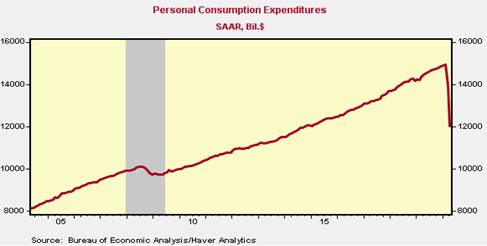

*Consumption expenditures plummeted 13.6% in April following their 7.6% fall in March (Chart 1). This report is consistent with the widely-held view that consumption and real GDP have collapsed in Q2 by the largest quarterly annualized amount in history.

*The collapse in consumer spending was widespread: spending on nondurable and durable goods fell 16.2% and 17.3%, respectively, while consumption of services, which comprise almost 70% of total consumption, fell 12.2% following a 9.3% decline in March.

*Disposable personal income rose 12.9%, reflecting dramatic increases in government transfer payments to individuals (largely unemployment claims and payments to individuals under the CARES Act) and lower taxes. As a result of the monthly jump in disposable income and fall in consumption expenditures, the rate of personal saving soared to 33%, its highest ever (Chart 2).

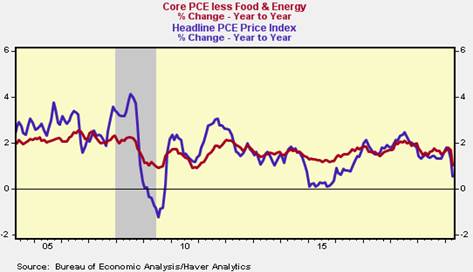

*The PCE price index fell 0.5% following its 0.3% decline in March, weighed down by a 17.6% decline in prices of energy goods and services, lowering headline inflation to 0.5%, while the core PCE index fell 0.4%, lowering its yr/yr to +1.0% (Chart 3).

This Department of Commerce Report on Personal Income and Consumption, along with the Employment Report, is the starkest reflection of the devastating impact of the pandemic and government shutdowns during their most acute stages. The magnitudes of the declines in consumer spending overwhelm any other monthly reports in U.S. history. The same is true of the spike in the rate of personal saving. But these data are not surprising under the circumstances.

Some sectors of the economy have gradually begun to reopen, but not likely in time for the May data reports. We expect reports for May to show further declines in consumption and soaring unemployment.

A sharp improvement in these data is expected in June and following months. Measured from such depressed bases, the percentage changes will be dramatic, suggesting a V-shaped recovery. We expect that, after an initial surge, improvement will continue, but both consumption and employment will take a while to recover to their pre-pandemic levels. In particular, activities in leisure and hospitality are expected to lag, constraining the recovery in both consumer spending and employment.

The decline in the PCE price index—temporary deflation—reflects insufficient demand for all goods and services relative to productive capacity. We have been forecasting this temporary deflation and anticipate that core inflation will drift lower and stay low during the early stages of recovery (“Temporary moderate deflation, despite aggressive monetary action”, April 28, 2020).

Mickey Levy, mickey.levy@berenberg-us.com