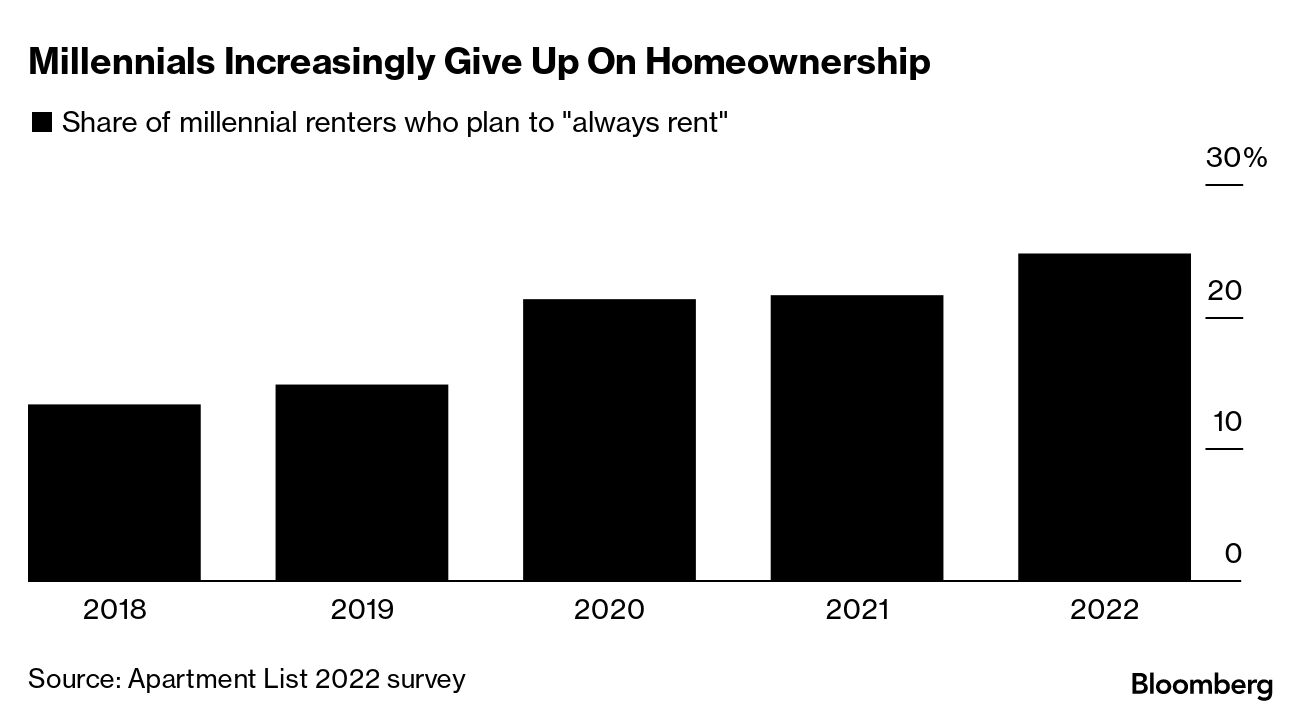

| Just six months ago, investors were plowing billions of dollars into I bonds. Now, some experts say it’s time to get out. The yield on series I savings bonds is expected to fall to around 3.8% in May, down from the current 6.89% and a historic 9.62% rate last year. The bonds’ yield is tied to inflation, which is showing signs of cooling. These days, investing options including high-yield savings accounts, money market funds and certificates of deposits are offering competitive rates, making I bonds look less attractive in comparison. —David E. Rovella US foreclosure filings jumped 22% in the first quarter compared to the same period a year ago. While still below pre-pandemic levels, foreclosure activity has increased on an annual basis for 23 straight months. The number of filings has been climbing since the federal moratorium ended in mid-2021. During the pandemic, an estimated 2 million homeowners fell behind on their mortgages. For the first time, more than half of millennials own a home. But many of the rest are at peace with saying they never will. The millennial homeownership rate hit 51.5% in 2022, US Census data show. It’s been a slog to get there for the generation that came of age during the financial crisis—by age 30, 42% of millennials owned their homes compared to 48% of Gen X and more than half of baby boomers. Meta Platforms, parent of Mark Zuckerberg’s Facebook, is said to be planning to terminate or relocate its London-based Instagram employees. The London office became a center for growth for the social-media app when its leader, Adam Mosseri, moved there temporarily last year. Now Mosseri plans to relocate to the US. It’s the latest retrenchment by a social media company that’s announced plans to fire 10,000 people. Tesla reported first-quarter earnings that missed analyst estimates after a series of aggressive price cuts squeezed profit margins. Profit excluding some items fell to 85 cents a share, slightly below the 86-cent average of estimates compiled by Bloomberg. The Austin, Texas-based electric-vehicle maker has been slashing prices in an effort to stay ahead of rivals. The company’s stock slid more than 4.5% on the news. Rupert Murdoch isn’t out of the woods yet. Fox News agreed this week to pay $787.5 million to settle a voting machine maker’s lawsuit over the cable channel’s broadcast of 2020 election falsehoods. But that still leaves a similar, $2.7 billion suit by voting technology company Smartmatic for Murdoch to reckon with. Every day, people mix up a friend’s address, go to the wrong house to pick up siblings or mistake another car in the parking lot for their own. Even police get addresses wrong sometimes. But these days in America, as the Associated Press reports, such mistakes get innocent people killed or wounded by gunfire. In Tennessee, meanwhile, where GOP legislators expelled Democrats who protested a recent mass school killing there, Republican lawmakers awarded final passage to a proposal that would further protect gun and ammunition dealers, manufacturers and sellers against lawsuits.  Speakers touch caskets memorializing lives lost from gun violence during a rally in Nashville, Tennessee, on April 17 Photographer: Alex Kent/Bloomberg While many people act like the pandemic is over, Covid-19 has spawned a new version of its dominant omicron variant that World Health Organization officials say they are closely monitoring. It’s called Arcturus, and it’s potentially more easily transmitted than earlier versions. Whether it’s more dangerous has yet to be determined. In the US, health regulators have authorized an additional booster of the bivalent coronavirus shot for the elderly and others at risk. Globally, the WHO reports an average about 300 Covid-related deaths each day. Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. Business tycoon Mike Jatania is looking to sell a 12-bedroom mansion just west of London, in what would be one of the UK’s biggest ever country house deals. The stately home in Denham, Buckinghamshire, a 30-minute drive from central London, will go on sale next week for £75 million ($93.2 million). The home has a famous former tenant: J.P. Morgan.  Source: Mel Yates Photography Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. The Bloomberg Green Summit. Join us in New York on April 26 to hear from leaders in climate solutions including John Podesta, White House Senior Advisor for Clean Energy Innovation and Implementation; Kal Penn, host of the Bloomberg Originals series Getting Warmer; Dorothy Fortenberry, Executive Producer for Extrapolations and more. Get more information here. |