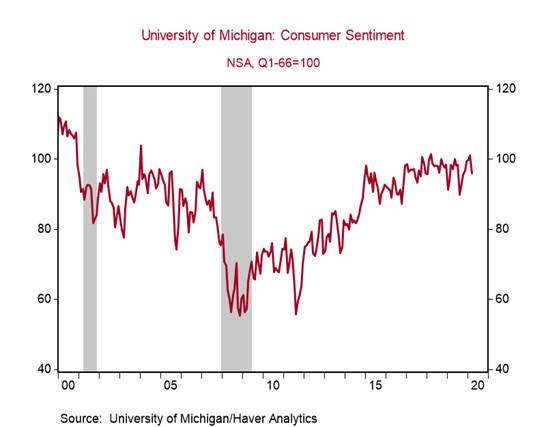

*During this period of high uncertainty, sentiment measures take on even more importance as we gauge economic activity in real time, because “hard” economic data are published with a lag. They will allow us to identify the depth of the decline in activity and the start of the eventual rebound. The University of Michigan Consumer Sentiment Index, which is released at the middle and the end of each month, showed a moderate deterioration in sentiment in early March as concerns about the spread of COVID-19 in the U.S. intensified.

*During this period of high uncertainty, sentiment measures take on even more importance as we gauge economic activity in real time, because “hard” economic data are published with a lag. They will allow us to identify the depth of the decline in activity and the start of the eventual rebound. The University of Michigan Consumer Sentiment Index, which is released at the middle and the end of each month, showed a moderate deterioration in sentiment in early March as concerns about the spread of COVID-19 in the U.S. intensified.

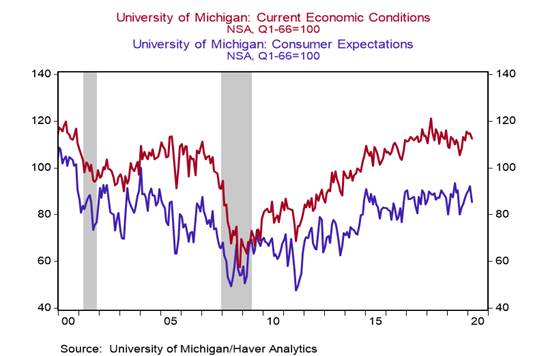

*The University of Michigan Consumer Sentiment headline index declined by 5.1pts to 95.9 in early March from 101.0 in February, a slightly smaller drop than expected (consensus: 95.0) and the lowest level since last October. The expectations index (Mar.: 85.3, Feb.: 92.1) declined much more than the current conditions index (Mar.: 112.5, Feb.: 114.8), as would be expected in this uncertain environment. See Charts 1 and 2.

*According to the survey, “the initial response to the pandemic has not generated the type of economic panic among consumers that was present in the run-up to the Great Recession.”

We expect sentiment to continue to deteriorate given how rapidly conditions have changed over the last few days. This situation is unique for households as it combines uncertainties about a global health pandemic, their financial situations, employment, and the economy. It is going to take some time for households’ social behavior and buying attitudes to return to normal, even after the economy opens back up. This is a significant shock that has evolved at an alarming pace.

The biggest effect on consumption is coming from the very necessary social distancing measures and event cancellations that are affecting the recreational services, restaurants and bars, personal care services, travel, and leisure & hospitality sectors the most. Moreover, employees in these industries will lose jobs and incomes, forcing them to reduce spending.

Respondents to the U. Mich. Survey reduced their expectations about future incomes and employment, and a large 78% of households view business expectations unfavorably (compared to 58% in February). Surprisingly, the shares of households saying it is a good time to buy a major household item (77%) and vehicle (64%), ticked up slightly, and the share saying it is a good time to buy a house remained high at 70%. It will be interesting to see how these assessments evolve in coming weeks. Growing uncertainty about the future will be associated with less spending on discretionary goods and big-ticket items.

The sell-off in equity markets that has significantly reduced household wealth is quickly dragging down household sentiment, but when markets do rebound, we do not expect consumer sentiment to follow them back up as quickly.

Chart 1:

Chart 2:

Roiana Reid, roiana.reid@berenberg-us.com