U.S. CPI inflation jumps in October, inflationary pressures mount

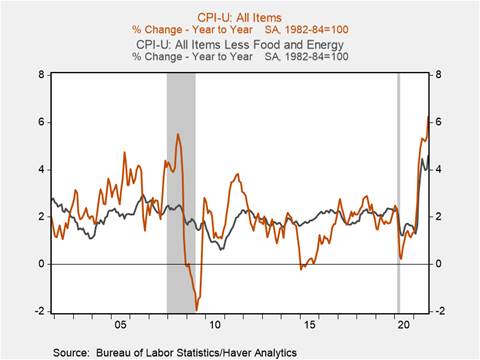

* The Consumer Price Index (CPI) surged in October, rising 0.9% m/m lifting its yr/yr increase to 6.2%, the highest level since 1990 driven by sharp increases in energy, food, and shelter prices. Core CPI (excluding food and energy) increased 0.4% m/m and 4.6% yr/yr, a notable acceleration (Chart 1). Elevated inflation is likely to persist as consumer demand remains strong supported by rising employment and wages while supply shortages and bottlenecks will not ease until 2022. Shelter costs, which account for approximately one-third of the CPI have begun to accelerate and will likely contribute substantially to headline inflation going forward.

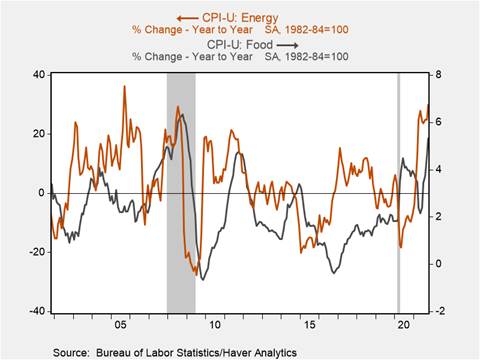

* Energy prices spiked in October reflecting rising energy commodity spot prices with motor fuel prices rising 6% m/m and 50% yr/yr while energy services prices increased 3% m/m and 11.2% yr/yr. Food costs have also risen markedly: the cost of food at home increased 1% m/m while food away from home increased 0.8% m/m (Chart 2). Soaring food and energy costs disproportionately harm low-middle income households, and an adverse winter coupled with rising food and gas prices could eat into this demographic’s purchasing power.

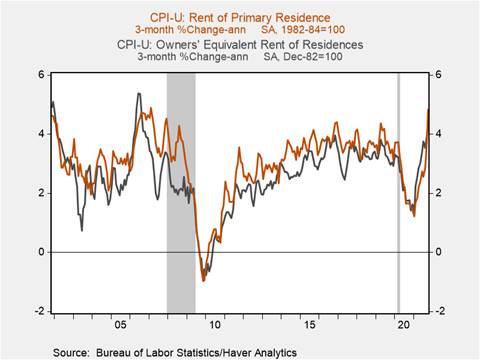

* Home prices and rents have soared over the course of the pandemic: according to the S&P CoreLogic Case-Shiller Index home prices increased 19.8% yr/yr in August, while rent increased 12.8% yr/yr according to Zillow’s Observed Rent Index. These increases have begun to filter into the CPI’s measures of shelter costs. Owners’ equivalent rent and rent of primary residences both increased 0.4% m/m and have accelerated, rising 4.6% and 4.8% on a three-month annualized basis respectively (Chart 3).

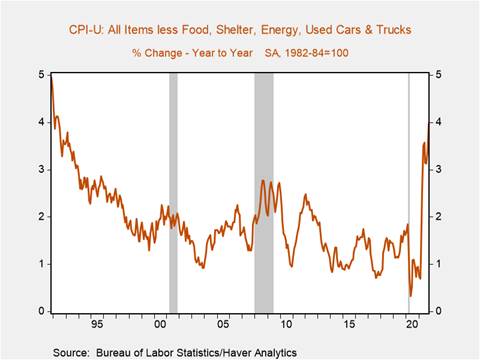

* Price pressures have broadened with prices rising across both goods and services industries. The price of commodities (excluding food and energy) increased 1% m/m while the price of services (excluding energy services) increased 0.4% m/m. Used vehicle prices, which increased at record rates to all time-highs earlier this year before moderating picked up again in October rising 2.5% m/m and 26.5% yr/yr. The CPI excluding energy, food, shelter, and used vehicles increased 0.6% m/m and 4% yr/yr its highest level since 1992, reflecting the breadth of price pressures (Chart 4).

* Supply shortages and disruptions to product distribution amid strong demand ahead of the holiday retail season continue to drive up goods prices. The price of commodities excluding food, energy, and used vehicles increased 0.8% m/m with the price of household furnishings and supplies rising 1.1% m/m.

* As inflation remains elevated and persists it will drive up household measure of inflationary expectations, particularly if the prices of food, energy, and shelter continue to rise. According to the FRB NY’s Survey of Consumer Expectations the median one-year ahead expected inflation rate increased to 5.7% in October, while the three-year expected inflation rate was flat at 4.2%. Rising inflationary expectations could become embedded in wage and price setting behavior, tilting inflationary risks to the upside.

Chart 1: CPI All Items & Core CPI (ex. food and energy) (yr/yr % change)

Chart 2: CPI Energy & CPI Food (yr/yr % change)

Chart 3: CPI Rent & CPI Owners’ Equivalent Rent (3-month annualized % change)

Chart 4: CPI All Items (ex. food, shelter, energy, used vehicles) (yr/yr % change)

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.