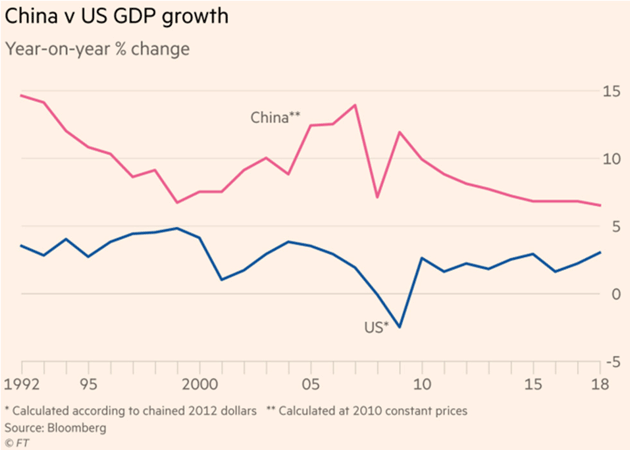

Something Wicked This Way Comes By John Mauldin | Jan 12, 2019 For a couple of years now, the economic narrative has shown a comparatively strong US against weakness in Europe and some of Asia (NOT China). The US, we are told, will stay on top. I agree with that, as far as it goes... but I’m not convinced the “top” will be so great. Americans like to think we are insulated from the world. We have big oceans on either side of us. Geopolitically, they serve as buffers. But economically they connect us to other important markets that are critical to many US businesses. Problems in those markets are ultimately problems for the US, too. Last week I gave you my Year of Living Dangerously 2019 US forecast, but I didn’t discuss important events overseas. Summarizing last week quickly, I think the base case is that the United States economy slows down but avoids recession in 2019. That said, there are significant risks to that forecast, mostly to the downside. Today we’ll make another literary metaphor to frame our discussion. “Something Wicked This Way Comes” is a 1962 Ray Bradbury novel about two boys and their horrifying encounter with a travelling circus. Later it was a movie. In our case, something wicked most certainly is coming this way. Several somethings, in fact, approaching from all directions. The real question is how much damage this circus will do before it leaves town. Many of our risks emanate from China, and as I wrote this section, I realized it deserves a longer treatment. I will do that in next week’s letter. For now, let’s touch on the big picture. By most measures, the US and China are the world’s largest and second-largest economies. They are also entwined with each other in so many ways that it can be hard to know where one stops and the other starts. Some call it “Chimerica,” which may be an apt description. That’s basically good, in my view. International trade promotes peace and prosperity for all, albeit not always smoothly, evenly distributed, or without issues. Such is the nature of great entanglements. But seen over decades? China’s growth has made the world better. Literally billions of people globally have been lifted out of poverty and destitution. All that said, the US and China are also separate nations with separate interests. We compete as well as cooperate so differences naturally arise. While we need to resolve them, the Trump administration’s methods aren’t helping. They seem not to grasp that intentionally weakening an economy so tied to our own risks weakening the US as well. The US is demanding (rightly, in my opinion) that China respect intellectual property rights and let foreign companies compete fairly, just as we let Chinese companies operate here. But achieving that isn’t like flipping a switch. Entire regions and industries are now optimized for a model we want to change. The change, however necessary, will cause problems if it’s not managed well. Worse, China’s economy is already on shaky ground. Its unique blend of “communism” (whatever that now means in China) and capitalism, along with sheer size, has produced enviable growth rates and I think will keep doing so, but a slowdown is inevitable. China is still subject to the law of large numbers. They can’t maintain 6% or higher GDP growth indefinitely. The gap between US and China GDP growth has been shrinking over the last decade.

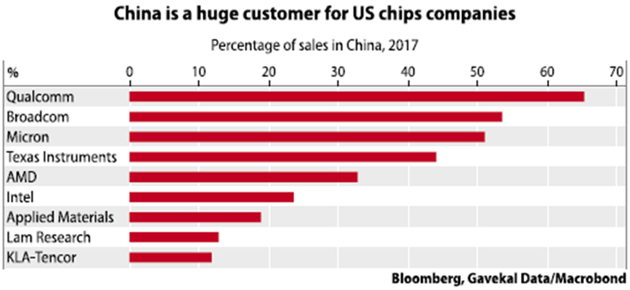

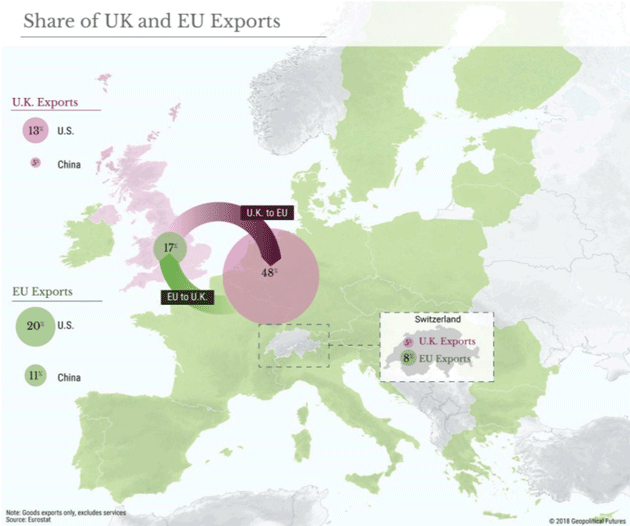

Source: Financial Times It now appears the eventual Chinese landing could be harder than expected. We’ve seen hints in the data for some time now and they’re starting to add up. Automotive sales are rolling over, for instance. That’s partly because ride-sharing services like Didi Chuxing (similar to Uber or Lyft) are gaining popularity, but it also suggests the Chinese middle class is no longer gaining prosperity at the rates it had been. It’s also a result of “front-loading” auto sales for the previous few years. When you pull future demand forward, the future eventually demands repayment. This isn’t just a Chinese problem. US and European automakers export vehicles to China and own factories within China. It is one reason General Motors closed several US and Canadian plants and laid off thousands of workers last year. Then you probably heard Apple’s revenue warning, in which it blamed a nasty surprise on weakening conditions in China. The uncomfortable fact is that a great deal of world growth is directly tied to Chinese growth. And not just absolute current growth, but expected future growth. Business has built 6% Chinese growth, compounded forever, into its models. It’s baked into the forecasts and expectations that keep shareholders happy. And when that growth doesn’t meet expectations, we get surprises. Apple is just the first of many. Yes, the US has a trade deficit with China. That doesn’t mean China buys nothing from us. They most certainly do and certain segments of our economy depend heavily on Chinese customers. Here’s a chart of China’s importance to top US semiconductor companies.  Note this is the percentage of sales, not earnings. We see here five major public companies that got a third or more of their 2017 sales from China. It would not take much change to wipe out all or most of their profits. Similarly, lots of smaller US companies depend on China for components that have no US alternatives. Rising costs, whether due to tariffs or anything else, hit their bottom lines, too. A significant part of US growth last year came from a rise in US inventories. In a somewhat arcane accounting methodology, building inventories is what counts for GDP, not actual sales. Many businesses that depend on Chinese materials built inventory ahead of what was feared to be a significant tariff at the end of 2018. Those inventories are going to be sold in 2019 and often not replaced. A large part of the slowing economy in 2019 will simply be a reduction of inventories. The apparent robust growth of the last half of 2018 was essentially pulling production forward from 2019. China has its own problems, too, namely enormous debt and increasingly strapped consumers. I’ll discuss those next week. The point to remember now is that economic weakness and falling markets in China are going to hurt the US, too. And they will weigh just as heavily on Europe and especially Germany. Which brings us to the next wicked thing that may be coming. Last month in European Threats, I quoted Victor Hill saying “a disorderly Brexit will be that spark that sets the Eurozone tinderbox aflame.” The fire is still ready to light and, if no deal emerges before the March deadline, could certainly erupt in flames, metaphorically speaking. Many analysts doubt this, trusting some last-minute agreement will emerge because a “hard” Brexit is in no one’s interest. It makes no sense, the logic goes, therefore it won’t happen. The problem is we are dealing with politicians who may have entirely separate interests, and in any case have been known to miscalculate. If governments always did the sensible thing we would never have wars and other international calamities. Yet we do. Politicians everywhere are perfectly capable of making terrible mistakes. My friend Lord Matt Ridley, one of the world’s premier free market philosophers (of The Rationalist Optimist and the uber-important The Evolution of Everything fame) recently made the point that even a no-deal Brexit would be better (for Britain) than the current proposal. He has a great deal of faith in free markets to adjust quickly, as do many others in the UK, so that may prove important to the final decision. We will see. (Incidentally, as an American, I take no position on the Leave vs. Remain question. I have long thought the EU will eventually fall apart. If so, better that it happen in the least painful way possible. A no-deal Brexit may not be the best start. But then, breaking up is always hard to do.) The UK parliament is supposed to vote next week on January 15 on Theresa May’s Brexit plan. That vote has already been delayed once and passage is not guaranteed. As of writing this, it looks like it will not pass, but things change in politics. Even if it does, the details and implications are hideously complex, with very little time to sort them out before the March 29 departure date. The resulting confusion will, at the very least, temporarily paralyze some businesses and disrupt EU/UK trade, of which there is a lot. Here’s a handy map my friend George Friedman shared in his 2019 Geopolitical Futures forecast (Over My Shoulder members can read a summary here.)

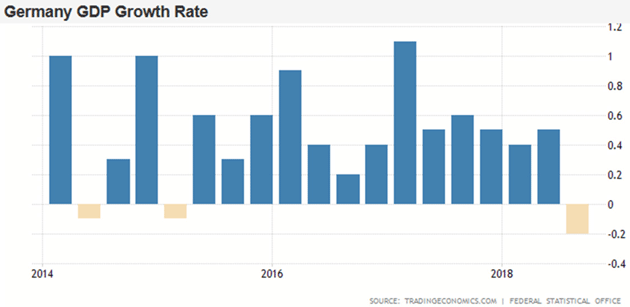

Source: Geopolitical Futures Some 48% of UK exports go to the EU, far more than it sells to the US. That means increasing trade with the US will have limited benefits, even if the US/UK sign a new free trade agreement. The EU is less dependent on the UK, though some regions and companies will surely get hurt. George is among those who think a deal will get done in the next few weeks. That doesn’t mean he is especially optimistic, though. From his forecast: Two key questions will remain: What will be the UK’s future relationship with the EU, and what will be the future of the UK itself? The United Kingdom maintains a close security relationship with several European states. It’s also an important trade partner for major EU economies such as Germany and the Netherlands. Deal or no deal, those relationships will continue, and the UK will be an important ally for EU states on the periphery seeking to balance against Germany and France. Its future is a different story. Much will depend on the deal, but the same forces that compelled the United Kingdom to leave the bloc threaten its unity, too. If a Brexit deal ends up disproportionately hurting Scotland, for example, it could create renewed calls for Scottish independence. Northern Ireland is also in an unstable position. The sectarian issues that led to the Troubles are still simmering, the peace held together by the 1998 Good Friday Agreement is fragile, and the economy is under significant pressure. Businesses aren’t waiting to see how this ends. A new EY study says financial firms are in the process of moving assets worth nearly $1 trillion out of Britain to various EU domiciles. Many are moving staff as well. Look for that trend to accelerate quickly if next week’s vote in Parliament fails. As noted, US/UK trade exposure is relatively small for both countries, but some of it is important and irreplaceable. The bigger problem is intangible. We rightly call it a “special relationship” because our two countries were once united. That split was painful, too, and took a long time to heal (see the War of 1812). Whatever hurts the UK will hurt the US, too. A Brexit-sparked recession will hinder trade, force some US companies to find other partners, and aggravate our own problems. But the bigger problem is that the US will get hit on both sides. A hard Brexit will hit both the EU and UK economies, including China, and the damage from both will then spread worldwide, including to the US. For years, whenever we talked about the European economy, one country drove the discussion: Germany. Yes, the UK and France are big but Germany is the giant. If Germany sneezes, the rest of the continent catches cold. And it is sneezing hard right now. The latest GDP forecasts peg German growth at 1.5% for full-year 2019. I think that is aggressively optimistic, coming after a 0.2% contraction in Q3 2018 and only 0.5% growth the quarter before.

Source: TradingEconomics.com It’s getting worse, too. Industrial orders for export dropped 3.2% in November and Germany’s exports are what keep its economy—and the Eurozone’s and the EU’s—alive. This is partly due to the same cyclical factors hitting US growth. Like the US, Germany had a good (although not spectacular) run since the last crisis and at some point it must end. Trump’s threat to slap tariffs on EU autos doesn’t help. But some of this is uniquely German, too. The euro currency effectively gave Germany a stranglehold over the zone’s smaller players who bought German exports with German loans. We saw how that worked with Greece. Now a similar dynamic is unfolding in much-larger Italy—which, for its part, has some unique problems, too. Yet with all this going on, the European Central Bank is still intent on ending its asset purchases in the coming year, even as it keeps interest rates negative. That is a formula for a wildly distorted economy, at the very least, and possibly much worse. Meanwhile, next door in France the “yellow vest” protests reveal substantial and well-organized working-class unrest. Imagine what will happen if (when) the EU economy turns seriously south, unemployment shoots even higher than it already is, governments can’t afford their safety nets, and the population can’t afford higher taxes. It could get ugly and not just in France. Remember, many EU countries are parliamentary systems whose governments can fall anytime. I admit, this is a gloomy outlook. Maybe it’s wrong. Gavekal’s Nick Andrews recently looked at these same issues and asked what could change Europe’s trajectory. With monetary and fiscal policy constrained, and with domestic consumer demand weakening, any such driver—for the economy or equities—is only likely to be external. There are several possible candidates: 1. A favorable Brexit deal. Since the UK’s 2016 referendum, eurozone shipments to the single currency bloc’s second-biggest export market have stagnated. If the clouds clear in the coming months, with a no-deal Brexit avoided, then risk premiums will diminish, sterling will rally and eurozone exports to the UK are likely to pick up. For now, however, the outlook on this front remains highly uncertain. 2. Improved US-China trade relations. A deal to avert tariff increases would remove one major uncertainty hanging over the global economy. Again, risk premiums would fall. 3. A stabilization or acceleration in Chinese growth, whether as a result of a trade deal or a domestic stimulus program. A pick-up in Chinese domestic consumer demand would benefit European companies exposed to Asia, notably luxury goods stocks. However, there is little probability of a stimulus effort on the scale of 2009’s, so the effect on Europe’s economy and markets of Chinese policy easing is likely to be muted. In short, there is little prospect of a new domestic driver of European growth emerging, and the external situation remains highly uncertain. In the absence of any clear new growth engine, the composite eurozone PMI released in the first week of January indicates that a slowdown of year-on-year GDP growth to around 1% from the ECB’s estimate of 1.9% for 2018 is possible. Nick says this very nicely, but his implication is disturbing: Europe is helpless and will continue circling the drain unless external events (over which it has little control) go its way. That is not a comfortable position to be in. If eurozone growth ends at 1% in 2018, it’s a good bet 2019 will be no better and possibly bring a true recession. What happens to German banks in that scenario? And if they go wobbly, what happens to US, Canadian, and Asian banks? And if Europe goes into recession, it will have a significant impact on the world and the US. Paying attention to Europe—and not just the Premier League—will be important in 2019. Something wicked is coming, and we may see far more yellow vests or their equivalent all over the world before this is over. I see significant potential for global recession and it will bleed over into the US market. A few unforced errors upon the part of the US central bank or government could bring recession sooner rather than later. Economics is about to get interesting. I write the final lines of this letter while in my “office” on American Airlines flying from California to Washington, DC. I get to spend Friday afternoon with my good friends Andrew Marshall, Neil Howe, and a small group talking about world events. For those who may not know, Andy Marshall was appointed by Richard Nixon in 1973 to head up what is now called the Net Assessment office of the US Defense Department, which was basically their futurist think tank. He was then reappointed by every president and secretary of defense until he retired three years ago at the age of 94. Even now, surprisingly to me, Andy “adopted” me and let me into his world and his thinking. The weeks I have spent at the Naval War College working on developing contingency planning concepts for the DoD have been some of the most stimulating in my life. Andy would assemble out-of-the-box thinkers from different backgrounds, then we went at it for 12–14 hours a day for over a week. He held those events for decades, which informed his advice to various administrations and leaders. To say he has been at the center of the development of US strategic policy is an understatement. At 97, he is as intellectually strong as ever. Is it a privilege and honor to be able to spend some time with him. Saturday I fly back to Dorado, Puerto Rico (where we now live) and meet Shane who is coming in from Dallas. I am looking forward to being back home, although Steve Blumenthal of CMG is trying to drag me back to Tampa Bay for an evening in the third week of January. Let me know if you’re in the area and would like to meet. Then at the end of the month I will be at the Tiger 21 conference in Boca Raton. I have been with Pat Cox for the last two days in San Francisco listening to presentations from biotech companies, particularly antiaging and age reversal technologies. It is a remarkable antidote to my assessment of the global economy and politics. We are on the cusp of new biotechnology that could eclipse the global, social, and economic impact of all previous technological revolutions. I think by the mid-2030s we will look back and just marvel. I must confess there are times when I feel a bit of mental dizziness. The profound implications and changes technology will bring are simply staggering. And then I try to wrap my head around how the world deals with the growing political, social, and economic “fingers of instability” and I am just stunned. Perhaps you have the same sense of disconnect? Maybe that combination is why I tend to be of the “Muddle Through” persuasion. And with that confession of confusion, I will hit the send button. I wish you a great week and perhaps a little time in the warmth and sunshine of Puerto Rico will help bring a little clarity to my mind. Your trying to absorb it all analyst,   | John Mauldin

Chairman, Mauldin Economics |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.     | | Share Your Thoughts on This Article | | |

|