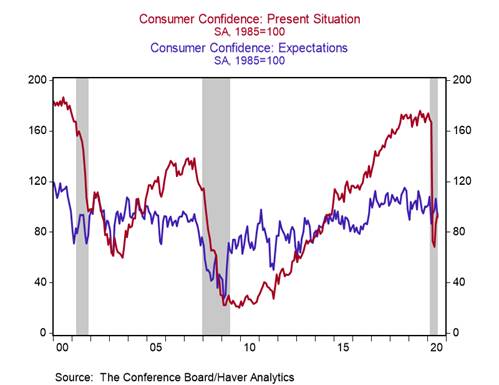

*The Conference Board U.S. Consumer Confidence Index declined by 5.7pts to 92.6 in July, reversing almost half of its 12.6pt increase between April and June (Chart 1). The reversal in confidence three months into the recovery reflects the spikes in incidence of COVID-19 across many states since late June, which have led to a flattening of economic and labor market activity. According to the Conference Board, “Large declines were experienced in Michigan, Florida, Texas, and California.

*Consumers’ concerns about the trajectory of the virus are reflected in the sharp 14.6pt decline in the future conditions index to 91.5, barely above March’s level (86.8). Consumers continued to assess the present situation more favorably in July (+7.5pts to 94.2), but to a lesser extent than in June (+18.3pts to 86.7). See Chart 2.

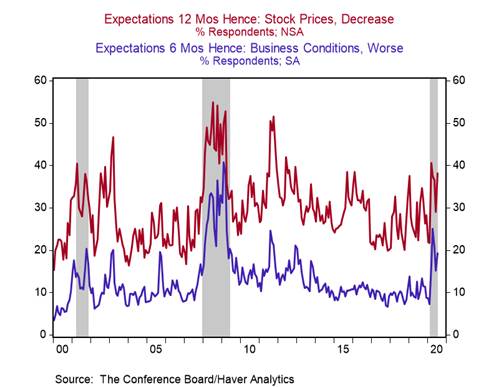

*Consumers became slightly more optimistic about current labor market conditions but more pessimistic about future business conditions and future employment and incomes, with a plurality expecting stock prices to decline (Chart 3).

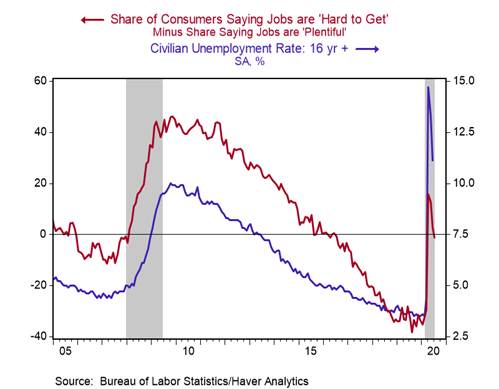

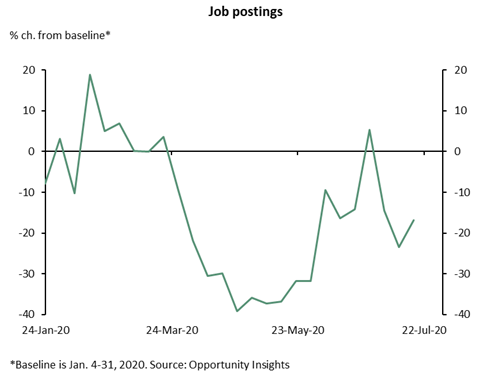

For the first time since March, the share of consumers saying jobs are "plentiful" (21.3%) exceeded the share saying jobs are "hard to get" (20.0%), pointing to another decline in the unemployment rate in July, though at a slower pace than in June (Chart 4). (See U.S. high frequency data indicate flattening labor markets, only small job growth in July). However, the share of consumers characterizing jobs as not so plentiful increased to 58.7% from 56.2%, one of the highest readings on record, consistent with other indicators reflecting weak labor demand (Chart 5).

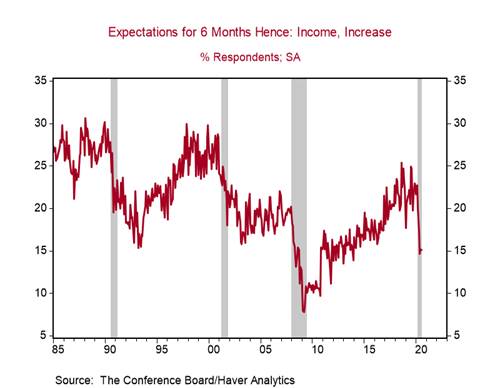

The share of consumers expecting incomes to increase over the next six months remained depressed at 15.1% (Chart 6), highlighting the need for continued financial support from the government to sustain the economic recovery (U.S. fiscal policy issues on the horizon, July 13, 2020).

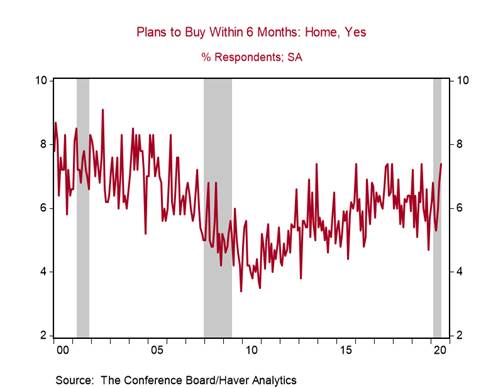

The share of consumers planning to buy a home within the next six months increased to 7.4% from 6.8%, one of the highest shares over the last 14 years, indicating that the strong housing momentum, fueled by historic lows in mortgage rates, is likely to be sustained (Chart 7). The share of households planning to buy major appliances declined for the fourth time in the last five months to 43.5%, the second lowest reading in the last 25.5 years, due to heightened uncertainties and low income expectations.

The expected inflation rate over the next 12 months remained high at 6.1%, reflecting the spike in inflation for food consumed at home (+5.6% yr/yr). See Chart 8.

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Chart 8:

Roiana Reid, roiana.reid@berenberg-us.com