|

| The Weekend Edition is pulled from the daily Stansberry Digest. The Digest comes free with a subscription to any of our premium products.

| ||||||||||

| The benchmark S&P 500 Index closed 2017 at 2,673.61. This was good for a gain of roughly 1% in December. But it also marked an unprecedented feat... You see, 2017 was the first year in history where U.S. stocks ended every single month in the green. Only three other years – 1958, 1995, and 2006, which each had 11 positive months – have even come close. All told, the S&P 500 rallied 19.4% for the full year. Including dividends, U.S. stocks returned nearly 22% in 2017, among the best annual gains in history. DailyWealth readers know Steve has been one of the most outspoken bulls over the past nine years. He was among the first analysts anywhere to turn bullish on U.S. stocks back in 2009. And he has reaffirmed his bullish stance again and again as stocks have soared to new highs. Around this time last year, many folks were worried that the end of the bull market was near. But Steve disagreed... He told readers 2017 was likely to be another great year for stocks. As he explained in the January 9, 2017 DailyWealth...

If you're not familiar, this index surveys hedge-fund and mutual-fund managers to see how they feel about the market. A rating of zero means managers own no stocks. And a rating of 100 means managers are fully invested. And they recently became as bullish as they've been in years. More from Steve...

But he also noted that this isn't a reason to sell. In fact, history says the opposite... Buying after each of these other similar extremes would have led to double-digit gains in one year or less. Of course, this is a relatively small sample size... And Steve would never recommend making investment decisions based on any single indicator alone. But alongside the other indicators he's following closely, it's one more sign that the long bull market has further to run...

----------Recommended Link---------

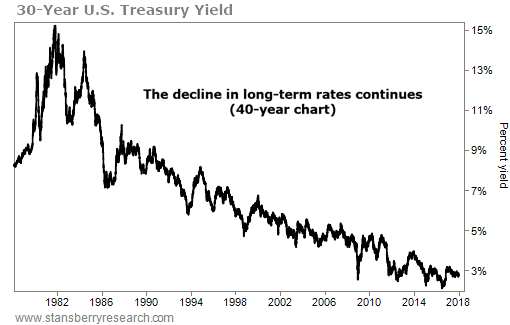

He also believes this year could bring the first significant rise in long-term interest rates in years. Steve's senior analyst Brett Eversole wrote about this idea earlier this week. As Brett noted, economists have been wrong about long-term interest rates rising for decades. But he explained one major reason why it could actually happen this time. You see, the latest Commitment of Traders ("COT") report shows that speculative traders are more bullish on U.S. Treasury bonds than almost any other time in history. Because bond prices and interest rates trade inversely, these record bets mean these traders are also betting heavily on lower long-term rates. Unfortunately, the last time this happened, it didn't work out so well for them. In mid-2016, traders all expected lower rates. Instead, the 30-year yield rose around 1% in less than six months. That's a major move higher for rates (and lower for Treasury bond prices). Brett noted that we have the same setup today. As you can see in the following chart, this would create the first uptrend of higher lows and higher highs in decades... and would likely signal an official end to the nearly 40-year bull market in bonds...  This obviously wouldn't be great news for owners of long-term government bonds. But it could be a boon for stocks – at least in the near term. You see, while higher interest rates will eventually lead to serious problems for our debt-driven economy, rising long-term rates should initially ease the falling yield curve we've been following. Barring an unexpected market shock, this could delay the next recession even longer. Stay long stocks... But be sure to protect your capital with good risk-management strategies, like conservative position sizing and trailing-stop losses. And hold some cash and gold, just in case. If you're interested in going even further – in maximizing your potential profits over the final "inning" of this bull market – we urge you to check out a brand-new presentation from our friend and TradeStops founder Dr. Richard Smith. In it, you'll learn how you can make much more money – while taking far less risk – in the same stocks you already own. In fact, Richard says you could have easily quadrupled the returns in Steve's True Wealth recommendations using this easy-to-follow strategy. And he has the data to prove it. Until Monday, you can watch this presentation – and learn how to claim a gift worth up to $1,000 – by clicking here. Regards, Justin Brill Editor's note: It doesn't matter how big your portfolio is... It doesn't matter if you're bullish or bearish right now... Using Dr. Richard Smith's TradeStops system is the only way to squeeze every last dollar out of the "Melt Up" AND sell at the exact right time. Through Monday, Richard is offering up to a $1,000 discount just for signing up. Learn more here. |

| |||||||||||||||||||||

| Home | About Us | Resources | Archive | Free Reports | Privacy Policy |

| To unsubscribe from DailyWealth and any associated external offers, click here. Copyright 2018 Stansberry Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry Research, LLC., 1125 N Charles St, Baltimore, MD 21201 LEGAL DISCLAIMER: This work is based on SEC filings, current events, interviews, corporate press releases, and what we've learned as financial journalists. It may contain errors and you shouldn't make any investment decision based solely on what you read here. It's your money and your responsibility. Stansberry Research expressly forbids its writers from having a financial interest in any security they recommend to our subscribers. And all Stansberry Research (and affiliated companies) employees and agents must wait 24 hours after an initial trade recommendation is published on the Internet, or 72 hours after a direct mail publication is sent, before acting on that recommendation. You're receiving this email at newsletter@newslettercollector.com. If you have any questions about your subscription, or would like to change your email settings, please contact Stansberry Research at (888) 261-2693 Monday – Friday between 9:00 AM and 5:00 PM Eastern Time. Or if calling internationally, please call 443-839-0986. Stansberry Research, 1125 N Charles St, Baltimore, MD 21201, USA. If you wish to contact us, please do not reply to this message but instead go to info@stansberrycustomerservice.com. Replies to this message will not be read or responded to. The law prohibits us from giving individual and personal investment advice. We are unable to respond to emails and phone calls requesting that type of information. |