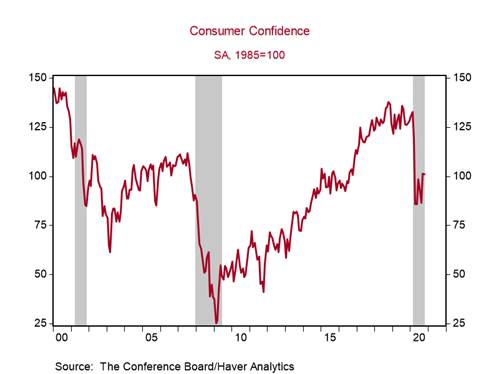

*The Conference Board U.S. Consumer Confidence Index inched down to 100.9 in October from 101.3 in September, placing it 28.2pts below its pre-pandemic average (Chart 1). The confidence index has failed to sustain gains in this recovery because of the early summer and fall spikes in COVID-19 cases, which is having a disproportionately negative impact on services consumption.

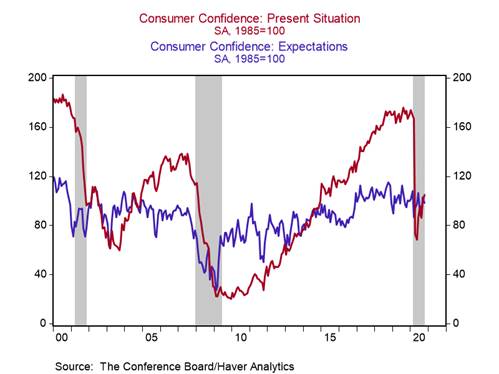

*The divergence in the present situation index (+5.7pts to 104.6) and the expectations index (-4.5pts to 98.4) in October reflects the increased uncertainty stemming from the latest spike in COVID-19 cases (Chart 2).

*Consumers grew more optimistic about current labor market conditions, but their assessment of current business conditions remained very depressed. They increased their future employment and income expectations, but downgraded expectations for future stock market performance.

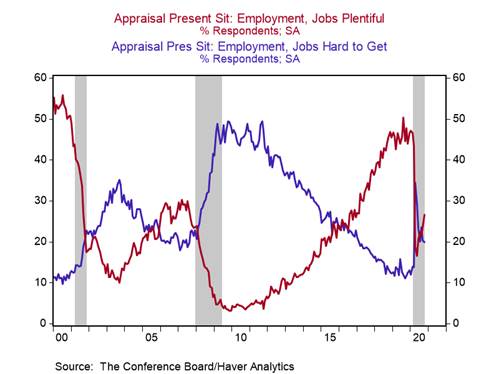

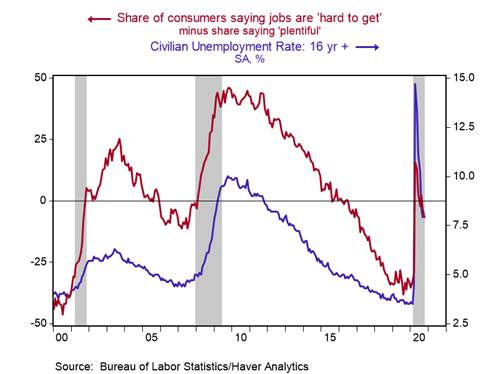

The share of consumers saying jobs are "plentiful" increased by 2.9pp to 26.5% in October, exceeding the share saying jobs are "hard to get" (19.9%) for the second consecutive month (Chart 3). Although labor market perceptions are still more downbeat than pre-pandemic times, the moderate improvement suggests that the unemployment rate continued to decline in October (Chart 4).

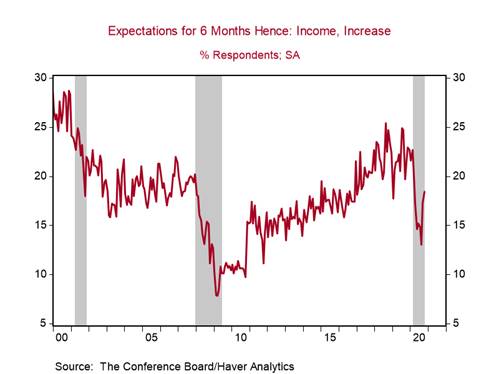

The share of consumers expecting incomes to increase over the next six months increased by 1.1pp to 18.4%, still somewhat below the pre-pandemic average of 22% (Chart 5). Additional financial support from the government to affected households would minimize the downside risks to consumption and the economic recovery.

The share of consumers planning to buy a home within the next six months inched up to 6.6%, remaining below its July peak of 7.7% and supporting the reasonable expectation that housing activity will continue to increase, but at a slower pace than the initial rebound. Reflecting heightened uncertainties about the outlook, the share of households planning to buy major appliances in the next six months declined by 5.3pp to 44.2%, one of the lowest readings since the mid-1990s.

Only 7.2% of consumers plan to travel to a foreign country within the next six months, which is roughly half the share that planned foreign travel at the same time last year. On the other hand, a plurality of consumers, 44.6%, intend to vacation within the U.S. over the next six months.

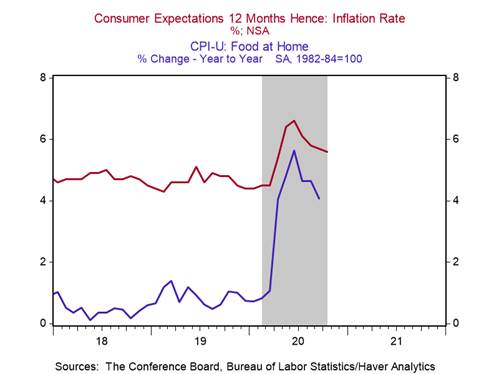

Consumers’ expected inflation rate over the next 12 months remained high at 5.6%, but it has declined in line with the deceleration in inflation for food consumed at home (Chart 6).

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Roiana Reid, roiana.reid@berenberg-us.com