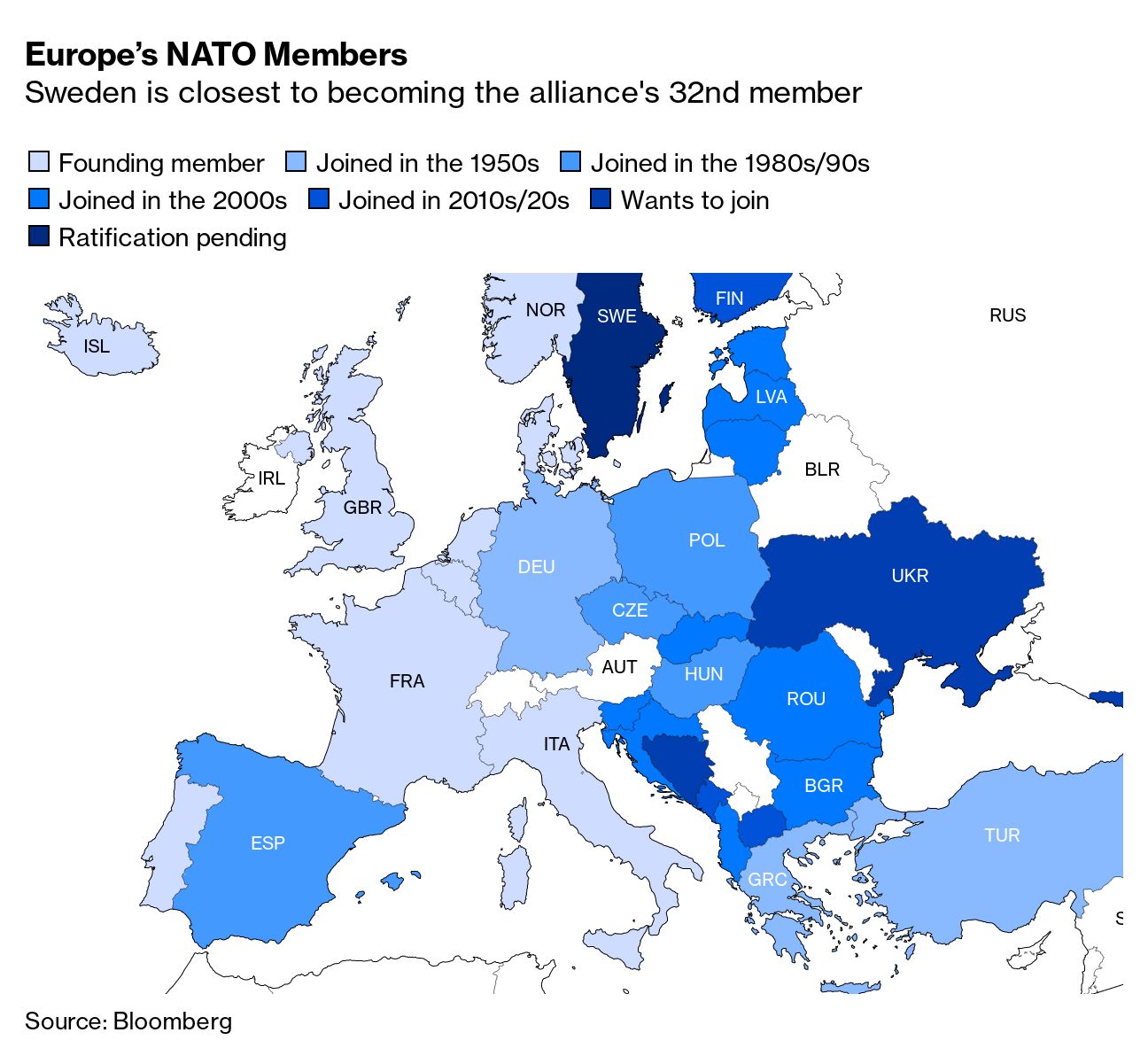

| Major banks are facing one of the biggest regulatory overhauls since the 2008 financial crisis, setting up a clash over the amount of capital they must set aside to weather a storm. The US Federal Reserve’s top banking regulator, Michael Barr, said he wants banks to start using a standardized approach for estimating credit, operational and trading risks, rather than relying on their estimates. He also said the Fed’s annual stress tests should be modified to better capture dangers that firms can face. The plans laid out by Barr on Monday follow a months-long review of capital requirements, a politically sensitive topic that became a lighting rod after several regional lenders collapsed this year. Barr said his examination found that, although the current system was generally sound, changes were needed that will result in banks setting aside more money to protect against losses.—Natasha Solo-Lyons Turkish officials did a sudden about-face Monday, saying the government will ask parliament to advance Sweden’s bid for membership in the NATO alliance after receiving assurances on key demands. The flip, after months of withholding assent, paves the way for Swedish accession, which in turn would cement the massive geopolitical blowback engendered by Vladimir Putin’s invasion on Ukraine.  Turkish President Recep Tayyip Erdogan, left, shakes hands with Swedish Prime Minister Ulf Kristersson in front of Secretary General of NATO Jens Stoltenberg at a meeting ahead of Tuesday’s NATO Summit in Vilnius, Lithuania. Photographer: Filip Singer/Pool/Getty Images Still, Turkey has damaged itself, Bobby Ghosh writes in Bloomberg Opinion. President Recep Tayyip Erdogan’s earlier suggestion that he might lift his veto in exchange for Turkey’s admission to the European Union was the baldest blackmail, Ghosh writes. Erdogan’s EU proposition should be taken by the US and its European allies as further proof that Turkey’s president is not a reliable ally within multilateral organizations. It seems Putin met with Wagnermercenary leader Yevgeny Prigozhin just days after Prigozhin’s failed rebellion—the one Putin denounced as treason. The extraordinary meeting, in tandem with news that Prigozhin is in Russia and not exiled in Belarus, adds another twist to a saga that has become a serious threat to Putin’s nearly quarter-century rule. A key measure of US inflation is easing. Used-car prices fell 4.2% in June, the largest monthly drop since the beginning of the Covid-19 pandemic, and were down 10.3% from the previous year. The price drop in June was the biggest ever for the month and among the largest in the history of the used-car price index compiled by Manheim, a vehicle auction service. Still, for those who had any residual doubt, three Fed officials said on Monday that policymakers will need to raise interest rates further this year to bring inflation back to the central bank’s goal. Meanwhile, Chair Jerome Powell assured lawmakers the Fed is committed to avoiding a repeat of 2019—when the repo market, a key part of US financial plumbing, seized up—Wall Street economists and strategists caution that quantitative tightening remains complex and hard to predict. QT involves letting Fed bond holdings mature without replacement, draining cash from the financial system. In the coming months, the full brunt of the Fed’s current QT program is set to be felt. The stock market kicked off the week on a cautious note. Following a three-day slide in the S&P 500, the benchmark posted a small gain as the market received little support from megacap stocks. Tesla fell almost 2% and Amazon dropped before its Prime Day event. Here’s your markets wrap. Threads, Meta’s answer to Twitter, has rocketed to 100 million users in less than a week, Chief Executive Officer Mark Zuckerberg announced Monday. “Threads reached 100 million sign ups over the weekend,” Zuckerberg said in a post. “That’s mostly organic demand and we haven’t even turned on many promotions yet.” Airlines in Europe are trying to avoid a repeat of last summer’s travel chaos, when strikes and staff shortages were so bad that London’s Heathrow Airport capped passenger numbers and asked airlines to limit ticket sales. Travelers are set to jam European airports again in July and August, with passenger numbers returning to or exceeding pre-pandemic levels. Here are the 10 airports in Europe that currently rank worst, along with the 10 that are delivering a smoother summer.  Gatwick Airport in the UK Photographer: Gareth Fuller/PA Wire Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. The Bloomberg Sustainable Business Summit returns to Singapore on July 26. Join us in person or virtually for programs convening business leaders and investors to drive innovation and scale best practices in sustainable business and finance. Register now to secure your spot. |