Here’s what we know: Inflation is rising, growth is weakening, and the Fed is tightening. All these seem likely to persist, though to varying degrees and with occasional breaks. That means recession is coming, if not already here.

“In 1998, MIT economist Rudi Dornbusch observed that ‘none of the post-war expansions died of natural causes, they were all murdered by the Fed.’ The motive for this murder is usually to save the economy from incipient inflation by killing the economy.”

(That’s from a new research paper we will discuss today.)

As I noted last week, this will be A Weird Recession. The post-2008 expansion phase was unusually long and unusually weak. It ended not because the economy overheated but because COVID triggered the unusually deep yet brief 2020 recession.

Now we have other elements, like a war raising global food and energy prices and re-ordering geopolitical relationships, supply chains, a stressed labor market, etc. Not to mention a more dramatically inverted yield curve.

Today we’ll explore some of the factors in this recession (or whatever you want to call it). This will be a deeper dive into the issues I raised last week. We have more challenges and mysteries than I can describe in a single letter.

The most obvious weirdness factor going into this recession is the still-strong employment data. Employers are hiring people faster than they are firing them, and many wish they could hire more. That doesn’t square with recessionary conditions.

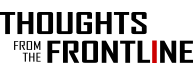

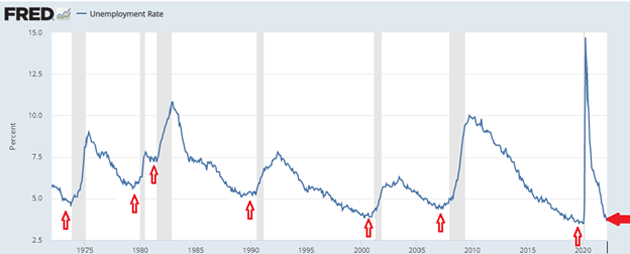

This may be because the recession is still young. A reader sent me this chart in response to last week’s letter. It shows the unemployment rate with arrows pointing out a bottom just ahead of each recession (the shaded areas).

Source: Richard Vesel

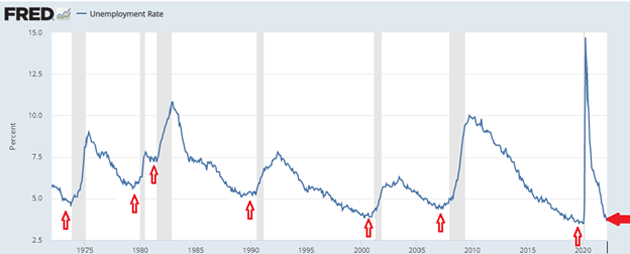

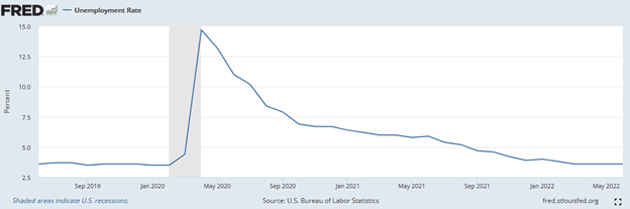

Richard said in his note, “Low unemployment and frenetic activity ARE precursors to recession: they are evidence of an overheated economy, and inflation is one additional, although not necessary, symptom.” A fair point. Higher unemployment may be coming but it’s not here yet. Here is the same data, zoomed in to show the last four years.

Source: FRED

The market was expecting July job growth of 250,000. It got 528,000 plus another 28,000 in positive revisions for prior months. The labor force shrank slightly, helping the top-line unemployment rate drop to 3.5%, matching the 2019 low which was the lowest since the 1950s. While wages rose, participation rates dropped in the especially critical 25–54 age category.

This doesn’t seem like recession, at least not yet, but the two don’t always coincide. Remember the period after 2009. We spent years talking about a “jobless recovery.” The economy was growing, albeit slowly, without the kind of job growth you would normally expect.

If a jobless recovery is possible, maybe the opposite is too: A GDP recession without high unemployment. I’m leery of comparisons to past recessions because the demographic picture has changed. In 2008, the oldest Baby Boomers still hadn’t reached age 65. Now, most have, or are close to it, and some retired early due to COVID concerns. Subsequent generations aren’t big enough to fill the gap, hence the labor shortage that is keeping unemployment low. That could persist even with weaker business activity and consumer spending.

Some estimates show “Long Covid” could be keeping as many as 4 million workers sidelined. Between retirement, Long Covid, less labor force participation, etc. it is entirely possible that unemployment won’t resemble past recessions.

Having said that, I’m sure we will see some increase in unemployment. It may just be concentrated in a few sectors rather than spread across the economy. Fed policy is already affecting the homebuilding industry, for example, and will probably keep doing so. Higher mortgage rates in an already expensive market will price out many prospective buyers, meaning less demand for construction workers, mortgage brokers, furniture delivery drivers, and related jobs.

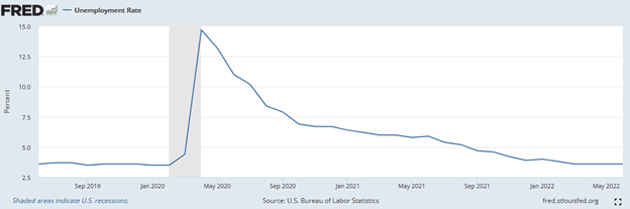

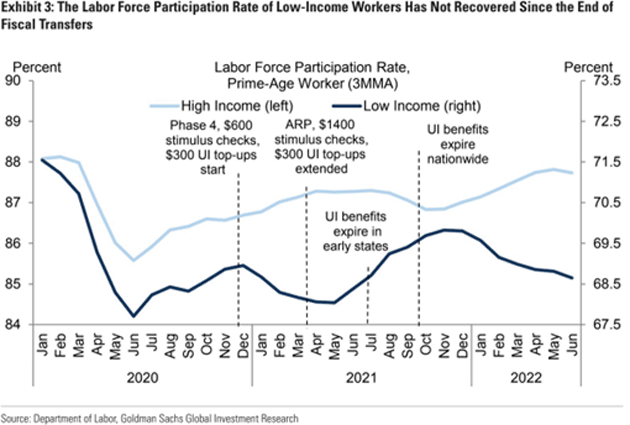

This may lead some people who had left the labor force to re-enter, which would help raise the unemployment rate. I’m skeptical because we have been expecting for a year now to see the end of COVID benefits force people back to work. It hasn’t happened. Goldman Sachs made this handy chart combining the prime-age participation rate with the dates benefits went away.

Source: Lydia DePillis

They split the data by income, and it shows lower-income prime-age workers left the workforce even faster after enhanced benefits ended. Where are they going and how are they surviving? I don’t know but it’s an important question.

Finally, let’s note that scarce labor, manifested as low unemployment, can be a recessionary factor in itself. Labor-intensive businesses that can’t find labor (think restaurants) face limits in how much revenue they can generate. At some point, they may close. Many are already reducing hours in a kind of partial closure. This trickles through the economy.

Energy prices are a second confounding recession factor. Indeed, the February/March energy pop arguably triggered the current conditions. Energy inflation was brewing months earlier, particularly in Europe, but the Ukraine war sent it into overdrive. And, because all economic activity requires energy, it’s having a recessionary effect.

It’s important to consider the energy pain as distinct from the monetary pain. The latter is a response to the former. Energy helped trigger inflation, to which the Fed responded with higher interest rates. It’s trying to control inflation by reducing demand.

But the higher energy prices themselves should have reduced demand more than what is happening. That’s another oddity I think we don’t fully understand. Prices have fallen recently but are still what we would have considered high a few years ago.

Worldwide production ex-US is basically flat since 2014 with the increase coming from the US. Think Russian production is going to increase without Schlumberger and Halliburton helping? I don’t either.

Demand is going to increase as the population rises. We need energy. The Fed raising rates can crush demand but will also crush drilling and supply. Oil production is cash intensive. Rates matter.

European governments are running full speed to reduce their dependence on Russian oil, coal, and natural gas. For many, this is an embarrassing turnaround, but they are finally admitting reality. Like the US, Europe needs a large, dependable energy base that, at least for now, can only come from fossil fuels. They used to get it from Russia. That deal is ending, and the transition out of it will be rough. It could easily trigger major recessions in the EU and UK, which would affect the US.

Another question is why energy producers aren’t producing more. The industry has always had a boom-bust cycle. Most recently, the fracking boom and then COVID sent prices far lower than many thought possible. The resulting near-death experiences convinced many energy executives to not assume another boom was coming. Add in government regulations and a rapid shift toward renewable energy sources, the ESG movement and all the incentives are to just pump all you can from existing wells and not make risky investments in a highly uncertain future.

US gasoline prices dropped in recent weeks, due in part to the government releasing crude oil from its Strategic Petroleum Reserve. The reserve isn’t unlimited, though. Eventually it needs refilling, so the current releases really represent more demand in the future.

That could be an opportunity, though. On July 26, the Biden administration announced a wonky-sounding but potentially important SPR policy change:

“Under current regulations, the Department [of Energy] can enter into contracts for future delivery, but the price paid reflects prices at the time that product is delivered. By instead allowing for the price to be fixed at the time the transaction is executed between the parties, this regulatory change would provide greater certainty to producers regarding the revenues they could expect to generate if they produce more crude oil in the short-term, knowing that the Department has contracted to purchase these barrels at a previously agreed-upon price to replenish reserves.”

Basically, they’re saying the government will refill the SPR in future years at pre-negotiated fixed prices. That’s one of the missing pieces in getting oil and gas companies to produce more. They need confidence in future prices before investing in future production.

So, for example, the federal government could offer to buy X billion barrels of oil for the SPR to be delivered in 2024–2030 at $80 a barrel, guaranteed by contract. That might generate enough new supply to stabilize market prices. The companies would earn nice profits and the economy would benefit. (One problem would be: Who gets that nice juicy contract?)

Is that government intervention? Absolutely. It could go badly wrong, too. But it’s not conceptually different from the USDA’s crop price guarantee programs. Those aren’t ideal but they do help ensure an adequate supply of critical resources.

| Learn How to Build “The Portfolio All Investors Should Have.” In this time-sensitive training, we show you why it’s important to have an elementary, foundational knowledge of this straightforward and easy-to-understand asset class—BONDS. Click here to learn more. (From Our Partners.) |

I’ve told the “What Is Water?” story before. Fish aren’t really aware of water; it’s just this thing in which they exist. They can’t conceive of anything else.

Economic eras are kind of the same way. After World War II, the Bretton Woods agreement produced a sharply different kind of “water” for the world economy. It worked for a while but eventually broke down. We’ve had something else for the last few decades.

Credit Suisse strategist Zoltan Pozsar posted a fascinating research note last week, suggesting we are entering an entirely different era, one in which central banks are increasingly irrelevant to much larger forces.

Larger forces than central banks? Yes. One new era began in the early 1990s, giving us globalization, low interest rates, and persistently low inflation. All that is now ending. Here are some excerpts from Zoltan (emphasis mine).

“The low inflation world stood on three pillars: first, cheap immigrant labor keeping service sector wages stagnant in the US; second, cheap goods from China raising living standards amid stagnant wages; third, cheap Russian gas powering German industry and the EU more broadly.

“US consumers were soaking up all the cheap stuff the world had to offer: the asset rich, benefiting from decades of QE, bought high-end stuff from Europe produced using cheap Russian gas, and lower-income households bought all the cheap stuff coming from China. All this worked for decades until nativism, protectionism and geopolitics destabilized the low inflation world…

“Central banks went from waging a war against deflationary impulses coming from the globalization of cheap resources (labor, goods and commodities) to ‘cleaning up’ the inflationary impulses coming from a complex economic war.

“Think of the economic war between the US, China, and Russia as something that will weaken the pillars of the globalized, low inflation world described above – the process will be slow, not sudden, but it will be certain, where ongoing economic ‘tits’ for ‘tats’ will have the potential to drive more and more inflation.

“Think of the economic war as a fight between the consumer-driven West, where the level of demand has been maximized, and the production-driven East, where the level of supply has been maximized to meet the needs of the West… until East-West relations soured, and supply snapped back…

“ The unfolding economic war between great powers is stochastic and not linear, and what inflation will do in the future depends not only on the shocks that occurred in the recent past, but also on the many shocks that can happen still. These include more sanctions and the further weaponization of commodities, and more technology sanctions and further supply chain issues for cheap goods.

“Getting right where inflation goes from here is basically a matter of perspective; do you see inflation as cyclical (a messy re-opening after COVID, exacerbated by excessive stimulus) or structural (a messy transition to a multipolar world order, where two great powers are challenging the might and hegemony of the US). If the former, inflation has peaked. If the latter, inflation has barely started.”

To be clear, Zoltan isn’t saying structural inflation is certain. He sees a notable risk that inflation will stay higher for longer due to the ongoing economic warfare he describes—a risk for which investors should prepare.

Reading that in combination with both energy and labor markets where supply can’t keep up with demand, it is increasingly hard to see a return to the pre-COVID low-inflation regime. It has more likely ratcheted higher and will remain so until the forces of deflation weigh in (and they will!). How much higher will vary. We may well see lower US inflation as the Fed’s tightening efforts bring on recession. But if the structural forces don’t change, inflation will return.

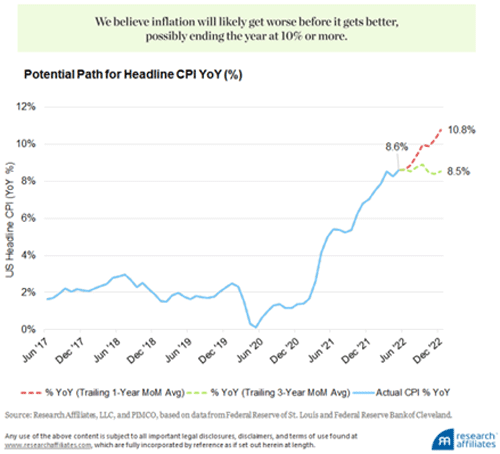

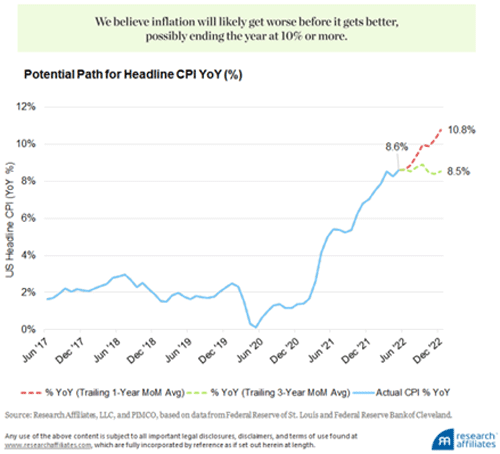

My friends Robert Arnott (founder of Research Affiliates) and Campbell Harvey (of Duke University) have a new paper titled “ No Excuses: Plan Now for Recession.” Rob contends inflation will be high, if not higher, at the end of the year. I have learned over our 20 years of friendship to be very careful disagreeing with him. He is extraordinarily careful and precise. Here’s an excerpt:

“… The near-term prognosis for inflation is not good. Each month’s 12-month inflation rate matches the previous month’s inflation rate, plus a new month, minus the corresponding month dropped from the previous year. We can’t know with any confidence what the new month’s rate will be, but we know with precision the rate of the month being dropped. The next four months to be dropped from 2021 will be 0.9%, 0.5%, 0.2%, and 0.3%, respectively. The Cleveland Fed produces an “inflation nowcast” which estimates what the monthly inflation would be if the month ended today. If their nowcast is correct, the 0.9% from June 2021 will be replaced with 1.0% for June 2022. If inflation in each subsequent month through year-end 2022 matches the average inflation rate over the prior 12 months, we should finish the summer at 9.9% and finish the year at 10.8%. If, alternatively, monthly inflation recedes to match the trailing 36-month average, then the current 8.6% inflation rate would remain steady through year-end. This simple analysis leads us to believe that inflation will likely get worse before it gets better.

Source: Rob Arnott

“… There’s another problem with the way CPI inflation is calculated. The largest component, shelter, is one-third of the total and is smoothed and lagged. According to the Bureau of Labor Statistics (BLS), their chosen measure for the cost of home ownership, owners’ equivalent rent (OER), is up 7.3% in the last two years, while the S&P/Case-Shiller Home Price Index shows that US home prices have risen by 37% in the two years ended March. The BLS switched to OER after the last inflationary surge in 1979–81; indeed, if inflation was calculated today like it was in 1981, we would already be solidly into double digits. Similarly, the BLS estimate of rental prices, rent of primary residence (RPR), is up a near-identical 7.1% in the last two years, while the CoreLogic Single-Family Rent Index is up twice that in the last year alone (and an astounding 41% in Miami!). The BLS uses survey data to gauge shelter inflation. Homeowners’ perceptions of their property rental values anchor on the past and only respond to soaring home prices slowly, gradually, and over several years. The one-third of CPI for shelter will be playing catch-up for some years to come. Empirically, most of that catch-up occurs over the subsequent two to three years. Note that this inflation has already happened; it simply hasn’t made its way into CPI quite yet.”

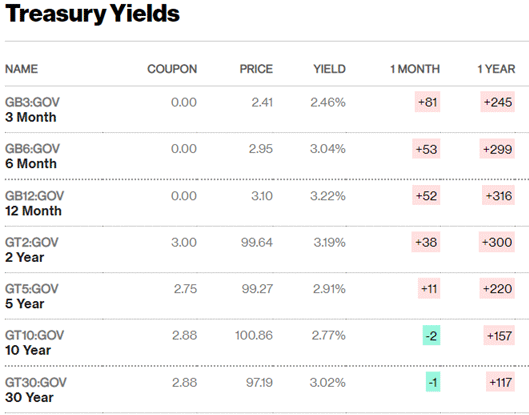

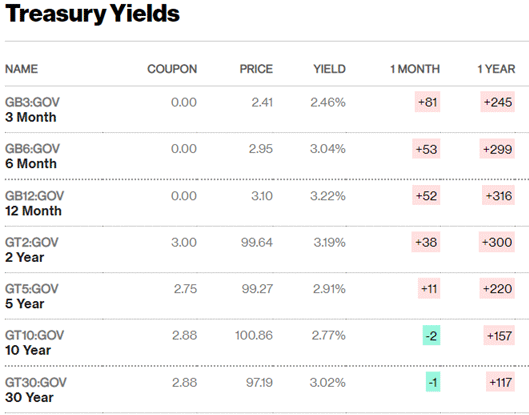

I have probably written more on the yield curve and recessions than any single topic over the last 23 years. A yield curve inverted as deeply as today’s is as close to guaranteed recession as it gets.

I am sure my friend Dr. Campbell Harvey, who wrote the first paper on inverted yield curves in recessions back in 1996, might be able to find a similar time, but today we are inverted from six months to 30 years. The 2-year/10-year curve is inverted a significantly deep 42 basis points.

Inverted yield curves are tricky, but the deeper they are and the longer they persist, the higher recession odds rise.

Source: Bloomberg

If we get another strong employment report in August, with 8%–9% annual inflation, will the Fed have any choice other than to hike 75 points? That won’t make the yield curve any less inverted.

As I wrote long ago, the Fed has painted itself into a corner it can’t escape. Failing to fight inflation will mean That 70s Show all over again.

If Rob and Harvey are right, and rates are still well above 8% at yearend, the Fed will be raising rates more than the markets are currently predicting. What will it take to crush demand? A 4% fed funds rate? 5%? I don’t know but we are going to find out. Otherwise, the Fed will lose all its credibility against inflation.

That adds up to a tough investment outlook for the coming years, but don’t despair. We’ll still have opportunities; they’ll just be different ones.

While I don’t welcome inflation, I do welcome a challenge. We are being handed a big one.

As noted last week, I will be at the Cleveland Clinic for four days then in British Columbia salmon fishing at the end of the month. Then a likely trip to Dallas.

Big changes coming to my world. But for now, the letter is too long, so time to hit the send button and for Shane and me to wish you a great week. We have a world-class masseuse visiting us, so I know we will! And don’t forget to follow me on Twitter!

Your looking forward to getting loose analyst,