| | | Good afternoon. New CPI print today! 3.5%. It marks the 37th consecutive month of inflation humming above the Fed’s 2% target. Meanwhile, bitcoin’s inflation rate is about decrease 50% in 9 days. | Today’s Big Stories:

🏦 Big banks are warming up to bitcoin ETFs

👿 SEC goes after Uniswap

❤️🩹 Galaxy gearing up for a major acquisition? Or just rugging investors? | Today's newsletter is 1,210 words, a 7-minute read. |

| |

| | |

|

Big Banks Make Bets on Bitcoin, Despite Mixed Messages |

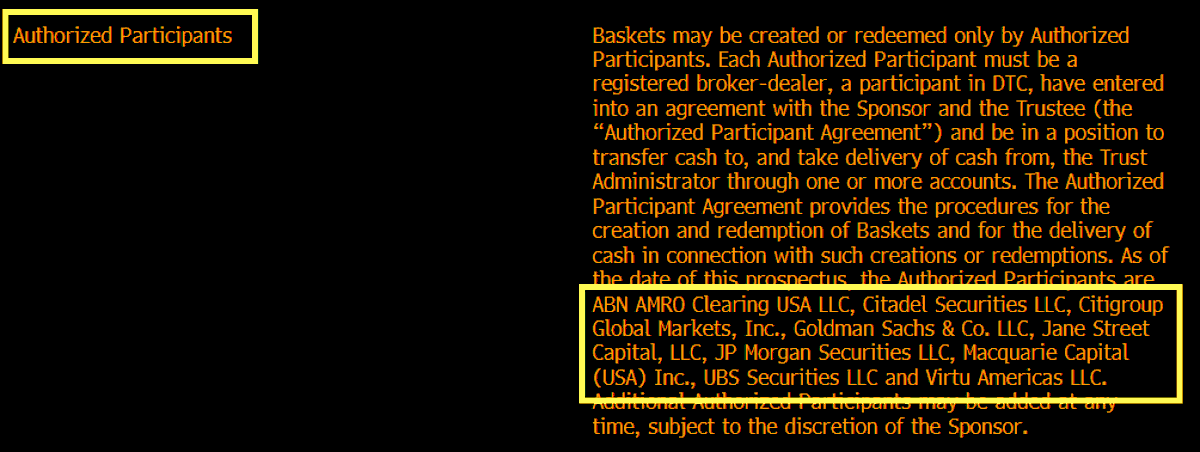

BlackRock has expanded its list of Authorized Participants (APs) for its bitcoin ETF, iShares Bitcoin Trust (IBIT), onboarding financial heavyweights like Goldman Sachs, Citadel, UBS, and Citigroup. |

| Eric Balchunas @EricBalchunas |  |

| JUST IN: BlackRock updated its bitcoin ETF prospectus w/ many new Authorized Participants incl first-timers Citadel, Goldman Sachs, UBS, Citigroup. Takeaway: big time firms now want piece of action and/or are now OK being publicly associated w this. H/t @akibablade@CryptoSlate… twitter.com/i/web/status/1… |  | | | Apr 5, 2024 | | |  | | | 4.92K Likes 1.18K Retweets 205 Replies |

|

|

Why it matters: The inclusion of such prominent institutions, despite all the previous skepticism, underscores a growing trend: legacy players can longer ignore crypto… even if they want to. Major financial players are increasingly being forced to align with the sector either by direct involvement or indirect mechanisms like ETFs. |

|

Everyone on the wagon: The newly added banks now join ABN AMRO, JP Morgan, Jane Street, Macquarie Capital, and Virtu on the list of IBIT APs. |

Ok, but why does it really matter: Because this isn’t your neighborhood mom and pop bank getting on board. These are banks like Citi, Goldman, and UBS. UBS was founded more than 200 years ago! |

Two-Faced: Speaking of Goldman Sachs, they actually paint an interesting addition. Just last week, the firm expressed disinterest in crypto in an interview with WSJ, claiming that they “do not think it is an investment asset class” and that they’re “not believers in crypto.” |

Obviously, the firm's actions tell us a different story. |

|

SPONSOR | Elon Musk’s warning to America | “The biggest corruption of American democracy in the 21st century.” | New film exposes a shocking political plot that’s been hatched inside D.C. in order to secure Biden’s victory this November – even against the will of the people. | Elon Musk calls it “the biggest corruption of American democracy in the 21st century.” Yet almost nobody has heard of it. Go here to find out how you protect your wealth and stream it now at no cost. |

|

|

|

Another Crypto Regulatory Battle For the SEC to Lose |

Today, the SEC issued a Wells Notice to Uniswap Labs, signaling an upcoming lawsuit likely over securities violations. |

Why Uniswap? The specific nature of the SEC’s allegations against Uniswap remain unknown. But knowing our lovely government, it’s likely more of what we’ve already seen: Another exchange illegally offering unregistered securities, or failing to register as a broker or an exchange.

What makes this upcoming lawsuit unique, however, is the nature of how Uniswap operates. As a leading decentralized exchange (DEX) built on top of the Ethereum network, Uniswap has become a beacon for the entire DeFi sector. |

Unlike traditional exchanges, DEXs like Uniswap don’t have a central authority overseeing trades. It’s like a self-driving car. It relies on automated protocols, neutrality, and very limited governance. The protocol itself is open source and used by many other projects in the DeFi world. |

Given Uniswap’s massive footprint in the world of crypto – facilitating over $2 trillion of transactions since its inception – the outcome of this case would not only be a watershed moment for the DEX itself, but for all of DeFi. |

Let the battle begin: Founder Hayden Adams and Chief Legal Officer Marvin Ammori have both expressed their readiness to fight, asserting that Uniswap’s products comply with U.S. law and each, rightfully so, criticizing the SEC’s approach. |

Our Thoughts |

We like Uniswap. While we don’t often use it to trade the wide variety of altcoins it hosts on its exchange, Uniswap has proven to be an essential piece of infrastructure for traders and devs alike.

The protocol is 6 years old… the largest use case of Ethereum… has facilitated over $2 trillion in transactions… is home to the most copied open-source smart contract protocol (replicated over 2,000 times)… and has never been hacked. |

So we have to give credit where it’s due. |

On top of that, Uniswap founders have chosen to operate in broad daylight in Brooklyn, NY rather than offshore. |

In other words, Uniswap is an industry leader, through and through. And the recent Wells Notice underscores a common theme with the SEC: Let’s intimidate and try to enforce the good actors, and let the bad ones slip away.

Uniswap has money to fight. They will fight. And given the SECs piss-poor success rate, Uniswap will probably win. And all of crypto will be supporting them along the way. |

|

SPONSOR | Crypto Pioneer Names His Five Favorite Altcoins | Charlie Shrem has an uncanny knack for spotting the biggest winners, like on Steem, Cindicator, and as much as the 200,000% he made on Bitcoin. Now, he says, there are five coins you must take a look at right away. | Click here to see the details » |

|

|

|

Galaxy Stock Slides 19% on $125 Million Deal |

Fresh off Q4 earnings that reported a huge swing to profitability, Galaxy Digital (TSX:GLXY) is looking to shore up cash… |

…but the market isn’t loving it. |

Yesterday, Galaxy entered into an agreement with Canaccord Genuity, a financial services firm, to purchase 12,100,000 ordinary shares of Galaxy at a price of C$14.00 (~$10.31). |

The deal also grants Canaccord the option to purchase an additional 1,815,000 ordinary shares at the same price in the future. |

Before the announcement, Galaxy shares were trading at C$16.05 before falling more than 19% to C$13.00. |

Our Thoughts |

Galaxy doesn’t necessarily need the cash, as the company had more than $316 million in cash & equivalents and $1.08 billion in digital assets on the balance sheet as of December 31, 2023. |

|

This after the company just announced a $100 million venture fund for early stage crypto as well as a participation in crypto VC firm 1kx’s latest $75 million fund. |

So what does Galaxy need the money for? |

We’ve previously written about how Galaxy CEO Mike Novogratz may be gearing up for another acquisition, but as of today we just don’t know. |

A Tale of Two Companies |

Since going public in 2018, we have been promoting Galaxy as a backdoor way to play crypto. |

And while in that time you would be up more than 600% on your investment, the road to get there has been volatile with some major swings in price. |

Huge venture funds, a failed billion dollar BitGo acquisition, stablecoins, an ETF launch, and who could forget the infamous LUNA tattoo. The company has been busy. |

As we have said multiple times in this rag, although Galaxy should be a very smart investment in the long run, in the short run the company has been not only difficult to value for investors, but doesn’t really seem to care to explain itself. Yesterday’s deal with Canaccord is no exception. |

Compare that to a company like Coinbase, which is doing everything it can to court investors. |

And it shows. While Coinbase is up more than 600% over the past 24 months, Galaxy is up only 245%. |

|

|

| Charlie Bilello @charliebilello |  |

| Price changes over last year (March CPI report)...

Transportation: +10.7%

Shelter: +5.7%

Electricity: +5.0%

Food away from home: +4.2%

Overall CPI: +3.5%

Medical Care: +2.1%

Gasoline: +1.3%

Food at home: +1.2%

New Cars: -0.1%

Used Cars: -2.2%

Gas Utilities: -3.2%

Fuel Oil: -3.7% | | | Apr 10, 2024 | | |  | | | 425 Likes 136 Retweets 23 Replies |

|

|

|

Other Content You Might Enjoy |

In Partnership With One Page Crypto |

|

|

SPONSOR | Titanium Shortage Proves Promising For This Value Play | The sad truth is that more than 90% of titanium – a strategic wartime metal – is produced in Russia and China. And with a global shortage of the lightweight "wonder metal" already in play, aerospace-grade titanium has become particularly scarce. | That’s why, this new Canadian titanium discovery, and the company that could benefit, could be such a big deal. | Learn more about the company here » |

|

|

|

How did you like today's email? |

|

|

About CoinSnacks |

Launched in December 2017, CoinSnacks is home to the longest continuously running crypto newsletter. Each week, we publish our cryptoasset musings to an audience of 35k+ crypto enthusiasts and investors. |

In a space flooded with new projects, research, and narratives, you may feel overwhelmed or confused. CoinSnacks offers a solution by doing the digging for you, so you don't have to spend hundreds of hours sifting through the noise. Learn more here » |

|

Reach Our Audience |

If you’re a brand interested in partnering with CoinSnacks to find your next customers, partners, or allies, we’d love to hear from you. Learn more here. |

|

Check out our other publication |

| Gold Playbook All your gold investing news in a single daily email. | | Subscribe |

|

|