatever variant we had was clearly not what people were getting two years ago. We are lucky.

And with that, I will hit the send button. Going to be an interesting quarter. In another few weeks, I will change my life by closing one business (NOT this letter!) and joining another. There are just so many opportunities. Don’t forget to follow me on Twitter.

Your thinking of the ones that got away analyst,