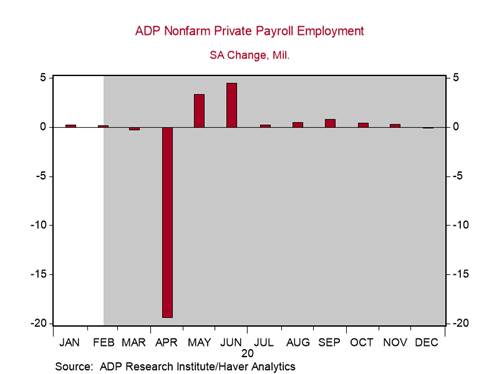

*ADP, the payroll processing company, estimates that U.S. private payrolls declined by 123k in December, the first decline since April (Chart 1). Although ADP's initial estimates of private payrolls have been unreliable predictors of the Bureau of Labor Statistics’ (BLS) initial estimates since May, it is likely that the BLS will report either a decline or small increase in payrolls in its December Employment Report (set for release on Friday, January 8).

*Today’s payrolls data are consistent with our forecast for a temporary slowdown in labor market performance because of the intensification of the pandemic that has led some state and local governments to impose renewed restrictions on businesses and individuals to voluntarily change their behaviors. We expect a reacceleration in job growth once this intense stage of the pandemic ends but project that the recovery in labor markets will lag the recovery in GDP (U.S. labor market: big gains, big shortfalls and Chart of the week – U.S. labor market begins temporary slowdown).

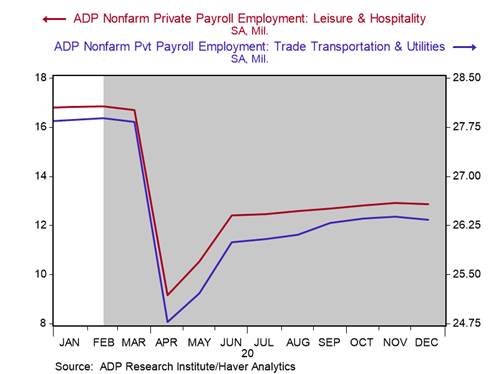

According to the ADP, the service sectors most vulnerable to the COVID-19 pandemic –trade/transportation/utilities (-50k), and leisure and hospitality (-58k) – accounted for the bulk of the decline in December’s payrolls, further reducing the still-depressed levels of their respective payrolls (Chart 3). Manufacturing payrolls declined by a sizable 21k, contrasting the optimism in manufacturing sentiment surveys. The construction (+3k), financial activities (+2k), professional and business services (+12k), and healthcare (+9k) sectors eked out relatively small payroll gains in December. Small and large businesses shed 13k and 147k jobs, respectively, while medium-sized businesses added 37k jobs.

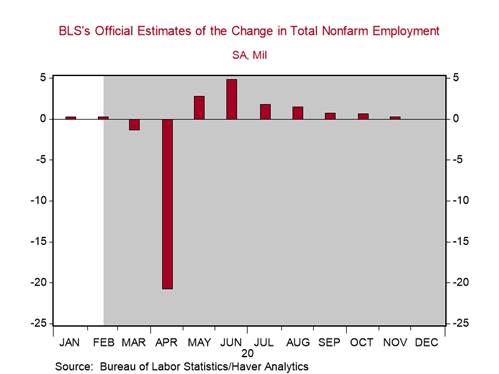

Note that the BLS’s official estimates of job growth have been flattening since the fall (Chart 4). The bulk of the employment gains in the recovery occurred between May and August (+10.8m), with gains in the last two months slowing to a total of 855k. Similar to the early stages of the recovery, we expect job growth to reaccelerate once vaccines become more widely available, individuals gain confidence, and normal activities are allowed to resume. The demand for labor will increase and more people will re-enter the labor market. We expect the increase in the labor force participation rate to slow the decline in the measured unemployment rate this year, following its sharp 8pp decline from 14.7% in April 2020 to 6.7% in November 2020.

ADP has mostly underestimated the BLS’s initial estimates of private payrolls since May and it has historically been a poor predictor of BLS’s payrolls in December (Chart 2). Still, a further slowdown in labor market performance is consistent with our forecasts.

We estimate that the BLS will report a 100k increase in December’s nonfarm payrolls on Friday – the smallest in this recovery – but risks to our forecast are clearly to the downside. We estimate that the unemployment rate was unchanged at 6.7%.

Chart 1:

Chart 2:

Sources: ADP Research Institute, Bureau of Labor Statistics, and Berenberg Capital Markets

Chart 3:

Chart 4:

Roiana Reid, roiana.reid@berenberg-us.com