| A Message from Porter & Co. Dear Reader,

Time is ticking.

I thought we had more time.

But I was wrong. Dead wrong.

Our financial system is unraveling even faster than I predicted.

And with November 5 just moments away – and our next President incoming – it’s urgent that you wake up and pay attention to what’s really going on.

The converging forces I expose here, in my emergency broadcast are bearing down right now – and could soon have a devastating impact on your portfolio and savings.

This is not a drill.

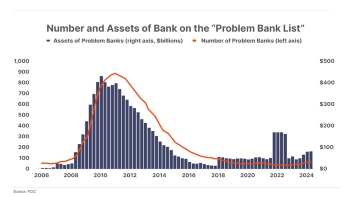

As you read this, sixty-six banks in America now face insolvency risk.

The Federal Deposit Insurance Corporation’s (“FDIC”) “Problem Bank List” grew to 66 at the end of the second quarter, up from 43 a year ago, as the value of “Problem Assets” for banks jumped alongside Treasury yields.

Today, the yield on a 10-year U.S. Treasury hit 4.18% – up from 3.78% at the end of September.

This is a problem for banks (Bank of America in particular) that piled into Treasuries during 2021 and 2022 when yields were at an all-time low.

Since the Federal Reserve began its rate-cutting campaign, long-term yields have risen, resulting in major unrealized losses for these banks.

Today, the unrealized losses on securities at America’s largest banks are already dramatically worse – as of the end of Q2, $517 billion of these loans were underwater.

Inflation remains sticky, and if yields continue to rise, these Treasury bonds held by the bank will continue to fall in value.

Now legendary investor Stanley Druckenmiller has placed a large bet that Treasury yields will continue to rise – he’s using around 15% to 20% of capital from his hedge fund to short U.S. Treasuries.

That’s high conviction. And when the smart money is betting on a disaster, you need to pay attention to it.

In my urgent broadcast I want to show you how to move your money into specific assets that (history tells us) tend to flourish under these extreme conditions… even while others see their wealth evaporate.

I even name my #1 highest conviction stock to buy before the polls close, to start getting yourself on the right side of this emerging crisis.

Sadly, it’s not “just” a potential banking collapse you need to worry about – and urgently prepare for.

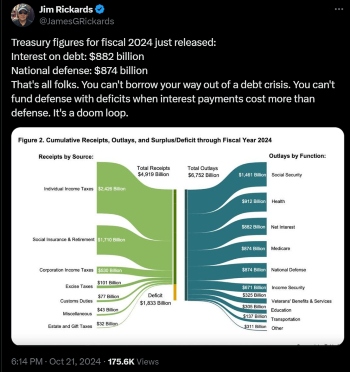

A former CIA man, presidential advisor and old friend of mine – Jim Rickards – is sounding the alarm about America’s out-of-control debt spiral:

Jim is right. But what most people don’t realize is, the situation is even worse. Interest rates will explode higher as foreign buyers abandon our treasuries.

That’s already happening. China has been dumping our Treasuries for years. They smell a disaster.

For the first time in our lifetime, there is a real risk of a Treasury default in America.

Obviously America’s accumulation of debt has been baked into the cake for decades. But like the old Hemingway quote tells us, these things happen slowly, slowly, then all at once.

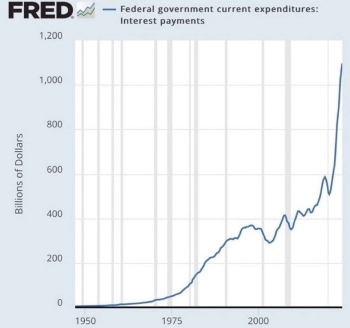

Here’s what all at once looks like:

As the X (formerly Twitter) account Wall Street Silver explains:

“This isn’t a chart of Apple, Tesla or Even Nvidia. This is interest payments on the US national debt of $36 trillion”.

With interest payments on an exponential climb, it’s only a matter of (short) time until the printing presses are fired up.

And we won’t be talking about the Fed printing a trillion dollars. Or ten trillion. Think closer to 50 trillion. Even more.

When that happens, that’s the day the dollar dies.

Inflation will take off like no one is prepared to believe. Hyperinflation is a possibility here. The kind of situation where a loaf of bread would be priced at $10,000. If that seems impossible, you simply don’t understand financial history.

This is the way ALL great, indebted empires collapse. As my favorite financial historian Niall Ferguson recently warned:

“Any great power that spends more on debt service than on defense will not stay great for very long.

True of Habsburg Spain, true of ancient régime France, true of the Ottoman Empire, true of the British Empire.

This law is about to be put to the test by the U.S. beginning this very year.”

America is now at Breaking Point.

Our next president can’t save us. They will simply do what every sitting president for the last 50 years has done: print money. They will accelerate the crisis. They will push national finances into oblivion and destroy the wealth of tens of millions of Americans.

I see that scenario as irreversible. Unstoppable. But that doesn’t mean YOU have to suffer.

I’ve issued an emergency investment plan to help you get your money on the right side of the epic wealth-destroying crisis that’s already underway.

You’ll discover the specific assets that could thrive as inflation takes off again and America’s debts run wild. Without this plan in your hands, your money is at grave risk of complete wipeout.

Watch my emergency broadcast now.

With the polls closing in a matter of days, you don’t have long before the new president is advised to turn on the printing presses to “save America”.

When that happens, it will be too late to save yourself.

Porter |