I borrowed this letter’s “Soft Now, Hard Later” headline from Dave Rosenberg. It was the title of his leadoff SIC presentation, for reasons I’ll explain below. But I think it also describes the entire SIC experience. As you hear from some of the world’s top experts in various fields, the words register but you don’t immediately grasp their full importance. You start making connections as others add to the conversation. Gradually, it all becomes clearer. Then at some point (often weeks later) it hits hard. You “get it” and your perception of everything changes.

With that in mind, in my next couple of letters I’ll try to give you my first, high-level “soft” impressions from SIC. I’ll probably miss some important points because right now I’m still in the thick of it. Then I’ll have a few more letters with deeper thoughts as I assimilate all we learned. You’re going to see a work in progress first, and then a better-formed structure a little later. Please excuse our dust in the meantime.

Speaking of meantime, you don’t have to wait for me. You can still join us for SIC with full access to videos, transcripts, speaker slides, and more. Watch it live or watch the recordings later, as many times as you want, from the comfort of your own home or office. Click here for more information and registration.

Dave Rosenberg is my traditional SIC leadoff hitter. He always marshals a vast collection of charts and data and presents it with both humor and authority. Dave is neither bull nor bear; he follows the data wherever it leads him. Right now, he thinks it leads to recession… but not just yet.

In Dave’s view the disinflationary forces we were looking at pre-COVID are still alive and well. He calls them the “Three D’s”—debt, demographics, and disruptive technology.

I often say debt is future consumption pulled forward. Dave states it a little differently: debt depresses demand growth . It has been doing so for several decades now, and not just government debt. Everything—mortgages, credit cards, student loans, autos, corporate junk bonds—all these balances eventually grow unsustainable. Whatever that point is, it’s getting closer.

As for demographics, just look at Japan. Aging societies have low inflation rates. The US is a decade or so behind but we’re catching up as the population ages and births diminish. And technology? You’re reading this letter on a device that was unimaginable not so long ago at anything like the price you paid for it. It helped send productivity to warp speed.

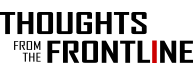

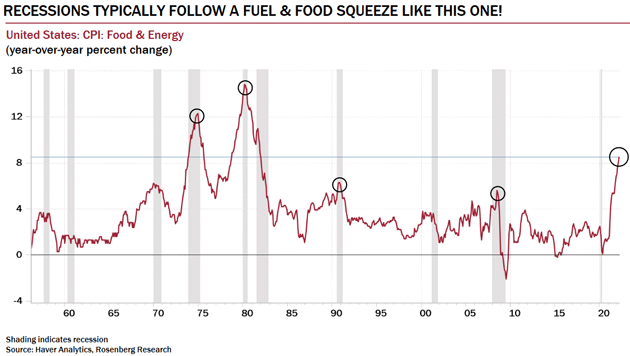

COVID did nothing to change these megatrends, and Dave thinks they will reassert themselves. He believes today’s inflation is indeed transitory and will diminish soon. What will diminish it? A recession. Here’s one of his charts.

Source: Rosenberg Research

The gray bars are recessions. You can see how they coincide with food and energy price spikes. But more important, the food and energy part of the CPI tends to drop quickly after recessions begin. Dave anticipates the same this time. He expects the Fed to tighten hard and push the economy into recession later this year or in 2023.

This view—that inflation is transitory and will come down sooner than we think—is different than what we will hear from other speakers. (I have the advantage of listening to preparation calls so I have some idea of what you’ll be hearing.) But I’ve learned that one does not ignore Rosie’s outlook. If he’s right, we will begin to see it by late summer or early fall, and that will have serious economic and market implications.

Next, we heard from pollster Frank Luntz, whom you have probably seen on TV moderating voter focus groups. Frank has his finger on the public pulse as well as anyone I know. He looks beyond politics to the way people see their lives and futures… and what he sees right now is disturbing, to say the least.

Frank’s data shows two things that shouldn’t go together. Large majorities of Americans across the spectrum believe they are invested (metaphorically if not financially) in America’s future. That’s good. But at the same time, large majorities of Americans across the spectrum believe America isn’t invested in their future.

We are a deeply pessimistic nation. People feel alone, marginalized, hopeless. They believe their families face a dark future. For the first time, the significant majority of America feels their children will not be better off than they are. This leads nowhere good.

Among other things, this pessimism makes people reject both major political parties. He sees high potential for a well-funded independent presidential candidacy in 2024. As for 2022, he thinks Republicans will capture the House but Democrats will keep the Senate. Inflation will be the top issue but not so much under that word. We’ll hear lots of talk about “affordability” and “rising prices.”

Frank also had some advice for employers and business owners. This “Great Resignation” situation will get worse. They will keep struggling to attract talent and they will be lucky not to lose their most loyal, productive workers. Even high-income Americans feel financial anxiety. Offered something better, workers will take it and not look back.

I can guarantee you I will be reading the transcript of this session and having this discussion with my partners in my various business ventures.

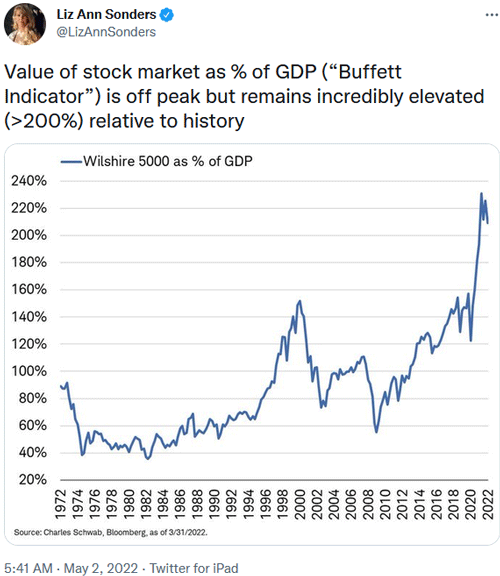

Liz Ann Sonders is the chief investment strategist at Charles Schwab. That means her job is kind of like mine: helping investors make sense of the macro “big picture” as it affects their portfolios—except she has millions more people listening to her. She had a wide-ranging conversation with Mark Yusko (whom we’ll hear from separately next week). Here are a couple of her points I thought especially insightful.

First, investors often process new data through a “good or bad” filter. Liz Ann says it’s better to think in “better or worse.” We should evaluate information and opportunities relative to the available alternatives. Maybe this development isn’t what we hoped, but it’s the best we are likely to get. If so, the right choice may be to grab it while you can. I thought that was good advice.

Second, she doesn’t accept the (increasingly common) comparisons of our present situation to the 1970s inflation era. While there are similarities, there are also major differences. The demographic situation says unemployment isn’t likely to reach the heights it did back then. Wage growth is behind inflation, but limited labor supply may keep it elevated. This period will be something new, not a 1970s rerun.

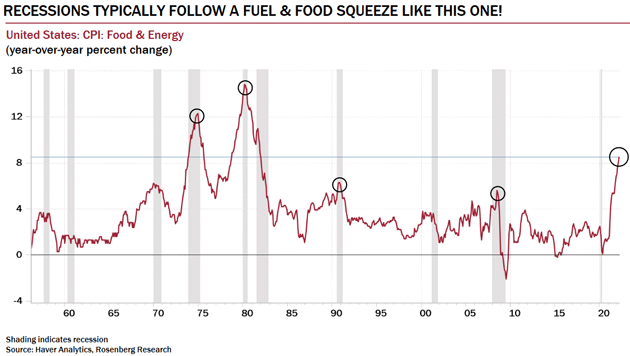

She pointed to another key difference: Today’s stock market is far more tied to the economy than ever before. That morning she had just tweeted a chart of the “Buffett Indicator,” which is the stock market’s total value as a percentage of GDP.

Source: Liz Ann Sonders

As you can see, the ratio zoomed higher since 2020. I don’t foresee it staying there. Bringing it down will probably happen via lower stock prices and a smaller economy, the journey to which won’t be fun.

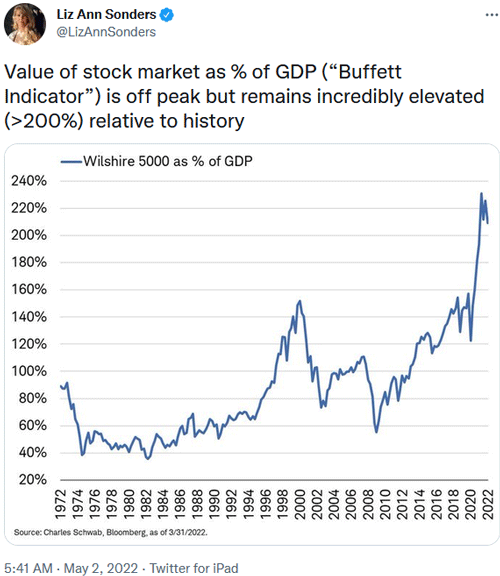

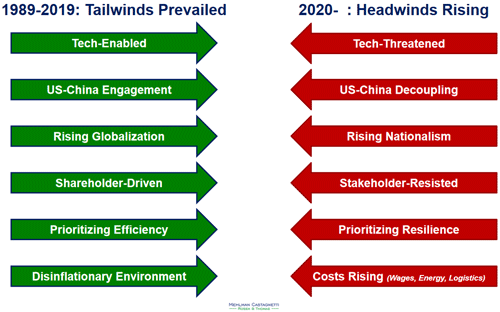

Bruce Mehlman may be one of the most connected people in Washington. His bipartisan lobbying firm, Mehlman Castagnetti Rosen & Thomas, is the nexus between powerful corporations and powerful politicians. He makes fascinating slide decks on important macro issues and kindly lets us share them in Over My Shoulder. And this time he shared a special one with SIC attendees.

I can’t possibly summarize the broad issues Bruce covered. He called his presentation “The Great Acceleration: How 2022 Is Hastening the Age of Disruption.” This graphic (one of 47!) highlights the challenge.

Source: Bruce Mehlman

Change was brewing even before the pandemic. Now, between COVID’s myriad effects and the Russia-Ukraine War’s geopolitical and economic thunderbolts, the long-term trends are accelerating. And worse, the very same forces that acted as beneficial tailwinds for three decades aren’t just ending but reversing .

Like Frank Luntz, Bruce sees a lot of distrust. Comparing survey data between 1979 and 2021, the only major institution in our society to gain trust since that time is the military. All others—media, religion, courts, schools, labor, business, Congress—lost much and sometimes most of their credibility since then.

Bruce isn’t entirely pessimistic, though. Like me, he also anticipates accelerating innovation and change: faster productivity, entrepreneurship, smarter healthcare, and a transition to next-generation energy sources. But we’ll have some tough times first.

We like to think investing is all about data and numbers. Those are indeed important, but we’re still human. We make decisions intuitively and sometimes emotionally. What goes on inside our heads is critically important, and no one describes it better than Morgan Housel. He says more in his book The Psychology of Money , which everyone should read. I was fascinated by Morgan’s presentation.

Morgan opened with a story about two investors: one a simple working person who spent her entire life with no apparent wealth, basically living at what could be described as poverty level. Then she died at 100 and turned out to have been a multi-millionaire. The other was a highly educated, pedigreed executive who retired in his 40s with a great fortune… which he soon lost in bankruptcy.

Here’s the lesson Morgan Housel draws from that (quoting from the SIC transcript):

“What that shows, I think, that is so easy to ignore in this field is that good investing is not about what you know, it’s not about how smart you are. It’s not about where you went to school. It’s not about the connections that you have. Good investing is overwhelmingly just about how you behave. It’s about your relationship with greed and fear, how gullible you are, who you trust, who you seek your information from, your ability to take a long-term mindset, long-term time horizon. That’s what actually matters. That’s what moves the needle more than anything else.

“And all of those topics are not analytical. They’re not about data and formulas. All of those topics are behavior, and behavior is kind of a soft and mushy topic. That’s not analytical. You can’t summarize it on a spreadsheet or with a formula. So it tends to kind of be ignored in investing, even if it is one of the most important aspects of investing.”

What did the elderly lady do right? She saved as much as she could each week and for 80 years kept it in the stock market and never sold. Compounding worked incredibly. The wealthy philanthropist? Took the wrong risks and imploded.

The last sentence in that quote is important, too. Because investor psychology is soft and mushy and hard to quantify, we too often pretend it just doesn’t exist. Economists do this all the time. They assume people will act “rationally” to “maximize their utility.”

But people aren’t rational. Money isn’t always everything. They make decisions that aren’t remotely in their self-interest—sometimes for good reasons, sometimes not. But it makes them hard to predict… which is one reason investing is hard.

With the Russia-Ukraine War driving so much of the economy, I asked retired UK General Sir Richard Shirreff to give us his strategic analysis. As someone who was once deputy commander of all NATO forces, he speaks with authority and deep knowledge.

Shirreff said the war is not going well for Russia, but Putin can’t afford to lose. Ukraine won’t give up, either, so the most likely outcome is a long war of attrition. He thinks it could last the better part of this decade. Europe will not see peace again as long as Putin is in power, and we should not assume a Putin successor would be any different.

Ominously, he sees at least some chance Russia will declare war on NATO, and all 30 NATO countries must be ready for it. He’s pleased to see Finland and Sweden moving toward NATO membership but expects pushback from Russia. On a more relieving note, Shirreff thinks use of chemical and nuclear weapons is unlikely.

He also talked about consequences outside Europe. China sees the West is not a pushover, which should inform their thinking about Taiwan. But he also sees China using this time to exert greater influence in the Asia-Pacific region. The West needs deeper alliances to counter that effort.

Finally, General Shirreff noted the world is not as united against Russia as it may seem. Aside from China, India and most of Africa are trying to stay neutral in this conflict, and in some cases show sympathy for Russia. That includes some countries and regions with key roles in Western supply chains, so businesses should watch who is susceptible to instability and build resilience now.

Carlyle Group co-founder David Rubenstein is one of the most successful private equity investors in history. His deep connections and insights matched some of Richard Shirreff’s thoughts.

For one, he believes the Russia-Ukraine conflict will not be resolved soon. It is a failed effort by Putin but won’t threaten his position. Rubenstein also thinks the sanctions, while damaging, won’t push Russia to collapse. Other countries will see the confiscation of Russian assets as a warning, and they will seek alternatives. Certain countries will rethink the role of US dollars as the reserve currency. All this could help lift crypto currencies.

In terms of investments, Rubenstein thinks smart investors should be raising cash now to buy when markets bottom, and consider finding a good money manager and let them do what they do best. He believes the US remains the best place in the world to live and raise a family, and the economy will come back.

I will stop here and pick up next week. I apologize to the other fantastic speakers I haven’t mentioned. It’s already been a roller coaster ride. We still have three more days coming, including our Plus-Day when our own and guest analysts will reveal their best trade ideas and favorite sectors. You’ll come away with a solid game plan for what to invest in right now. Click here to get your Virtual Pass now.

And don’t forget: You get everything if you sign up now . The entire conference is being recorded in video and audio format; your Virtual Pass also includes full transcripts and (as available) presenters’ slides. This is too important to miss, so get your Virtual Pass today.

The months and weeks leading up to SIC are always emotional for me. The excitement of getting new speakers, the challenge of blending the right information so that it all comes together at the right time, the frustrations of getting turned down by speakers I really want because of schedules or whatever. There is an enormous amount of preparation.

I can’t say enough about my team. You see Ed D’Agostino as the emcee, and he has really upped his game. My partner Olivier Garret. My editor Patrick Watson. But the team in the backroom, Samantha Dube, Renee Shelton, Jessica Russell, and all the others, the vast technical team. One team, one goal, one result: bringing you the best conference possible at the right time. And this is clearly our best conference ever.

I miss the live physical conference, the interaction with attendees and speakers. I look forward to getting back there someday. But there’s also freedom in doing it virtually as well. So many more people can participate—not just attendees but speakers as well.

Believe it or not, I experience a little bit of anxiety (maybe more than a little bit) when I’m in front of the camera. You would think by now it would be old hat. So far, that hasn’t happened. I do have a speaking gig in Vancouver in a few weeks. I am looking forward to seeing a live audience again.

Let me wish a very warm Mother’s Day to all mothers everywhere, including Shane and my daughters, who are the mothers of my grandchildren. I still remember my own mother singing Irish lullabies to me as a child.

And with that, let me hit the send button and wish you a great week. And don’t forget to follow me on Twitter.

Your drinking information through a firehose analyst,