*The U.S. Conference Board Consumer Confidence Index increased by 12.2pts to 98.1 in June, the largest monthly increase since November 2011, but it has only reversed one-fourth of its recent decline, placing it 34.5pts below Februaryâs level (Chart 1). Still, Juneâs sizable increase is encouraging, given that consumer confidence will shape the recovery in consumption. The cut-off date for this survey was June 18, so it does not capture the recent COVID-19 incidence spikes in several large southern and western states that could derail this momentum (Chart of the week - U.S.: COVID-19 spike in south & west to temper recovery, June 26, 2020)

*Consumers upgraded assessments of present conditions in June (+17.8pts to 86.2) after a historic downgrade in April (-93.7pts to 73.0), and unsurprisingly, they continued to assess future conditions more favorably ‑- the expectations index increased by 8.4pts to 106, placing it within the upper end of observations over the last 20 years (Chart 2).

*Consumers are slightly more optimistic about current business conditions and labor markets, a relatively elevated share, 42.3%, expect stock prices to increase within the next 12 months, and they expect a significant increase in the rate of inflation over the next 12 months (6.7% compared to ~4.6% pre-COVID-19 pandemic). See Chart 3.

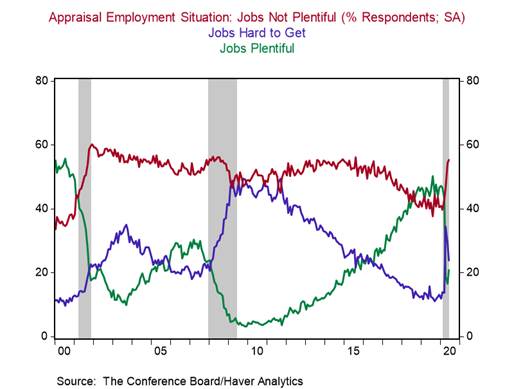

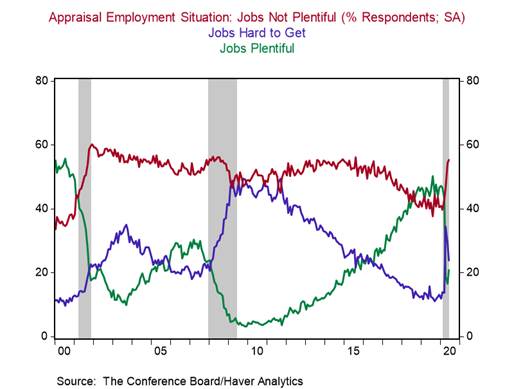

Householdsâ assessments of the labor market continued to improve slightly in June. The share of consumers characterizing jobs as âplentifulâ ticked up to 20.8% from 16.5% and 23.8% of consumers said jobs were âhard to getâ (down from 29.2% in May), but a majority of consumers, 55.4%, continued to describe jobs as ânot so plentifulâ (Chart 4). The less pessimistic assessments of labor markets indicate that the unemployment rate likely declined for the second consecutive month in June, but remained historically high (Chart 5).

The share of consumers expecting incomes to increase over the next six months remained very low at 15.1%, highlighting the need for continued financial support from the government (Chart 6).

Despite the gloomy expectations for incomes, the shares of consumers planning to buy autos (June: 11.7%, April: 8.1%) and homes (June: 6.5%, April: 5.3%) in the next six months continued to rise from Aprilâs lows, consistent with the quick rebounds in spending on motor vehicles and parts, new home sales, and mortgage applications for home purchases. However, the share of households planning to buy major appliances ticked down to 45.5% from 46.5%, a 5.5-year low.

Confidence in medical systems and treatments, statesâ abilities to slow the transmission of COVID-19, and outlook for the economy and labor market are critical for a sustained recovery until there is a vaccine for COVID-19.

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Roiana Reid, roiana.reid@berenberg-us.com

Member FINRA & SIPC

This email and any files or attachments transmitted with it may contain confidential or privileged information and are intended solely for the use of the intended recipient. If you are not the intended recipient, please do not copy, retain, disclose or use any part of the message or its attachments. Please notify the sender immediately by return email and destroy or delete any copies. Dissemination or use of this information by anyone other than the intended recipient is unauthorized and may be illegal. Communications by email cannot be guaranteed to be secure or error-free. Emails and their attachments are subject to being intercepted, becoming corrupted, getting lost or delayed, or may contain viruses. Therefore, neither the sender nor Berenberg Capital Markets LLC (BCM) accepts any liability for any errors or omissions in the content of this message or problems in its transmission, including those arising as a result of its transmission over the internet.

BCM does not assume liability for the correctness and completeness of all information given and/or attachments contained herein. The provided information has not been checked by a third party, especially an independent auditing firm. BCM explicitly points to the stated date of preparation. The information given can become incorrect due to passage of time and/or as a result of legal, political, economic or other changes. BCM does not assume responsibility to indicate such changes and/or to publish an updated document. Any document(s) or attachment(s) is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers.

In light of upcoming regulatory changes, please be informed that BCM will continue to share information with you until unsubscribe@berenberg-us.com receives your termination/deletion request. For more information about the General Data Protection Regulation (GDPR) and our privacy policies please refer to

https://www.berenberg-us.com/legal-notice/. BCM reserves all the rights in this communication. No part of this communication or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without BCMâs prior written consent.

For Berenberg the protection of your data has always been a top priority.

Any e-mail message (including any attachment) sent by Berenberg, any of its subsidiaries or any of their employees is strictly confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received such message(s) by mistake please notify the sender by return e-mail. We ask you to delete that message (including any attachments) thereafter from your system. Any unauthorised use or dissemination of that message in whole or in part (including any attachment) is strictly prohibited. Please also note that any legally binding representation needs to be signed by two authorised signatories. Therefore we do not send legally binding representations via e-mail. Furthermore we do not accept any legally binding representation and/or instruction(s) via e-mail.

In the event of any technical difficulty with any e-mails received from us, please contact the sender or info@berenberg.com. Please find more information on our Privacy Policy here.