| After two quarters of contraction, the American economy started growing again, news the White House quickly hailed as evidence still-strong consumer spending and wildly low unemployment are pushing the US through to the other side. Those partial to the looming recession-school however remain convinced a downturn is still in the cards, just not right away. To be sure, economists point to how the 2.6% increase in GDP in the third quarter had more to do with rising exports than anything else. But the Commerce Department report also revealed that one measure of inflation fell in recent months. No matter how you slice it—recession avoided, recession still coming, recession avoided and still coming—it’s a very strange economic situation. Consumer prices are still climbing, household spending is under pressure and surging mortgages rates are cooling the housing market as unemployment sits at a five-decade low. Meanwhile, major companies are sending conflicting earnings messages, leaving the stock market confused. “It’s nice to see a positive GDP number, but I don’t think we’re in the clear yet,” said Brittany Brinckerhoff, financial advisor at Hilltop Wealth Advisors. “With inflation still high, the Fed is still positioned to keep raising interest rates and it’s likely we’ll see economic growth continue to slow as a side effect from that.” The push and pull of changing numbers could also mean the Fed, in its fight to lower inflation without cratering the economy, may be closer to threading the needle in its bid for that mythical “soft landing.” —David E. Rovella Vladimir Putin seemed to change his tune on Thursday, saying Russia didn’t “need” to use nuclear weapons against Ukraine. But in the past, he’s rattled his nuclear saber and, more recently, triggered concern he might consider detonating a radioactive “dirty bomb” in Ukraine. The Pentagon appears to have taken all of that behavior to heart, from Kremlin threats to Russia’s actual killing of potentially tens of thousands of Ukrainians. The US military’s new National Defense Strategy rejected limits on American use of nuclear weapons long championed by arms control advocates and, in the past, President Joe Biden. Citing an acute threat from what it sees as a declining Russia, and a long-term threat from a rising China, the Defense Department said Thursday that “by the 2030s the United States will, for the first time in its history face two major nuclear powers as strategic competitors and potential adversaries.” In response, the US will “maintain a very high bar for nuclear employment” without ruling out using the weapons in retaliation to a non-nuclear strategic threat to US territory, US forces abroad or allies.  A Trident II missile is launched from an Ohio-class US nuclear submarine. The Pentagon has backed away from a “no first use” doctrine when it comes to using atomic weapons. Source: Getty Images/Hulton Archive Elon Musk has changed his story, too. In his case, the turnabout relates to a reported promise to fire 75% of Twitter’s employees when he closes a deal (which he tried to back out of) to buy the social media platform. The bow could be tied on the purchase as soon as tomorrow. Musk has sent engineers from Tesla to meet with product leaders at Twitter, moving swiftly to make a mark on the company he’s about to take private.  Elon Musk Photographer: Patrick Pleul/AFP Amazon projected sluggish sales for the holiday quarter as the e-commerce giant contends with slower growth and consumers cutting spending in the face of economic uncertainty. Shares fell almost 20%. Egypt’s pound dived after the nation’s central bank said it was moving to a more flexible currency regime in an overhaul of policies that helped the government secure a deal with the International Monetary Fund. The pound depreciated 15% to a record low of 23.09 against the dollar. Embattled Swiss bank Credit Suisse revealed the most dramatic steps yet in its latest restructuring: raising billions of dollars, firing thousands of employees and carving out its investment bank. The overhaul is an urgent attempt to restore credibility after a succession of big losses and management chaos shattered its reputation as one of Europe’s most prestigious lenders. Investors, looking at combined charges of about $6.6 billion and the dilution effect of planned share sales, sent the bank’s stock hurtling downward as much as 16%. Speaking of nosedives, Mark Zuckerberg’s fortune plunged by $11 billion after Facebook-parent Meta reported a second-straight quarter of disappointing earnings. That means Zuckerberg has lost more than $100 billion in just 13 months.  Mark Zuckerberg Photographer: Drew Angerer/Getty Images North America Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. - Meta’s $676 billion shellacking boots it from world’s top 20 stocks.

- Taiwan’s economy faces growing risk as demand for exports slows.

- Before a possible Biden meeting, Xi takes a conciliatory tone.

- Bloomberg Opinion: Russia is set to lose the energy war it started.

- Daughter of Putin’s mentor flees Russia amid criminal case.

- Apple slips after iPhone and services revenue come up short.

- Pork supplies are at a record high—and that means the McRib is back.

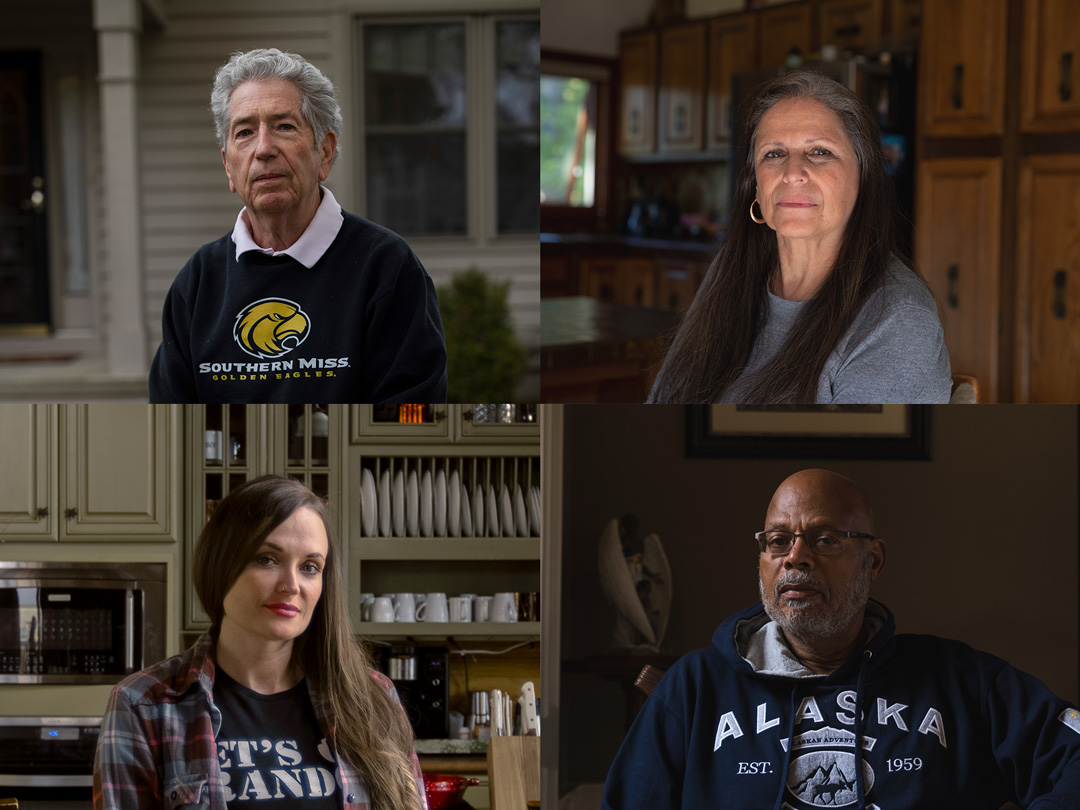

Back in March, the US middle class hit a milestone: its average net wealth was the highest ever at $393,000. All things considered, this once-in-a-generation boom means the middle class is actually faring pretty well — at least on paper. But inflation, a crumbling housing market and interest rate hikes are hitting hard. Listen and subscribe to the first episode of the new daily podcast The Big Take to hear more. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Bloomberg Growth Summit: Companies are finding they have to work harder to keep their customers and attract new ones. Join us in New York or virtually on Nov. 3 as top executives from some of the world’s most exciting companies discuss how they are taking their businesses to the next level with customer-centric strategies. Register here. |