I’ll have some thoughts on the Ukraine effects at the end of this letter. First I want to tell you about an economic analysis I thought was striking for its clarity. It also has a disturbing conclusion, even without the most recent developments in Europe.

Then, as I try to do occasionally, I want to answer some of the many questions readers send me. I get dozens every week and read them all, but I simply can’t answer everyone. I appreciate them all and I always learn something.

On with the show…

Economists talk about “recovery.” Exactly what is it?

Modern economies go through cycles, always either expanding or contracting. The “recovery” phase is the part where it makes up the gains lost during the prior recession/contraction. The last US recession was the brief but sharp COVID downturn in early 2020. It ended in April 2020 and the economy has been expanding ever since, though at a highly uneven pace.

Austin Kimson, chief economist in Bain & Company’s Macro Trends Group (headed by my friend Karen Harris), recently described the global recovery as a kind of drama in three acts.

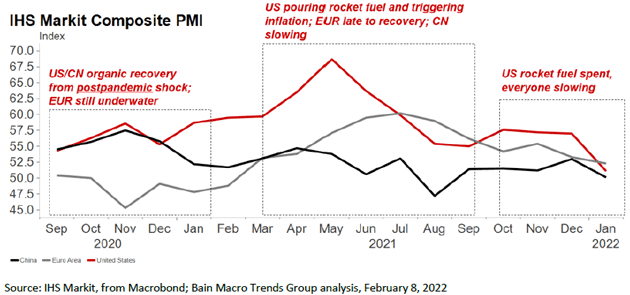

“In the first act, China and the US experienced organic recoveries from the shock of various pandemic-inspired policies. We use a beachball analogy to describe these recoveries: when you release a beachball after holding it under the water, it pops up and then settles back to the surface relatively quickly. Because Europe lagged behind China and the US in its pivot away from aggressive disease-mitigation policies, economic activity in that region remained depressed even as it popped back in China (first) and then the US.

“In the second act, US fiscal policy delivered rocket fuel to the organic recovery process, briefly producing some of the highest economic growth rates of modern times. But then high demand collided with constrained supply, leading to inflation. During this time, Europe enjoyed its own bounce-back, a delayed version of the recovery the US and China experienced in the first act, while China’s economy began to decelerate.

“In the third act, all three players seem to be aligning around shared choreography—a shuffle to a slower pace. Last week’s IHS Markit composite PMI data (for the month of January 2022) indicates the US, Chinese, and European economies are in their closest proximity to each other since January 2020.”

Source: Bain Macro Trends Group

Kimson says the third act seems to be reaching a climax, with all major economies simultaneously slowing, though not yet contracting. He sees three potential scenarios from here.

The first possibility is “substantial softening” of growth compared to 2021. If we’re lucky, it would resemble the pre-COVID period of mild but positive growth with low inflation. Unfortunately, relieving today’s very high inflationary pressure might require more than just a soft stretch. The word Kimson uses is “stagnation,” which is never pleasant to hear.

Another scenario is what he calls “continued heady growth with a side of continued heady inflation.” In my opinion, this would come about if the Federal Reserve does not lean against inflation aggressively enough. Imagine, for instance, the Fed raises rates by 75 basis points over three meetings, inflation slows (helped by year-over-year comparisons) but stays relatively high, and then the Fed shifts to quantitative tightening and defers further rate increases. It may think the economy has cooled enough and inflation will keep retreating. That all sounds good but the problem is that wage growth, while up, still lags inflation for most workers. That is not conducive to the consumer spending needed to sustain GDP growth.

The third possible outcome would be rising market instability, similar to 2001 and 2007. This would help moderate inflation but imperil growth. Given today’s crazy valuations and the activity of so many inexperienced investors, this is a real possibility. It would likely end in recession.

Kimson concludes that in all the scenarios he thinks plausible, GDP growth will take a hit and maybe a substantial one, pushing inflation out of mind.

By the way, Over My Shoulder members can read the full Bain report here . It’s a good example of the research we gather from my exclusive network, much of which isn’t otherwise available to the public. You are not getting the full Mauldin experience unless you’re reading Over My Shoulder . Click here to join me .

Now let’s get to some reader questions. We’ll start with this response to last week’s Inflation Thoughts letter. I said I preferred low inflation in order to forestall deflation.

Gordon disagreed:

“Why the aversion to deflation? I see mild sustained deflation, on the order of 1%, to reflect a healthy and positive economy. Stable monetary policy—or a hard currency—in a time of technological advances should result in the things we need and use generally falling in price, and the value of a given unit of currency gradually rising in value.

“I realize that this is anathema to the big banks and a debt-based economy, but again, just because that is what we have been manipulated into over the last century-plus doesn't make it a good thing. I would far prefer that our money be a hard currency and that debt be something that most people seek to avoid, and which is seen as a moral failing if used by individuals to live beyond their means.

“A mild sustained deflation over decades and longer would also severely discourage overspending by governments, which would be another huge plus.”

These are good points. I think we probably agree that excessive deflation and inflation are both bad. Gordon thinks a little deflation is healthy. Indeed, if we had a fixed money supply, something like a gold standard, deflation would be the natural outcome as population grew. But that’s not the world we have.

In the world as it actually is, we have gargantuan amounts of debt owed not just by households who “live beyond their means,” but also by governments. Deflation would increase that burden. Historically, overly indebted governments don’t just admit their problem and do better. They have the ability to cause other kinds of trouble, so it rarely ends well.

Gordon has a nice thought but as a practical matter, I just don’t see how we can get there.

Historical deflationary side note: In the late 1870s, new technology sharply increased farm production and prices fell. This was deflationary. However, tariffs kept prices high for many of the inputs farmers had to buy. Many went bankrupt, blaming the gold standard and bankers for charging high interest rates.

But it wasn’t just food; many prices fell in that period of panics and recessions and turmoil. It ended with the Panic of 1907, from which emerged that now-famous creature from Jekyll Island, the Federal Reserve System. And now we have the Fed back at the center of things, but we are not worried about deflation this time.

Here’s another one, inspired by my Financialized Everything letter. I described how the US dollar’s reserve currency status and our giant trade deficit keep US interest rates low. Jesse M. disagreed.

“I think your explanation of interest rates is overly simplistic at best. The US 10yr looks like a high-yield bond relative to Japanese, German, and other European issues. None of these economies benefit from having a global reserve currency and many rely on exports to drive their economies.

“Reviewing global rates there is evident regional clustering of rates, as regional trade would dictate this. There also exists the obvious differences in rates of nations reliant on foreign capital for their economic development and developed nations financing them.”

First, Jesse, I try to make these things simple without being simplistic. So let me clarify: Having the reserve currency and a large trade deficit makes US interest rates lower than they would otherwise be . That’s not necessarily lower than rates in other countries. As Jesse correctly says, US sovereign rates are actually above equivalent-maturity bonds in Europe and Japan.

I think what Jesse misses is that everything ultimately settles in dollars. Sometimes the money makes several hops on its way back to these borders, but it finally comes home. In theory there could be several reserve currencies. The problem is a currency’s value depends on its wide acceptance and liquidity, so the natural incentive is for central banks and financial institutions to gather around one agreed medium of exchange.

So it’s true the plumbing doesn’t have to work this way. In time something will replace the dollar, just as the dollar replaced the pound sterling. But it’s a slow process and until it plays out, the US will keep the “exorbitant privilege.” Which, as I noted, isn’t always a privilege.

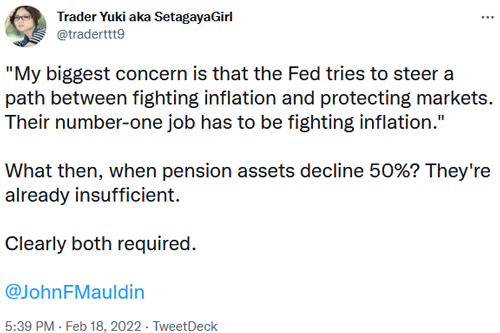

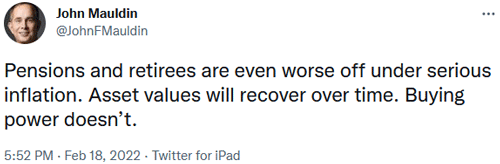

On Twitter I have a growing number of, well, “fans” may not be the right word but it is a group of regular correspondents. We have some fun back-and-forth discussions. Here’s one from a reader in Japan, taking issue with my statement the Fed should prioritize inflation over markets.

Admittedly, this is a “between a rock and a hard place” situation. Inflation isn’t good, nor are pension losses. I’ve written extensively on both problems. They’re similar in that all the options are bad. But in my view, out-of-control inflation is worse than plunging markets, for one simple reason.

The nature of retirement is that your income-generating ability can decline while your expenses rise. Some pensions have inflation adjustments, but they’re based on benchmarks which may not reflect your actual living costs. Worse, the adjustments can destabilize the plan’s long-term finances and imperil its ability to pay any benefits at all. I think that’s a much bigger problem than market losses. A well-run pension portfolio should have its assets arranged to keep benefits protected from all the longest bear markets… though it’s an open question how many really do.

I usually get on Twitter in the evening and have some fun with it before bedtime. If you don’t already, follow me and throw me a question.

Everyone wants to know what the Ukraine situation will do to the global economy. Dueling economic sanctions could certainly have an effect, but that’s not all.

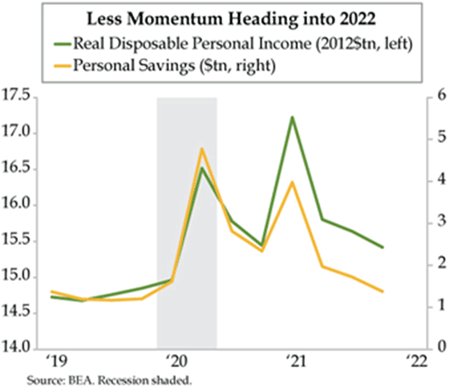

My friend Nouriel Roubini wrote that he thinks that even though Russia is just 3% of world GDP (adjusted for purchasing power), more supply chain disruptions combined with already-high inflation pressures in Europe and the US have the potential to create a stagflationary economy. While that’s not my base case, I certainly foresee a slowing economy, for the reasons I described over the past few months. Reinforcing that case visually, here’s a new chart from the Daily Feather :

Source: Quill Intelligence

We don’t have up-to-the-minute data, but you can see the trend. The two spikes in Real Disposable Personal Income and Personal Savings occurred simultaneously with the massive fiscal stimulus. As there will be no more stimulus, the trend should take us back to 2019 and likely below, as inflation affects both indicators.

So no matter what the source, I think we are in for a slowdown of material proportions—assuming the Fed follows through and fights inflation as it should. If it doesn’t, we will soon be in even worse shape.

My good friend Barry Kitt, a former hedge fund manager (who now runs Pinnacle Family Offices) is one of the best traders I personally know. He is also a collector of rare and beautiful gemstones. Going to his office is like visiting a museum. He owns some of the largest gold nuggets in the world which are on display at the Perot Museum of Natural History in Dallas. Barry recently did a YouTube interview at the museum where they actually took out the massive nuggets and described how they were found—some by accident. It’s fascinating history I know many of you will like. Watch the video here .

This may be the shortest Thoughts from the Frontline I have ever written, for two unconnected reasons. First, my wife discovered black mold over the weekend in our bedroom air conditioning. No big deal, part of living in the tropics. We scheduled repairs and moved into the downstairs guest room, where the bed is about two feet higher than I am used to. That was a problem.

I groggily woke up in the middle of the night, needing to take that necessary trip, put my foot over the bed and reached out to the floor—and kept reaching until I slipped off the bed, hitting the side of my head on the wooden frame and landing on my back. Nothing seemed broken so I eventually, if gingerly, went back to bed.

The next morning, I was moving slowly from a very stiff upper back which was not feeling good. Oddly, I had a serious black eye, but no real pain. Monday is when my editor Patrick Watson and I begin outlining the next letter. At that point, it was not clear if I would be up to normal writing so we decided to do an abbreviated letter.

As it turned out, other than looking like I got into a fight with Mike Tyson, I now feel fine. Then the other problem: serious computer problems dramatically slowed my productivity. All that combined to give you this shorter-than-usual letter. Hopefully, next week we will be back to normal.

And with that, I will hit the send button. You have a great week!

Your happy I didn’t break anything analyst,