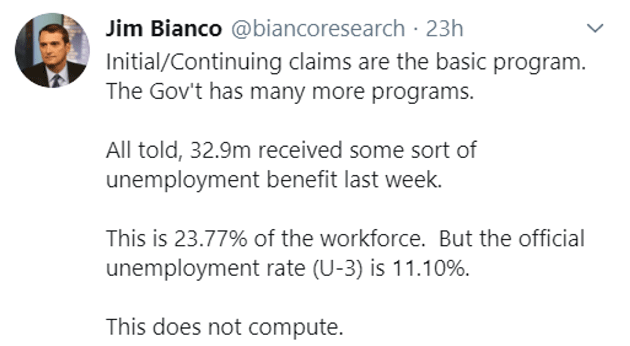

Stumble-Through Jobs Market By John Mauldin | Jul 11, 2020     Work has always been a fact of life. Paycheck-producing jobs are actually a recent development. Until the Industrial Revolution, most people lived on subsistence agriculture, sustaining themselves with whatever they could produce or working as slaves/serfs. The practice of producing something you wouldn’t personally use had been around but reached a new stage with the Industrial Revolution. It wasn’t without controversy, either. Karl Marx had major issues with it. But now we are at the other extreme. Most of us work for some form of paycheck, even the self-employed. Few subsist on their own efforts. The resulting division of labor created a complex yet highly efficient economy that has delivered more prosperity to more people than Marx thought possible. But we still need jobs, and they are growing scarcer. The same division of labor that enables so much prosperity also prevents most people from living without a job. Even retirees, politicians, and welfare recipients live off someone’s labor, if not their own. Savings, if you have any, are the result of past labor. That makes a job shortage problematic for everyone, not just the jobless. The June US employment report showed some welcome improvement. Businesses brought back many workers as parts of the country reopened. That’s great but it was only a start. We need several more months like that one and it’s not at all clear they are coming. Today we’ll look at the data, including some non-government sources. As you will see, millions of workers will stumble through this period, and they may be the lucky ones. One little-noticed effect of COVID-19 is the havoc it wrought on our employment data. Government statistics have always had their quirks, and often measure the wrong things, but the bureaucracy is at least consistent. It collects the same numbers, the same way, over and over again. Not anymore. The core problem: When is someone unemployed? Suddenly we have several new categories. Some workers were temporarily furloughed, with the employer intending (but not promising) to bring them back. Meanwhile they might or might not be collecting unemployment benefits. Others are effectively furloughed, because they aren’t working, but still on their employer’s payroll with help from the PPP program. Are they jobless or not? Then you have people who are still employed, but working for fewer hours and/or lower wages. And yet others who were never formally “employees” but independent contractors, like Uber drivers. In previous recessions they wouldn’t have received any benefits but this time, thanks to the CARES Act, they do… maybe. Some states are implementing that program slowly, if at all. Historically, the Bureau of Labor Statistics considered someone “unemployed” if they were able to work and seeking work, but not currently working. Yet now millions can work, but aren’t looking, because they expect to be called back but may not be. How do we classify them? There’s a vast difference between the numbers filing unemployment benefit claims vs. the surveys BLS conducts for the monthly employment report. And those benefit claims are also questionable, since state agencies were inundated with claims they couldn’t process. My friend Jim Bianco noted this in a tweet.

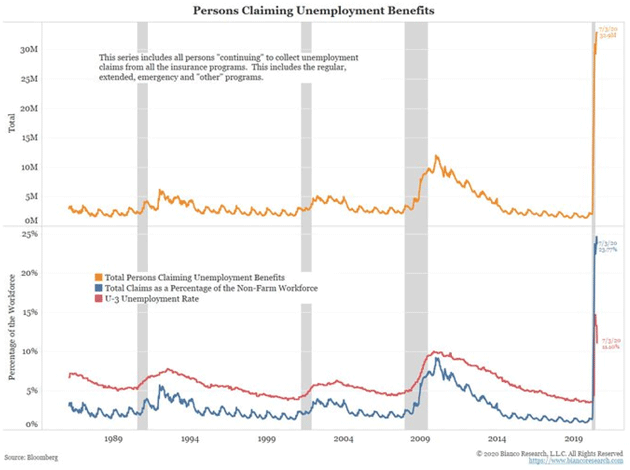

Source: Bianco Research Then there is the hard-to-measure but real question of how extra benefits have affected people’s willingness to work. If you can make more money staying home than by working, staying home is perfectly rational. But will you admit that in a government survey? All this makes assessing the situation difficult. Clearly, many businesses are closed and many workers jobless. Some will go back but some jobs will be permanently lost. That’s true in any recession. The difference now is that this one happened very suddenly, with a depth and severity unseen in 90 years, accompanied by a swift and generous fiscal response. Many people (though far from all) were made comfortable. They thought their jobs were safe and expected to go back. That means we haven’t had the kind of pain signals a situation of this magnitude would normally generate. Those signals may be coming, though. Many sources I read assume unemployment is getting better. The data says otherwise. While initial jobless claims have had a steep drop since March, they are mostly moving sideways now. This is from my friend Danielle DiMartino Booth of Quill Intelligence:

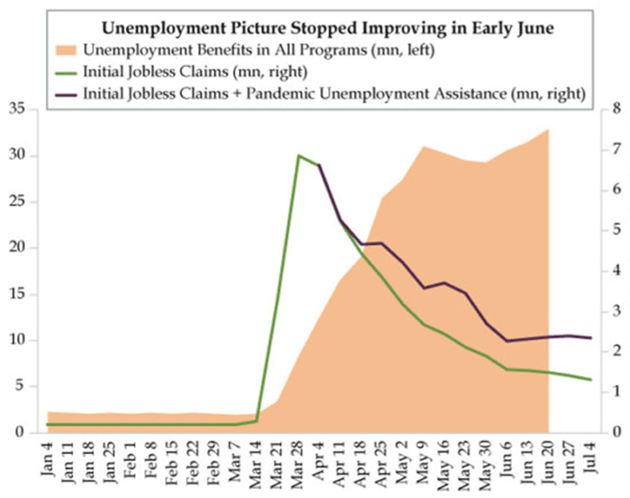

Source: Quill Intelligence Quoting: According to QI’s Dr. Gates, the winds shifted in June leaving many investors rudderless: “The layoff picture stopped improving as did the credit market’s view on default risk. The growing chorus of the 110 company bankruptcies, and counting, is behind this coordinated move.” (40-year-old, Miami-based COEX Coffee International, which traded 3 million bags of coffee per year, announced plans to liquidate yesterday making it 111). This is what happens when nonfinancial business debt hits a 74% ratio to GDP during a debt-fueled recovery. As we’re reminded by today’s Financial Times, the IMF closed out 2019 with a stern warning that 40% of $19 trillion in business debt, led by the United States, could be vulnerable if there was a “material slowdown.” You’d agree what we’re contending with today is “material.” The FT’s diplomacy stings: “The financial crisis prompted a similar discussion about excessive financial engineering, but the response in the decade since has been to increase leverage, not wind it down.” Experts’ conclusion: monkeying with balance sheets has manifested in a drag on U.S. productivity. Into this sclerotic growth, insanely levered Corporate America swam the blackest of swans. Enter stage left (graph). Much to the sell-side’s superficial splendor, Regular State initial jobless claims (green line) continue to gradually improve. Tack on initial Pandemic Unemployment Assistance (PUA) claims (purple line) and the elation ebbs. Historical comparisons, while sometimes useful, have limits because history never repeats itself precisely. That’s even more true now. The world has never seen anything remotely like this. But we still look at history for clues. Here’s a chart comparing this year’s percentage job losses with prior recessions.

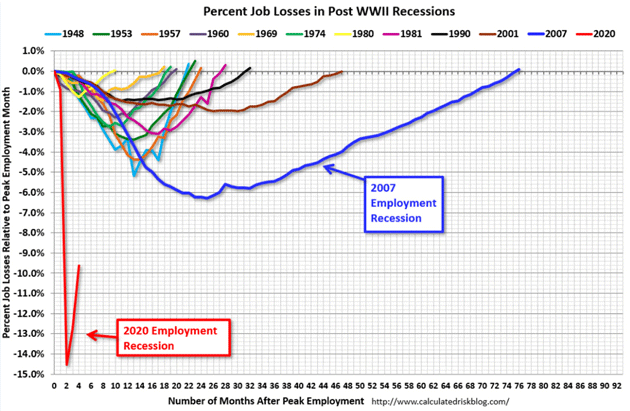

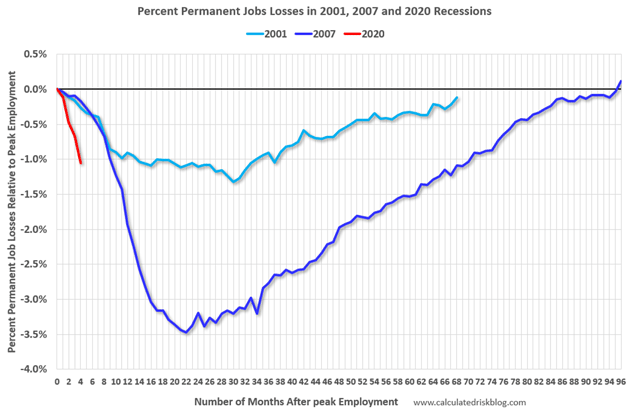

Source: Calculated Risk That bright red waterfall is where we are right now. It appears to have hit bottom and splashed a bit, but there’s a lot of white water ahead. You can see in the 2007 line how long it took employment to recover after the last recession. At that pace, all the jobs will be back sometime in 2026. (Not a typo.) To assume the “V” seen above will continue in the same direction means thinking there will be a quick return to normalcy. And maybe this time is different since at least some of the layoffs were temporary. The BLS data tries to distinguish between temporary and permanent job losses. That’s a moving target because employers don’t always know. They furlough people with the intent of bringing them back, but then find conditions don’t allow it. At some point, temporary job losses can turn into permanent ones. This chart shows how that worked in the last two recessions, and this one so far.

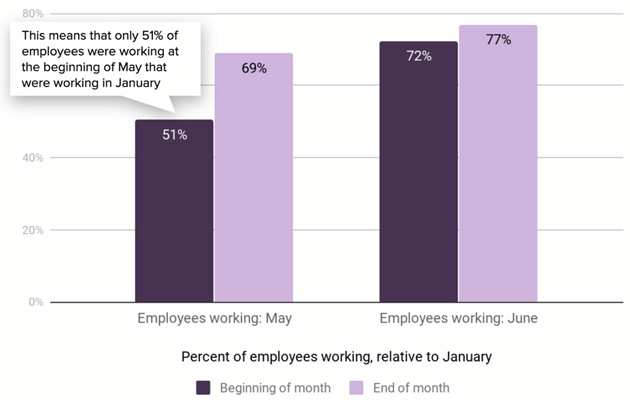

Source: Calculated Risk This time around, we have seen the same percentage of permanent job losses in 4 months that took nine months in 2007, and over a year in the 2001 recession. There is every reason to think it will get worse before getting better. And it will get better… but probably not soon. The nature and mix of occupations naturally change over time. A century or two ago, it happened pretty slowly. Industries would shrink and disappear over decades, while others arose at a similar pace. That cycle has been shrinking and this time may implode. Consumer preferences are changing before our eyes, within months. As recently as February, Americans were getting on planes and eating in restaurants without a second thought. Now many are not, and don’t intend to anytime soon. That’s a giant problem for employment in those sectors—and for everyone else who depends on spending by those workers and their families. Non-government data also suggests any jobs recovery will take time. Homebase, an online provider of employee time tracking software, has a unique and valuable real-time dataset. Aggregating its data reveals how many people are working how many hours, both by business type and geographic area. At the companies using Homebase, only 51% of the employees who were working at the beginning of January were working four months later, at the beginning of May. That’s dismal. But it improved considerably as businesses reopened, reaching 77% by the end of June.

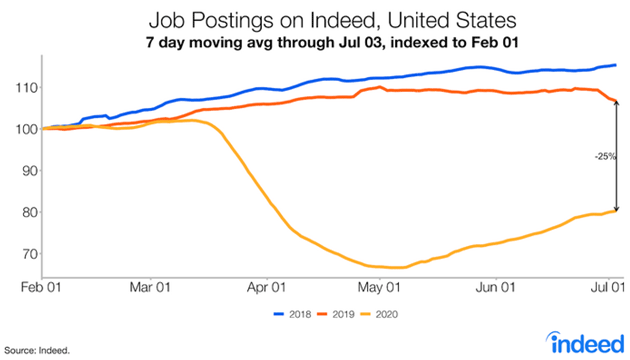

Source: Homebase That is obviously major improvement. But in absolute terms, it remains disastrous to have 23% of workers still jobless. We now know that COVID-19 cases began rising again in mid-June in many states. Did that slow the rehiring progress, or would it have slowed anyway? It’s hard to say. But the Homebase data was an early and accurate tip-off back in March, revealing a significant business slowdown even before mandatory closures. It may be doing the same this time. That’s bad news generally, and especially for the permanent job losers who need to find new work. Indeed.com, a top job search site, is a good barometer for hiring activity. Fewer job postings mean fewer job opportunities for those seeking them. And that is indeed (pun intended) what has happened.

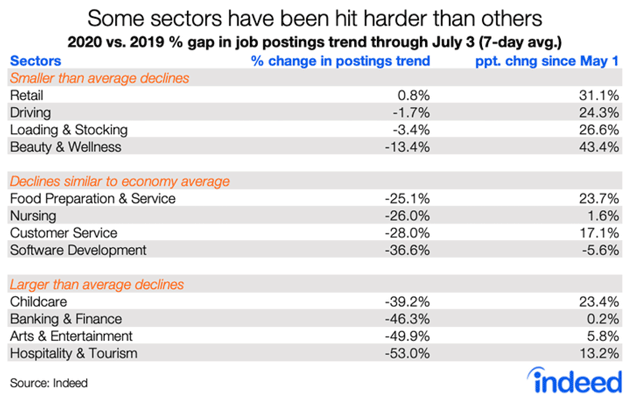

Source: Indeed Job postings collapsed in March, bottomed in early May (consistent with the Homebase data) and have been rising slowly since them. But they remain fully 25% lower than February. The kind of job openings tells us something, too. Indeed’s data shows which industries have the worst hiring non-activity.

Source: Indeed As you might expect, hospitality and tourism are at the bottom of the list. Hotels are hurting badly. The fall in banking and finance listings is a bit mysterious. I suspect it might relate to mortgages, but we know banks have been closing and consolidating branches, too. On the other end, “smaller than average declines” (since no sector was especially good) in job listings occurred in retail, driving, loading, stocking, beauty and wellness. Those may be clues about where the economy is headed. Retail, already changing rapidly, is now moving at lightspeed to online and hybrid distribution. “Order online and pick up at the store” is gaining popularity. Driving and warehouse work relates to this as well. The beauty and wellness part? Obviously, most of us need haircuts. But speculating beyond that, I wonder if the virus is making people pay more attention to their health. “Wellness” can include weight loss, nutrition, supplements, etc. So maybe we are facing our mortality a bit more seriously. That’s probably good, if people get good advice. There’s a lot of useless and even harmful wellness info floating around. Lurking around all this are deeper employment questions. First is the latest resurgence in COVID-19 cases. Governors in some large states, notably Florida and Texas, have paused or reversed some of their reopening plans. Even if it gets no worse (which is not a sure thing), it will at least temporarily put some of the recently recalled workers back on furlough, and prevent more from being rehired. Related to that, we still don’t have a good idea of how many furloughed and unemployed workers want to go back, or are even able to. Some have health concerns, for either themselves or a vulnerable family member. Others have young children who may or may not go back to school this fall. That will likely vary by location. And some who are making more from unemployment benefits than they would by working will keep doing so as long as they can. On that point, this chart came from Philippa Dunne as I was about to wrap up this letter.

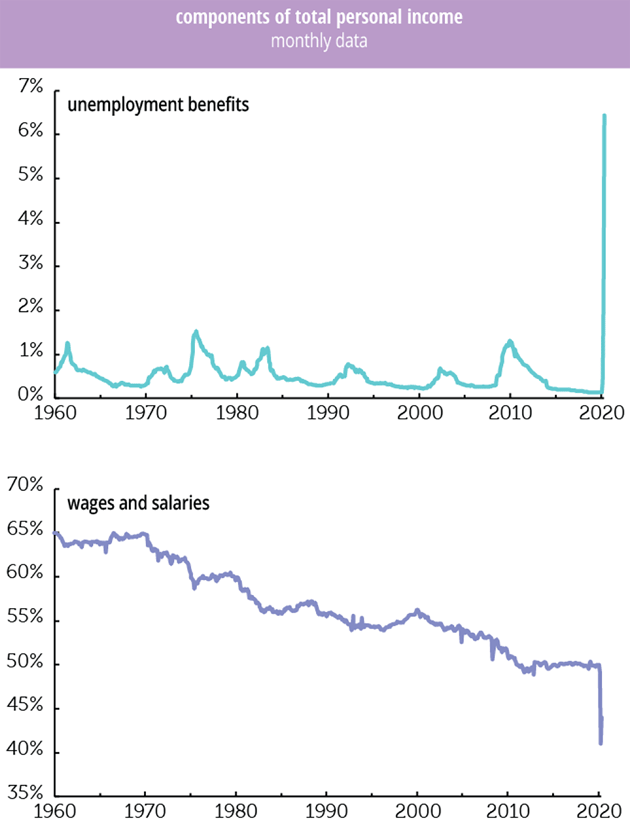

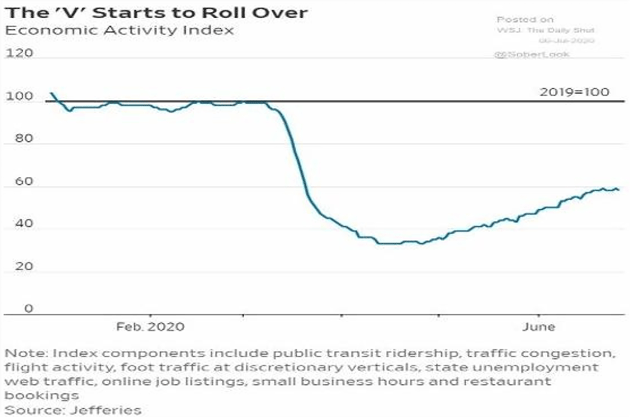

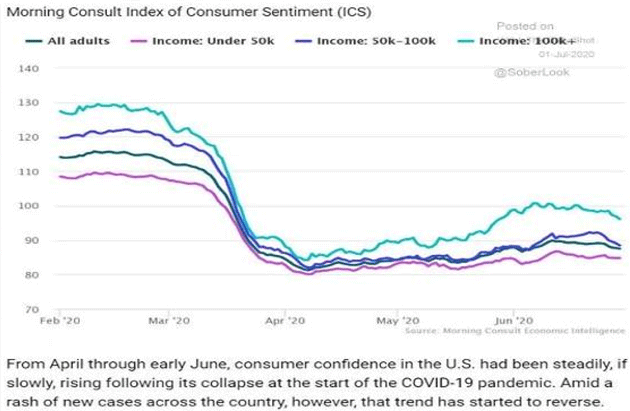

Source: TLRanalytics Unemployment benefits are skyrocketing as a percentage of personal income while wages and salaries are dropping hard. Those trends speak for themselves. All those are sticky problems with no good solutions. We will get some partial answers this month because Congress must extend, modify, or allow the enhanced unemployment benefits to expire. But we know one thing for sure: An economy with double-digit-percentage unemployment isn’t going to have a V-shaped recovery. It just can’t. Yes, some specific areas and industries might do well. But consumer spending, consumer confidence, and business capital spending will be nowhere near normal. Neither will GDP growth. And if we manage to recover from all that, we will still face a global recession and a slowdown in trade and travel. Countries that have beaten down the coronavirus are understandably not going to admit travelers from places where it is rampant. This makes international commerce difficult, at best. And you might say that’s ok because we need to be less dependent on other countries like China. I agree. But there are good ways and bad ways to make that transition, and cold-turkey isn’t a good one. Last month I retired my longtime “muddle-through” paradigm and said we are in a Stumble-Through Economy. Similarly, millions of workers are set to stumble through the next few years, looking for jobs that don’t exist, trying to gain new skills, juggling the checkbook as they try to stay afloat. Ditto for many business owners and managers. This won’t be easy for anyone. We will stumble through, but not without some deep scratches and scraped knees. One of my greatest privileges is that I can get on the phone with some of the smartest people in the investment business. Yesterday I talked with Doug Kass, who can politely be described as a veteran of trading and investing. George Soros tried to hire him back in the early ‘80s. He is a wizard. He is also a very thoughtful Democrat. I called him to basically “wargame” the next 12 to 24 months. What happens if Biden wins? What happens if Trump wins? We went back and forth on a few issues but the bottom line is the same: We are in for a very rough ride. There is no magic recovery formula no matter who controls the government. He gave me a great quote that is appropriate for our times: “We are in a major bear market of political decency.” Doug sent me one of his latest letters (and kindly let me share it with Over My Shoulder members). The two charts below show economic activity and consumer sentiment appear to be rolling over.

Source: RealMoney Quoting Doug: In aggregate terms, COVID-19 will likely have a sustained impact on the domestic economy—in reduced production and profitability—for several years, and in some industries, forever.

At the core of my concerns:

*Important Industries Gutted: Several key labor-intensive industries—education, lodging, entertainment (Broadway events, concerts, movie theatres, sporting events), restaurant, travel, retail, nonresidential real estate, etc.—face an existential threat to their core. For these industries, the damage is done as they simply cannot survive the conditions they face. For these gutted industries, we face, at best, an 80% to 85% recovery in the years to come. It should be emphasized than in the case of some of these sectors, like retail, COVID-19 sped up what was already a secular decline. Doug went on for several pages highlighting specific industries. It was not a pretty picture. Government programs and safety nets can help, but they don’t magically produce GDP and jobs. We both agreed that investors will be seriously disappointed in corporate earnings over the next two years. However, given the Fed’s money printing, the market can keep rising even as the economy rolls over. But at some point lower earnings will have a market impact. Don’t ask me when, because I don’t know. Lately I am spending more time on the phone with those who I believe have greater insight than I ever have. There is one common theme: We are in a period of great uncertainty. But I’m also talking with people who see greater opportunities. I have been liquidating some of my assets, in some size, to invest in a company I think will be gangbusters in the future. It will probably surprise you that it’s not even a biotech or anti-aging company. It is in a fairly mundane industry but I think it will turn that industry upside down with new technology. I think it is a true global powerhouse in the making. It is still private so I can’t talk about it by name, but there are many such opportunities developing. Understand, the world is not coming to an end. We are just repricing everything and trying to figure out how we move forward. But I am also making plans for what to do if my income drops more than I expect, if some of my investments don’t pan out the way I previously hoped they would. What new income opportunities are out there? Where can I cut back? Where do I need to focus? In other words, I am not merely coming up with a plan B. Given the uncertainty in the world, I am having to do my own personal wargame of plan C, D, and so on. I want to take advantage of the opportunities, just like you should, but we also all need to recognize that our worlds are going to change and be prepared to change with them. Let me end with a personal note. I tend to end my day reading on Twitter and occasionally posting. You should follow me at @johnfmauldin. I follow a very eclectic group of people, purposely including many I don’t agree with so I have a feel for the zeitgeist. So one night, this came across my iPad. A member of a NYC Community Educational Council to a colleague: “It hurts people when they see a white man bouncing a brown baby on their lap.” "I would like to know how having my friend's nephew on my lap was racist." Along with this was a picture of a young lady who was evidently holding her nephew, wondering why she would be considered racist. Okay, it was late at night. Maybe I should’ve thought about it, but I responded: OMG, what do I do? I have two black sons, two Korean twin daughters, a blonde (now bald) [all adopted], a brunette and a redhead plus a Choctaw son via Shane. I must be all kinds of racist. Silly me, I just thought I was being a father. That got a lot of positive response but a few just made me wonder what are we teaching our children? I actually had people write me and tell me that I needed to apologize to my children for my white privilege. One had advice on how I should ask their forgiveness. I haven’t told my kids about this because the response probably wouldn’t be printable. At least not in a family letter. Quite frankly, this was one of the most depressing things I’ve dealt with in a long time. I was encouraged to see the original incident condemned from all corners. Hopefully such attitudes are rare. This matters economically. We are all better off if every human can maximize their talents, without regard to race. And slowly, we are getting there. I truly believe the future will be amazing. Your thinking maybe I should work on plan E analyst,   | John Mauldin

Co-Founder, Mauldin Economics |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.    | | Share Your Thoughts on This Article | | |

|