U.S. Bipartisan Congressional Fiscal Legislation to Support Economy

Bipartisan Congressional negotiations have culminated in a substantial $900 billion stimulus package that will provide important support to the economy, mitigating the temporary depressing impacts of the second wave of the COVID-19 pandemic and partial government shutdowns. Such a fiscal initiative is rare during a lame duck Congressional session and a lame duck presidency, but it is timely.

The $900 billion in additional spending — equal to 4.25% of GDP — will involve $286 billion in direct payments to individuals and unemployed persons, and income support to small businesses through a second round of the earlier Paycheck Protection Program (PPP) and other programs totaling $325 billion. It also includes $69 billion in government funding of health and medical services, including the costs of administering vaccines, plus additional spending on other government programs such as nutrition and agriculture ($26 billion), education ($82 billion) and child care ($10 billion), $25 billion in rental assistance, $45 billion in relief to transit agencies, airlines, airports and state departments of transportation, and $7 billion for broadband. In addition to the CARES Act and other legislation enacted in March 2020, this emergency pandemic relief initiative lifts the Federal government’s total increase in deficit spending to address the COVID-19 pandemic above 17% of GDP. This compares to the decline in real GDP in H1 of 10.1%.

Economic consequences

While the recovery from the sharp contraction of the pandemic in Q2 2020 has been solid in terms of GDP and employment, exceeding even our earlier optimistic forecasts, recently momentum has flattened in response to the second wave of the pandemic and partial government shutdowns. Gains in labor markets have stalled as initial unemployment claims have risen and the services sectors such as leisure and hospitality are suffering (US labor market: big gains, big shortfalls, December 9, 2020).

Absent this fiscal legislation, a flattening of growth in Q4 2020 and Q1 2021 (but no decline in real GDP) followed by a reacceleration that would lift real GDP back to its pre-pandemic level by year-end 2021 appeared to be the most likely outcome. However, in anticipation that Congress would agree on a fiscal support package, we increased our Q1 forecast and also strengthened our overall forecast for real GDP in 2021 to an increase of 5.0% (Forecasts at a glance, December 18, 2020). The increase in consumption and government purchases in Q1 will contribute to sustained growth. We continue to believe that the probability that growth exceeds our baseline forecast beginning in Q2 2021 outweighs the probability of weak performance.

Of the $900 billion in spending, an estimated $286 billion is for direct payments to individuals — checks for $600 to all individuals with incomes below $75,000, phasing out completely at $99,000, and an extension of unemployment compensation to unemployed individuals (including independent contractors) with an additional $300 per week kicker through March 14, 2021. This is roughly 1.6% of disposable income. If spent in Q1 (or the first half) it will have an accentuated impact on annualized consumption growth in GDP. Distribution of income support checks are expected in January, as the U.S. Treasury is geared up to quickly distribute the funds, learning from its CARES Act experience. The same is true of the extended unemployment compensation.

These government transfers will add materially to disposable income and consumer purchasing power. The second wave of the pandemic and partial government shutdowns will constrain spending and “force” some saving. If we assume that just a fraction of the direct income support is spent, it will still add materially to consumption, particularly when calculated on an annualized basis in Q1.

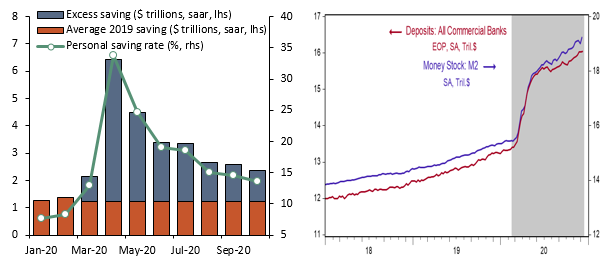

The portion of the government transfers that are saved will add to the stock of personal savings that are already approximately $1.25-$1.5 trillion higher than pre-pandemic averages (Chart 1). This “excess savings” — equal to approximately 6%-7% of GDP — reflects constrained spending during the COVID-19 pandemic and the boost to disposable income provided by the government’s transfer payments. A large portion of this excess savings is deposited in banks, earning close zero interest (Chart 2, The outlook for economic policies and performance—a presentation, December 3, 2020). We anticipate that once the pandemic and risks of it subside, consumers will spend all or most of it. This supports our outlook for economic strength.

Chart 1: Personal saving, personal saving rate Chart 2: Deposits and M2

Sources: Bureau of Economic Analysis, BCM Sources: Federal Reserve Board, Haver Analytics

Note: saar = seasonally adjusted annual rates

The fiscal legislation allocates approximately $284 billion to the PPP program that will provide direct subsidies to small businesses. The earlier PPP program provided important income support to businesses, linked to maintaining employment amid the severity of the pandemic. This updated PPP will help to keep some small businesses afloat as they suffer through this second wave. Similar to the government transfers to individuals, some portion of the PPP subsidies will be saved, although we expect it will be a smaller portion.

In addition to the funding for government financing of health and medical services, this legislation extends the availability of funds provided to states and local governments for pandemic-related purposes under the CARES Act - a sizable portion of which has not yet been spent - to December 31, 2021.

Politics and points of difference

While the economic realities of the second wave of the COVID-19 pandemic and the pending expiration of unemployment compensation have heightened the need for another fiscal support package, the November election results shifted the political negotiations. The diminished political power of Democratic House leader Pelosi (and to a lesser extent Democratic Senate leader Schumer), who held out for an unrealistically large $2.5 trillion package before the election cost some incumbent Democrat House members their elections, forced her to negotiate to a far smaller package, closer to the size of spending favored by Republican Senate leader McConnell. Nevertheless, once again, the final package of $900 billion is sizable — to put it into perspective, it is bigger than the American Recovery and Reinvestment Act of 2009 that was enacted at the height of the 2008-2009 financial crisis.

Two major differences prolonged the political negotiations. First, Democrats favored a large Federal grant to states — in the earlier House legislation, it was $1 trillion — to fill states’ financing gaps generated by the pandemic. Republicans pushed back, opposing Federal subsidies to select states that had failed finances before the pandemic.

Second, Democrats wanted to extend the capital allocation provided by the CARES Act to the Treasury to capitalize Federal Reserve programs to provide business loans and purchases of corporate and municipal bonds that are scheduled to expire December 31. In reality, the Fed’s loans to businesses and bond purchases under the programs capitalized by the Treasury have been very small and the vast majority of the capital allocated to the Fed’s capital account at the Treasury was unused. However, this is a contentious political issue. Beyond the amount of the Fed’s near-term financial support and the budget accounting of the magnitude of this fiscal package, it involves the role and scope of the Fed in initiatives that historically have been credit and fiscal policies. We have not seen the end of the debate about this issue.

Mickey Levy, mickey.levy@berenberg-us.com

Roiana Reid, roiana.reid@berenberg-us.com