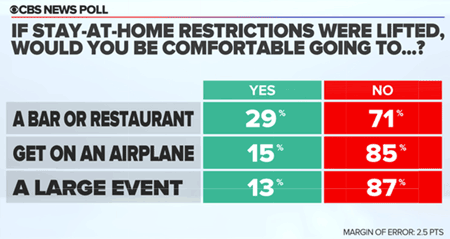

Viral Thoughts By John Mauldin | Apr 25, 2020  We are looking at a world with parameters bounded by pure imagination; where we go from here is anyone's guess. —Will Thomson and Chip Russell, Massif Capital Today’s letter will be another hop-around review of the crisis landscape. I’ll touch on several topics instead of going deep into a single theme. So much is going on, it’s really hard to know where to start. There will be something to annoy everybody. So, let’s just dive in. Actually, let’s start with some good news. I talked with Dr. Joseph Kim of Inovio yesterday. They are beginning the initial safety/immune response phase human trials of a vaccine which should show data in June, and they should be in a larger phase 2/3 trial as early as July/August. Inovio plans (but isn’t promising) to have a million vaccinations ready by year-end, and is looking for even higher capacity. Many other vaccine trials are underway around the world, too. Dr. Kim named several he was familiar with, some of which are also beginning human trials. They use different mechanisms but with the same end goal. He is hopeful some will work, saying, “Look, think of it like 71 shots on goal. The more we try the more likely we are to score.” Of those, probably 10 or so will look promising enough to draw funding. Vaccine production capacity will be key. We will need millions per week and eventually billions per year. This is a global crisis and must be treated globally. Dr. Kim thinks people will likely need multiple vaccinations, probably every other year, but we just don’t know yet. The first vaccinations should go to healthcare workers, then those providing necessary services like food, power, and so forth. Then those who are most at risk, and finally everyone else. If you want to know the future, some say to look at China. The coronavirus originated there and China was the first to impose the kind of restrictions now common elsewhere. The virus had already spread rapidly through that highly dense urban population before lockdown measures. What we see is that after 2–3 months of ruthlessly enforced lockdown, the virus receded enough to let people leave home and businesses begin reopening. The downtime created massive unemployment, disruption, and lost income that will take years to recover. Daily life is still heavily constrained, consumer spending is nowhere near what it was and will probably remain so until a vaccine is available. We don’t yet see anything that looks like a V-shaped economic recovery in China. Unfortunately, I think the US and Europe will follow a similar course. We will learn a lot in the next couple of weeks as some areas begin reopening. The key question: Can they do so without hospitalizations and deaths spiking higher? If so, maybe we can have a modified but somewhat normal summer. But there is a real risk of having to clamp down again if it doesn’t work. The economic trajectory is also uncertain but only in the sense that we don’t know how bad it will be. I am sure you’ve seen poll data like this from CBS News.

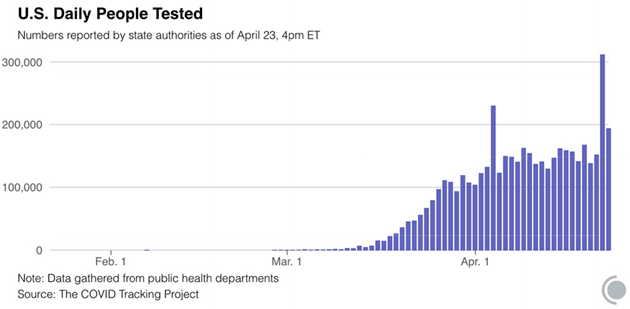

Source: CBS News There are other surveys with different timelines and activities but they all point in the same general direction. This is not going to be like turning on a light switch. Absent miraculous breakthroughs, the economic pain is only just beginning. We are going to see entire industries either wiped out or hastily transformed. I was expecting some of this anyway, but over a much longer period of time which is why my forthcoming book is called the “Age of Transformation.” Thanks to the pandemic, it is coming even faster than expected. We’ll be discussing all this in my Virtual Strategic Investment Conference, an online event we are holding on five days between May 11–21. If you ever wanted to attend the live event but couldn’t make it, this year you can get a front-row seat and never have to leave home. I am rather enjoying the challenge of reorganizing the event for this format. It opens new possibilities I hadn’t previously considered. It will clearly be the greatest lineup of speakers we have ever had. Click here to learn more and register. Everybody wants to know when the economy can reopen. In one sense, that’s the wrong question. The economy isn’t “closed.” Many essential businesses are still open. People still buy and sell things. Those sitting at home still engage in economic activity. But it is of a different nature, and the change creates costs. So what we’re really asking is when the previously normal economy will be back. The answer is “never,” I’m afraid. We will return to something quite different and as yet unknown. According to Danielle DiMartino Booth’s Quill Intelligence, less than 3% of US counties account for half of GDP and 61% of COVID-19 cases. Until these densely populated counties can reopen, economic activity will be lackluster which drags on consumption. The urban areas will be the hardest to bring back online. But without them, we can’t approach anything that looks like “normal.” As for when this can happen, we actually have a plan. On April 16, President Trump announced his guidelines for “Opening Up America Again.” These are recommendation to governors, who may choose different paths, but the plan seems sensible. It envisions three phases, and each state would move through them based on 14-day periods of declining cases and adequate hospital capacity. You may think Trump’s plan is too relaxed or too strict, but it is at least relatively objective. It gives us targets to meet and recognizes local differences. Best of all, the phased approach should boost public confidence that the danger is easing—and that is critical to bringing the economy out of deep-freeze. I get the resentment some feel toward being kept from work, but lockdown orders aren’t the only barrier. Businesses won’t reopen and put employees back on the payroll unless customers feel they can return safely, and the poll data shown above says they mostly don’t. All this will take time. There’s no way around it. The measures we are presently taking have successfully “flattened the curve” nationally (local areas vary). We have to reopen without letting it shoot higher again. We also have to protect vulnerable people—the elderly and those with underlying health conditions. Doing all this at once will be a giant juggling act, but I believe we can do it. I think most of the US can be in phase 3 by the end of May if we do this right. If we don’t do it right? Good-bye, summer, and hello to a recession that lasts much longer than it otherwise would. I am privileged to be in an email group (courtesy of Dr. Mike Roizen) that is helping provide counsel for state governments. The suggestions they make are somewhat similar to Trump’s, but with a lot more detail. They break the population into five groups based on risk factors like age, and health condition. For instance, Group 1 is under age 50. Group 2 would be 50 – 65 without body mass indexes of greater than 39. Group 3 would be those with BMI over 39. (About 3% of Ohio, as an example.) All those over age 80 and those age 65 to 80 with one or more serious comorbidities (hypertension, obesity, type2 diabetes, chronic lung disease, immune dysfunction, kidney disease requiring dialysis, increased clotting disorders) are in Group 5 (about 3.5% of population and 55% of deaths). The recommendation is to offer some type of financial inducement for higher-risk groups to stay home until there is adequate testing of the total community. If we do something like this, they estimate that 80% of the working population can be released initially, and another 10% in phase 2, and then everyone when adequate testing and a vaccine are available. Testing is key to any reopening plan. Most of the experts think the US needs to be testing at least 500,000 people a day to truly get the pandemic under control. We are just starting to get into the neighborhood of 200,000 on average for the last few days. We need to at least triple that number. And then double it again. And then double that again. And again. We know private labs have plenty of capacity. We trust them to test us for everything else. Get them working…

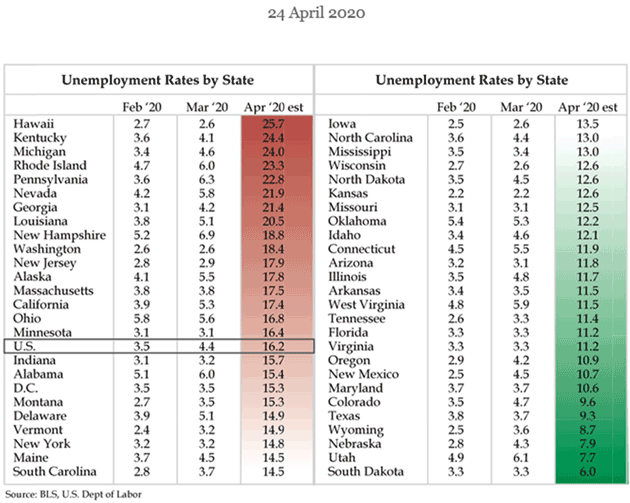

Source: COVID Tracking Project The tests and labs are not the only constraints here. Paraphrasing the old proverb, “For lack of a swab, the test wasn’t done.” Ditto for supplies like gloves and other protective equipment for health workers. We need to get every component, in adequate quantity, in the right places at the right times. Our initial inability to do that let the virus grow far faster in the US than it did in places with extensive testing, like South Korea and New Zealand. I can’t stress enough how important this is. Widespread, reliable testing will help generate the confidence we need to get the economy moving again. Not enough testing will mean less confidence and slower recovery. As I’ve been saying the last four weeks, without intervention we face the certainty of a massive deflationary depression. The Fed is leaning against this in unprecedented ways while the government tries to replace the lost income for businesses and individuals. This is not what we normally think of as “stimulus.” It is not intended to boost economic activity but simply replace a lost portion of it. The hope is to reopen the economy soon enough for recovery to take place on its own. I think this will take 2+ years, and we won’t see anything like a V-shaped recovery this year. I sadly think that we will need even more rather large government spending. It will almost certainly be needed before the election, and quite likely before Congress breaks for the summer so that those checks and other help arrive in time for the elections. This is a bipartisan “need” for politicians. Furthermore, although it offends every philosophical sense of right and wrong I hold dear, I understand why the Fed is intervening in the junk bond market to keep some zombie companies from going under. These companies represent jobs and the task right now, at least as the Fed sees it, is to prevent a major recession from becoming a depression. Clearly that is going to help some companies but not all. (Bloomberg)—More than 10% of US collateralized loan obligations are now at risk of cutting off cash payments to holders of their riskiest portions amid a surge in downgrades among leveraged loans backing the securities, according to analysts at Nomura Holdings, Inc. (H/T Mark Grant) Essentially, many of the loans the Fed was trying to help are going to be downgraded anyway. The Fed’s action simply kept the price up, but did not increase the companies’ ability to actually service their debt. So many of the zombie companies will fail anyway. But is all this Federal Reserve buying (NOT money printing) going to cause inflation down the road? Let’s turn to Dr. Lacy Hunt’s latest Hoisington Investment Management letter (emphasis mine): Recent articles have suggested that the Federal Reserve and the Department of the Treasury are engaged in Modern Monetary Theory (MMT) or some form of “helicopter money,” the famous Milton Friedman phrase also referred to by Ben Bernanke. The inference is that once the virus is contained, these new efforts will yield different and more powerful economic and inflation results than did the Quantitative Easing periods following the 2008–09 Global Financial Crisis (GFC). Further, the suggestion is that the fiscal policy actions taken this year totaling $2.7 trillion will be far more effective than the $2 trillion stimulus package of 2009. Are these assertions that MMT is in place and monetary and fiscal actions will spur economic and inflation rates higher true? The short answer is no. …For the Fed to engage in true MMT, a major regulatory change to the Federal Reserve Acts would be necessary: The Fed’s liabilities would need to be made legal tender. Having the Treasury sell securities directly to the Fed could do this; the Treasury’s deposits would be credited and then the Treasury would write checks against these deposits. In this case, the Fed would, in essence, write checks to pay the obligations of the Treasury. If this change is enacted, rising inflation would ensue and the entire international monetary system would be severely destabilized and the US banking system would be irrelevant. Many cases of making a central bank’s liabilities legal tender or its equivalent have occurred historically—China in the 1930s, Germany in the 1920s, Yugoslavia and Hungary immediately after WWII as well as multiple cases in Latin America. Inflation in these circumstances was so burdensome that economic conditions became horrific and serious political ruptures occurred. As these cases remind us, money printing would in the final analysis be an attempt to improve the economy by destroying its very basic foundations. Note that Lacy is well aware that inflation and indeed hyper-inflation are possible under the right conditions. The Federal Reserve act would have to be changed. Dr. Woody Brock in his latest writings pointed out that it was the rise of the service economy from 25% of the workforce in 1910 to 86% of the workforce today that produced the stability we have seen in the business cycle. (The instabilities were due to leverage, especially from low interest rates and the financialization of the economy. These were an enormous monetary and regulatory policy mistake.) The shock we are experiencing today is unlike anything we have seen in the past. We are simply seeing the service sector implode and we have no idea how long it will take to come back. As the quote at the beginning of the letter said, we are living in a world bounded only by our imaginations. Here are two predictions, the first from Danielle DiMartino Booth at Quill Intelligence and the second from Mike (Mish) Shedlock.

Source: Quill Intelligence Quoting Quill: Extrapolating the data for the last five weeks indicates U3 unemployment rate for April payrolls should be around 16.2%; risk is to the upside surprise for the unemployment rate as some densely populated states’ unemployment rates are lower than what would be expected Mike Shedlock offered another analysis. You can see his math and methodology as to how he comes up with his numbers at the website. Based on 26 Million Claims, What's the Unemployment Rate? My comfort range is 17–25% with an expectation of 20–24%. A U-6 rate well into the 30% range is likely in any case. (“U-6” is a broader unemployment rate that includes “involuntary part-time workers” who took those jobs but really want to work full-time.) In a late-night conversation with Mish, we both agreed that the May number will be even higher, because unemployment will still be rising into their data collection, which is whatever day includes the 12th of the month. Depending on how fast the economy opens up, and how fast the large urban areas can begin to function, a 25% unemployment rate for a short period of time is quite possible. That is just ugly. There is so much else I could talk about. Literally I could do another letter this size just from the data that is screaming to get on this page. But it is time to begin to close. But first, this quick notice. I think this pandemic is accelerating the timeline for what I call The Great Reset, when we will have to rationalize global debt. My friends at CMG and I are redoing a paper on that along with some other COVID-19-related items. You can see these and more by visiting the CMG website. You can also learn how my team at CMG is helping clients navigate the current investing environment. I am proud of how our team has been working together to help clients just like you. It is impolite to complain when you are quarantined in paradise, but I have taken more long walks on the beach in the last 40 days than I have in my entire life. I prefer to get on a treadmill where I can read on my iPad, and then go to the various machines and weights and try to stay in shape. I am 70 (so in that vulnerable age range), and am slowly gaining weight. My wife has started online workouts with The Beast back in Dallas. With her complaining how sore she is, I have agreed to start tomorrow. We really do have no idea when the gym will open and for what groups. I try to work out at home, but it is not the same. I look at the surveys about when people will venture out to do what (restaurants, shopping, air travel, hotels, etc.). I will admit that it might be a while before I get on a plane. We’ll see. But I’ll definitely be back in the gym the first day it opens. Wearing gloves and a mask, of course, but I need to feel Brother Iron and Sister Steel in my hands. I will never take them for granted again. It is time to hit the send button. You have a great week! Your needing to do more push-ups analyst,   | John Mauldin

Co-Founder, Mauldin Economics |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.    | | Share Your Thoughts on This Article | | |

|